Market Summary

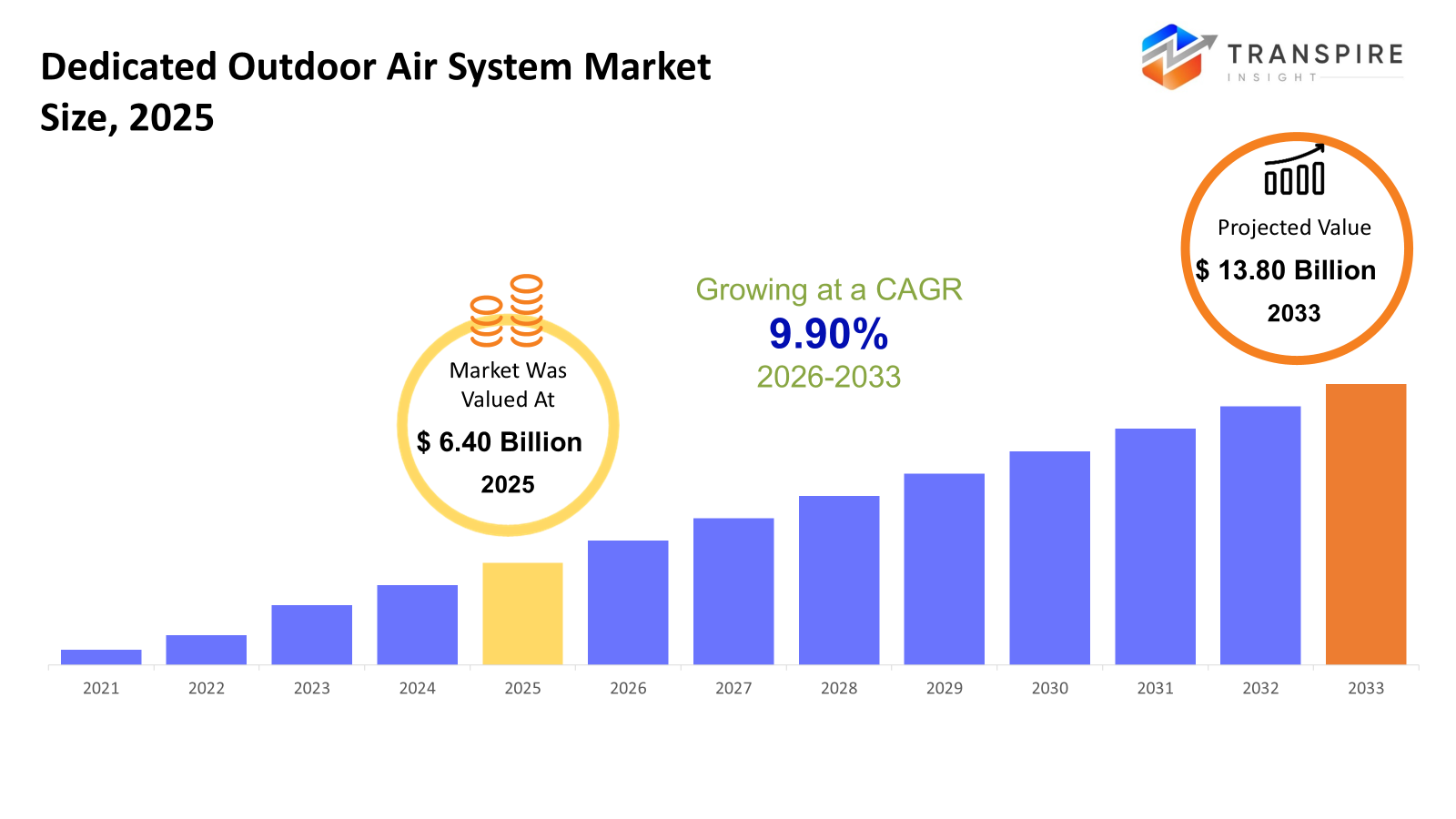

The global Dedicated Outdoor Air System market size was valued at USD 6.40 billion in 2025 and is projected to reach USD 13.80 billion by 2033, growing at a CAGR of 9.90% from 2026 to 2033. The market for dedicated outside air systems is steadily expanding due to the growing regulatory emphasis on ventilation efficiency and indoor air quality in commercial and institutional buildings. New installations and system improvements are being accelerated by the growing awareness of occupant health and the increasing usage of energy-efficient HVAC systems. Global demand for cutting-edge ventilation solutions is also being fuelled by the growth of commercial infrastructure and green building efforts.

Market Size & Forecast

- 2025 Market Size: USD 6.40 Billion

- 2033 Projected Market Size: USD 13.80 Billion

- CAGR (2026-2033): 9.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Strong adoption of dedicated outdoor air systems is seen in North America, which is bolstered by strict energy efficiency laws, an increase in retrofit projects, and a growing focus on improving indoor air quality throughout commercial infrastructure, especially in healthcare, education, and office buildings looking to optimize operations.

- Strong demand is emerging from commercial construction and institutional facilities that prioritize sustainability and long-term energy savings. The US market is impacted by building modernization initiatives, growing adoption of energy recovery technologies, and increased integration of smart HVAC controls.

- Rapid urbanization, growing commercial construction, and growing awareness of ventilation standards are driving market expansion in Asia Pacific, especially in China, Japan, South Korea, and India, where climate diversity supports demand for energy-efficient air management solutions.

- Packaged DOAS units are becoming more and more popular in office buildings, educational institutions, and retail developments worldwide because of their standardized performance, ease of installation, and suitability for commercial retrofits. These factors allow for cost-effective ventilation upgrades while maintaining energy efficiency.

- Due to its applicability in small and mid-sized commercial establishments, where energy efficiency, compact design, and flexible installation requirements encourage adoption throughout new construction and renovation projects, the up to 20 tons capacity sector continues to sustain high demand.

- Energy recovery ventilation systems, which enable efficient heat and moisture transfer while upholding ventilation standards and enhancing overall HVAC system performance in large commercial buildings, are becoming more and more popular as organizations prioritize reduced operational energy consumption and sustainability targets.

- As companies increasingly invest in cutting-edge ventilation systems to meet air quality regulations, improve occupant comfort, and lower energy consumption—particularly across offices, hospitality, healthcare, and educational infrastructure developments—the commercial end-use segment is driving adoption.

