Market Summary

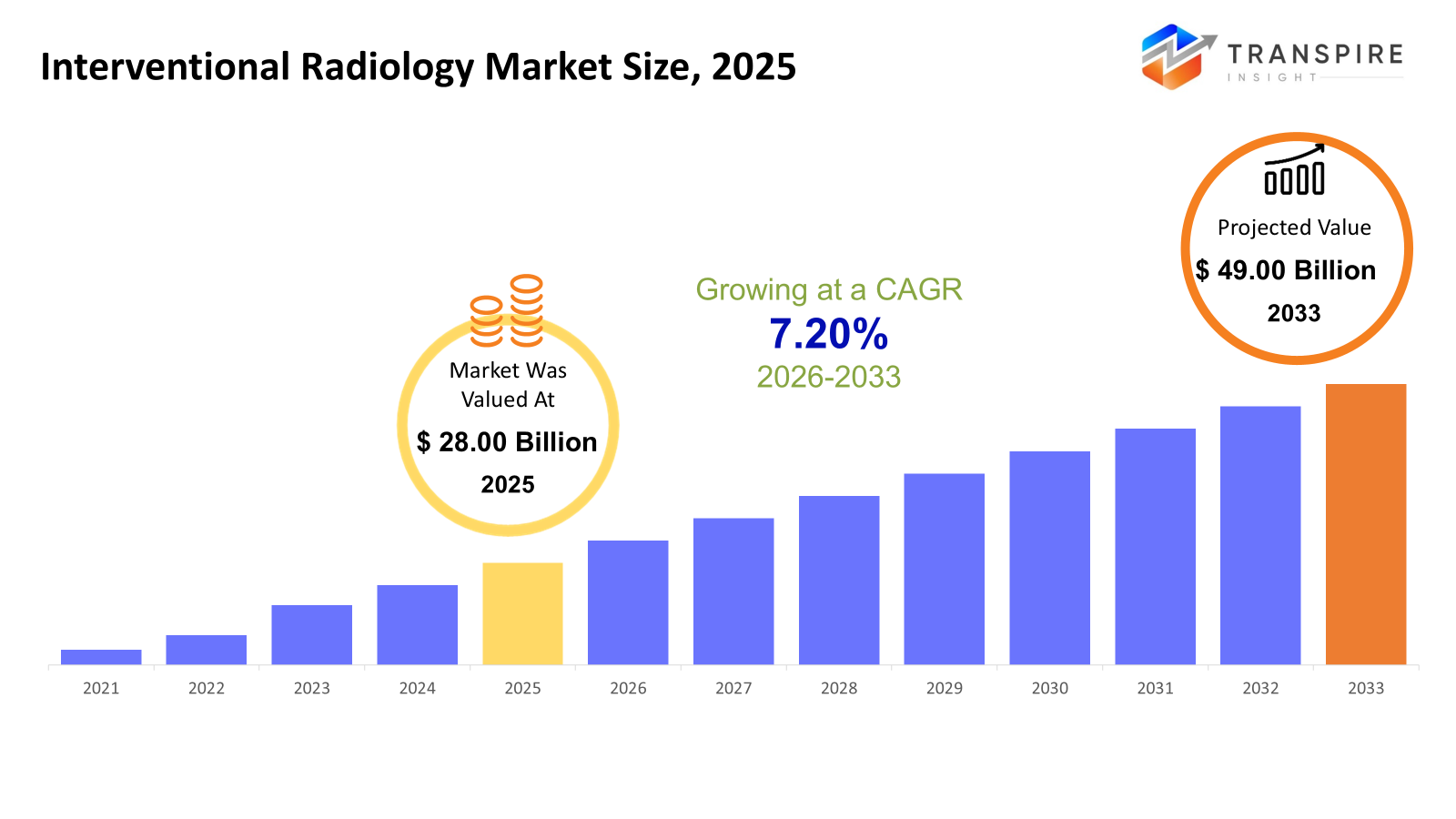

The global Interventional Radiology market size was valued at USD 28.00 billion in 2025 and is projected to reach USD 49.00 billion by 2033, growing at a CAGR of 7.20% from 2026 to 2033. Growth in AI for factory automation spreads fast because more places adopt smart production methods along with the Industry 4.0 movement worldwide. Machines now think better thanks to artificial intelligence, helping spot breakdowns early, smooth out workflows, check product quality, improve delivery routes, cutting waste while lifting output. As robots link up with sensors and learning systems on shop floors, interest grows stronger every quarter.

