Market Summary

The global Hospital Facilities market size was valued at USD 205.00 billion in 2025 and is projected to reach USD 345.60 billion by 2033, growing at a CAGR of 6.30% from 2026 to 2033. More people needing care means more pressure on hospitals worldwide, especially where services are limited. Because illnesses that last a long time are becoming more common, clinics must handle larger numbers of patients. Older populations around the planet add further strain on these centers every year. Equipment for diagnosis and surgery is growing in demand due to longer stays in wards. New tools like digital scans and automated processes now spread quickly through medical buildings. Smart setups inside hospitals help manage tasks faster than before.

Market Size & Forecast

- 2025 Market Size: USD 205.00 Billion

- 2033 Projected Market Size: USD 345.60 Billion

- CAGR (2026-2033): 6.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 40% in 2026. North of the continent leads the way not through luck, but steady spending on tools that track health data more clearly. Modern clinics rise where fiber lines run deep into city grids. Money flows from both government desks and corporate offices alike, shaping how care reaches people faster. Systems upgrade quietly behind the scenes while older models fade without announcement. Progress shows up in small steps, new software here, a wired wing there.

- United States, out there, where medical bills pile up fast, clinics keep growing. Since so many people live with long-term health issues, hospitals shift focus to more appointments outside traditional wards and more niche treatments. Money flows heavily into care here, pushing buildings taller, teams wider. Instead of just beds, they add rooms for quick visits and tailored therapies.

- Asia Pacific pulls ahead in growth pace. Urban areas are spreading fast. More money flows into health services across the region. Insurance reaches further than before. Government projects boost systems in places like China and India. Emerging economies add momentum without slowing down.

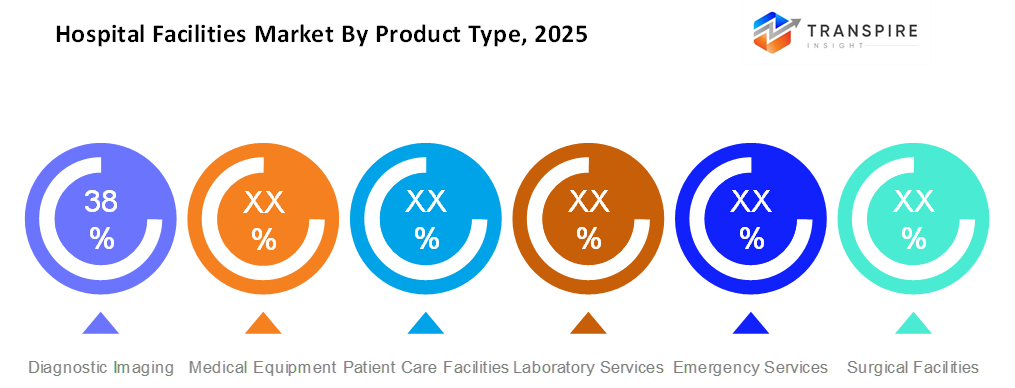

- Diagnostic Imaging shares approximately 41% in 2026. Faster than anything else, diagnostic imaging keeps expanding. Hospitals are putting money into high-end tools like MRI and CT machines that use artificial intelligence. These upgrades help catch health issues sooner. They also make daily operations run more smoothly.

- Hospital stays remain on top worldwide, yet new ways of treating people where they live are catching up fast, helped by lower expenses and better comfort. What once seemed rare now shows up more often across regions.

- What drives private hospitals ahead is their knack for trying new things when it comes to treatment options. Ownership under independent hands brings in more money from patient services overall. These places often feature upgraded rooms and tools that feel a step above average. Smooth daily workflows help keep everything running without long delays. Revenue piles up simply because they move fast while charging higher rates.

- Most people get care at public hospitals because services are widely available. Government funding helps these facilities stay open and serve more patients. Access shapes their role across the system. Budget support keeps operations running through a steady resource flow.

Out here, where medical needs meet real-world setups, hospital facilities form the backbone of health services worldwide. These places hold everything from treatment rooms to labs, plus spots for tests and surgery. Think about it, emergency zones, beds for overnight stays, areas that help patients heal, all tied together. What stands out is how modern demands push designs toward smoother workflows and better coordination. Care now shapes building plans, not the other way around. Efficiency sneaks into every corner, driven by the need to keep things running while focusing on people getting better. Over time, these spaces adapt, quietly shifting to match new ways medicine works.

