Feb 05, 2026

The report “Interventional Radiology Market By Procedure Type (Vascular Interventions, Non-Vascular Interventions), By Device Type (Guidewires & Catheters, Stents & Stents Grafts, Embolization Coils & Devices, Balloons & Accessories), By Application (Cardiovascular Diseases, Oncology, Neurology, Urology & Nephrology, Gastroenterology, Musculoskeletal), By End-Users (Hospitals & Specialty Clinics, Ambulatory Surgical Centers, Diagnostic & Imaging Centers)” is expected to reach USD 49.00 billion by 2033, registering a CAGR of 7.20% from 2026 to 2033, according to a new report by Transpire Insight.

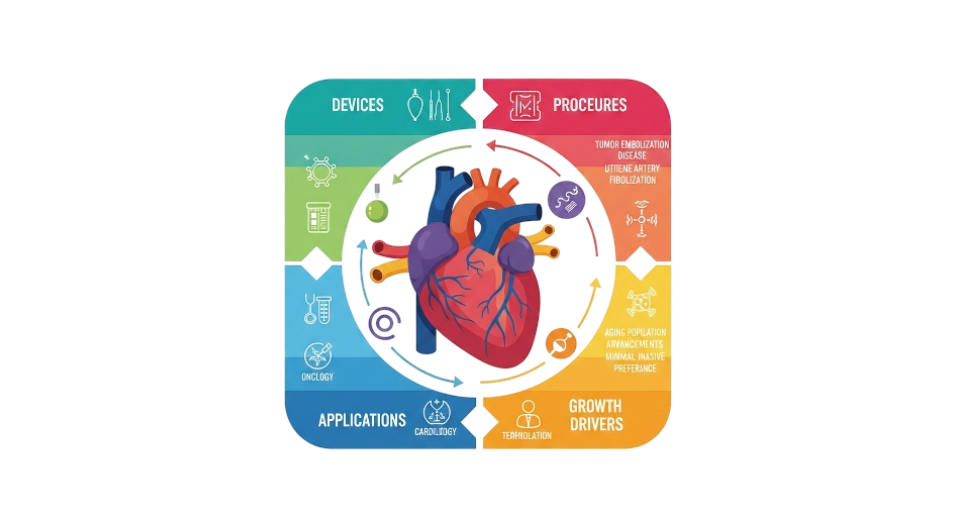

Fast growth marks the global interventional radiology market, thanks to wider use of less invasive treatments in heart care, cancer, brain health, and similar fields. With tools like CT, MRI, ultrasound, or fluoroscopy, doctors steer procedures including angioplasty, stent placement, embolizations, tissue sampling, and heat-based cell destruction. More people face long-term illnesses now, a shift that lifts demand, while shorter healing times and fewer days in hospitals add further pressure on services.

Vascular treatments top the list, driven by widespread heart-related illnesses; meanwhile, nonsurgical methods like tissue sampling and cell destruction gain ground in cancer and brain care. Leading the gear used are stents and stent-like implants, backed up through wires that guide, tubes that channel, inflatable tools, and coils that stop blood flow. Progress never stops - coated stents release medicine, temporary implants melt away over time, clearer scans steer operations better, making each step more accurate, secure, and under control.

Hospitals still lead the way when it comes to using high-end imaging tools and trained specialists. Specialty clinics follow close behind, relying on precision and experience. Outpatient facilities grow busier by handling smaller surgeries without overnight stays. Imaging hubs play a quiet but vital role in backing up these treatments. Spending more on health services helps push progress forward. New tech opens doors previously closed. Patients now know their options better than before. Less invasive methods appeal strongly today. This mix keeps the worldwide field of interventional radiology moving steadily ahead.

The Vascular Interventions segment is projected to witness the highest CAGR in the Interventional Radiology market during the forecast period.

According to Transpire Insight, Growth in vascular treatments stands out amid rising heart-related illnesses, alongside a stronger lean toward procedures that do not require large incisions. Angioplasty, along with stent placement and embolization, forms part of this area common choice when dealing with blocked arteries or circulation problems. Instead of older surgical methods, many now choose these options because healing happens quicker, risks drop, plus time spent in hospitals shrinks. Doctors support them too, since outcomes often improve without heavy trauma to the body.

New tools like better stents, flexible catheters, and blocking agents for blood vessels, along with sharper imaging tech, keep pushing more doctors toward minimally invasive treatments. On top of that, people now pay closer attention to heart wellness, countries spend more on medical care, and insurance systems in places like North America and parts of Europe cover these procedures well, making it easier for clinics and hospitals to adopt them. Because all these pieces fit together just right, the field focused on fixing blood vessel issues is outpacing every other area in worldwide image-guided medicine.

