Market Summary

The global Pharmaceutical Packaging market size was valued at USD 128.00 billion in 2025 and is projected to reach USD 215.00 billion by 2033, growing at a CAGR of 6.0% from 2026 to 2033. The pharmaceutical packaging market is experiencing steady growth in terms of CAGR results, led by the rising need for biologics, vaccines, and specialty medicines that require high-tech packaging. The regulatory environment in the form of compliance for drug safety, as well as drug counterfeiting, is also thereby contributing to the growth of tamper-evident as well as child-resistant packaging. Growing awareness about sustainability in relation to eco-friendly packaging materials is also driving growth in this direction. Along with this, the rise in the e-pharma as well as home healthcare sector is also creating demand for light-weight yet robust packaging in regions.

Market Size & Forecast

- 2025 Market Size: USD 128.00 Billion

- 2033 Projected Market Size: USD 215.00 Billion

- CAGR (2026-2033): 6.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- In North America, the pharmaceutical packaging market is healthy with robust growth, largely underpinned by the developed healthcare infrastructure, regulatory adherence, and high uptake of biologics, with noticeable trends towards green packaging, automation, and high-barrier packaging materials to ensure the safety of pharmaceuticals with extended shelf life

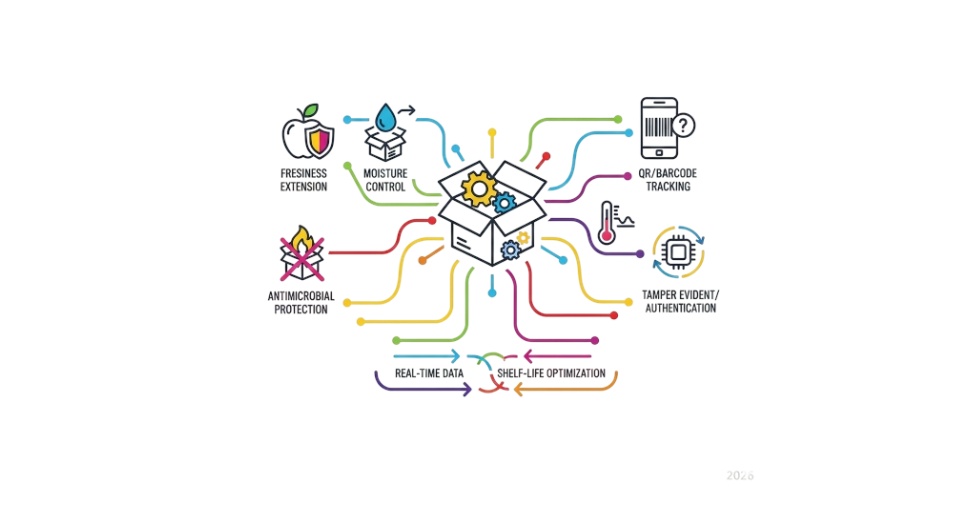

- The market leader for pharmaceuticals packaging in the United States is characterized by substantial innovation for advanced materials, automation, and smart packaging technologies due to high expenditure in pharmaceuticals, specialty drug development, and a growing demand for sustainable packaging formats.

- The pharmaceutical packaging market is poised to grow at the fastest rate in Asia Pacific, underpinned by the pharmaceutical manufacturing industry, access to healthcare, and consumption of generic pharmaceuticals.

- Plastic still remains the primary segment in terms of material in this overall market, given its lightweight nature, cost effectiveness, and ease in manufacturing bottles, pouches, and containers, whereas glass maintains its significance for injectables and other formulations requiring best-in-class properties

- Bottles are the leading packaging format driven by extensive adoption across liquid and solid oral dosage forms of medications, further fueled by the need for tamper-evident containers and patient-friendly dosage systems while facilitating mass production of pharmaceuticals and the growing e-pharmacy landscape.

- Hospitals and clinics are still mainly end users because of the large quantities of sterile injectables consumed and specialty formulations, thereby fueling demand for advanced forms of primary packaging that guarantee sterility, dosage accuracy, and compliance with ever-increasing healthcare safety standards across the globe

So, The pharmaceutical packaging market includes the material, container, and/or system utilized to ensure safety, stability, and integrity of drug products through the entire distribution network. In turn, the drug package consists of the active pharmaceutical ingredient in its container, which can be a bottle, vial, ampoule, or blister package. Increasing demand for tamper evident, child-resistant, and single-dose packages for biologics, vaccines, and specialty injectables is fuelling the demand. The shift in consumer behavior due to the increasing practice of home healthcare and e-pharmacy is creating a demand for lighter, transportable, and convenient packaging. Additionally, the development of environmentally-friendly materials such as biodegradable plastic, paperboard, and laminates is also adding to the demand. Additionally, regulatory practices like FDA, EMA, and ISO standards aid in quality, safety, and traceability practices that further promote advanced packaging techniques. The market is also impacted by demographic factors, prevalent chronic illnesses, and increased consumer awareness regarding drug safety and sustainability.

