Feb 04, 2026

The report “Pedicle Screw Systems Market By Product Type (Traditional Pedicle Screws, Cannulated Pedicle Screws, Expandable Pedicle Screws, Monoaxial Pedicle Screws, Polyaxial Pedicle Screws), By Material (Titanium, Stainless Steel, PEEK, Others), By Surgery Type (Open Spinal Surgery, Minimally Invasive Surgery), By Application (Degenerative Disc Diseases, Trauma & Fractures, Scoliosis & Spinal Deformities, Others)” is expected to reach USD 7.60 billion by 2033, registering a CAGR of 6.70% from 2026 to 2033, according to a new report by Transpire Insight.

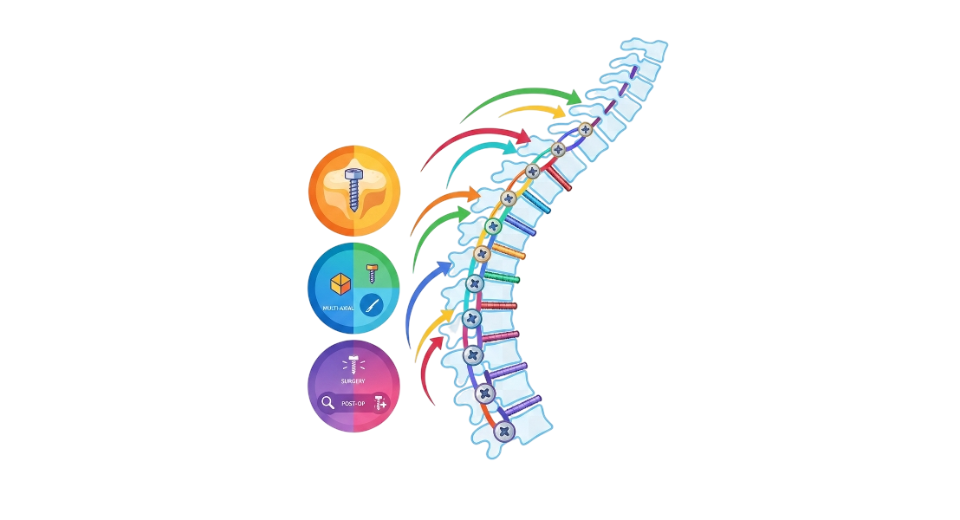

Spinal issues like scoliosis and damaged discs are becoming more common, nudging the global pedicle screw systems market upward. A sharper focus on spine well-being, along with older people needing care, feeds into higher surgery numbers. These implants hold vertebrae in place during fusions, doing quiet but vital work across bone and nerve operations. Their role has become hard to overlook in today's operating rooms.

Flexibility in aligning rods makes polyaxial pedicle screws stand out when it comes to handling tricky spinal curves. Titanium holds favor because it plays well with body tissues and offers solid durability. PEEK enters the picture where visibility on imaging matters, bringing lightness into play. Surgical results climb as tools evolve alongside methods that slice through tissue with less intrusion. Fewer issues after operations show up thanks to smarter screw shapes and better instruments. Hospitals and clinics focused on spine care now lean more heavily on these updated approaches. Progress in how procedures unfold has quietly shifted what gets chosen most often in operating rooms.

North America keeps a firm grip on the market, thanks to well-developed medical systems, widespread use of minimally invasive surgery, and major companies making spine implants right at home. Leading that charge, the United States sees more people dealing with back problems, fueling interest in better spinal support devices. Elsewhere, Asia Pacific surges ahead faster than any other area, lifted by deeper spending on health services, new operating centers popping up, plus greater knowledge about care options across nations such as China, India, and Japan. On another front, Europe stands tall too - tight rules meet quick uptake of innovations, helping push worldwide expansion steadily forward until 2033.

The Polyaxial Pedicle Screw segment is projected to witness the highest CAGR in the Pedicle Screw Systems market during the forecast period.

According to Transpire Insight, they move in multiple directions, giving surgeons more freedom when placing rods. Because these screws allow flexible alignment, corrections for spine deformities become smoother. Surgeons find they can work faster without forcing components into place. Less strain on the hardware often means fewer issues after surgery. This kind of adaptability works well whether the approach is open or less invasive. Growing trust in their function pushes this segment ahead in growth. Flexibility built into the design supports a range of motion that older models lack. Efficiency gains during operations help explain why adoption keeps rising.

Besides, more doctors choosing minimally invasive procedures means a higher need for polyaxial screws. Older people becoming a larger share of the population adds pressure on spine device demand. Conditions that wear down the spine over time show up more often now, which pushes usage even higher. Better screw shapes help patients heal faster, so clinics prefer them. Materials like titanium stick around longer inside the body without causing issues. Tools that make implantation exact have become standard in many operating rooms. Regions such as North America lead in using these devices early. European centers follow close behind with steady adoption rates. Across the Asia Pacific, hospitals are adding new surgical capabilities quickly. Infrastructure upgrades allow complex procedures once unavailable locally. Growth looks likely to continue at the current speed for years ahead.

