Market Summary

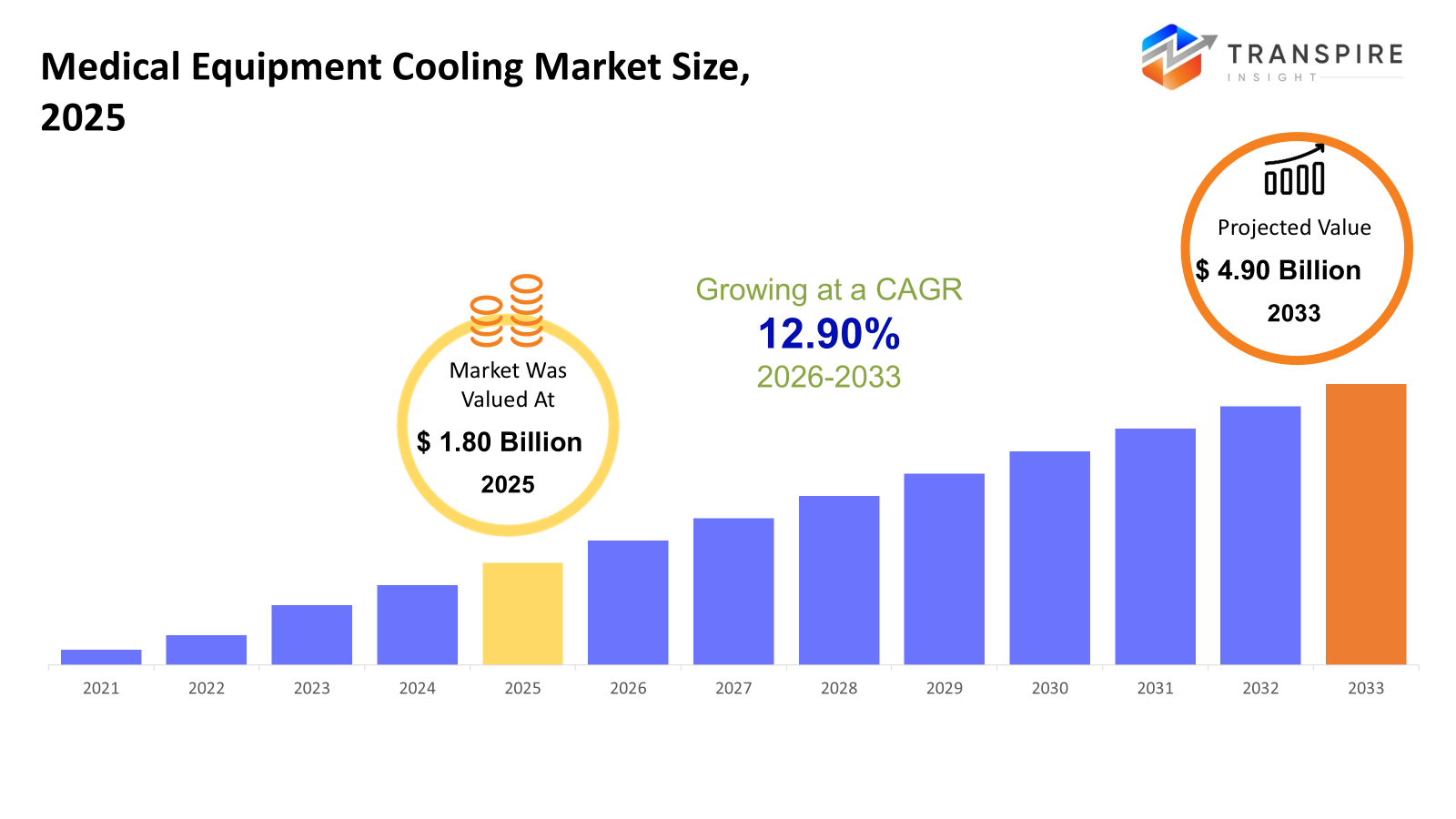

The global Medical Equipment Cooling market size was valued at USD 1.80 billion in 2025 and is projected to reach USD 4.90 billion by 2033, growing at a CAGR of 12.90% from 2026 to 2033. Out in hospitals and clinics, more machines now need exact temperatures to work right. Imaging tools, lasers, and powerful electronic gear push the need for steady cooling methods. Not long ago, older devices did not rely so heavily on thermal balance. Today’s upgrades mean better results when heat is managed well. Money flowing into health centers helps, too. New buildings often include modern gear from the start. As these technologies spread, their hunger for stable operating temps grows stronger. Behind every scan or treatment session, a quiet system keeps things cool without drawing attention. Progress here does not shout; it just runs smoothly, step by step.