Pharmaceutical Packaging Market Segmentation

By Material Type

- Plastic

Plastic dominates the pharmaceutical packaging segment due to its light weight, very low cost and versatility. Bottles, vials, and pouches are the major applications in which plastic is commonly used, while markets that stress convenience and safe transportation of drugs are driving this segment. Biodegradable plastics are emerging especially in Europe and North America.

- Glass

Glass has remained crucial for injectables, vials, and ampoules because it is chemically inert and highly effective as a barrier material. North America, Europe and the Asia Pacific find it preferred in sectors like biotechnology and high-value pharmaceuticals. Handling and breakage problems limit it to the emerging markets.

- Metal

Metal packaging involves aluminum and tin, mainly for blister packs, tubes and cans. Its strength and barrier properties make it suitable for sensitive drug formulations, with strong adoptions in North America and Europe however, cost and weight considerations restrict broader applications in the Asia Pacific region.

- Paper & Paperboard

Paper and paperboard are traditionally used for secondary packaging formats such as cartons and labels. They help achieve sustainability benefits and are a sought material due to the pressure for sustainable products in Europe and North America. They are used increasingly in Asia Pacific due to cost-effectiveness.

- Others

Other materials in the category include hybrid laminates, biodegradable polymers and composites. These materials are newer solutions to environmental challenges. Use of these materials is more prevalent in regions like Europe and North America which have stringent sustainability standards.

By Packaging Type

- Bottles

Bottles find broad applications for liquid formulations, syrups, and tablets. In the emerging markets, plastic bottles are more predominant due to cost efficiency in high-value and injectable drug segments, glass bottles are preferred. North America and Europe remain innovation hubs for premium bottle packaging.

- Blister Packs

Because of dosage precision and long shelf life, blister packaging is generally preferred for tablets and capsules. While most of the adoption is seen in Europe and North America, Asia Pacific is also catching up because of the increasing prevalence of chronic diseases and the consumption of generic drugs.

- Vial

Injectable and vaccine vials are critical in nature and need high sterility and barrier properties. Glass vials dominate the injectables and vaccines markets in the developed regions of North America, Europe and Japan, while plastic vials are gaining traction gradually in cost-sensitive Asian markets.

- Ampoule

Ampoules also tend to be used for single-dose injectables or for potent drugs. Glass ampoules are the conventional choice all over the globe owing to chemical inertness. North America, European Union, and Asia Pacific vaccine formulations demonstrate good demand for these.

- Pouches & Sachets

Pouches and sachets are increasingly being used for powders, granules, and single-dose formulations, and the convenience and portability of these dosage forms make them attractive in the retail pharmacy market and in emerging markets in the Asia Pacific region and Latin America

- Others

Other formats include prefilled syringes, prefilled cartridges, and advanced multi-dose systems. These formats are growing with biologic drugs and personalized medications, particularly in North America, Europe, and Japan.

To learn more about this report, Download Free Sample Report

By End User

- Hospitals & Clinics

Applications in hospitals and clinics drive demand for injectable packaging, prefilled syringes, and ampoules. North America and Europe dominate the market due to high-volume immunization and special administration of drugs, while Asia Pacific is seeing growing adoption with expanding healthcare infrastructure.

- Retail Pharmacies

Retail pharmacies need products in convenient, tamper-evident packaging, such as blister packs, bottles, and pouches. North America and Europe continue to lead in organized retail chains of pharmacies, though the Asia Pacific is seeing the fastest growth on account of increasing sales of OTC drugs.

- Online Pharmacies

Online pharmacies need secure, light, and tamper-proof packaging so that their delivery is safe. The growth is good in North America, Europe, and India, driven by e-commerce penetration, especially for OTC, nutraceuticals, and chronic disease medications.

- Pharmaceutical Companies

It focuses on packaging by the manufacturers for maintaining product integrity, regulatory compliance, and extended shelf life. Advanced automation and sustainable packaging adoption have been leading in the North American and European regions, while in the Asia Pacific region, the manufacturing companies are investing increasingly in state-of-the-art primary and secondary packaging lines.

