Market Summary

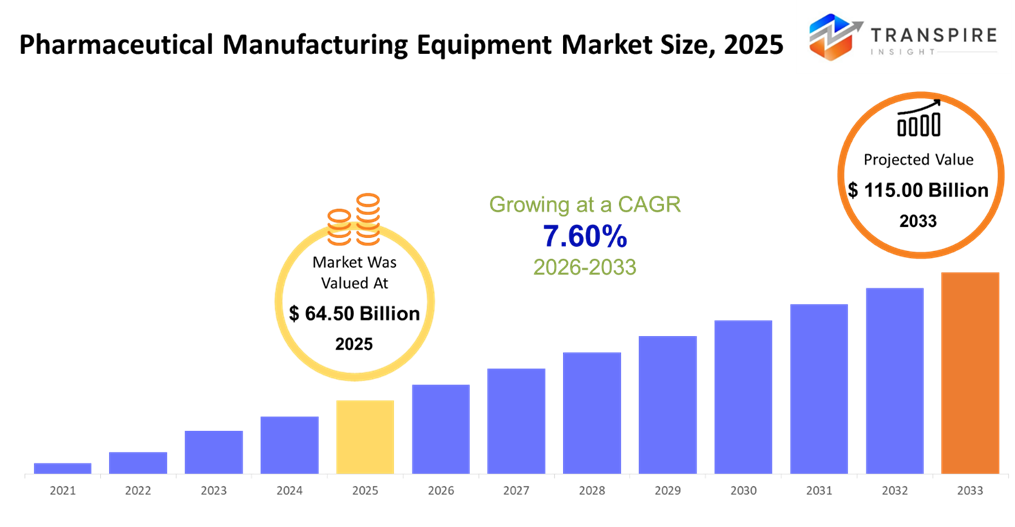

The global Pharmaceutical Manufacturing Equipment market size was valued at USD 64.50 billion in 2025 and is projected to reach USD 115.00 billion by 2033, growing at a CAGR of 7.60% from 2026 to 2033. The growing need for biologics, vaccines, and complicated dosage forms is expected to propel the global pharmaceutical manufacturing equipment market's growth at a notable compound annual growth rate (CAGR). Growth is further accelerated by regulatory compliance requirements, automation adoption and an increase in outsourcing to CMOs and CDMOs. Technological advancements in continuous manufacturing and single-use systems as well as expansion into emerging markets, improve operational efficiency and support steady CAGR development.

Market Size & Forecast

- 2025 Market Size: USD 64.50 Billion

- 2033 Projected Market Size: USD 115.00 Billion

- CAGR (2026-2033): 7.60%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- With sophisticated regulatory frameworks, widespread automation use, and robust R&D infrastructure, North America continues to lead the industry. High-precision filling and packaging solutions boost overall efficiency, while formulation and processing equipment dominates investment.

- While CMOs and big pharmaceutical companies target digital integration and aseptic processing to fulfill quality and productivity goals, the United States leads the area in growth thanks to strong pharmaceutical manufacturing, ongoing manufacturing adoption, and rising biologics output.

- Low-cost manufacturing hubs, rising generic and biopharmaceutical production, and increased government initiatives in China, India, and Japan are all contributing to Asia Pacific's rapid expansion. Automation and cleanroom adoption are also driving demand for formulation, filling, and bioprocessing equipment.

- The regulatory requirements for serialization, traceability, and aseptic filling, especially for injectables and biologics, are driving a strong momentum in filling and packaging equipment, resulting in increased investments in high-speed, contamination-controlled and inspection-integrated packaging lines.

- Due to the huge worldwide consumption of tablets and capsules, solid dosage applications dominate market demand. This is reinforced by large-scale generic manufacturing and growing automation in tablet compression, coating, and inspection procedures to improve product quality and throughput.

- Due to constant capital expenditures in cutting-edge machinery to support high-volume production, regulatory compliance, and diversification into specialty and high-value therapeutic niches, large and mid-sized pharmaceutical manufacturing businesses continue to be the main end customers.