The Titanium segment is projected to witness the highest CAGR in the Pedicle Screw Systems market during the forecast period.

Expect strong growth in titanium pedicle screw demand through the forecast window, as its durability stands out. Because it bonds well with body tissues, doctors lean toward using it across surgical types. Some pick it for open operations, others for less invasive routes; either way, performance holds up. Resistance to rust inside the body adds another layer of trust among medical teams. High stress situations like spine trauma or curved backbone fixes see frequent use. Even worn discs get addressed reliably when these fasteners go in. Allergic responses pop up less often compared to alternatives on hand today. Strength under pressure keeps it relevant where forces shift unpredictably. Surgeons keep coming back not because of trends but track records. Long-term stability matters most when mending vertebrae one level at a time.

Better titanium mixes and new coating methods help screws bond faster, stay put longer, and leave surgeries more reliable. Older people need support more often now, back problems spread more widely each year, small-cut operations grow common, and the use is increasing across countries. Regions like North America, Europe, and parts of Asia ride this wave strongest, likely holding the lead for years ahead.

The Minimally Invasive Surgery segment is projected to witness the highest CAGR in the Pedicle Screw Systems market during the forecast period.

According to Transpire Insight, Smaller cuts mean less harm to tissues, which is why Minimally Invasive Surgery is gaining ground in the Pedicle Screw Systems field. Recovery moves faster when there's little blood lost, one reason it outpaces older open methods. Surgeons now lean toward these techniques even for tricky spine work because precision stays high despite tiny entry points. Accuracy holds firm without putting patients at greater risk. Across clinics, dedicated spine units, and outpatient surgery spots globally, use keeps rising each year. The numbers show a steady climb ahead.

Now more than ever, tools like computer-guided navigation and robotics help surgeons place screws with better precision during spine operations. These improvements make the process smoother, which builds trust among medical teams and those receiving care. Real-time scans add another layer of control throughout the procedure. People are learning more about less invasive options, which plays a role in shifting preferences. Spine issues tied to aging discs or structural changes are becoming more common across populations. As understanding spreads, so does interest in specialized hardware designed for smaller incisions. Demand grows quietly, driven by practical needs rather than trends.

The Degenerative Disc Diseases segment is projected to witness the highest CAGR in the Pedicle Screw Systems market during the forecast period.

Spinal wear linked to aging pushes more people toward treatment, lifting the Degenerative Disc Diseases portion of the Pedicle Screw Systems industry faster than others. Though not always immediate, surgeries often follow when daily movement becomes difficult due to deteriorating discs. These implants hold bones steady during healing, especially where natural cushioning between vertebrae breaks down. Pain that lingers for months tends to prompt medical steps involving hardware insertion. As life spans extend globally, problems tied to spine health grow more common - this shift feeds into why DDD leads in usage across applications. Equipment designed for backbone support sees a wider need simply because bodies last longer, but do not always function better.

Better knowledge about modern spine care spreads faster now. New screw shapes help too, alongside smaller incisions and body-friendly metals that heal more easily. Progress like this nudges more clinics toward using them for worn-down spines.

The North America region is projected to witness the highest CAGR in the Pedicle Screw Systems market during the forecast period.

Among older adults, spinal issues are becoming more common across North America. This trend helps explain why the area claims a large portion of the worldwide Pedicle Screw Systems market. Modern medical facilities give patients access to newer treatment options. Minimally invasive spine operations gain favor here, replacing traditional methods in many cases. A shift toward less aggressive surgery fuels demand for specialized implants. In this landscape, the United States stands out clearly. Major companies that make spinal devices operate heavily within their borders. Innovation thrives due to consistent investment in new techniques and tools. Surgeons increasingly rely on robot-assisted systems during complex procedures. Navigation-based guidance also sees frequent use in operating rooms. These technologies support precision, shaping how interventions unfold.

Better knowledge about back care, wider insurance support, plus more people choosing spine operations. Hospitals, specialized clinics, even outpatient surgery spots now lean toward tools that help patients heal faster - like flexible-head screws, titanium hardware, less invasive methods. Growth sticks around mainly because results matter more than before across North America during the years ahead.

Key Players

Top companies include Medtronic, Stryker Corporation, NuVasive, Zimmer Biomet, Globus Medical, B. Braun Melsungen AG, Orthofix International, DePuy Synthes (Johnson & Johnson), K2M Group Holdings, Inc., Aesculap (B. Braun), RTI Surgical, Smith & Nephew, Spineart, Ulrich Medical, CONMED Corporation, SeaSpine Holdings Corporation, and Alphatec Spine.

Drop us an email at:

Call us on:

+91 7666513636