Market Size & Forecast

- 2025 Market Size: USD 28.00 Billion

- 2033 Projected Market Size: USD 49.00 Billion

- CAGR (2026-2033): 7.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Fueled by modern medical systems, North America sees expansion as less invasive treatments gain ground, backed up by steady insurance coverage. A system built for innovation, where new techniques fit smoothly into practice, supported every step by financial frameworks that pay for progress.

- Heart conditions are on the rise across the United States regions, fueling a steady need for care. Newer medical tools used during procedures play a key role in treatment growth. Local patient patterns shape how widely these technologies spread.

- A burst of progress sweeps through the Asia-Pacific, fueled by clinics reaching more people every year. Growth hums along as patients begin choosing less invasive treatments. New tools for diagnosis pop up regularly, backed by steady funding pouring into medical centers across cities and towns.

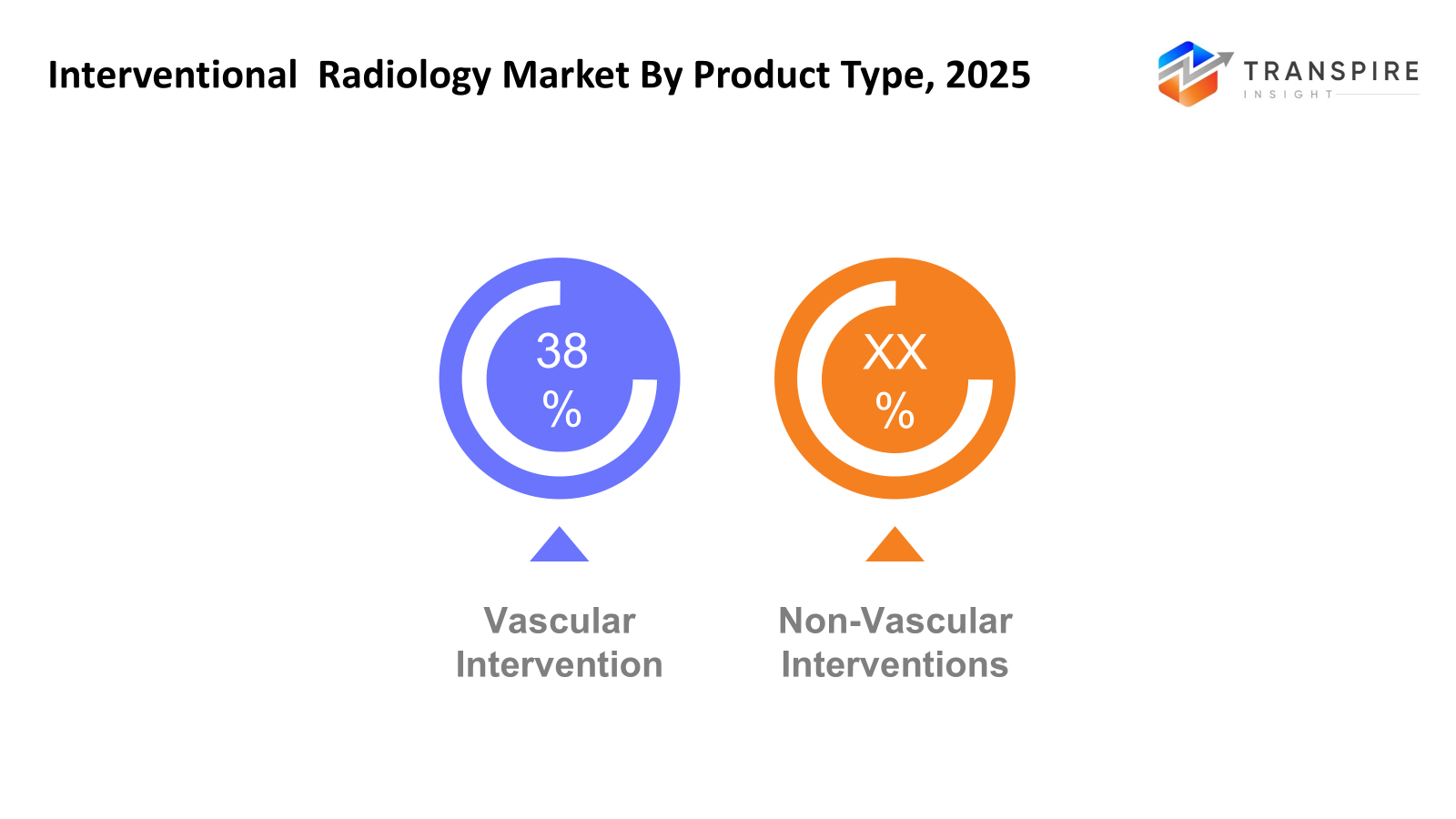

- Vascular Intervention shares approximately 40% in 2026. Vascular interventions top the list - more heart issues mean more procedures. Because doctors lean toward less invasive options now, these treatments are often. Growing numbers show a clear shift in what patients need most.

- Stents and stent grafts see strong uptake because newer designs work better. Thanks to coatings that release medicine, healing looks more promising these days. Progress in how they are built has made a noticeable difference for people using them.

- Fueled by rising cases of heart-related issues, cardiovascular diseases lead in usage numbers. Procedures grow more common mainly because blocked arteries affect so many people. Blood flow problems in limbs also add to the increasing demand across clinics.

- Hospitals and specialty clinics lead the field simply because they house cutting-edge imaging tools. Their edge comes from teams of experienced interventional radiologists working on site. Full-service treatment setups make complex procedures possible under one roof. Because equipment access is reliable, these centers handle high volumes smoothly. Expertise combined with infrastructure creates a strong advantage naturally.

Growth in the interventional radiology market is picking up speed. More doctors choose less invasive methods now, especially in heart care, cancer treatment, brain conditions, and similar fields. Imaging tools, including CT scans, MRI, soundwave visuals, and live X-ray, help steer treatments such as opening narrowed arteries, placing support tubes, blocking blood flow to tumors, taking tissue samples, or destroying abnormal cells. More people face long-term health issues these days; hospitals aim to shorten admission periods, while patients lean toward options that mean quicker healing and fewer complications - all pushing wider use of image-guided procedures around the world.