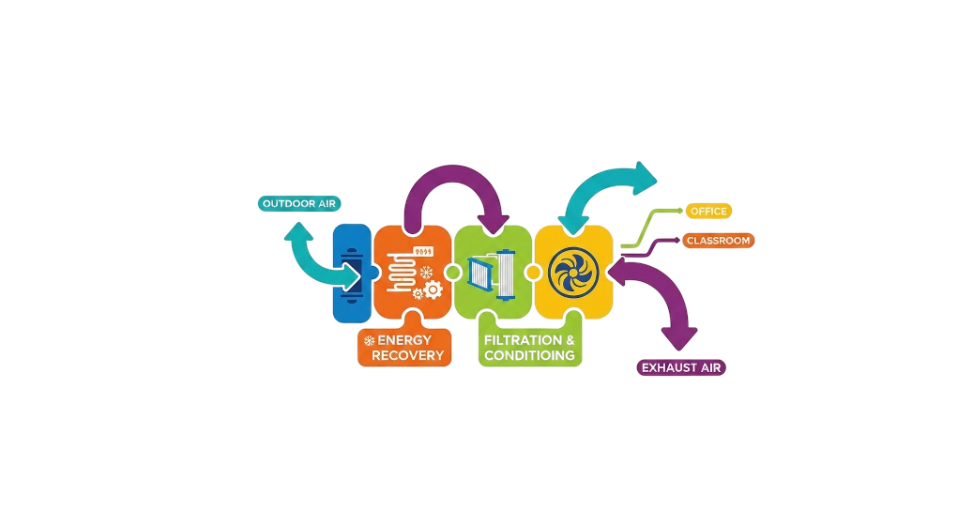

So, The market for HVAC systems intended to independently control ventilation air by conditioning and supplying fresh outdoor air apart from room heating and cooling systems is known as the Dedicated Outdoor Air System market. By regulating humidity and ventilation rates and lessening the strain on traditional HVAC equipment, these systems enhance indoor air quality. Globally, the usage of DOAS systems in commercial and institutional applications has risen due to growing awareness of health, air quality, and energy efficiency. Changing construction regulations, sustainability programs, and the growing need for energy-efficient infrastructure all have an impact on the industry. DOAS systems are appropriate for contemporary buildings with tighter envelopes and larger occupant densities because they allow for better humidity control and energy recovery. Long-term adoption is supported by the integration of smart controls and cutting-edge monitoring technologies, which further improve system efficiency and operational flexibility. Increased investment in green buildings, rehabilitation of outdated HVAC systems, and growth in commercial construction all contribute to growth. DOAS systems are being used more and more by sectors like healthcare, education, and hospitality to ensure constant indoor environmental quality. In both developed and emerging economies, the market is continuing to move toward high-efficiency ventilation solutions as energy prices rise and regulatory frameworks get stronger.

