Market Summary

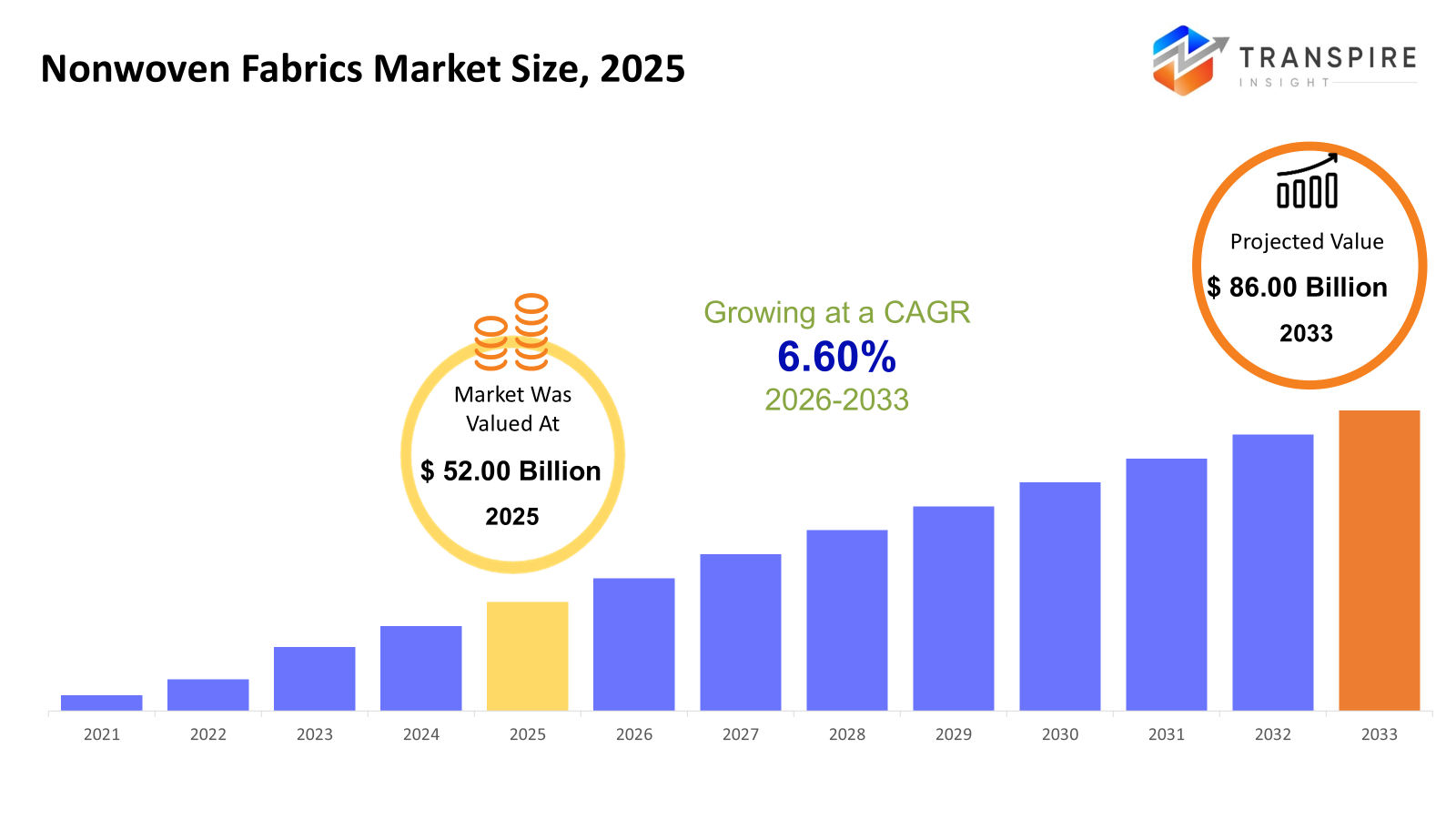

The global Nonwoven Fabrics market size was valued at USD 52.00 billion in 2025 and is projected to reach USD 86.00 billion by 2033, growing at a CAGR of 6.60% from 2026 to 2033. Demand for hygiene and medical products, driven by population growth, aging population, and pandemic preparedness, is a key factor in the CAGR growth. Industrial and automotive sectors are witnessing the adoption of lightweight and strong nonwovens. Advances in biodegradable and high-performance fibers, along with government initiatives to promote eco-friendly materials, are fueling the adoption of nonwovens in the construction, packaging, and agricultural industries. Emerging market infrastructure development and urbanization in the Asia Pacific and South American regions are also fueling market growth.