So, The machinery and systems utilized in the production of pharmaceuticals, such as formulation, processing, filling, and packaging equipment, are included in the pharmaceutical manufacturing equipment market. These systems support a variety of drug types, from tablets and capsules to biologics and vaccines, and guarantee quality, uniformity, and regulatory compliance. Market growth is supported by rising chronic illness prevalence, expanding generic medication production and rising global healthcare demand. Automation, continuous manufacturing, and single-use systems are increasingly commonplace in production due to technological improvements, especially in the production of high-value biologics and vaccines. In order to enable quick scaling and economical production, contract manufacturing companies and mid-sized pharmaceutical companies are investing more in adaptable, multi-product capable machinery. Capital expenditure is also driven by regulatory constraints for serialization, traceability and aseptic production in North America and Europe. Growing domestic production, government incentives, and expanding export prospects are driving the adoption of pharmaceutical manufacturing equipment in emerging countries in Asia Pacific, Latin America, and the Middle East. Operational efficiency is increased through strategic alliances, production facility upgrading, and digital integration for quality assurance and monitoring. Global healthcare access, innovation and regulatory compliance all contribute to the market's overall growth.

Pharmaceutical Manufacturing Equipment Market Segmentation

By Equipment Type

- Formulation & Processing Equipment

Mixers, granulators, dryers, reactors, and bioprocessing units all necessary for drug formulation and API preparation are included in this section. Growing need for complicated dosage forms, biologics production, and automation integration that boosts product quality and throughput are its main drivers. Large and mid-size players are increasingly favoring advanced processing lines with automated control and real-time monitoring. The section, which accounts for a sizeable portion of the overall equipment expenditure, is nevertheless essential for core production.

- Filling & Packaging Equipment

The integrity of final drug products and regulatory compliance depend heavily on filling and packaging equipment, including liquid filling lines, aseptic fill-finish systems, blister sealers, and inspection machines. Investment in these systems is increasing because to the trend toward tamper-evident packaging and serialization, particularly in North America and Europe. The need for high-precision sterile filling solutions is further fueled by the expansion of biologics and parenteral goods. In terms of market value, packaging equipment continuously ranks in the top sub-segments.

- Other Product Types

Ancillary and specialized systems, such as lyophilizers, sterilizers, quality control devices, and supporting utilities (such HVAC for cleanrooms), fall under this category. The value proposition of these items is improved by the quick adoption of Industry 4.0 features and digital inspection technology. Despite being smaller on their own than core formulation and packaging equipment, these systems are crucial to advanced biologics manufacturing, operational effectiveness, and compliance.

To learn more about this report, Download Free Sample Report

By Application

- Solid Dosage Forms

Because tablets and capsules are so widely used worldwide, solid dosage applications dominate in terms of volume and investment. The introduction of automated tablet presses and capsule fillers is being driven by regulatory demand for consistent quality control and the production of generic drugs in Asia-Pacific. Sensors and predictive quality tools are examples of smart manufacturing enhancements that improve throughput and lower reject rates. This market segment continues to be the foundation of the pharmaceutical equipment industry.

- Liquid Dosage Forms

Precise filling, mixing, and stability-assurance equipment are necessary for liquid formulations, especially for oral and parenteral liquids. As producers increase their capacity for syrups, suspensions, and solution products, demand is high in both developed and developing markets. The adoption of advanced clean-in-place (CIP) and automated sterilization systems is influenced by regulatory focus on contamination management.

- Parenteral / Injectable Products

Supported by vaccines, biologics, and high-potency injectables, this application category is one of the fastest expanding and requires fill-finish technology and aseptic processing. Capital spending in this area is driven by advancements in single-use systems and strict regulations on sterility. This trend has been accelerated globally by COVID-19 and the growth of vaccine manufacture.

- Biopharmaceuticals & Vaccines

The expansion of biopharmaceuticals and vaccines calls for specialized processing instruments, chromatography systems, and bioreactors. Modular platforms and single-use technologies allow for flexibility across production scales, which is especially appealing to CDMOs and biotech companies. Asia and the Middle East saw an increase in demand for specialized equipment due to regional investments in local biologics capabilities.

