Feb 06, 2026

The report “Dedicated Outdoor Air System Market By Equipment Type (Packaged DOAS Units, Custom-Built DOAS Units), By Capacity (Up to 20 tons, 20-40 tons, 40-60 tons, Greater than 60 tons), By Technology (Energy Recovery Ventilation (ERV) Systems, Direct Expansion (DX) Systems) and By End-Use (Commercial, Industrial, Residential)” is expected to reach USD 13.80 billion by 2033, registering a CAGR of 9.90% from 2026 to 2033, according to a new report by Transpire Insight.

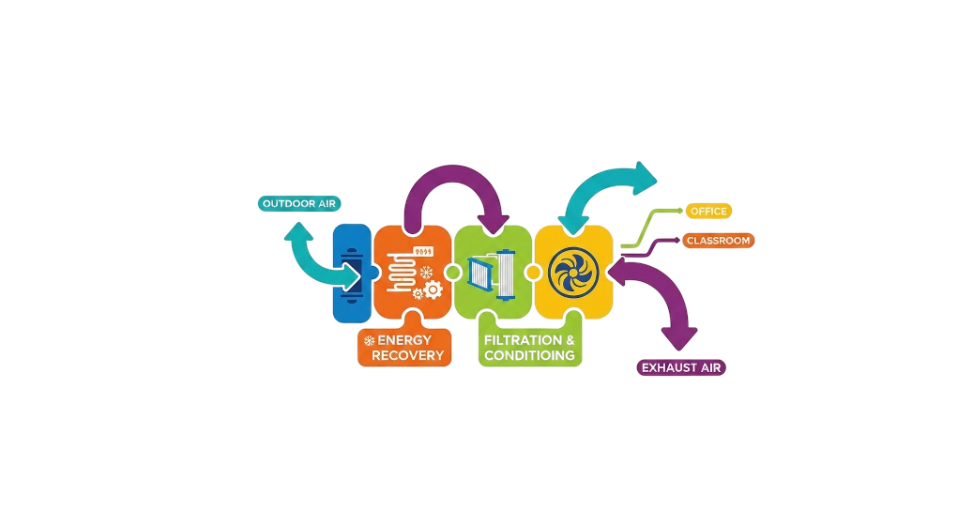

As building operators place a greater emphasis on indoor air quality, energy economy, and regulatory compliance in ventilation systems, the market for dedicated outside air systems is steadily growing. Improved humidity control and optimal ventilation performance are made possible by DOAS solutions, which are made to supply and condition outdoor air independently of conventional heating and cooling systems. Adoption in commercial and institutional structures worldwide is being aided by growing awareness of environmental sustainability and occupant health. The growing demand to lower HVAC energy usage while upholding constant air quality standards is driving market expansion. By controlling ventilation air independently, DOAS systems enhance operational efficiency and lessen the strain on primary cooling equipment. Investments in energy-efficient ventilation solutions are increasing in both developed and emerging nations due to rising energy costs and tighter building performance regulations.

With the help of remodeling projects and the modernization of outdated HVAC infrastructure, the commercial construction industry is still a major contributor to market growth. In order to increase thermal comfort and air quality outcomes, DOAS solutions are being used more frequently in facilities like workplaces, healthcare facilities, educational buildings, and hospitality organizations. System performance and adoption rates are being further improved by the integration of modern control systems and energy recovery technology. Demand for specialized ventilation systems is also rising as a result of Asia Pacific's and portions of the Middle East's rapid infrastructural expansion and urbanization. In order to meet changing building needs, manufacturers are concentrating on modular designs, energy recovery integration, and smart monitoring capabilities.

The Packaged DOAS Units segment is projected to witness the highest CAGR in the Dedicated Outdoor Air System during the forecast period.

According to Transpire Insight, Packaged DOAS units stand for the largest equipment segment due to their standardized configuration, ease of installation, and reduced commissioning time compared to custom-built systems. These units are commonly used in commercial applications where operational reliability, installation efficiency, and project timeliness are important considerations. They are especially well-suited for medium-scale commercial developments and retrofit projects because of their factory-assembled design, which reduces on-site complexity while guaranteeing constant performance. Adoption in offices, retail settings, and institutional buildings is further supported by an increasing focus on cost effectiveness and easier maintenance.