Because health demands keep shifting, so does growth here, more chronic illnesses, injuries, stronger need for lasting treatments shape what happens next. With more people needing help, hospitals add space, renew equipment, yet still aim to protect how well they treat and safeguard patients. As care begins focusing on results, not just volume, upgrades in layout start playing bigger roles - fewer days spent inside, smarter routines emerge quietly behind walls.

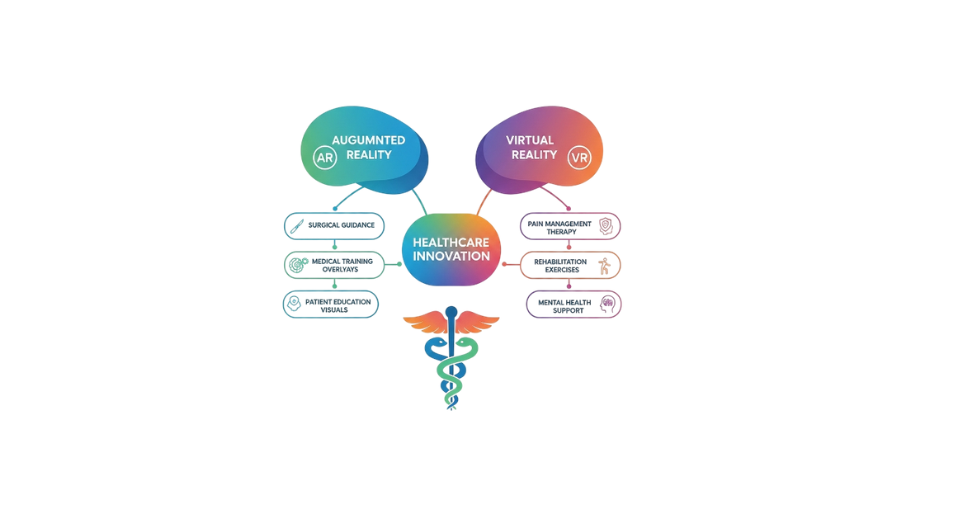

Faster tech changes push how hospitals grow their spaces. Built-in scanners now work faster, labs run without constant help, screens track sick people round the clock, buildings manage lights and heat by themselves, all meant to get better results while using less. Digital files move smoothly between rooms, walls trap fewer germs, and power needs shrink since recent worldwide illness scares; these features matter more.

Nowhere is change more visible than in how hospitals grow under mixed guidance. State funding pushes public medical centers toward wider reach and steady systems. Meanwhile, corporate efforts zero in on precision treatment and polished settings. Joint ventures between officials and investors pop up more often, speeding construction along with fresh methods. Outcomes shift slowly, buildings gain smart tools, adaptability, and attention to those who walk through their doors.

Hospital Facilities Market Segmentation

By Product Type

- Medical Equipment

From stethoscopes to scanners, the gear found in clinics helps spot illness. Machines that track breathing or heart activity give real-time updates. Tools built for precise testing shape how doctors understand symptoms. Some software runs; others rely on manual input. Each piece plays a role during checkups or emergencies. High-tech units assist when quick decisions matter most.

- Patient Care Facilities

Wards, recovery areas, these spots exist for one reason: tending to people who need help. Spaces shaped around care, not just structure. Where healing gets room to breathe, literally. Systems quietly running beneath the surface, making sure someone can rest, heal, sit up, and talk again. Not just walls and beds. A flow runs through them, steady, unseen. Comfort built into corners, routines, and air.

- Laboratory Services

Finding answers often begins with a sample. Whether it is blood or something solid, labs put them through tests. These spaces are built for spotting what’s wrong inside the body. Diagnosis gets clearer when results come back. Managing illness follows more easily once patterns show up. Testing happens under careful conditions, every single time.

- Emergency Services

When seconds count, teams trained for crisis show up fast. These units handle sudden injuries plus serious health emergencies. Quick thinking meets immediate treatment out in the field. Help arrives ready to act before hospital entry. Sudden pain, accidents response follows without delay. Speed links directly to survival chances here. Each member knows their role under pressure. Equipment on hand matches what clinics hold inside.