Market Size & Forecast

- 2025 Market Size: USD 52.00 Billion

- 2033 Projected Market Size: USD 86.00 Billion

- CAGR (2026-2033): 6.60%

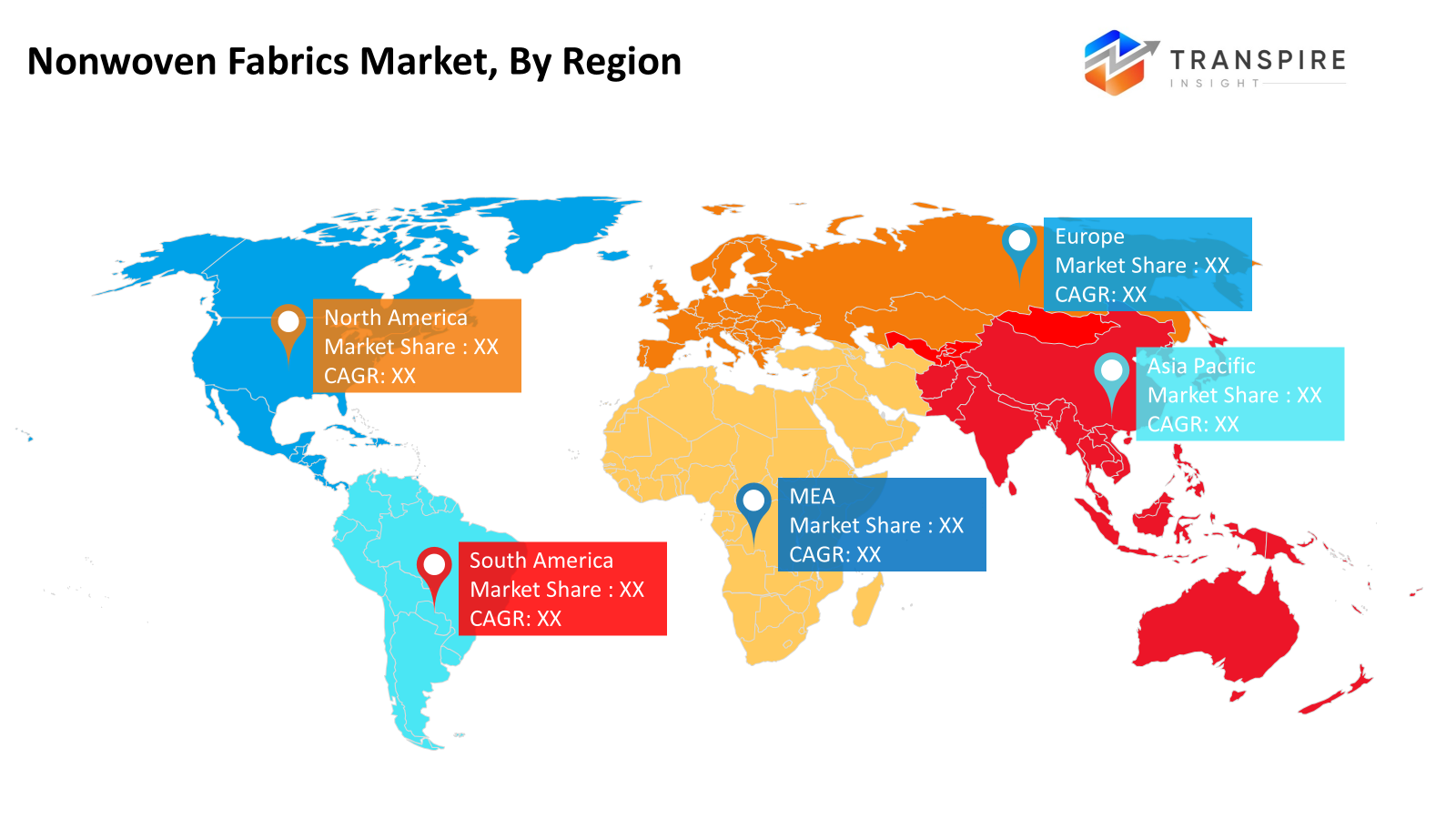

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America remains a region with stable demand fueled by the presence of a highly developed healthcare infrastructure, a high usage rate of hygiene products, and sustainability regulations that promote the use of high-performance and recyclable nonwoven materials in the medical, filtration, and packaging sectors, while also maintaining a technological edge in product development.

