Market Summary

The global Pedicle Screw Systems market size was valued at USD 4.40 billion in 2025 and is projected to reach USD 7.60 billion by 2033, growing at a CAGR of 6.70% from 2026 to 2033. Growth in AI for factory automation spreads fast because more places adopt smart production methods along with the Industry 4.0 movement worldwide. Machines now think better thanks to artificial intelligence, helping spot breakdowns early, smooth out workflows, check product quality, improve delivery routes, cutting waste while lifting output. As robots link up with sensors and learning systems on shop floors, interest grows stronger every quarter.

Market Size & Forecast

- 2025 Market Size: USD 4.40 Billion

- 2033 Projected Market Size: USD 7.60 Billion

- CAGR (2026-2033): 6.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Fueled by more people choosing cutting-edge spine procedures, care systems that already have strong support networks spring up. Older adults needing spinal treatments grow in number, pushing change forward. Medical centers adapt as demand climbs steadily over time.

- Spine problems are on the rise across the United States, fueling greater need in the region. Home to leading implant makers, the country sees wide adoption of less invasive surgeries. Because providers lean toward techniques that reduce recovery time, demand holds steady despite broader trends.

- Asia Pacific China, India, and Japan are seeing more use of minimally invasive spine methods. Healthcare spending is going up across the region. New surgical centers keep opening. More people now know about spinal care options. Growth here outpaces other regions. That surge comes from better access plus stronger medical infrastructure.

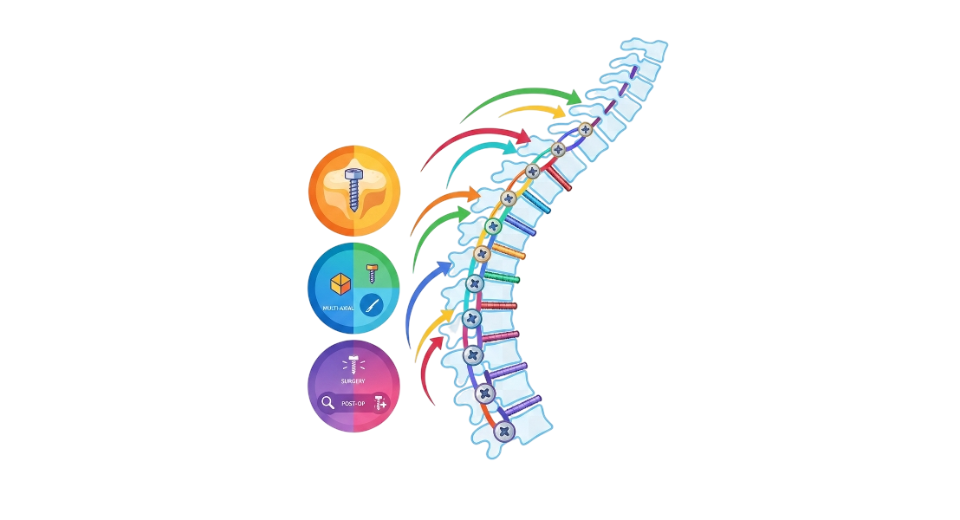

- Polyaxial Pedicle Screw share approximately 55% in 2026. A single misstep here can undo hours of precision. Yet polyaxial pedicle screws often handle shifts without fuss. Their design allows small adjustments after placement. That breathing room matters when anatomy throws a curveball. Alignment becomes less rigid, more forgiving. Surgeons tap into that leeway during tricky fusion cases. Movements flow smoother around tight corners. The mechanism unlocks options mid-procedure. Flex enters where stiffness once ruled. Unexpected angles find support they lacked before.

- Stronger than most metals, titanium stands out due to how well it resists rust while staying safe inside the human body. Its ability to endure tough conditions makes it a top pick where reliability matters most.

- With tiny cuts and quicker healing, Minimally Invasive Surgery spreads fast because problems after surgery happen less often. Because patients bounce back sooner, this method grows faster than others in medicine. Smaller openings mean less risk, which explains its rising edge.

- Older age groups mean more people face worn discs over time. Spine issues grow common, pushing this area forward slowly but steadily.

Growth in the pedicle screw systems market continues at a measured pace. Spinal conditions like scoliosis, worn discs, broken vertebrae, along those bending abnormally, push numbers upward. More attention now lands on spine well-being especially as older adults increase, and bodies wear down over time. Stability during surgery finds support through these devices. Fusion processes gain help because pedicle screws hold things firmly. Surgeons across regions often choose them for bone and nerve fixes. Their role stays central where backbone strength matters.

