Market Summary

The global Active & Intelligent Packaging market size was valued at USD 25.00 billion in 2025 and is projected to reach USD 45.00 billion by 2033, growing at a CAGR of 7.60% from 2026 to 2033. Something fresh shows up every day in how products stay safe once they leave the factory. A push for better quality makes companies rethink what surrounds their goods. Not just paper or plastic, now tech slips inside the wrapper itself. Because people notice when things taste off or expire too soon, new solutions spread fast. Sensors appear where you least expect them, inside caps, under labels, even printed on boxes. Change comes quietly through tiny tags that track temperature or humidity along the way. Freshness lasts longer thanks to materials reacting to shifts in the environment safety steps forward without loud announcements. Little by little, machines talk to systems using invisible signals stitched into packages. What used to be simple containers now breathe, adapt, and watch.

Market Size & Forecast

- 2025 Market Size: USD 25.00 Billion

- 2033 Projected Market Size: USD 45.00 Billion

- CAGR (2026-2033): 7.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 38% in 2026. Fueled by sharp demand across industries, North America stands out where innovation in packaging takes root. Where rules tighten around safety, companies respond to food and drink containers evolving just as medicine storage does. Consumer attention grows; so does the push for smarter wraps and seals on shelves. Regulations act like guardrails, guiding how products are tucked into their outer layers. Awareness spreads quietly, shaping choices without loud announcements.

- Home to the biggest share across North America, the United States runs on solid transport networks and deep investment in smart package research. At the same time, its well-established production lines keep active and intelligent packaging moving smoothly.

- A burst of change sweeps across the Asia Pacific, fueled by cities that keep getting bigger. New demands rise as food and drink makers grow their reach. Medicine production climbs higher each year. Shoppers now turn to online stores more often, while modern shops spread fast - both need smarter ways to wrap and protect goods.

- Active Packaging shares approximately 60% in 2026. A fresh wave of interest hits active packaging, driven by a need for longer-lasting goods plus stronger safety measures. What stands out is how quickly it's being picked up across industries focused on freshness. Growth here beats other types, mainly because keeping products safe matters more now. Extending shelf life is not just helpful; it’s becoming essential. The shift leans heavily toward solutions that react and adapt during storage. Expect this path to keep accelerating without slowing down.

- Flexibility, durability, and smooth integration with active and smart packaging tech give polymer-based materials an edge. Their adaptability across applications keeps them ahead of alternatives.

- Fresh on everyone's mind, time-temperature indicators are seeing a rise. Not just noise; real demand drives them forward. Storage worries grow, so does reliance on these tools. Now non-negotiable. These little monitors answer that pressure quietly. Movement builds without fanfare. Expect more eyes turning their way soon.

- Most demand comes from food and drink because these items spoil fast, needing constant checks on quality. Freshness matters a lot here, so tracking stays strict across supply chains. Safety rules push frequent oversight, making this sector lead in usage. Perishables drive need without quick monitoring, and waste rises sharply.

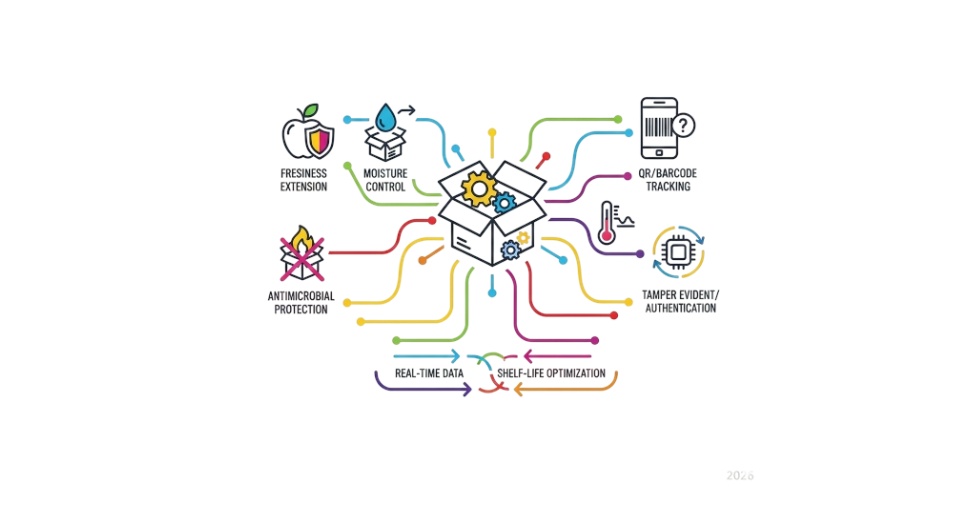

Because products must stay safe and fresh, demand grows for smarter ways to protect them. Instead of just wrapping items, materials now fight oxygen damage using tools like scavengers or catch extra moisture before it causes harm. Films that block microbes also play a role, slowing decay so goods last longer on shelves. Monitoring gets easier when labels change color if something goes wrong during transit. Sensors give updates about temperature shifts or physical shocks while shipments move around. Tracking each step becomes possible through tiny chips embedded in the outer layers. These systems work together without needing constant human checks driving rapid growth in the active & intelligent packaging market.