- The United States market exhibits strong growth fueled by a high usage rate of disposable products, a growing medical and filtration market, and ongoing investments in advanced manufacturing technology, thereby promoting the use of high-quality nonwoven materials with improved barrier protection, durability, and environmentally compatible material formulations.

- The Asia Pacific market leads the world in production and consumption rates due to the region’s fast-paced industrialization, growing population, and increased access to healthcare, with the region’s large-scale manufacturing capabilities fueling the demand for hygiene, medical, and industrial applications, while cost-effective manufacturing practices enhance the region’s competitiveness in the global market.

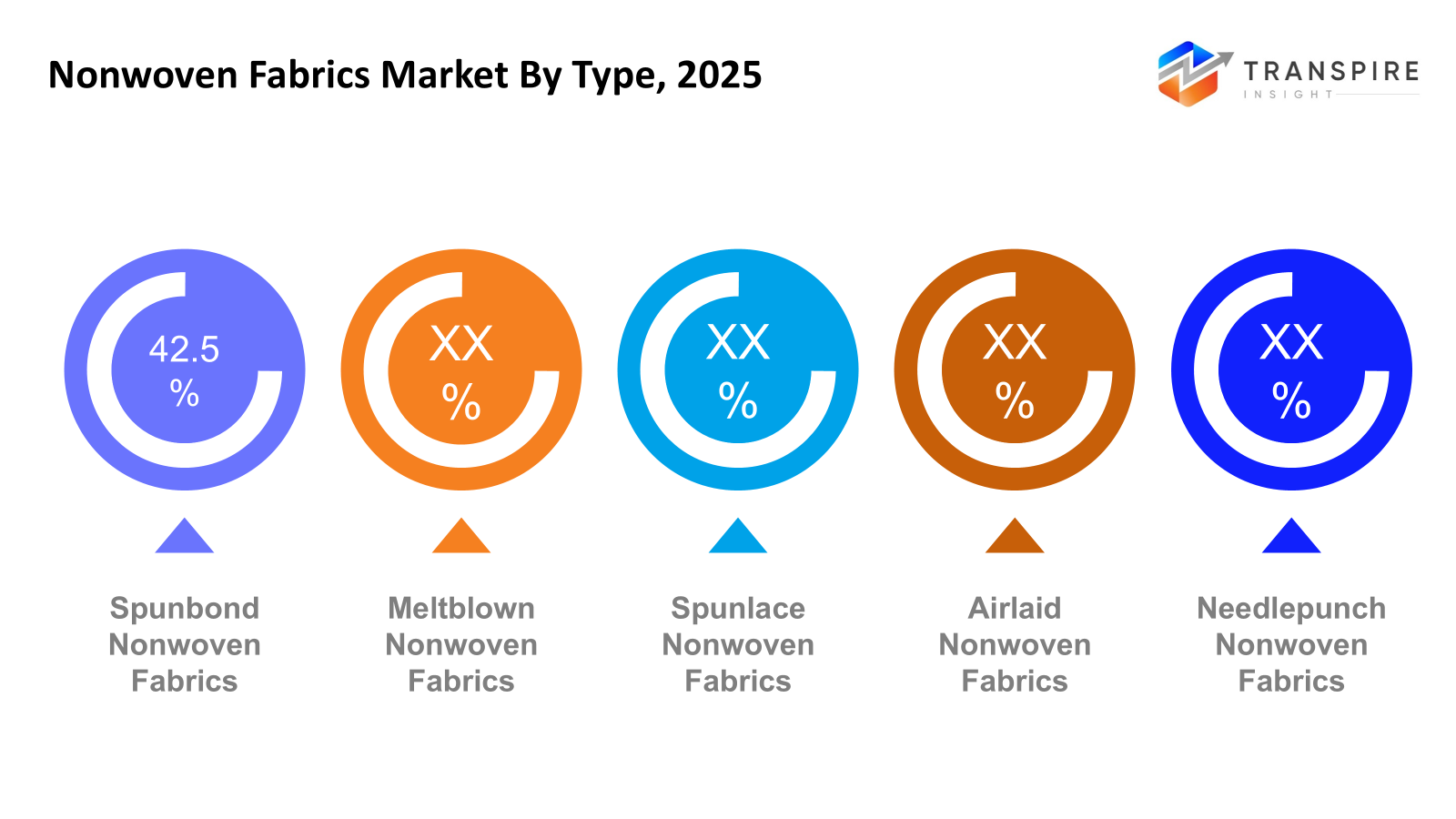

- Spunbond nonwoven fabrics currently lead the type segment due to scalability, strength, and versatility, while multilayer fabric technology and meltblown technology integration are continuously enhancing filtration efficiency and functional performance in end-use industries.