- Herbal & Nutraceuticals

Supported by vaccines, biologics, and high-potency injectables, this application category is one of the fastest expanding and requires fill-finish technology and aseptic processing. Capital spending in this area is driven by advancements in single-use systems and strict regulations on sterility. This trend has been accelerated globally by COVID-19 and the growth of vaccine manufacture.

- Oncology & Specialty Drugs

The expansion of biopharmaceuticals and vaccines calls for specialized processing instruments, chromatography systems, and bioreactors. Modular platforms and single-use technologies allow for flexibility across production scales, which is especially appealing to CDMOs and biotech companies. Asia and the Middle East saw an increase in demand for specialized equipment due to regional investments in local biologics capabilities.

By End User

- Pharmaceutical Manufacturing Companies

With significant investments in automation, digital validation, and compliance-ready platforms, large integrated pharmaceutical companies control the majority of the industry. Equipment that improves scale, dependability, and regulatory reporting is given priority. To compete with bigger firms, mid-sized businesses also make investments in scalable and flexible solutions.

- Contract Manufacturing Organizations (CMOs) / CDMOs

The need for adaptable, multi-product capable equipment is being driven by the quick growth of CMOs and CDMOs as outsourcing partners for biologics and small molecules. They frequently use technology that can quickly switch between projects while upholding strict quality standards, which is a crucial competitive advantage.

- Biotechnology Companies

Biotech companies concentrate on biopharmaceutical production technology like downstream purification tools, cell culture bioreactors, and single-use systems. Innovation cycles, regulatory scrutiny for biologics, and scalability for clinical to commercial transitions all influence their equipment selections.

- Research Laboratories & Academic Institutions

To support R&D, formulation development, and process optimization, these users require specialized, smaller-scale equipment. The segment promotes early acceptance of new technologies and tends to influence larger industry uptake, while spending less overall than commercial producers.

- Hospitals & Clinics

Compact, adaptable production systems are mostly needed by hospitals and clinical facilities for sterile preparations, customized medications, and specialist compounding. At lesser numbers, their equipment requirements center on safety, usability, and regulatory compliance.

- Nutraceutical / Veterinary Product Manufacturers

Strong yet reasonably priced equipment for non-prescription and veterinary products is given priority in this market. Investment in processing and packaging technologies that meet changing quality standards is encouraged by rising consumer demand, particularly in emerging nations.

Regional Insights

With the United States leading in pharmaceutical production capacity and technological adoption, North America continues to be the most developed market. Canada and Mexico also contribute through expanding CMO activities and economical manufacturing. Demand is significant in Europe, where strict EMA regulations are supporting the adoption of modern equipment for high-precision packaging, aseptic filling, and biologics by Germany, the United Kingdom, and France. With growing investments in automation and quality control systems, European nations like Italy and Spain continue to grow moderately. The fastest-growing region is Asia Pacific, where China and India are becoming major global centers for the production of vaccines, biopharmaceuticals, and generic drugs. While the rest of Asia Pacific is increasing capacity for regional supply chains and export markets, South Korea, Australia, and Japan concentrate on sophisticated processing technologies, digital integration, and regulatory compliance. While other nations in the region follow with smaller-scale projects, South America, led by Brazil and Argentina, is investing in processing and packaging infrastructure, progressively boosting local manufacturing capabilities.

Africa and the Middle East are developing markets, and Saudi Arabia, the United Arab Emirates, and South Africa are propelling expansion through strategic alliances and government-supported pharmaceutical infrastructure development. To fulfill the need for healthcare both domestically and internationally, the rest of the Middle East and Africa is progressively implementing automation and technology that is ready for compliance. In general, manufacturing capacity, technological adoption, regulatory constraints, and investments in contemporary machinery all influence regional dynamics.

To learn more about this report, Download Free Sample Report

Recent Development News

- February 2026, With an underlying EBITDA margin of 29.7%, Sartorius AG's preliminary full-year figures for 2025 revealed a notable increase in profitability and a 7.6% increase in sales revenue (~€3.5 billion). Growth was aided by both the consumables and equipment/instruments businesses, and the business anticipated more growth in 2026. The findings demonstrate the ongoing need for Sartorius' bioprocess solutions and instrument technologies utilized in the production of pharmaceuticals and biotech, while investments in international production networks and cutting-edge goods continued to be strategic goals.