Smart packaging keeps changing how things sell. New tech shows up almost every month, pushing what boxes and wraps can do. Some labels now track heat changes over days, giving clues about shelf life. Others react when food starts going bad, showing clear signs right on the surface. These updates help factories watch their goods better. Shoppers also get clearer hints about whether something is still fresh. Little by little, seals and tags stop being just stickers; they start talking back through color shifts or signals. Safety checks become simpler because proof of damage appears without guessing.

Fueled by shifting daily habits, more people now pay attention to what they consume. Because safety matters more than before, companies respond with smarter ways to wrap their goods. These new types of packaging do more than seal items; they signal care and build familiarity over time. When products behave better on shelves, shoppers tend to stay loyal, pushing entire sectors to rethink how things are presented.

A shift toward greener practices shapes how products reach consumers. Because rules tighten around waste and safety, firms turn to smarter wraps that work well yet leave less behind. These updated packages track conditions, share data, and even fight fakes with tools in a larger push for honesty on shelves. As needs evolve, so do designs, opening space for fresh ideas and wider reach.

Active & Intelligent Packaging Market Segmentation

By Type

- Active Packaging

Inside the wrap, a quiet reaction keeps things fresh longer. Not just holding it - working with it. A slow exchange slows decay. What's inside changes how long it lasts. Hidden helpers adjust moisture or fight spoilage. The container does more than sit there. Time stretches when chemistry steps in. Protection comes alive. Freshness gets support from within. Each breath of air is managed, not ignored.

- Smart Packaging

From inside the box, signals show if goods are genuine or damaged. Sensors react when tampering happens nearby. Freshness levels appear through color shifts on labels. Hidden codes unlock updates via phone scans. Temperature changes trigger visible alerts on surfaces. Details emerge only under certain light angles. Each package tells its own story over time.

To learn more about this report, Download Free Sample Report

By Material

- Polymer-Based

Flexibility meets long-lasting design in polymer-based wraps, common across food items, drinks, and boxes holding medicine. These materials bend without breaking, seen daily where freshness matters most.

- Paper & Board-Based

Packaging made from paper and board often works well for outer wrapping or everyday items. It comes from materials that can be reused or recycled afterward. This type fits many product types without adding waste. Its strength supports handling during transport, too.

- Metal-Based

A hard shell made of metal guards what's inside, common in food cans. Tough stuff keeps things safe from damage out there. Containers like these hold drinks, too. Strong walls resist dents and pressure around them. People rely on this type when long storage matters.

- Glass-Based

From glass it's made that holds drinks, lotions, and even medicines without changing them. Lasts many uses before needing replacement. Feels weighty in hand, signals quality without words. Not plastic, never leaks chemicals. Washed again, filled again, seen on shelves again.

By Technology

- Time-Temperature Indicators

When things move through hot or cold spots, these tools track what happens. Heat shifts show up clearly on them. Cold spells leave marks, too. Quality stays checked because of their watchful design.

- Freshness Indicators

Something changes when food starts to go bad; tiny sensors notice right away. These small tools track rot or breakdown in items that do not last long. They work quietly, spotting damage before the eyes can see it.

- RFID

Tracking begins when tags respond to signals. These small chips stop fake goods by verifying the origin. Visibility across shipping routes improves with each scan. Information flows without human help. Security is built into everyday items quietly. Movement data is recorded at every step. Counterfeit risk drops as verification strengthens.

- Antimicrobial Packaging

A fresh twist on keeping food protected, this wrap slows down microbes. Safety gets a boost while spoiling takes longer. Think of it as armor made quiet, working behind the scenes. Instead of chemicals floating free, they stick close, doing their job slowly. Time stretches out before decay shows up. Protection builds right into the layer around the product. Not magic, just smart material choices shaping results.

- Modified Atmosphere Packaging

A different mix of gases inside the package slows spoilage. This method helps keep food and drinks fresh longer by changing what fills the space around them.

By Application

- Food & Beverages

Staying fresh matters most when it comes to what we eat and drink. Safety slips away if storage fails. Long-lasting quality shows up best in how items are preserved. A product keeps its promise only when handled right from start to finish.

- Pharmaceuticals

From start to finish, medicine stays effective when stored right. Conditions during storage are closely monitored by systems that track changes. What you receive matches what was made because checks happen all along the way.