Packaged DOAS units stand for the largest equipment segment due to their standardized configuration, ease of installation, and reduced commissioning time compared to custom-built systems. These units are commonly used in commercial applications where operational reliability, installation efficiency, and project timeliness are important considerations. They are especially well-suited for medium-scale commercial developments and retrofit projects because of their factory-assembled design, which reduces on-site complexity while guaranteeing constant performance. Adoption in offices, retail settings, and institutional buildings is further supported by an increasing focus on cost effectiveness and easier maintenance.

The Up to 20 Tons segment is projected to witness the highest CAGR in the Dedicated Outdoor Air System during the forecast period.

Due to its high applicability in small to mid-sized commercial facilities where ventilation requirements are minimal but regular air quality control is still crucial, the up to 20 tons capacity category has a leading share. These systems are appropriate for offices, clinics, schools, and retail establishments because they provide a balance between performance, energy efficiency, and installation flexibility. Adoption in projects with limited space and financial constraints is encouraged by their small footprint and lower operating costs.

The demand for this capacity range is further strengthened by an increase in retrofit activities in older commercial buildings, as facility managers look for effective ventilation solutions without requiring significant infrastructure changes. Growing demand for decentralized HVAC solutions that enable better zoning and operational control also helps this market. The up to 20 tons segment is anticipated to maintain steady growth across several countries as urban commercial spaces continue to rise and building owners concentrate on energy optimization.

The Energy Recovery Ventilation (ERV) Systems segment is projected to witness the highest CAGR in the Dedicated Outdoor Air System during the forecast period.

According to Transpire Insight, Energy Recovery Ventilation systems dominate the technology segment due to their ability to significantly reduce heating and cooling loads while maintaining required ventilation levels. ERV-based DOAS solutions lower energy usage and improve overall HVAC efficiency by moving heat and moisture between the incoming and exhaust air streams. This feature is especially useful in areas with harsh weather, where ventilation loads significantly raise operating expenses.

ERV technology adoption in commercial infrastructure is being accelerated by the growing focus on sustainability and carbon reduction goals. Solutions that promote green building certifications and long-term operating savings are being given top priority by building owners and developers. The position of ERV systems as the dominant technology option in contemporary dedicated outdoor air applications has been strengthened by ongoing improvements in heat exchange materials and system design, which have increased dependability and efficiency.

The Commercial segment is projected to witness the highest CAGR in the Dedicated Outdoor Air System during the forecast period.

Due to growing legal requirements and increased awareness of indoor environmental quality in public buildings and workplaces, the commercial segment holds the greatest share of the dedicated outside air system market. Reliable ventilation systems that can maintain constant air quality while using the least amount of energy are necessary in offices, schools, hospitals, and hospitality companies. By isolating ventilation air from space conditioning processes, DOAS technologies meet these needs and increase overall HVAC efficiency.

Additionally, growing expenditures in smart building technologies and the upgrading of commercial infrastructure continue to fuel demand in this market. In order to improve occupant comfort, adhere to ventilation regulations, and lower operating expenses, facility owners are progressively implementing DOAS systems. Dedicated outdoor air systems are anticipated to continue to be widely used in both established and emerging countries as commercial buildings increasingly include ecological and energy-efficient design principles.

The North America region is projected to witness the highest CAGR in the Dedicated Outdoor Air System during the forecast period.

Due to strict energy efficiency regulations, heightened awareness of interior air quality, and the extensive use of cutting-edge HVAC technologies, North America is the largest geographical market for dedicated outdoor air systems. Large-scale commercial construction, the refurbishment of aged infrastructure, and a growing focus on sustainable building methods are the ways that the United States drives regional demand. Adoption of energy-efficient ventilation systems has increased in workplace, healthcare, and educational settings thanks to regulatory frameworks.

Leading HVAC companies are well-represented in the area, and ventilation system technology is constantly evolving. Market expansion is further strengthened by rising retrofit activity and rising investments in smart building management systems. Over the course of the forecast period, North America is anticipated to continue to hold the top spot in the global DOAS market as building owners continue to place a high priority on operational effectiveness and environmental compliance.

Key Players

The top 15 players in the Dedicated Outdoor Air System market include Daikin Industries Ltd., Carrier Global Corporation, Johnson Controls International plc, Trane Technologies plc, LG Electronics Inc., Mitsubishi Electric Corporation, Greenheck Fan Corporation, AAON Inc., Nortek Air Solutions, LLC, Munters Group AB, Lennox International Inc., Samsung Electronics Co., Ltd., Desiccant Rotors International Pvt. Ltd. (DRI), Addison HVAC, LLC, and Desert Aire Corporation.

Drop us an email at:

Call us on:

+91 7666513636