Feb 06, 2026

The report “Active & Intelligent Packaging Market By Type (Active Packaging, Smart Packaging), By Material (Polymer-Based, Paper & Board-Based, Metal-Based, Glass-Based), By Technology (Time-Temperature Indicators, Freshness Indicators, RFID, Antimicrobial Packaging, Modified Atmosphere Packaging), By Application (Food & Beverages, Pharmaceutical, Cosmetics & Personal Care, Electronics & Consumer Goods, Others)” is expected to reach USD 45.00 billion by 2033, registering a CAGR of 7.60% from 2026 to 2033, according to a new report by Transpire Insight.

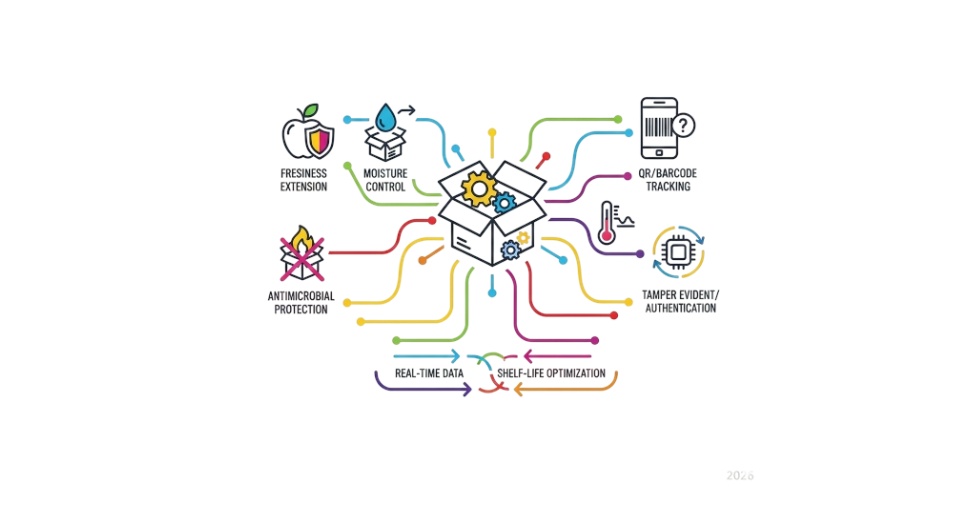

From farm to table, keeping goods safe and fresh pushes innovation in how items are packed. Oxygen eaters, dampness traps, or germ-blocking wraps keep what's inside stable longer. On another note, smart labels with tiny sensors, color-changing spots, or digital tags show live updates about a product’s state. These signals allow a closer watch during shipping and handling. Freshness matters more now than before. Tracking changes over time becomes possible when packaging talks back.

New tools keep changing how markets work. Because of smart designs like labels that show heat exposure, sensors tracking ripeness, or seals revealing if a package was opened, goods stay trustworthy. As these systems grow, firms build wrappers that share updates with makers and buyers at once. This shift helps people choose better, while cutting down waste caused by aging or damage.

Shifts in what people want, combined with a stronger focus on sustainable choices, keep pushing the market forward. Quality matters more now, along with ease of use and clear information, so companies adjust how they package their goods, making them both kinder to the planet and practical. On top of that, smart packaging tech tracks conditions, shares data, even fights fakes, which helps firms meet rules while earning customer confidence, spurring steady advances across the field.

The Active Packaging segment is projected to witness the highest CAGR in the Active & Intelligent Packaging market during the forecast period.

According to Transpire Insight, expect growth in active packaging to outpace other areas of intelligent packaging over the coming years. Freshness matters more now, so companies turn to tools that stretch how long items stay usable. Oxygen removers, damp catchers, and germ-fighting wraps play bigger roles in keeping goods intact from factory to buyer. These methods help avoid early rot, meet tight health rules, plus keep medicines effective longer. Less waste moves through delivery routes when smart barriers guard what's inside. Firms across fields begin favoring these systems simply because they work too well to ignore. People want cleaner outcomes - fewer spoiled meals, safer pills, tighter control.

What's unfolding now comes from sharper tools and smarter wraps, pushing how things stay fresh longer. Because today’s packs do more than just hold items, firms adjust by using cleaner stuff that is easier. New thinking begins when buyers start noticing what keeps food safe, prompting shifts inside factories, too. Growth follows where trust grows - this space adapts because people demand proof, not promises. Over time, results show up quietly: better barriers, fewer spoils, steady progress without noise.

The Polymer-Based segment is projected to witness the highest CAGR in the Active & Intelligent Packaging market during the forecast period.