Regional Insights

North America (United States, Canada, and Mexico) is an established market for the use of state-of-the-art glass, plastic, and TE packaging materials. The United States focuses on the packaging innovations of biologics and specialty drug packaging, whereas Canada and Mexico emphasize cost-effective packaging solutions. Europe, comprising Germany, United Kingdom, France, Spain, Italy, and Rest of Europe, is focused on using sustainable and recyclable packaging. Materials include blister packs, glass bottles, and paperboard. Germany, the United Kingdom, and France are at the forefront of innovations in packaging, while Southern Europe and Eastern Europe are looking at cost-effective, standardized packaging.

Asia Pacific (Japan, China, Australia & New Zealand, South Korea, India, Rest of Asia Pacific) drives the market due to its growth in pharmaceutical manufacturing, prevalence of chronic diseases, and use of generics. Japan and South Korea have high-quality glass and vial-based packaging, while China, India, and other Asia Pacific countries use plastic and paper-based packaging.

South America (Brazil, Argentina, Rest of South America) focuses on light weight and portable packages, with Brazil stressing innovation and Argentina soon to follow with rapid as the healthcare infrastructure grows. Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of Middle East & Africa) has the focus on tough and climate-resistant solutions, wherein the adoption of plastic and metal packages has been strong in the UAE, Saudi Arabia, and South Africa. Emerging markets are gradually improving their compliance with regulatory and pharmacueticals production.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, Gerresheimer launched the official construction phase of a new production hall at Gerresheimer’s Wertheim, Germany, site. The new hall will be used to produce RTF Vials and EZ-fill Smart, ready-to-use packaging solutions for sensitive biopharmaceuticals, thus supporting enhanced capacity for the production of high-quality primary packaging. The expansion, which will be achieved through an investment of approximately EUR 30 million, will create new job opportunities.

- In April 2025, A new-generation coating plant in Selangor, Malaysia, has been completed by Amcor, which increases its capability to make sterile healthcare substrates using advanced air knife technology and reaffirms its commitment to supply chain security and lead time reductions in the region. The new plant is the first in Asia to manufacture both top and bottom substrates domestically for medical device packaging, with demand for advanced packaging solutions in pharmaceuticals and health growing in the Asian region.

(Source:https://www.amcor.com/media/news/amcor-coating-facility-enhancing-healthcare-packaging-asia-pacific)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 128.00 Billion |

|

Market size value in 2026 |

USD 135.00 Billion |

|

Revenue forecast in 2033 |

USD 215.00 Billion |

|

Growth rate |

CAGR of 6.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Amcor plc, Gerresheimer AG, West Pharmaceutical Services, Inc., Schott AG, AptarGroup, Inc., SGD Pharma, Berry Global, Inc., CCL Industries, Inc., Becton Dickinson & Company, Comar, LLC, Vetter Pharma International, WestRock Company, Drug Plastics Group, International Paper, Catalent Pharma Services |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Plastic, Glass, Metal, Paper & Paperboard, Others), By Packaging Type (Bottles, Blister Packs, Vials, Ampoules, Pouches & Sachets, Others) and By End User (Hospitals & Clinics, Retail Pharmacies, Online Pharmacies, Pharmaceutical Manufacturers) |

Key Pharmaceutical Packaging Company Insights

Amcor plc is a leading company that specializes in pharmaceutical packaging. Its extensive portfolio of flexible and rigid packaging products complies with strict regulatory requirements and environmentally friendly standards. It has a broad geographical footprint that includes North America, Europe, Asia Pacific, and Latin America. The company serves large pharmaceutical companies that demand high-performance packaging materials that are recyclable. The company’s strategic initiatives have strengthened its position in the market by expanding its capabilities in innovative blister packs, specialty cartons, and barrier films. The company’s focus on environmentally friendly packaging will remain a major driver for the growth of the company as there is increasing pressure to comply with stringent environmental standards.

Key Pharmaceutical Packaging Companies:

- Amcor plc

- Gerresheimer AG

- West Pharmaceutical Services, Inc.

- Schott AG

- AptarGroup, Inc.

- SGD Pharma

- Berry Global, Inc.

- CCL Industries, Inc.

- Becton Dickinson & Company

- Comar, LLC

- Vetter Pharma International

- WestRock Company

- Drug Plastics Group

- International Paper

- Catalent Pharma Services

Global Pharmaceutical Packaging Market Report Segmentation

By Material Type

- Plastic

- Glass

- Metal

- Paper & Paperboard

- Others

By Packaging Type

- Bottles

- Blister Packs

- Vials

- Ampoules

- Pouches & Sachets

- Others

By End User

- Hospitals & Clinics

- Retail Pharmacies

- Online Pharmacies

- Pharmaceutical Manufacturers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636