Vascular treatments lead the field, simply because heart-related illnesses are common plus doctors now lean toward less invasive methods. Not far behind, non-vascular uses like tissue sampling, fluid removal, or destroying abnormal areas - are gaining ground fast, particularly when dealing with cancer or nerve system issues. Better tools play a big role: improvements in tube-like instruments, materials that block blood flow, and scanning tech make operations sharper, safer, and actually more likely to work. Because of these gains, more medical teams choose image-guided techniques every year.

Stents and stent grafts still top the list when it comes to devices, thanks to the steady need in heart and blood vessel procedures. Guidewires, catheters, balloons, and embolization coils each play a quiet but vital role. New ideas keep coming: stents that release medicine, implants that dissolve over time, better real-time scans, all nudging hospitals to upgrade their radiology rooms. Most often, these tools go toward treating heart conditions; cancer care follows close behind, since less invasive methods mean quicker healing and better results for patients.

Most demand comes from hospitals and specialized clinics. These places have top-tier imaging tools, experienced radiologists, and ready access to coordinated treatment setups. Outpatient surgeries now draw more interest, so ambulatory surgery hubs see steady uptake. Imaging-focused centers help too, delivering clear scans that steer medical actions precisely. Spending on health keeps climbing, new tech rolls out regularly, patients know more about options, fewer invasive methods attract wider acceptance, all pushing the worldwide interventional radiology field forward steadily.

Interventional Radiology Market Segmentation

By Procedure Type

- Vascular Interventions

Opening narrowed blood vessels happens through angioplasty, while stents hold them open afterward. Blocking abnormal flow occurs during embolization, targeting issues beyond the heart, too. These steps manage problems in arteries and veins across the body.

- Non-Vascular Intervention

Starting off, there's a range of treatments that skip blood vessels entirely. These include taking tissue samples through needles. Fluid removal also fits here, helping ease buildup in different areas. Tumor destruction methods show up too, targeting growths without surgery. Some handle brain-related issues, others address various body systems. Each method avoids arteries and veins completely. Procedures like these serve conditions beyond circulation problems.

To learn more about this report, Download Free Sample Report

By Device Type

- Guidewires & Catheters

Slippery wires plus tubes help doctors reach places inside blood vessels or elsewhere in the body. These tools slide through pathways so treatments can get where they need to. Movement is smoother because the gear goes ahead, guiding the way. Some procedures rely on them, whether veins are involved or not. They set the course before bigger instruments follow.