- The hygiene products segment leads the application type due to growing awareness of personal care, aging populations, and rising disposable incomes, which are fueling demand for diapers, sanitary products, and incontinence products, thereby encouraging producers to develop softer, more absorbent, and environmentally sustainable nonwoven materials.

- Polypropylene leads the material type due to its cost-effectiveness, lightweight properties, and excellent chemical resistance, which are supporting large-scale production of hygiene, medical, and filtration products, while continuous innovations are improving recyclability and functional performance to meet growing regulatory and sustainability demands.

- The end-use industry segment is dominated by the healthcare and hygiene sector due to infection prevention standards, the growing demand for healthcare services, and the demand for disposable healthcare products, while advancements in antimicrobial, breathable, and biodegradable nonwoven materials boost adoption.

So, The Nonwoven Fabrics Market refers to engineered fabrics that are made from fibers that are mechanically, chemically, or thermally bonded. These fabrics are versatile and can be used in the hygiene, medical, industrial, and construction industries. The Nonwoven Fabrics Market is driven by factors such as increased awareness of healthcare, improved hygiene standards, and the demand for insulation and filtration in industries. Technological advancements in materials such as polypropylene, polyester, and biodegradable fibers enable manufacturers to tailor their products according to specific demands. Nonwoven fabrics are increasingly being used as an alternative to traditional textiles in the production of disposable hygiene products, automotive interiors, and geotextiles. Manufacturers are also concentrating their efforts on research and development to improve the strength, softness, and functional properties of nonwoven fabrics, such as antimicrobial, flame retardancy and water resistance. The market is also fueled by regulatory measures that support sustainable materials, particularly in the European and North American regions. Increasing urbanization, the need for e-commerce packaging, and the need for eco-friendly disposable products have fueled the demand for new nonwoven materials. Moreover, the growth of various industries in emerging countries, such as the Asia Pacific and South American regions, offers substantial opportunities for growth.

Nonwoven Fabrics Market Segmentation

By Type

- Spunbond Nonwoven Fabrics

Spunbond nonwoven fabrics are made using a continuous filament technique, providing strength and durability. These fabrics are commonly used in medical and hygiene products because of their cost-effectiveness, versatility, and ability to be rolled into large rolls.

- Meltblown Nonwoven Fabrics

Meltblown fabrics have microfibers that are very fine, providing excellent filtration and barrier properties. The high filtration efficiency of meltblown fabrics makes them essential for medical masks, air and liquid filters, and high-quality protective clothing.

- Spunlace Nonwoven Fabrics

Spunlace fabrics are made using the hydroentanglement process, providing softness and flexibility. These fabrics are suitable for use in medical and hygiene applications where softness and absorbency are required.

- Airlaid Nonwoven Fabrics

Airlaid nonwovens have high absorbency and bulk, making them suitable for sanitary products, wipes, and absorbent pads. Their lightweight properties and flexibility enable them to be tailored for use in disposable hygiene products.

- Needlepunch Nonwoven Fabrics

Needlepunch nonwovens are mechanically bonded, giving them thickness, strength, and stability. They are usually used in construction, automotive insulation, and geotextiles, where the material needs to withstand stress.

To learn more about this report, Download Free Sample Report

By Application

- Hygiene Products

Nonwoven materials in hygiene products allow for comfort, absorbency, and skin protection. Advances in softness, permeability, and biodegradability are propelling the adult incontinence and feminine hygiene markets.

- Medical & Healthcare

The medical industry requires sterilizable, high-barrier, and disposable nonwoven materials. Compliance with regulations, infection prevention, and pandemic-related demand are accelerating the surgical and protective market.

- Automotive

Nonwoven materials in the automotive industry provide weight reduction, sound insulation, and improved air filtration. The trend towards lightweight construction and the development of electric vehicles are accelerating material development in this market.