Dedicated Outdoor Air System Market Segmentation

By Equipment Type

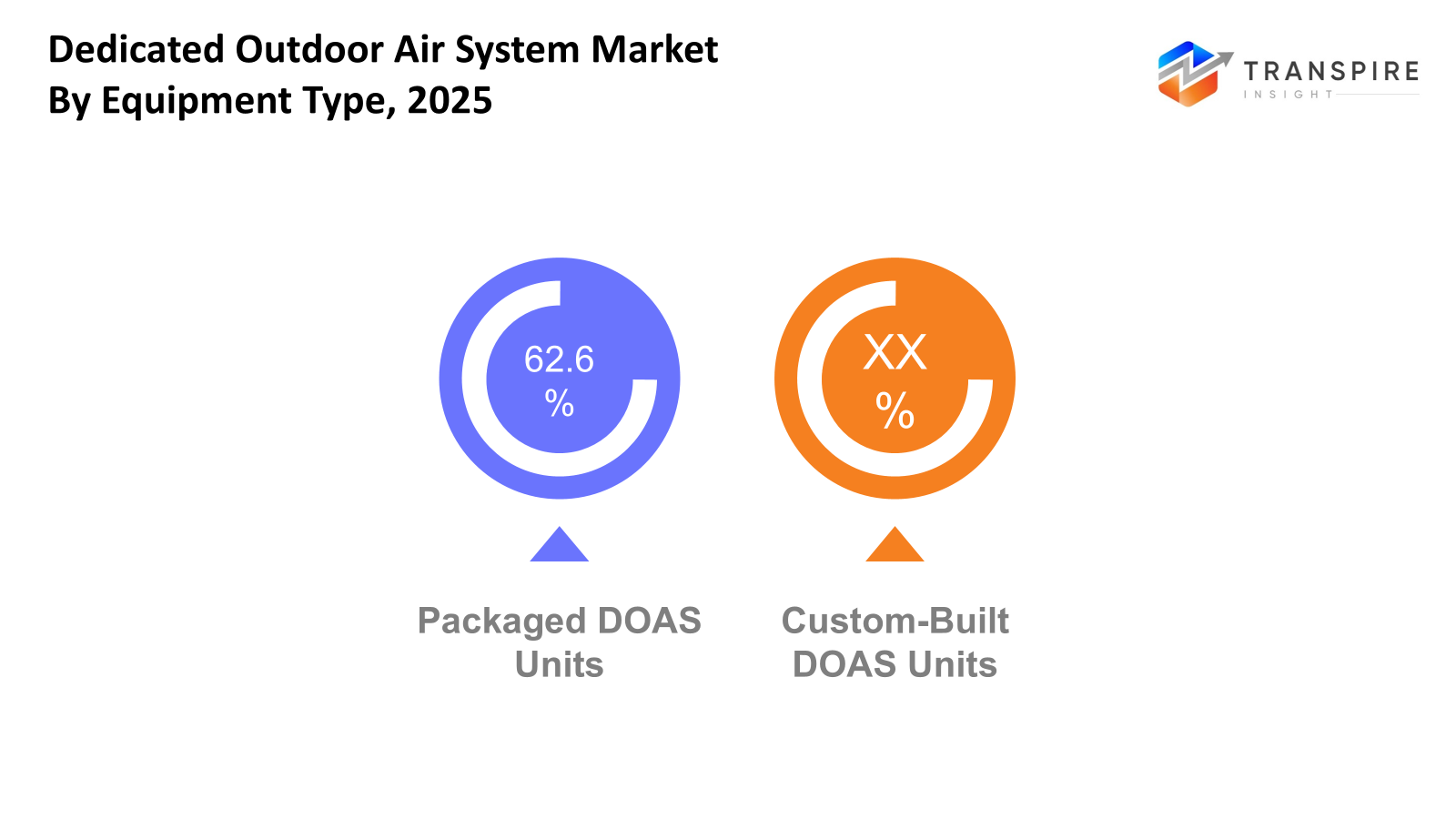

- Packaged DOAS Units

Packaged DOAS devices allow for easier installation and consistent performance by combining ventilation, cooling, heating, and control components into a single factory-assembled system. Because of their simpler installation and fewer maintenance needs, these systems are frequently used in commercial retrofits and new building projects. In offices, retail establishments, and institutional facilities where space and operational efficiency are crucial, their small shape facilitates quicker deployment. Packaged systems are a leading equipment category worldwide due to market demand which is bolstered by energy-efficiency standards and the growing focus on indoor air quality compliance.

- Custom-Built DOAS Units

Large or specialized buildings needing precise airflow control, humidity management and interaction with intricate HVAC systems are the target market for custom-built DOAS machines. These systems are favored in settings where operational conditions differ greatly between zones, such as hospitals, labs, data centers and industrial settings. Their adaptability makes it possible to integrate them with cutting-edge energy recovery and building management systems, increasing the effectiveness of large-scale projects. The need for customized ventilation solutions in high-performance buildings seeking sustainability certifications and improved environmental control is fueling this segment's growth.

To learn more about this report, Download Free Sample Report

By Capacity

- Up to 20 tons