Polyaxial pedicle screws lead in product demand because they allow more movement when aligning rods, fitting well with tricky spine shapes and small-incision operations. While these stand out, monoaxial types still play a role, along with hollow-centered cannulated versions that help guide wires into place during tight-space work. Expandable models add another layer of fit adjustment once inside bone, whereas standard fixed-head screws remain steady choices where less motion is needed. Surgeons now see better results thanks to smarter tool designs that lower chances of problems after surgery. Because devices behave more predictably under stress, confidence in using them has grown across clinics. Hollow screws are gaining ground especially where precision matters most - like threading through narrow zones without damaging nearby tissue.

Titanium shows up often because it plays well with body tissues, handles stress without breaking, resists rust better than many metals. Cost matters too, so some turn to stainless steel when budget weighs heavy, especially for routine operations. Imaging after surgery gets easier with PEEK, which stays invisible on X-rays, unlike metal parts that block the view. How a device works during operation ties closely to what it is made of, recovery time links back to those choices just as much. New blends of metals keep appearing, stronger mixes designed to fit more types of cuts doctors make, whether big openings or tiny holes. These shifts slowly change who uses what, where they use it.

North America stays ahead thanks to cutting-edge hospitals, widespread use of gentle surgical methods, along with major companies setting up shop there. Rising back problems push the United States forward, paired with a stronger interest in modern spine support tools. Speeding past others, Asia Pacific gains ground fast - more money flows into clinics, operations rooms multiply, people learn more about fixing spine issues gently, especially seen across China, India, and Japan. Europe keeps pace too; strict rules apply, new tech spreads quickly, knowledge runs deep when it comes to spine health - all helping steady worldwide expansion until 2033.

Pedicle Screw Systems Market Segmentation

By Product Type

- Traditional Pedicle Screw

Bones get held in place using a common screw type trusted by surgeons because it slides into position without trouble. These screws have stuck around for years since they do exactly what is needed.

- Cannulated Pedicle Screws

Surgeons often pick cannulated pedicle screws when doing small incision procedures. These fit well with wire guides that help position them just right. Placement turns out to be more precise because of the inner channel. The design works smoothly with tools meant for tight spaces.

- Expandable Pedicle Screws

Popping up where bone strength falls short, these pedicle screws stretch to grip better. Stability gets a boost when material density dips too low. Designed not just to fit but adapt, they respond as spine support needs shift. Movement resistance improves even when the structure softens from wear.

- Monoaxial Pedicle Screws

Firm hold in spine work, these screws lock into place using a single alignment. They help fix misalignments while supporting bone joining during surgery.

- Polyaxial Pedicle Screws

Twisting easily at their base, these spine screws let the connecting rod settle into place without strain. Their design allows movement during placement, which means less pressure builds up where parts join.

To learn more about this report, Download Free Sample Report

By Material

- Titanium

Titanium often wins. Its toughness stands out; body tissues rarely protest, and rust simply does not happen. Toughness matters; this metal keeps up without wearing down. Living things accept it well, like a quiet guest who fits right in. Water, saliva, acids, it just shrugs them off.

- Stainless Steel

Made of stainless steel, it saves money while holding up well under regular use. Common in everyday applications due to reliable strength and ease of access.

- PEEK

Light as air, PEEK stays invisible on X-rays. Because it does not block scans, doctors see healing clearly after surgery. This plastic gives a clear view, thanks to its radiolucent nature. Healing progress shows without interference, since the material steps aside. Imaging works better when the implant does not get in the way.

- Others

Materials like cobalt-chrome show up where strength matters most. Sometimes a mix of substances works better, so hybrids appear, too. These choices respond directly to how the body moves and loads stress.

By Surgery Type

- Open Spinal Surgery

Besides handling tough spine issues, open surgery often tackles several levels at once. Sometimes it's the go-to when simpler methods will not reach deep enough. While less common now, it still plays a role in serious cases. Not every fix fits through small cuts; some need more room. When alignment is far off, this method brings stronger correction.

- Minimally Invasive Surgery

Surgery with tiny cuts spreads fast less downtime, and fewer problems after. It skips big openings and heals quicker than older ways.

By Application

- Degenerative Disc Diseases

Older people have more spine problems. That pushes demand up. Spinal wear happens a lot as bodies age. This need shapes the biggest chunk of use. Age shifts drive it forward. Wear in discs grows common over time. So this area stays on top.

- Trauma & Fractures

Screws go into the spine when breaks happen. Injury holds steady because of metal pieces placed just right. Bones stay put thanks to these small rods slipped between vertebrae.

- Scoliosis & Spinal Deformities

Curves in the spine get adjusted when screws hold things in place. Fixing these shapes often relies on small metal pieces locking in position. Movement slows once support hardware takes effect. Position shifts happen more safely with anchored tools inside. Bone alignment improves because steady pressure guides change. Structure gains balance where flexibility used to cause tilt.

- Others

Spinal tumors might need stabilization. Infections in the spine can lead to similar needs. Congenital issues sometimes demand structural support too.