- Cosmetics & Personal Care

From lotions to soaps, keeping formulas steady often means a seal matters just as much as ingredients. A shift in color or texture can start when protection slips, tiny gaps let air mess things up. What holds up over time is not always chemistry alone; sometimes it is the wrap, the lid, the layer no one notices until it fails.

- Electronics & Consumer Goods

From tiny gadgets to big appliances, it keeps track of authenticity while checking how items hold up over time. A hidden layer fights fakes. Sensors spot wear before damage shows. Each piece tells its story through data trails. Real-time alerts pop when something shifts. Trust builds without labels or logos. What you see is backed by constant checks behind the scenes.

- Others

From labs to factories, certain uses call for high-performance wraps and seals. These jobs are not about everyday storage - they need materials built for tough conditions. Think of reactors, precision tools, or niche manufacturing setups. Handling extremes matters here: heat, pressure, corrosion. Packaging must keep up without failing. It's not just containment - it's reliability under stress.

Regional Insights

Home to top packaging firms and strong production networks, North America sees steady demand for smart and active packaging. Because consumers pay close attention to product freshness and safety rules are strict, industries like food, drinks, and medicine lean heavily on new types of wraps and containers. New ways of building packages spread fast here, helped by ready access to tech and skilled operations. Growth gets an extra push from companies focused only on next-gen wrapping methods, already set up across the area.

Europe's market moves because rules push companies to follow standards. New needs grow for greener, smarter packaging across the region. Research gets more funding, especially in tech that makes packaging responsive. Germany, France, and the UK lead by using materials that keep goods fresh longer. These places also track products better through advanced wrapping methods.

Urban areas across the Asia Pacific keep expanding, pushing demand higher as food and drink production ramps up alongside online shopping. Quality concerns shape choices there; safety matters more now than before. Elsewhere, markets in Latin America, along with parts of Africa and the Middle East, move forward at a quiet pace. New spending flows into updated packaging methods because customers want better goods and smoother delivery networks. Growth follows where investment takes root, slowly changing how things reach shelves.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 15 2025 – Tetra Pak and Jus De fruits Caraibes launched connected packaging for good.

- March 27, 2025 – ProAmpac expands active and intelligent packaging with advanced, sustainable moisture adsorbing solutions.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 25.00 Billion |

|

Market size value in 2026 |

USD 27.00 Billion |

|

Revenue forecast in 2033 |

USD 45.00 Billion |

|

Growth rate |

CAGR of 7.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Amcor plc, Sealed Air Corporation, Avery Dennison Corporation, Mondi Group, 3M Company, DuPont de Nemours, Inc., CCL Industries Inc., Constantia Flexibles Group GmbH, Dai Nippon Printing Co., Ltd., Huhtamäki Oyj, Stora Enso Oyj, Smurfit Kappa Group, Crown Holdings, Inc., Ball Corporation, Multisorb Technologies, Inc., Thin Film Electronics ASA |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Active Packaging, Smart Packaging), By Material (Polymer-Based, Paper & Board-Based, Metal-Based, Glass-Based), By Technology (Time-Temperature Indicators, Freshness Indicators, RFID, Antimicrobial Packaging, Modified Atmosphere Packaging), By Application (Food & Beverages, Pharmaceutical, Cosmetics & Personal Care, Electronics & Consumer Goods, Others) |

Key Active & Intelligent Packaging Company Insights

Packaging ideas move forward at Amcor plc, where clever designs serve food, drink, medicine, and everyday products across continents. Instead of standing still, the team builds materials that fight oxygen, lock out dampness, while adding digital touches for better freshness and protection. Across labs worldwide, experiments shape what comes next - eco-smart wraps are gaining ground because they work well, last longer, and do less harm. Standards rise quietly when one firm keeps refining how things are wrapped, shipped, and used. Global reach helps new methods spread without fanfare, simply by showing up stronger each time.

Key Active & Intelligent Packaging Companies:

- Amcor plc

- Sealed Air Corporation

- Avery Dennison Corporation

- Mondi Group

- 3M Company

- DuPont de Nemours, Inc.

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- Dai Nippon Printing Co., Ltd.

- Huhtamäki Oyj

- Stora Enso Oyj

- Smurfit Kappa Group

- Crown Holdings, Inc.

- Ball Corporation

- Multisorb Technologies, Inc.

- Thin Film Electronics ASA

Global Active & Intelligent Packaging Market Report Segmentation

By Type

- Active Packaging

- Smart Packaging

By Material

- Polymer-Based

- Paper & Board-Based

- Metal-Based

- Glass-Based

By Technology

- Time-Temperature Indicators

- Freshness Indicators

- RFID

- Antimicrobial Packaging

- Modified Atmosphere Packaging

By Application

- Food & Beverages

- Pharmaceutical

- Cosmetics & Personal Care

- Electronics & Consumer Goods

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636