Small to medium-sized business locations, including offices, schools, and healthcare institutions, frequently use DOAS systems with a 20-ton capacity. Their small design, reduced energy consumption, and suitability for moderate ventilation loads in areas with limited space are the main reasons for their popularity. Without incurring unnecessary operating costs, these devices offer reliable fresh air delivery and effective humidity management. The segment's robust market position is sustained by growing use in light commercial and retrofit applications.

- 20-40 tons

The capacity range of 20 to 40 tons meets the needs of institutional establishments and mid-sized commercial buildings with moderate to high occupancy levels. These systems are appropriate for schools, hospitals, and multi-story business buildings because they provide a balance between airflow capacity, energy efficiency, and installation cost. Because of its compatibility with current HVAC systems, designers prefer this segment for retrofit work. As building managers look for scalable ventilation solutions that maximize energy efficiency while upholding indoor air quality standards, demand stays steady.

- 40–60 tons

Large commercial and industrial buildings that need multi-zone air distribution and heavy ventilation loads usually use the 40–60 ton capacity segment. These systems increase operational efficiency over broad floor areas by supporting intricate heating and cooling combinations, such as hydronic and radiant applications. The demand for this capacity range is rising as a result of the expansion of commercial centers and industrial infrastructure. It is a top option for large-scale installations due to its capacity to provide high-performance ventilation while promoting energy optimization.