Regional Insights

Despite slower progress elsewhere, demand for pedicle screw systems climbs quickest across the Asia Pacific. Boosted by heavier spending on health services, more cases of spine-related conditions appear in nations like China, India, and Japan. Surgical centers are spreading wider in these areas, which helps new methods gain ground. Minimally invasive procedures now draw greater interest, adding momentum. Medical travelers seeking treatment also play a role, nudging growth forward. Because of these shifts, the region stands out as a central point for advances in spinal implants.

The United States. drives North America’s large piece of the global market, thanks to cutting-edge medical systems and lots of spine operations happening each year. Major companies that make spinal implants have deep roots here, helping keep supply lines steady. New ways to place screws more precisely are catching on fast, pushing innovation forward quietly. Older adults facing back problems are growing in numbers, which keeps needing consistent care across clinics. Minimally invasive methods now dominate surgical choices, favored for shorter recovery times. Canada adds momentum with upgraded hospitals and rising numbers of planned spine treatments. Even Mexico is seeing gains, fueled by better access to care and slowly improving surgical capacity. Each country plays a different role, yet all feed into one connected regional trend.

Growth holds firm across Europe, thanks to tough safety rules, a clear understanding of spine care, plus widespread use of modern screw devices in nations like Germany, France, and the United Kingdom. Meanwhile, places such as Latin America and parts of the Middle East, along with Africa, start seeing momentum - not fast, yet noticeable as clinics upgrade, knowledge spreads about operations, and more people need back procedures; still, these areas trail behind Asia Pacific, North America, and Europe when it comes to size.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 17, 2025 – ChoiceSpine™ announced launched of ChoiceSpine™ app for surgical use with eCential robotics Op.n™ robotic and navigation platform.

- January 27, 2023 – Orthofix Medical launched the Mariner Screw System.

(Source:https://www.medicaldevice-network.com/news/orthofix-medical-mariner-screw-system/)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.40 Billion |

|

Market size value in 2026 |

USD 4.80 Billion |

|

Revenue forecast in 2033 |

USD 7.60 Billion |

|

Growth rate |

CAGR of 6.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Medtronic, Stryker Corporation, NuVasive, Zimmer Biomet, Globus Medical, B. Braun Melsungen AG, Orthofix International, DePuy Synthes (Johnson & Johnson), K2M Group Holdings, Inc., Aesculap (B. Braun), RTI Surgical, Smith & Nephew, Spineart, Ulrich Medical, CONMED Corporation, SeaSpine Holdings Corporation, and Alphatec Spine |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Traditional Pedicle Screws, Cannulated Pedicle Screws, Expandable Pedicle Screws, Monoaxial Pedicle Screws, Polyaxial Pedicle Screws), By Material (Titanium, Stainless Steel, PEEK, Others), By Surgery Type (Open Spinal Surgery, Minimally Invasive Surgery), By Application (Degenerative Disc Diseases, Trauma & Fractures, Scoliosis & Spinal Deformities, Others) |

Key Pedicle Screw Systems Company Insights

Medtronic stands out on the world stage. From their base in multiple continents, think North America, Europe, and even deep into the Asia Pacific, they shape how spine care moves forward. Pedicle screws come in many forms under their roof: some twist freely, others stay fixed, while certain models slip easily into minimally invasive setups. Fusion goals or fixing complex curvatures, the tools are built for both. Precision gets a boost when they bring navigation tech into the room, sometimes pairing it with robot-led guidance during operations. Surgeons notice the difference; patients often do too. Growth does not slow because fresh ideas keep flowing from labs tied closely to real-world clinics. Collaboration fuels progress, hospitals link up, research pushes further, and devices evolve steadily behind the scenes.

Key Pedicle Screw Systems Companies:

- Medtronic

- Stryker Corporation

- NuVasive

- Zimmer Biomet

- Globus Medical

- Braun Melsungen AG

- Orthofix International

- DePuy Synthes (Johnson & Johnson)

- K2M Group Holdings, Inc.

- Aesculap (B. Braun)

- RTI Surgical

- Smith & Nephew

- Spineart, Ulrich Medical

- CONMED Corporation

- SeaSpine Holdings Corporation

- Alphatec Spine

Global Pedicle Screw Systems Market Report Segmentation

By Product Type

- Traditional Pedicle Screws

- Cannulated Pedicle Screws

- Expandable Pedicle Screws

- Monoaxial Pedicle Screw

- Polyaxial Pedicle Screws

By Material

- Titanium

- Stainless Steel

- PEEK

- Others

By Surgery Type

- Open Spinal Surgery

- Minimally Invasive Surgery

By Application

- Degenerative Disc Diseases

- Trauma & Fractures

- Scoliosis & Spinal Deformities

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636