Growth looks likely in polymer-based active and intelligent packaging, thanks to how well these materials adapt, last long, and work alongside modern tech features. Built-in functions like blocking oxygen, resisting dampness, or fighting microbes help keep food, drinks, and medicines fresh much longer. Lightweight gives them an edge, while bending easily into different shapes makes fitting specific needs simpler. Customizing forms and performance rolls smoothly into many types of packages used today.

New types of plastic and greener options are pushing this area forward. Because companies now choose reusable or break-down-over-time plastics, they meet people's wish for cleaner packaging while keeping performance strong. On top of that, putting smart tools like tracking sensors right into the material helps watch products live, which lifts this part well within the Active & Intelligent Packaging field. Growth here ties closely to how these updated polymers behave in daily use.

The Technology segment is projected to witness the highest CAGR in the Active & Intelligent Packaging market during the forecast period.

According to Transpire Insight, Growth in tech-driven packaging points to a surge in time-temperature tracking tools. Because items like medicine, drinks, and meals demand careful handling, watching heat shifts matters more now. Real-time updates on cold or warm spells show if goods stayed safe. Spoiled batches drop when these sensors spot risky conditions early. Less trash piles up behind stores and labs thanks to smarter alerts. Efficiency climbs as trucks and warehouses adjust routes based on live data clues. Companies across fields latch onto this - not out of trend but practical gain. Hidden signals replace guesswork each hour; something moves from factory to shelf. Trust builds quietly every time a label confirms proper care. Fewer surprises happen when changes leave traces visible at a glance. That steady proof keeps systems running smoother than before imagined. Demand rises simply because things must arrive right - no second chances often exist. Monitoring becomes less optional, more routine background check woven into daily flow. Results speak without fanfare: fresher outcomes, tighter control, fewer losses. This shift sticks not through push, but quiet usefulness seen day after day.

Now fresh signals show up right inside the wrapper, changing how we see food safety. Tracking tags and tiny sensors work together, giving companies clearer data on what happens after items leave the factory. Because rules get stricter and shoppers demand proof, firms pour more into tools that deliver trust. These shifts quietly push tech-driven packaging forward, making it a steady mover in the years ahead.

The Food & Beverages segment is projected to witness the highest CAGR in the Active & Intelligent Packaging market during the forecast period.

Freshness matters most in food and drink, pushing this sector to lead the active and smart packaging field. Because people want safer items that last longer, demand keeps rising. Dairy, meat, fish, and pre-made dishes go bad fast unless handled right. These goods need wraps that lock out dampness, block air damage, or stop germs from spreading. Instead of old methods, new tools like packets that grab oxygen, sheets that pull water, or labels that show ripeness now pop up more often. Trust grows when buyers see proof that their meal stayed fresh. Growth here seems likely to continue under current trends.

Growth here keeps moving because new ideas mix well with tech upgrades. Inside packages today, active parts work alongside clever tools such as sensors, labels that react to heat changes, and tiny tracking chips. These help watch how fresh food stays while it moves around. People care more about safe meals, regulations push harder on knowing where things come from, so makers turn to smarter wraps, turning the Food & Beverages area into one strong force behind wider industry gains.

The North America region is projected to witness the highest CAGR in the Active & Intelligent Packaging market during the forecast period.

Active and Intelligent Packaging is one of the large markets in North America since consumers are well aware of food safety, quality, and traceability of their products. The adoption of the advanced packaging solutions is very extensive in the food, beverage, and pharmaceutical industries and has been backed by stringent regulation and a high level of investment in research and development. Active and smart packaging technologies by manufacturers in the region are being used to offer better shelf life, minimize spoilage, and enhance supply chain efficiency.

The United States also has the advantage of a developed supply chain, modern infrastructure, and an expanding e-commerce and cold-chain logistics as the biggest player in the North American region. Firms are also considering novel approaches to packaging, such as active packaging using oxygen scavengers and moisture absorbers, smart packaging systems such as time-temperature indicators, and RFID-based monitoring. These and other trends, coupled with the consumer demand for transparency and safety, make North America a major region in adopting and developing Active and Intelligent Packaging solutions.

Key Players

Top companies include Amcor plc, Sealed Air Corporation, Avery Dennison Corporation, Mondi Group, 3M Company, DuPont de Nemours, Inc., CCL Industries Inc., Constantia Flexibles Group GmbH, Dai Nippon Printing Co., Ltd., Huhtamäki Oyj, Stora Enso Oyj, Smurfit Kappa Group, Crown Holdings, Inc., Ball Corporation, Multisorb Technologies, Inc., Thin Film Electronics ASA.

Drop us an email at:

Call us on:

+91 7666513636