- Greater than 60 tons

Large infrastructure projects like airports, industrial facilities, and sizable university campuses are the main locations for DOAS systems weighing more than 60 tons. These large-capacity systems are made to handle demanding ventilation needs and high occupancy loads while preserving constant temperature and humidity levels. For these systems, manufacturers are progressively creating modular designs to speed up installation and increase scalability. Large-scale commercial expansions and emerging economies are anticipated to adopt this category due to the expansion of smart buildings and mega infrastructure projects.

By Technology

- Energy Recovery Ventilation (ERV) Systems

Energy Recovery Ventilation systems greatly increase energy efficiency in DOAS applications by recovering heat and moisture from exhaust air and transferring it to incoming outdoor air. This technique is appropriate for areas with harsh climates since it lowers heating and cooling loads while preserving proper ventilation and humidity control. Because ERV-based DOAS solutions can save operating energy costs, they are being used more and more in green buildings and sustainability-focused projects. The use of ERV technology in commercial infrastructure is further supported by the increased regulatory attention on energy-efficient HVAC systems.

- Direct Expansion (DX) Systems

Direct Growth Compared to chilled-water systems, DOAS systems offer quicker response times and easier installation since they use refrigerant-based cooling to directly condition outdoor air. Commercial facilities that need separate ventilation and cooling management are more likely to adopt these systems which are frequently used in packaged configurations. Particularly in humid climates, DX technology promotes consistent indoor air quality and efficient dehumidification. Growing usage in commercial buildings, where cost effectiveness, compact design and ease of operation are important factors in purchases, affects market demand.

By End-Use

- Commercial

Because of the growing focus on indoor air quality, occupant comfort, and energy economy in workplaces, retail establishments, educational institutions, and hospitality facilities, the commercial sector has the greatest adoption base for DOAS systems. Demand for specialized outdoor air systems in this market is driven by building modernization initiatives and more stringent ventilation requirements. DOAS technologies are crucial for the construction of contemporary commercial infrastructure since they allow for better humidity control and energy savings as compared to traditional HVAC systems.

- Industrial

DOAS systems are used by industrial facilities to maintain controlled environmental conditions, especially in data centers, manufacturing facilities, and process industries where precise ventilation is essential. These systems promote worker safety and operational efficiency by assisting in the management of heat loads, pollutants, and humidity levels. Stable demand is a result of growing industrial infrastructure and increased automation in emerging economies. DOAS integration with energy recovery systems that lower operating costs in energy-intensive areas also benefits industrial users.

- Residential

The use of DOAS systems in homes is steadily increasing, especially in energy-efficient housing complexes and high-rise apartments where regulated ventilation enhances indoor air quality. In order to meet the needs of urban housing and more constrained building envelopes, compact and mini-DOAS solutions are being developed more frequently. Long-term growth in this market is supported by increased awareness of health, ventilation requirements, and energy-efficient living spaces. However, because of the system complexity and greater initial installation costs, adoption is still relatively modest compared to commercial applications.

Regional Insights

Strong regulatory frameworks and the widespread use of energy-efficient HVAC systems continue to propel North America's market toward maturity. Due to extensive commercial infrastructure development and retrofitting projects, the United States leads the region in demand, whereas Canada prioritizes building requirements that are driven by sustainability. Mexico's steady growth is bolstered by growing industrial expansion and commercial construction. Europe shows consistent market growth backed by stringent energy performance guidelines and environmental laws. Germany, the UK, France, Spain, and Italy are important markets where demand is supported by the adoption of green buildings and the restoration of outdated infrastructure. Adoption is still occurring throughout the rest of Europe as a result of modernization of commercial facilities and energy efficiency efforts. The fastest-growing geographical market is Asia Pacific as a result of increased infrastructure, urbanization, and awareness of indoor air quality. Australia and New Zealand place a strong emphasis on energy-efficient building techniques, while China, Japan, South Korea, and India generate a large amount of demand through commercial construction and industrial development. Growing HVAC use and urban growth help the remainder of Asia Pacific. Brazil and Argentina lead the moderate growth in South America, where the expansion of institutional and commercial infrastructure facilitates the progressive use of sophisticated ventilation systems. Large-scale commercial projects in Saudi Arabia and the United Arab Emirates are driving the Middle East and Africa area, while growing infrastructure investments and climate-driven ventilation requirements are driving adoption in South Africa and other regional markets.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, Greenheck implemented the growth of its dedicated outdoor air systems portfolio with the introduction of the RV-220 model, designed to deliver higher airflow, heating, and cooling capacities. The system improves installation economy and operational flexibility while supporting large commercial ventilation requirements with the use of R-454B refrigerant and increased cooling capacity. The development is a response to the growing need for energy-efficient ventilation systems that can handle large amounts of external air in institutional and commercial buildings.