Market Size & Forecast

- 2025 Market Size: USD 1.80 Billion

- 2033 Projected Market Size: USD 4.90 Billion

- CAGR (2026-2033): 12.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

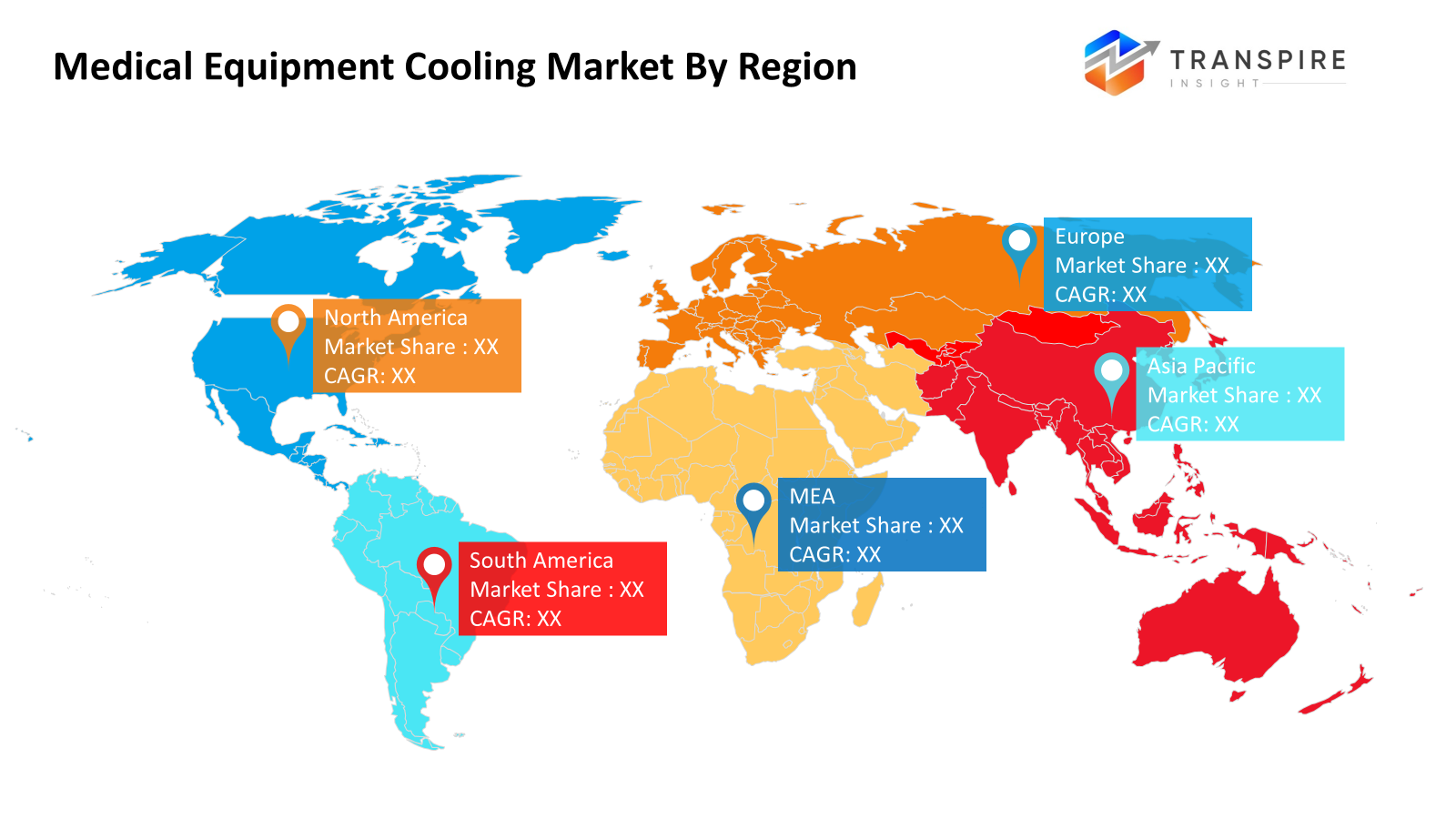

- The North American market share is estimated to be approximately 45% in 2026. Fueled by a strong network of hospitals, North America leans heavily on modern cooling systems. Because medical innovation gets serious funding here, upgraded tech spreads fast. Equipment must run without fail; lives depend on it. So steady performance is not optional. Patient well-being shapes how tools are designed and cooled. Reliability becomes the baseline, not a bonus.

- Hospitals across the United States lead in adopting advanced cooling systems, due to a well-established medical equipment sector. A steady flow of innovation fuels progress here, backed by deep research efforts. This country stands out in the area, driven not just by technology but also by how widely these solutions are used. Complex climate control is now common in clinics and testing facilities alike. Growth continues as infrastructure keeps pace with new demands.

- Out in the Asia Pacific, healthcare is reaching more people every year. New spending pours into machines that help diagnose and treat illness. Quality care becomes a bigger priority across the region. Because of this shift, better ways to cool medical devices are becoming more necessary. Equipment needs reliable temperature control just as fast as it gets upgraded.