- Stents & Stent Grafts

Inside blood vessels, stents hold walls open when they are narrow or fragile. These tiny tubes stop collapsing by giving structure where it is needed most. A special kind wraps around weak spots to keep the flow steady and safe.

- Embolization Coils & Devices

Stopping blood in specific spots helps manage bleeding or treat tumors. These tiny tools are placed inside vessels to block flow where needed. A doctor guides them using imaging, so they reach the right place. They stay put once delivered, creating a barrier over time. The body responds by forming clots around each device. That seals off the area without surgery. Healing follows as pressure drops behind the blockage.

- Balloons & Accessories

Starting small, balloons help open narrowed vessels. These tools also assist when placing stents inside arteries. During interventions, extra gear supports each step along the way. Their role becomes clear once treatment begins unfolding.

By Application

- Cardiovascular Diseases

This helps with narrowed arteries in the heart, problems in blood vessels of the limbs, and conditions tied to poor circulation. Blood flow gets support where it struggles most. Vessel health improves across key areas without extra strain on the system.

- Oncology

With precision tools, doctors target tumors without large incisions. Using imaging guidance, they destroy abnormal growths quietly. Instead of cutting, specialists block blood flow to weaken masses. Through tiny openings, tissue samples emerge for testing.

When it comes to brain care, fixing blood flow during a stroke or mending a weak spot in a vessel counts. Procedures step in where timing shapes recovery paths.

- Neurology

Draining fluid or placing supports in the kidney and bladder areas often involves tools from urology and nephrology. Procedures target tubes and filters where urine moves, keeping the flow steady when blockages occur. These medical fields handle issues deep inside the body using guided techniques that avoid open surgery. Small pathways let instruments reach problem spots without large cuts. Working through natural openings helps reduce recovery time afterward.

- Gastroenterology

Supports interventions like GI bleeding management, stenting, and drainage.

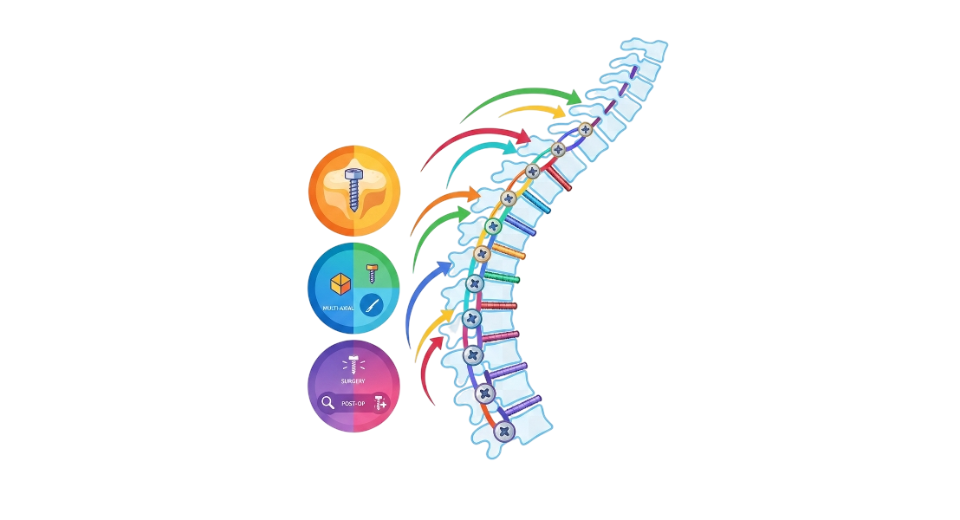

- Musculoskeletal

Fragments of bone get sampled through small surgical windows, while collapsed spinal segments find support via precision injections. Structural repairs unfold using guided tools, stepping into alignment without open cuts. Each move targets stability, shifting load where it belongs across joints and frames.

By End-Users

- Hospitals & Specialty Clinics

Besides clinics, hospitals handle most interventional radiology work. Specialty facilities often step in when complex imaging guidance is needed.

- Ambulatory Surgical Centers

Fewer nights in bed after surgery, more clinics are now set up just for quick outpatient operations. These centers pop up where small cuts beat long stays. Healing faster means walking out the same day, often without needing overnight care. New tools help doctors work more precisely, causing less damage overall. Recovery fits into life more easily when it takes days, not weeks.