- In October 2024, Greenheck announced enhancements to its air-source heat pump technology integrated into dedicated outdoor air systems, enabling efficient heating performance at outdoor temperatures as low as 0°F. In addition to supporting electrification and energy efficiency goals in commercial HVAC applications, the upgrade incorporates new refrigeration systems and enhanced control algorithms that enable DOAS units to function effectively throughout a wider range of climatic conditions.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.40 Billion |

|

Market size value in 2026 |

USD 7.10 Billion |

|

Revenue forecast in 2033 |

USD 13.80 Billion |

|

Growth rate |

CAGR of 9.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Daikin Industries Ltd., Carrier Global Corporation, Johnson Controls International plc, Trane Technologies plc, LG Electronics Inc., Mitsubishi Electric Corporation, Greenheck Fan Corporation, AAON Inc., Nortek Air Solutions, LLC, Munters Group AB, Lennox International Inc., Samsung Electronics Co., Ltd., Desiccant Rotors International Pvt. Ltd. (DRI), Addison HVAC, LLC, Desert Aire Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Equipment Type (Packaged DOAS Units, Custom-Built DOAS Units), By Capacity (Up to 20 tons, 20-40 tons, 40-60 tons, Greater than 60 tons), By Equipment Type (Energy Recovery Ventilation (ERV) Systems, Direct Expansion (DX) Systems) and By End-Use (Commercial, Industrial, Residential) |

Key Dedicated Outdoor Air System Company Insights

Daikin Industries Ltd.'s broad HVAC portfolio, global manufacturing base, and emphasis on energy-efficient ventilation technologies help it to maintain a strong position in the dedicated outdoor air system market. To increase operational effectiveness and indoor air quality performance, the organization places a strong emphasis on integrating energy recovery solutions, inverter-driven systems, and modern controls. Consistent acceptance across institutional and commercial projects is supported by its robust distribution network and enduring partnerships with commercial building contractors. Daikin's competitive positioning in both developed and emerging countries is strengthened by its ongoing investments in product innovation and sustainability-focused solutions, which enable it to satisfy regulatory requirements and changing building standards.

Key Dedicated Outdoor Air System Companies:

- Daikin Industries Ltd.

- Carrier Global Corporation

- Johnson Controls International plc

- Trane Technologies plc

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Greenheck Fan Corporation

- AAON Inc.

- Nortek Air Solutions, LLC

- Munters Group AB

- Lennox International Inc.

- Samsung Electronics Co., Ltd.

- Desiccant Rotors International Pvt. Ltd. (DRI)

- Addison HVAC, LLC

- Desert Aire Corporation

Global Dedicated Outdoor Air System Market Report Segmentation

By Equipment Type

- Packaged DOAS Units

- Custom-Built DOAS Units

By Capacity

- Up to 20 tons

- 20-40 tons

- 40-60 tons

- Greater than 60 tons

By Technology

- Energy Recovery Ventilation (ERV) Systems

- Direct Expansion (DX) Systems

By End-Use

- Dairy Farms

- Swine Farms

- Poultry Farms

- Other Farm Types

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636