- Construction & Geotextiles

In construction, nonwoven materials are used for soil reinforcement, filtration, and protection. The properties of importance are durability, UV resistance, and tensile strength, which make them useful for roofing, flooring, and construction works.

- Filtration

Filtration nonwovens help in accurate particle removal for industrial, domestic, and water treatment purposes. Efficiency, porosity, and resistance to chemicals are essential for various filtration systems.

- Agriculture

In agriculture, nonwovens act as crop protectors, improve germination, and help retain soil moisture. Lightweight, porous, and biodegradable materials are being used extensively for agricultural purposes.

- Packaging

Nonwoven materials are used as reusable, strong, and light packaging materials. The growing need for e-commerce and environmental issues have increased the use of nonwoven bags and protective packaging materials.

- Others

They are also used as furniture padding, interlining, support materials in apparels, and industrial wipers. Their strength, cushioning effect, and versatility make them useful for functional applications.

By Material

- Polypropylene (PP)

PP is the most commonly used material because of its low cost, chemical resistance, and ease of processing. It is the most prominent material in hygiene, medical, and packaging nonwoven products because of its lightness and strength.

- Polyester (PET)

PET nonwovens have high mechanical strength, heat resistance, and durability. They are recyclable and resistant to wear and tear. They are preferred in automotive, construction, and industrial applications.

- Polyethylene (PE)

PE nonwovens are moisture barrier materials. They are used in packaging, protective clothing, and agricultural films. They are cost-effective and versatile, which increases their demand in the market.

- Polyamide (PA) / Nylon

Nylon nonwovens are strong, abrasion-resistant, and light. They are used in filtration, automotive, and industrial applications where high tensile strength and flexibility are required.

- Rayon/Viscose

Rayon and viscose nonwovens have softness and high absorbency. They are chosen for hygiene, wipes, and medical dressings where comfort, skin friendliness, and fluid handling are important.

- Others

Blended and specialty fibers have attributes such as elasticity, absorbency, and biodegradability. Tailored applications in the medical, hygiene, and high-performance industrial sectors are propelling the specialty fibers segment.

By End-Use Industry

- Healthcare & Hygiene

The demand is fueled by infection control, population growth, and aging populations. The hospital, medical, and personal care markets favor high-performance, disposable, and biodegradable nonwoven materials.

- Automotive

Nonwoven materials help reduce the weight of vehicles, increase insulation, and provide improved interior comfort. The trend towards electric vehicles and the need for reduced emissions from vehicles promote the use of lightweight and sustainable nonwoven materials in the automotive industry.

- Construction

Nonwoven materials are used for reinforcing buildings, draining water, and insulating buildings. Urbanization, construction activities, and green buildings create stable demand in this area.

- Agriculture

Nonwovens are used for crop protection, weed control, and conserving soil moisture. Eco-friendly agriculture and climate-smart solutions are fueling the demand for breathable, UV-resistant, and biodegradable agricultural nonwovens.

- Packaging

The demand for sustainable, reusable, and protective packaging is fueling the use of nonwovens. Environmental policies and the rise of e-commerce are accelerating the adoption of nonwovens in consumer products, food, and industrial packaging.

- Consumer Goods

Nonwovens are used in clothing, home furnishings, and consumer products for cushioning, support, and strength. Eco-friendly and multi-functional fabric innovations are catalyzing market growth.

- Industrial

Industrial nonwovens cater to filtration, insulation, and protective gear applications. The demand is associated with the heavy industry, mining, and manufacturing industries, which require high-strength, durable, and chemical-resistant fabrics.

Regional Insights

North America, including the United States, Canada, and Mexico, is a mature market for nonwovens, with healthcare, hygiene, and industrial applications driving the market. High regulatory requirements and consumer awareness are pushing the demand for sustainable and high-performance nonwoven fabrics. Europe, including Germany, United Kingdom, France, Spain, Italy, and the rest of Europe, focuses on eco-friendly and high-quality nonwovens in the hygiene, automotive, and construction industries. Environmental regulations and the need for recyclable materials are major drivers for the market. Asia Pacific, including Japan, China, Australia & New Zealand, South Korea, India, and the rest of Asia Pacific, is the fastest-growing market. China and India are major production centers for nonwovens, meeting the global demand, while the domestic demand for hygiene, medical, and industrial applications is growing rapidly due to the increasing population and industrialization.