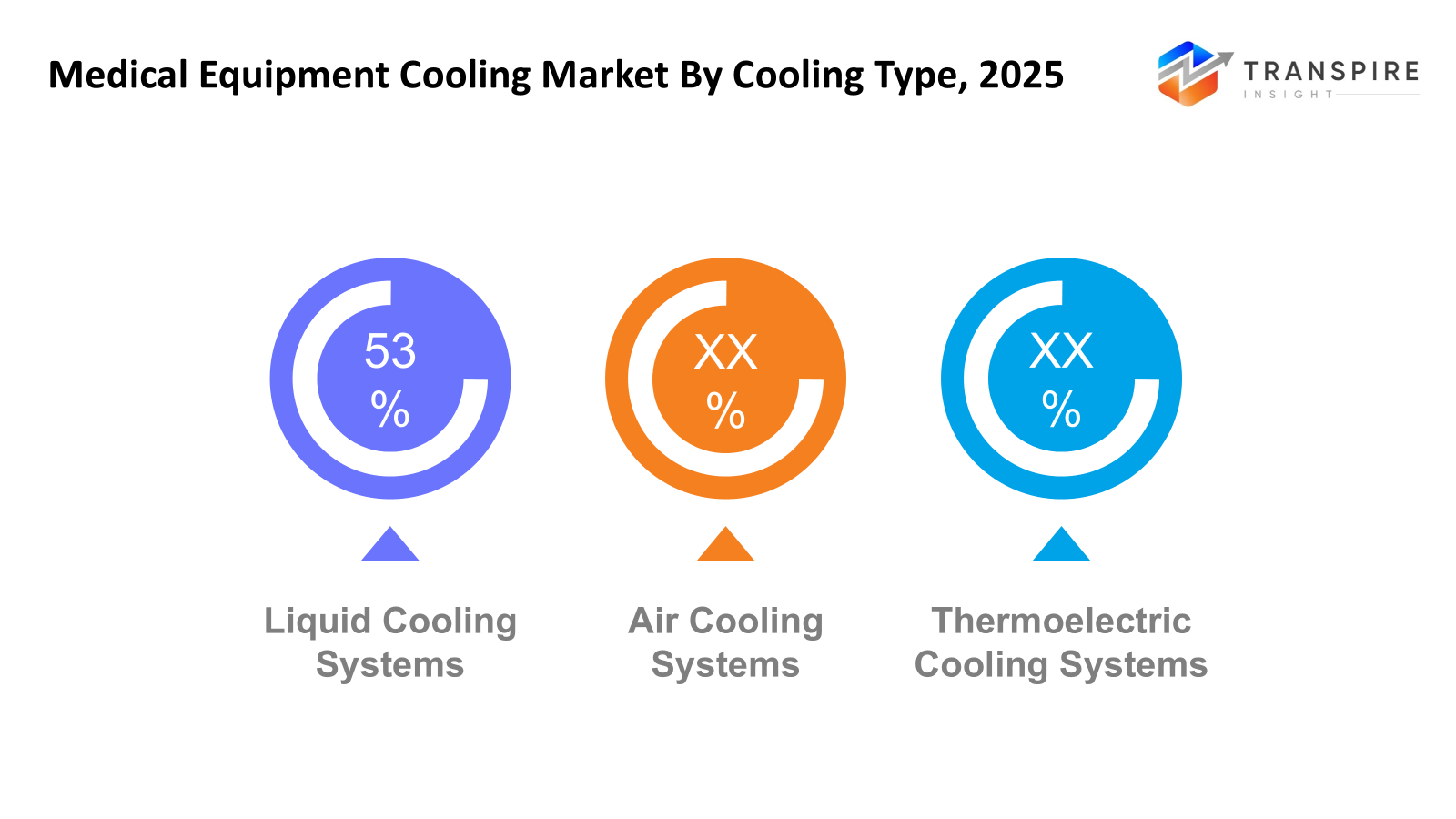

- Liquid Cooling Systems share approximately 54% in 2026. Fresh demand rises as liquid cooling handles intense heat from power-hungry medical gear better than older methods. Heat stays under control even when machines push hard through long procedures.

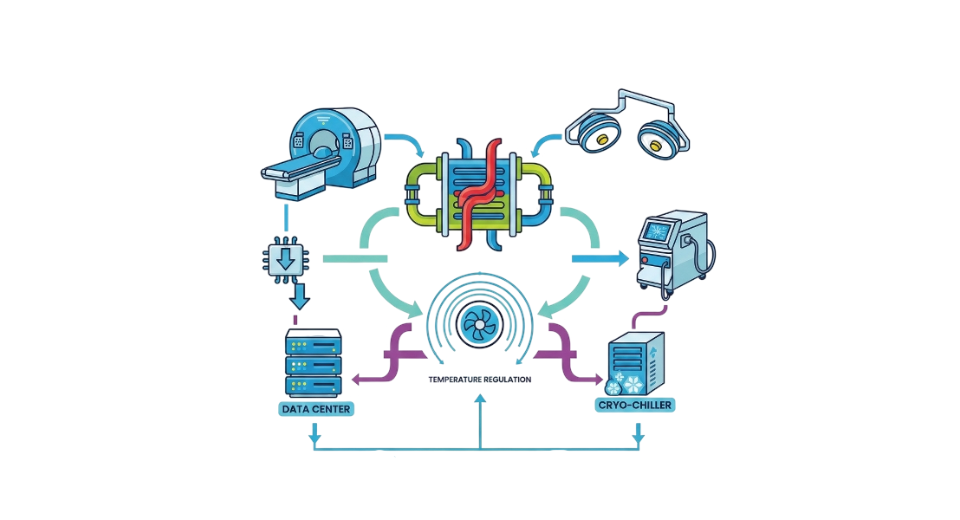

- Equipment type matters most when it comes to cooling needs - imaging tools lead the pack. Because machines like MRI, CT, and X-ray depend heavily on stable temperatures, their cooling demands are highest. Without consistent thermal control, these systems risk glitches or downtime. Performance stays sharp only when heat is managed well. That reality pushes imaging gear to the front of the line for climate solutions.