- Diagnostic & Imaging Centers

From X-rays to real-time scans, these centers guide precise treatments using detailed visuals. Equipment shapes how doctors navigate during complex interventions. Clear images come before every move, helping teams act with accuracy. Technology here links diagnosis directly to therapy steps. Each tool serves a role in mapping internal pathways safely.

Regional Insights

With more people needing heart-related treatments, the United States shapes North America's lead in interventional radiology. Advanced medical systems help too, since clinics can offer complex care without delays. Instead of long hospital visits, patients now choose quicker options done outside traditional wards. Strong insurance coverage keeps services accessible, fueling steady growth across the area.

Across Europe, healthcare runs deep within modern frameworks, where a clearer understanding of less invasive procedures takes hold. Germany, France, and the United Kingdom lead in using these methods for heart, cancer, and brain care. Progress moves forward because tools like imaging tech, stents, and devices that block blood flow improve over time. Government efforts help push low-cost, gentle-on-patients treatments into practice. Hospitals grow stronger too, thanks to ongoing upgrades and financial backing.

Growth picks up speed across Asia-Pacific, fueled by wider access to health services, more informed patients, and a climb in long-term illnesses. China, Japan, and India lead the shift - spending flows into sharper scans, specialized clinics, and less invasive treatments for heart and cancer cases. From far corners, places like Latin America or parts of Africa begin stepping forward, quietly embracing new methods as hospitals modernize and knowledge spreads. What once moved slowly now gains rhythm, tied closely to better tools, stronger systems. Progress shows uneven but steady signs wherever care begins, reaching further.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 11, 2025 – CIRSE launched three landmark studies to advance interventional radiology data.

- March 5, 2025 – Gleneagles Hospitals Bengaluru launched an advanced interventional radiology cath lab at Richmond Road

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 28.00 Billion |

|

Market size value in 2026 |

USD 30.00 Billion |

|

Revenue forecast in 2033 |

USD 49.00 Billion |

|

Growth rate |

CAGR of 7.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Boston Scientific Corporation, Medtronic plc, Abbott Laboratories, Terumo Corporation, Cook Medical, Siemens Healthineers, GE Healthcare, Philips Healthcare, Cardinal Health, Canon Medical Systems Corporation, Becton Dickinson and Company, C.R. Bard (BD), Guerbet Group, Penumbra, Inc., Hologic, Inc., Merit Medical Systems, and Neuwave Medical, Inc |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Procedure Type (Vascular Interventions, Non-Vascular Interventions), By Device Type (Guidewires & Catheters, Stents & Stents Grafts, Embolization Coils & Devices, Balloons & Accessories), By Application (Cardiovascular Diseases, Oncology, Neurology, Urology & Nephrology, Gastroenterology, Musculoskeletal), By End-Users (Hospitals & Specialty Clinics, Ambulatory Surgical Centers, Diagnostic & Imaging Centers) |

Key Interventional Radiology Company Insights

One name often comes up when talking about tools for image-guided treatments: Boston Scientific Corporation stands out worldwide. Its work touches both blood vessel and non-blood-vessel areas through advanced medical gear. From tiny mesh tubes to thin wires that guide instruments, their product line covers many needs in less invasive care. These tools help doctors treat heart issues, cancer, and conditions in limbs without major surgery. Innovation drives the company forward, not slogans, just steady progress backed by deep research. Patient results shape decisions here more than anything else. That mindset helps explain why it holds such firm ground across international markets where precision matters most.

Key Interventional Radiology Companies:

- Boston Scientific Corporation

- Medtronic plc

- Abbott Laboratories

- Terumo Corporation

- Cook Medical

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Cardinal Health

- Canon Medical Systems Corporation

- Becton Dickinson and Company

- R. Bard (BD)

- Guerbet Group

- Penumbra, Inc.

- Hologic, Inc.

- Merit Medical Systems

- Neuwave Medical, Inc.

Global Interventional Radiology Market Report Segmentation

By Procedure Type

- Vascular Interventions

- Non-Vascular Interventions

By Device Type

- Guidewires & Catheters

- Stents & Stents Grafts

- Embolization Coils & Devices

- Balloons & Accessories

By Application

- Cardiovascular Diseases

- Oncology

- Neurology

- Urology & Nephrology

- Gastroenterology

- Musculoskeletal

By End-Users

- Hospitals & Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic & Imaging Centers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636