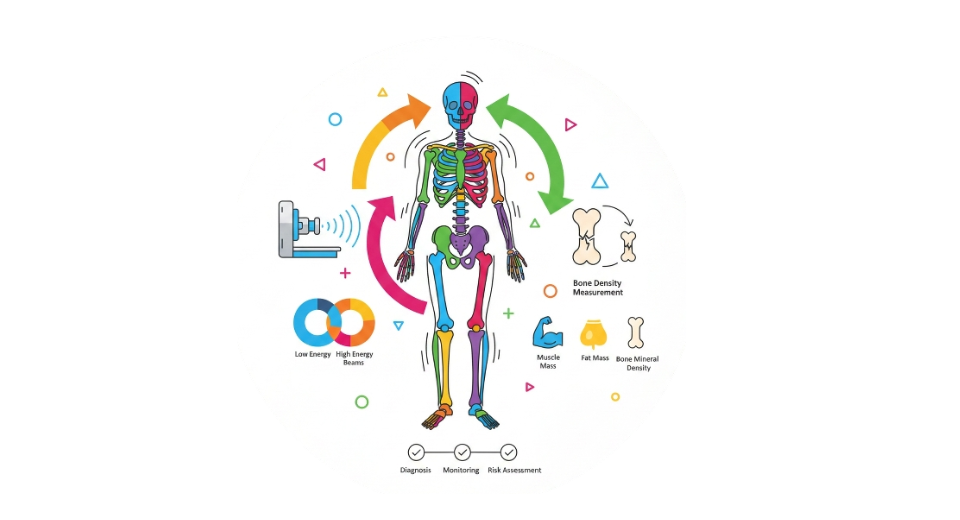

- Diagnostic Imaging

Inside hospitals, imaging centers take pictures of what is inside the body. These spots rely on tools such as X-rays, ultrasounds, MRIs, or CT scans. Each method shows different views beneath the skin. Machines capture details that doctors later examine. Structures hidden under tissue become clear through these images. Technology helps reveal issues without cutting open the body.

- Surgical Facilities

Inside hospitals, rooms are built just for surgery. These spaces come with tools and systems that keep everything clean. Equipment works together so doctors can operate safely. Cleanliness matters most during these medical tasks. Everything stays controlled to protect patients. Special areas handle only surgical work. Sterile settings reduce risks of infection. Procedures happen here when precision is needed. Support structures help staff do their jobs well. Each detail supports a smooth process.

To learn more about this report, Download Free Sample Report

By Application

- Inpatient Care

Overnight stays mark the start of care inside a hospital when someone needs close watching. Treatment unfolds where beds remain ready, not just for rest but ongoing attention through hours after dark. A room becomes home while recovery takes shape under medical eyes that never fully shut. Nights pass here because healing sometimes demands more than a visit can offer.

- Outpatient Care

Same-day health visits mean care happens outside hospitals. These checkups include tests plus treatment on-site. People go back home after the appointments finish. No overnight stay is ever.

- Emergency Care

When seconds count, care arrives fast - handling sudden injuries, critical conditions, or sharp declines in health without delay.

- Surgical Services

Operating rooms handle treatments for trauma, illness, or physical issues through invasive procedures. These tasks usually need trained personnel alongside specific equipment and space built for such work.

- Diagnostic Services

Lab work and scans help spot health issues. These checks track how a condition changes over time. Tests give clear clues about what is going on inside the body. Results guide next steps without guessing. Watching symptoms helps shape care plans.

By Ownership

- Public

Run by public authorities, these centers offer medical care to everyone through state funding and ownership.

- Private

Owned by individuals or companies, these clinics operate on money from bills or coverage. Instead, they often emphasize modern treatments alongside comfort features.

By End-Users

- Public Hospitals

Funded by taxes, public hospitals run under government oversight to serve everyone regardless of income. Their main job is treating illness while reaching people who might otherwise go without care. Open to all, these facilities focus on prevention just as much as treatment. Managed locally, they adapt to neighborhood needs rather than follow one-size-fits-all rules. Built into cities and towns, their presence helps stabilize health outcomes across populations.

- Private Hospitals

Some hospitals operate through private ownership, run by companies aiming to deliver medical help. These places usually include modern equipment, offering a higher level of service. Care here tends to feel more tailored, built around comfort and newer technology. Ownership stays outside government control, relying on funding from patients or insurers. Services might cost more, yet they often come with shorter waits and extra amenities.

- Specialty Hospitals

A few hospitals zoom in on just one kind of care, say, hearts or tumors, and build great skills around those areas. These places handle complex cases that others might send away. Expertise stacks up where attention narrows. Treatment paths get shaped by years of doing similar work day after day. Some patients travel far to land inside these walls. Focus changes what's possible behind closed doors.

- Academic Medical Center

Some hospitals train future doctors while treating patients; these are tied to med schools. They mix hands-on healthcare with learning for students. Research happens here too, woven into daily work. Care, study, and discovery run side by side in these centers.