South America, including Brazil, Argentina, and the other countries in this region, is also witnessing growing acceptance in the healthcare, agriculture, and construction sectors. The emerging countries are investing in hygiene products and infrastructure development, thus boosting the demand for nonwoven materials. The Middle East & Africa, including Saudi Arabia, United Arab Emirates, South Africa, and the other countries in this region, is also growing steadily in the healthcare, industrial, and construction sectors. The factors driving the market growth in this region include urbanization, increasing disposable income, and government initiatives for infrastructure development.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2025, Ahlstrom started up a new parchmentizer production line at its Saint-Séverin plant in France, enhancing its production capacity for specialty fiber materials. This move is in line with the growing demand for sustainable and function-oriented fiber materials, which will help the company enhance its flexibility and commitment to innovation and collaboration in fiber-related applications.

- In February 2025, Avgol Industries (a subsidiary of Indorama Ventures) launched a new production line with a US$100 million investment that will increase the production capacity of high-loft spunbond nonwoven fabric. This move will enable the company to meet the growing demand in the hygiene industry with increased production capacity, making Avgol a strong competitor in the industry.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 52.00 Billion |

|

Market size value in 2026 |

USD 55.00 Billion |

|

Revenue forecast in 2033 |

USD 86.00 Billion |

|

Growth rate |

CAGR of 6.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Berry Global Inc., Freudenberg Group, Ahlstrom‑Munksjö, Kimberly‑Clark Worldwide, Inc., Fitesa S.A., DuPont de Nemours Inc., Toray Industries, Inc., Suominen Corporation, Johns Manville, Avgol (Indorama Ventures), Fibertex Nonwovens, Sandler AG, Lydall Inc., Asahi Kasei Corporation, and Mogul Co., Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Spunbond Nonwoven Fabrics, Meltblown Nonwoven Fabrics, Spunlace Nonwoven Fabrics, Airlaid Nonwoven Fabrics, Needlepunch Nonwoven Fabrics), By Application (Hygiene Products, Medical & Healthcare, Automotive, Construction & Geotextiles, Filtration, Agriculture, Packaging, Others), By Material (Polypropylene (PP), Polyester (PET), Polyethylene (PE), Polyamide (PA) / Nylon, Rayon / Viscose, Others) and By End-Use Industry (Transportation, Manufacturing, Healthcare, Electronics, Construction, Oil & Gas, Power Generation) |

Key Nonwoven Fabrics Company Insights

Berry Global Inc. is a leading global manufacturer of nonwoven materials, with a balanced approach to scale and innovation in the areas of hygiene, healthcare, industry, filtration, and packaging. The company’s vertical integration in spunbond, meltblown, SMS, and composite nonwovens facilitates penetration into various end-use markets. Aggressive mergers, such as the creation of Magnera with Glatfelter, have helped the company establish itself as one of the largest nonwovens manufacturers in terms of revenue and capacity, with a geographical presence in North America, Europe, Asia Pacific, and South America. Berry Global’s emphasis on sustainable materials and innovative filtration solutions further helps to differentiate the company’s offerings, especially in the medical and hygiene markets, which require both functionality and regulatory acceptability.

Key Nonwoven Fabrics Companies:

- Berry Global Inc.

- Freudenberg Group

- Ahlstrom‑Munksjö

- Kimberly‑Clark Worldwide, Inc.

- Fitesa S.A.

- DuPont de Nemours Inc.

- Toray Industries, Inc.

- Suominen Corporation

- Johns Manville

- Avgol (Indorama Ventures)

- Fibertex Nonwovens

- Sandler AG

- Lydall Inc.

- Asahi Kasei Corporation

- Mogul Co., Ltd.

Global Nonwoven Fabrics Market Report Segmentation

By Type

- Spunbond Nonwoven Fabrics

- Meltblown Nonwoven Fabrics

- Spunlace Nonwoven Fabrics

- Airlaid Nonwoven Fabrics

- Needlepunch Nonwoven Fabrics

By Application

- Hygiene Products

- Medical & Healthcare

- Automotive

- Construction & Geotextiles

- Filtration

- Agriculture

- Packaging

- Others

By Material

- Polypropylene (PP)

- Polyester (PET)

- Polyethylene (PE)

- Polyamide (PA) / Nylon

- Rayon / Viscose

- Others

By End-Use Industry

- Healthcare & Hygiene

- Automotive

- Construction

- Agriculture

- Packaging

- Consumer Goods

- Industrial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636