The Stents & Stents Grafts segment is projected to witness the highest CAGR in the Interventional Radiology market during the forecast period.

Growth in heart and blood vessel issues across the globe is pushing up the use of tiny mesh tubes that hold arteries open. Because more people need these fixes, doctors rely on them during operations to clear blocked pathways in the body. Starting with fewer cuts than older methods, modern techniques favor such tools since healing tends to go quicker. Risk drops too when surgery is less intrusive. That shift plays a big role in why these implants see rising numbers each year. Expectations point to a steady climb ahead as conditions like clogged leg or heart vessels spread. They keep vital channels working right after treatment. Procedures once needing large incisions now often skip those steps entirely. This change sticks around because outcomes improve without added strain on patients.

Now coming into sharper focus, tech upgrades like medicine-releasing stents, dissolvable versions, and better graft fabrics help doctors do their jobs faster while improving results and keeping patients out of harm’s way. Backed by insurance frameworks that cover costs, more knowledge about heart wellness is spreading widely, plus steady uptake in medical centers from urban hubs to niche treatment spots, growth gets a strong push across regions like North America, Europe, and parts of Asia. With these pieces fitting together just right, devices built around stenting now move ahead more quickly than any other tool used during image-guided procedures.

The Cardiovascular Diseases segment is projected to witness the highest CAGR in the Interventional Radiology market during the forecast period.

According to Transpire Insight, Heart-related conditions are expected to lead to expansion in the imaging-guided treatment field over the coming years. Rising cases of blocked arteries in the heart and limbs worldwide help explain this shift. Procedures like opening narrowed blood vessels, placing supportive tubes, or blocking abnormal ones now happen more often than major surgery. Faster healing follows these less intrusive methods. Fewer problems arise afterward compared to older techniques. Patients tend to do better overall when treated this way. Growth in demand links closely to those benefits.

Despite setbacks, better cameras, tiny mesh tubes, flexible wires, and tools that block blood flow now make heart procedures sharper, safer, and lighter on patients. Hospitals lean into these upgrades thanks to steady payback rules, more money spent on care, plus people paying closer attention to their hearts. Put together, this pushes heart conditions ahead of everything else when considering how often doctors use image-guided fixes worldwide.

The Hospitals & Specialty Clinics segment is projected to witness the highest CAGR in the Interventional Radiology market during the forecast period.

Starting strong, hospital and specialty clinic setups lead the way in interventional radiology expansion, expected to grow fastest through the coming years. Advanced imaging tools sit ready, paired with expert radiologists and full-service procedure spaces, fueling momentum here. Procedures like opening narrowed vessels, placing supportive tubes inside them, taking tissue samples, or destroying abnormal areas happen mostly within these walls. Patient numbers stay high because intricate cases find solutions under one roof. A clear lean toward less invasive methods pushes this area ahead, making it stand out across the field.

Spending more on health care pushes hospitals and specialty clinics to grow, especially when new treatment tools become available. Reimbursement rules that back these advances add momentum, helping facilities adopt them more quickly. Because patient needs are shifting, many centers now link care across specialties, aiming for speedier healing and better results. This shift nudges clinics to build up their radiology-based procedures. When combined, these trends make hospitals and specialized sites the biggest and quickest-expanding users worldwide.

The North America region is projected to witness the highest CAGR in the Interventional Radiology market during the forecast period.

Despite having just two nations leading the charge, North America holds the top spot in interventional radiology use. Because hospitals there run on well-built medical networks, new techniques take root fast. Minimally invasive methods spread widely - not only due to tech but also steady insurance payouts. A heavy load of heart problems, tumors, and long-term illnesses pushes patient numbers up. With illness common, treatments targeting blood vessels or skipping them altogether remain in constant need. United States and Canadian clinics carry modern scanners plus teams trained to interpret live images accurately. Care moves smoothly when experts guide tools through body pathways using real-time visuals.

From the front, new tools like stents and imaging tech push growth across the United States regions. Because patients know more now, they often choose quicker treatments outside hospitals. Spending big on health care adds fuel to the fire. What stands out is how clinics here quickly take up modern methods. Rules that help instead of block play a role. Solid hospital networks make the region hard to beat worldwide when it comes to these medical procedures.

Key Players

Top companies include Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Terumo Corporation, Cook Medical, Siemens Healthineers, GE Healthcare, Philips Healthcare, Cardinal Health, Canon Medical Systems Corporation, Becton Dickinson and Company, C.R. Bard (BD), Guerbet Group, Penumbra, Inc., Hologic, Inc., Merit Medical Systems, and Neuwave Medical, Inc.

Drop us an email at:

Call us on:

+91 7666513636