- These days, medical gear leans on heat exchangers more because they move thermal energy well. Efficiency shows up where it counts - keeping devices cool without extra fuss. Reliability often follows when systems shed heat smoothly. Performance gains come through steady operation under load. Some designs handle stress better simply by managing temperature shifts. Cooling precision becomes possible when parts work quietly behind the scenes.

- Hospitals and clinics stand out because they rely heavily on high-tech gear that needs strong cooling. These facilities run complex machines every day, so temperature control becomes critical. The equipment used there demands constant airflow to function properly. Without solid cooling systems, performance drops fast. Most installations happen in these settings due to the sheer volume of heat-producing tools. Heavy usage pushes them ahead of others in adopting such tech.

Heat builds up in today’s medical gear scanners, treatment tools, lights, and monitors included. Because of this, keeping things cool matters more than most realize. Without proper temperature control, machines can slow down or fail too soon. Instead of pushing through issues, smart thermal management keeps everything running steady. As a result, the medical equipment cooling market is expanding, offering advanced solutions that protect performance and extend equipment life. Longevity comes not from luck, but from consistent operating conditions.

Medical gear keeps evolving, pushing cooler tech to catch up. Compact units now take shape where noise fades into background hums. Efficiency climbs while parts shrink inside diagnostic tools. Liquid pathways shift heat faster than old methods ever did. Some machines lean on electric currents instead of fluids to manage warmth. Heat exchanges grow smarter, fitting tight spaces without losing strength. Performance holds steady even under long use cycles. Patient ease stays central as engineering moves forward. Reliability rises when the design thinks ahead.

Safety concerns plus tighter rules keep shaping how this market moves. When devices perform under pressure, they need solid heat control built right in. Stable temperatures mean fewer breakdowns and more dependable results during care. Machines run more smoothly when cooling works without interruption. In hospitals, consistency matters most where errors cost too much.

On top of that, more clinics opening up means machines need better ways to stay cool. Because hospitals keep upgrading tools for patients, they also need steady cooling systems nearby. With new gear popping in every year, cooler tech has to keep pace just to keep things running. This push makes companies rethink how devices manage heat without slowing down. Growth here ties directly to how fast medicine adopts complex instruments across cities and towns.

Medical Equipment Cooling Market Segmentation

By Cooling Type

- Air Cooling System

Fans move air through devices where heat builds up slowly. These setups work well when cooling needs stay low. Equipment stays safe without complex parts getting in the way.

- Liquid Cooling Systems

A splash of liquid keeps the intense medical gear running cool. Not air, but fluid carries heat away where power surges. When machines work hard, this method steps in quietly. Heat vanishes through narrow channels, guided by design. High demand meets steady temperature control. Precision lives in every drop’s path. Power stays on without overheating worries.

- Thermoelectric Cooling Systems

Precision holds steady when tiny electric currents swap heat across junctions. Compact design fits tight spaces without moving parts to rattle. Temperature stays exact because electrons carry thermal energy on demand. Sensitive gear runs smoothly with no shakes from mechanical hiccups. Control stays sharp through solid-state reactions only.

To learn more about this report, Download Free Sample Report

By Equipment Type

- Machine Learning

Heat control matters most when machines learn during ongoing health data work. Without steady cooling, performance slips step by step. Running nonstop needs balance; too hot causes errors. Systems rely on even temperatures behind the scenes. Cooling is not optional; it keeps patterns clear. Processing live patient details demands calm conditions. Overheating breaks the rhythm slowly. Stability guards accuracy every hour. Temperature swings risk missed signals. A smooth flow stays cool by design.