Regional Insights

Modern hospitals fill North America, shaped by steady upgrades over time. Though older, they keep pace through new tools and smarter workflows. Instead of building from scratch, many choose to retrofit with tech that tracks performance. Patient results guide changes more than tradition now. Digital systems link departments once isolated in daily work. Even lighting and temperature respond to real-time needs in some clinics. Funding rarely stalls progress here, thanks to balanced public and private support. Teaching hospitals often test solutions before others adopt them. Specialized units pop up where demand grows quietly. Efficiency matters, yet not at the cost of individual care rhythms. Progress hums beneath the surface, unseen but felt.

Steady progress marks European hospital growth, driven by widespread health coverage, older citizens, and tighter rules. Instead of building big new centers, nations often renew their current ones, focus shifting toward greener operations, lower power use, and safer care settings. Upgrades roll forward through shared medical efforts between countries, backed by state money, especially in western and northern areas. In contrast, eastern regions place a stronger emphasis on adding space and increasing room for patients.

Out in the Asia Pacific, growth in hospital buildings is picking up fast. Latin America joins close behind, with change moving just as quickly. The Middle East and Africa follow a similar path, not far off pace. City life spreads wider each year, pushing the need for more medical centers. More people can now reach health services than before. Private companies step in where public systems leave gaps. They build clinics focused on specific treatments. New tech finds its way into these places early. Officials spend big on upgrading old structures, too. Fresh projects rise where demand climbs highest. These areas together shape what comes next for global healthcare spaces. What happens here influences plans elsewhere down the line.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 16, 2025 – Sakra World Hospital & IKOC launched a 50-bedded multi-specialty facility in BLR

- July 8, 2025 – Telecom Egypt signed a Memorandum of Understanding with KareXpert, a leading healthcare technology company powered by an artificial intelligence assistant, to launch a comprehensive digital healthcare platform managed through a secure national cloud hosted within Egypt.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 205.00 Billion |

|

Market size value in 2026 |

USD 225.00 Billion |

|

Revenue forecast in 2033 |

USD 345.60 Billion |

|

Growth rate |

CAGR of 6.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Siemens Healthineers, GE HealthCare, Koninklijke Philips, Canon Medical Systems, Fujifilm Holdings, Medtronic, Stryker Corporation, Johnson & Johnson, Becton Dickinson and Company, Boston Scientific, Baxter International, Hologic, Abbott Laboratories, Olympus Corporation, Hitachi Healthcare, Roche Diagnostics, Thermo Fisher Scientific, Drägerwerk, Toshiba Medical Systems, and Mindray Medical. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Medical Equipment, Patient Care Facilities, Laboratory Services, Emergency Services, Diagnostic Imaging, Surgical Facilities), By Application (Inpatient Care, Outpatient Care, Emergency Care, Surgical Services, Diagnostic Services), By Ownership (Public, Private), By End-Users (Public Hospitals, Private Hospitals, Specialty Hospitals, Academic Medical Centers) |

Key Hospital Facilities Company Insights

Medicine moves forward when tools get smarter. Siemens Healthineers builds that shift. Imaging grows sharper through their work on MRI, CT, and X-ray machines. Instead of just selling gear, they weave in artificial intelligence to smooth how clinics run. Behind the scenes, labs gain precision thanks to their diagnostic platforms. Hospitals rethink space and flow using guidance drawn from real-world data. Though based in Germany, reach stretches wide into North America, woven deep across Europe, reaching further still into parts of Asia. Progress does not pause, so neither does spending on new ideas. Better results often begin long before a patient walks through the door.

Key Hospital Facilities Companies:

- Siemens Healthineers

- GE HealthCare

- Koninklijke Philips

- Canon Medical Systems

- Fujifilm Holdings

- Medtronic

- Stryker Corporation

- Johnson & Johnson

- Becton Dickinson and Company

- Boston Scientific

- Baxter International

- Hologic

- Abbott Laboratories

- Olympus Corporation

- Hitachi Healthcare

- Roche Diagnostics

- Thermo Fisher Scientific

- Drägerwerk

- Toshiba Medical Systems

- Mindray Medical

Global Hospital Facilities Market Report Segmentation

By Product Type

- Medical Equipment

- Patient Care Facilities

- Laboratory Services

- Emergency Services

- Diagnostic Imaging

- Surgical Facilities

By Application

- Inpatient Care

- Outpatient Care

- Emergency Care

- Surgical Services

- Diagnostic Services

By Ownership

- Public

- Private

By End-Users

- Public Hospitals

- Private Hospitals

- Specialty Hospitals

- Academic Medical Centers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

.jpg)

APAC:+91 7666513636

APAC:+91 7666513636