- In May 2025, Syntegon Technology GmbH reported record financial performance for fiscal year 2024, driven by its new strategic focus on growth and operational excellence. The company's order intake increased by 11% to €1.8 billion, and its revenue increased by 7% to €1.6 billion. A 15% increase in adjusted EBITDA and a 14% EBITDA margin also shown significant increases in profitability. With 58% of all orders, the pharma business area was the biggest growth engine, indicating a need for Syntegon's biotech and pharmaceutical manufacturing services. The company's improved position in turnkey solutions and lifecycle services for pharmaceutical manufacture is highlighted by this milestone.

(Source:https://www.syntegon.com/press/syntegon-delivers-record-results-in-2024)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 64.50 Billion |

|

Market size value in 2026 |

USD 69.00 Billion |

|

Revenue forecast in 2033 |

USD 115.00 Billion |

|

Growth rate |

CAGR of 7.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

GEA Group Aktiengesellschaft, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Technology GmbH, ACG, Thermo Fisher Scientific Inc., Sartorius AG, Bausch + Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG, Romaco Group, Marchesini Group S.p.A., Glatt GmbH, Coperion GmbH, Fette Compacting GmbH, B. Bohle Maschinen + Verfahren GmbH, Tofflon Science and Technology Co., Ltd., Agilent Technologies, Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Equipment Type (Formulation & Processing Equipment, Filling & Packaging Equipment, Other Product Types), By Application (Solid Dosage Forms, Liquid Dosage Forms, Parenteral / Injectable Products, Biopharmaceuticals & Vaccines, Herbal & Nutraceuticals, Oncology & Specialty Drugs) and By End User (Pharmaceutical Manufacturing Companies, Contract Manufacturing Organizations (CMOs) / CDMOs, Biotechnology Companies, Research Laboratories & Academic Institutions, Hospitals & Clinics, Nutraceutical / Veterinary Product Manufacturers) |

Key Pharmaceutical Manufacturing Equipment Company Insights

Thermo Fisher Scientific Inc. is a leading provider of pharmaceutical manufacturing and processing equipment with a broad portfolio covering formulation, processing and analytical systems. The company's expertise is in combining extensive regulatory compliance assistance with cutting-edge technology, such as automated analytics and single-use bioprocessing, to facilitate the manufacture of biologics and small molecules. Its competitive positioning is strengthened by its wide service network, global presence in important markets and ongoing innovation in scalable production platforms. Its capacity to satisfy changing industry demands is further improved by strategic acquisitions and investments in filtration, purification and digital solutions, especially in high-growth industries like biologics and aseptic processing.

Key Pharmaceutical Manufacturing Equipment Companies:

- GEA Group Aktiengesellschaft

- M.A. Industria Macchine Automatiche S.p.A.

- Syntegon Technology GmbH

- ACG

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Bausch + Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG

- Romaco Group

- Marchesini Group S.p.A.

- Glatt GmbH

- Coperion GmbH

- Fette Compacting GmbH

- Bohle Maschinen + Verfahren GmbH

- Tofflon Science and Technology Co., Ltd.

- Agilent Technologies, Inc.

Global Pharmaceutical Manufacturing Equipment Market Report Segmentation

By Equipment Type

- Formulation & Processing Equipment

- Filling & Packaging Equipment

- Other Product Types

By Application

- Solid Dosage Forms

- Liquid Dosage Forms

- Parenteral / Injectable Products

- Biopharmaceuticals & Vaccines

- Herbal & Nutraceuticals

- Oncology & Specialty Drugs

By End User

- Pharmaceutical Manufacturing Companies

- Contract Manufacturing Organizations (CMOs) / CDMOs

- Biotechnology Companies

- Research Laboratories & Academic Institutions

- Hospitals & Clinics

- Nutraceutical / Veterinary Product Manufacturers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636