- Computer Vision

Heat builds fast when computers analyze pictures. Cooling must keep up, or systems risk overload. Machines push hard on visual tasks, so airflow becomes critical. Without steady temperature control, performance drops off. Processing images means more energy is used, which turns into warmth inside components.

- Natural Language Processing

Fans hum inside machines that help doctors talk to software, keeping everything running when heat tries to interfere.

- Predictive & Prescriptive Analytics

Fans hum quietly inside machines that learn your body's patterns. When heat builds up, mistakes creep into diagnoses. Cooling keeps predictions honest in hospital networks. Without steady temperatures, trust slips away slowly.

By Component

- Compressor

A spinning heart pushes coolant through tight loops, keeping chill performance steady. Movement inside builds pressure where needed most.

- Heat Exchanger

Starting with a core job, moving heat smoothly keeps systems running steadily. Not flashy, just doing what it must by balancing warmth where needed. Temperature control happens quietly behind the scenes. Efficiency comes through consistent performance, nothing more. Built to handle shifts without fuss. Running nonstop, yet staying out of the way. A necessary piece that simply works.

- Fans & Blowers

Fresh air moves through medical gear because of fans and blowers. These parts help spread out warmth so machines do not overheat. Instead of trapping hot spots, they guide currents where needed. Inside tight spaces, steady flow keeps electronics safe. Without them, delicate systems might fail under stress. Quietly working behind panels to balance temperature. Not flashy, yet vital for smooth operation.

- Chillers & Cooling Units

Cooling happens steadily when these units work together inside a single setup. Machines needing precise temperature control rely on such linked chillers. A stable flow of cold support comes through coordinated operation. Equipment with high demands stays within safe thermal ranges because components act as one.

By End-Users

- Hospitals & Clinics

Fresh air matters most where machines never stop humming. Equipment runs hot inside clinics, so chill keeps things steady. Places where healing people lean hard on cool airflow day after day.

- Diagnostic Centers

Machines that check your health need steady cool air to work properly. Without it, results might go wrong. Keeping things cold helps scanners do their job. Too much heat can slow down tests. Cold spaces protect delicate tools inside. When temperatures drop, errors stay low. Cooling runs quietly behind every result you get.

- Ambulatory Surgical Centers

Fresh air flows quietly where small coolers guard delicate tools. Surgery runs smoothly when heat is managed by smart designs. Machines breathe easier with tight, clever units nearby. Precision lives inside steady temperatures. A cool space means a safe space for every procedure.

- Research & Academic Institutions

When experiments are run, labs need steady cold environments to keep results reliable. Medical studies rely on exact temperatures, so cooling must never slip. For science work, stable chill matters most especially during long tests...

Regional Insights

Hospitals across North America need reliable cooling because modern machines require stable temperatures to run properly. Equipment makers in the region push innovation, which keeps new devices entering clinics regularly. Safety matters here; overheating can disrupt care, so facilities install precise thermal controls without delay. Imaging technology grows fast, demanding more power, thus increasing heat output that must be managed daily. Major producers base operations nearby, shortening supply chains and boosting local service speed. Healthcare spending supports upgrades, including climate systems built specifically for sensitive instruments. Reliability is not optional - it shapes how often providers replace or maintain hardware across locations. Coolant efficiency ties directly into uptime, something every center tracks closely now. Even small temperature swings matter when scans or surgeries depend on flawless machine behavior. Investment flows steadily into tech, bringing newer tools that generate additional thermal loads by design. Infrastructure stays ahead through planned updates, keeping pace with evolving clinical demands silently. Patient outcomes link indirectly to operating conditions behind the scenes everywhere. New installations appear constantly, each one relying on airflow tuned exactly right from day one. Demand holds firm since medicine leans heavily on gear that runs nonstop under pressure. Cooling becomes invisible only when it works perfectly, moment after moment.

Not far behind comes Europe, where solid healthcare networks push demand up. New tech in medicine spreads fast here, thanks to tough rules on how devices must perform. Across nations, clinics get upgrades this means better gear needs stable cooling. Keeping delicate instruments precise over time calls for smarter heat control. Equipment lasts longer when the temperature stays under tight control.

Fastest gains will likely appear across Asia Pacific, driven by a surge in healthcare facilities, higher spending on medical care, followed by stronger uptake of modern testing and treatment tools. Newer economies there keep broadening hospitals and labs; meanwhile, regions like Latin America, the Middle East, and Africa see gradual momentum as more people reach health services and funding flows into tech upgrades.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 23, 2025 – FedEx to launch healthcare-focused DUB-IND air cargo route.

(Source:https://www.supplychaindive.com/news/fedex-launch-dub-ind-air-cargo-route-healthcare-pharma/760675/)

- May 28, 2024 – A healthcare firm enhanced innovation, launching portable solar cooling devices for rural areas.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.80 Billion |

|

Market size value in 2026 |

USD 2.10 Billion |

|

Revenue forecast in 2033 |

USD 4.90 Billion |

|

Growth rate |

CAGR of 12.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Daikin Industries, Glen Dimplex Group, Copeland, Boyd Chillers, American Chillers, Atlas Copco, Drake Refrigeration, Ecochillers, EKS Thermal Systems, ELGi Equipment, Filtrine Manufacturing Company, General Air Products, Haskris, Ingersoll Rand, Johnson Thermal Systems, and Motivair Corporation. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Cooling Type (Air Cooling Systems, Liquid Cooling Systems, Thermoelectric Cooling Systems), By Equipment Type (Machine Learning, Computer Vision, Natural Language Processing, Predictive & Prescriptive Analytics), By Component (Compressor, Heat Exchanger, Fans & Blowers, Chillers & Cooling Units), By End-Users (Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers, Research & Academic Institutions), |

Key Medical Equipment Cooling Company Insights

One thing stands out about Daikin Industries: they shape how modern buildings manage heat and air flow across the world. Cooling is not just comfort here; it serves vital roles, especially where medical gear demands stability. Think MRI units, blood analyzers, ventilators, all need exact temperatures to work right. That’s where their finely tuned systems step in, keeping things steady without constant oversight. Instead of chasing trends, they refine what already works while weaving in smarter digital feedback loops. Performance stays high, yet power use drops over time. Hospitals trust these setups because interruptions are rare, even under heavy loads. Being everywhere from Tokyo clinics to rural telehealth hubs means support arrives fast when needed. Quality doesn’t slip, whether servicing a lab freezer or an ICU machine. In this corner of engineering, staying invisible might be the highest praise.

Key Medical Equipment Cooling Companies:

- Daikin Industries

- Glen Dimplex Group

- Copeland

- Boyd Chillers

- American Chillers

- Atlas Copco

- Drake Refrigeration

- Ecochillers

- EKS Thermal Systems

- ELGi Equipment

- Filtrine Manufacturing Company

- General Air Products

- Haskris

- Ingersoll Rand

- Johnson Thermal Systems

- Motivair Corporation.

Global Medical Equipment Cooling Market Report Segmentation

By Cooling Type

- Air Cooling Systems

- Liquid Cooling Systems

- Thermoelectric Cooling Systems

By Equipment Type

- Machine Learning

- Computer Vision

- Natural Language Processing

- Predictive & Prescriptive Analytics

By Component

- Compressor

- Heat Exchanger

- Fans & Blowers

- Chillers & Cooling Units

By End-Users

- Hospitals & Clinics

- Diagnostic Centers

- Ambulatory Surgical Centers

- Research & Academic Institutions

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636