Market Summary

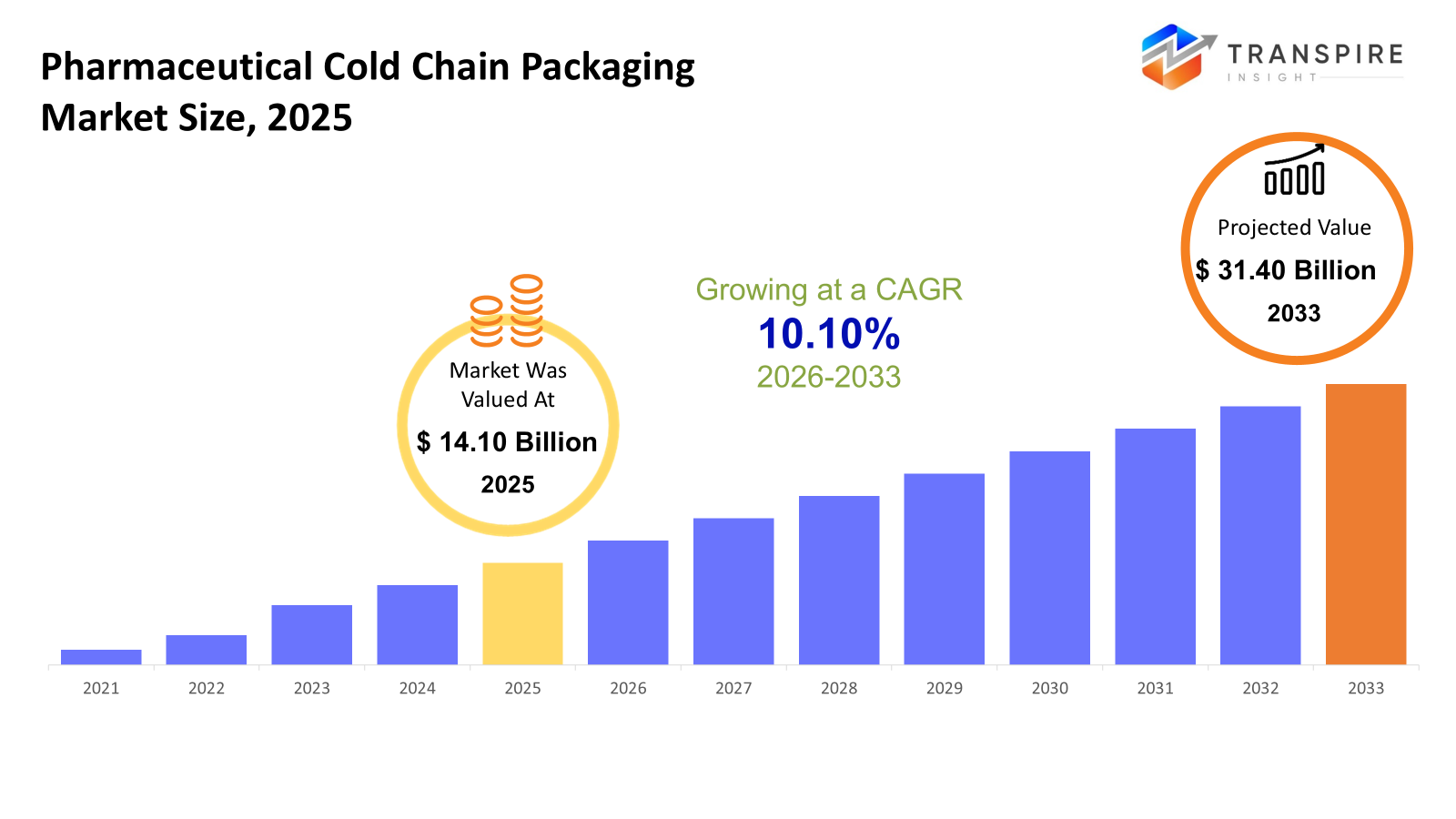

The global Pharmaceutical Cold Chain Packaging market size was valued at USD 14.10 billion in 2025 and is projected to reach USD 31.40 billion by 2033, growing at a CAGR of 10.10% from 2026 to 2033. The market for pharmaceutical cold-chain packaging is growing at a positive CAGR as a result of the increasing production of biologics, growth in the distribution of vaccines, and the regulation to control temperatures. The demand for pharmaceutical cold-chain packaging is fuelled by the globalization of clinical research, outsourcing of pharmaceutical logistics, and advancements in technology.

Market Size & Forecast

- 2025 Market Size: USD 14.10 Billion

- 2033 Projected Market Size: USD 31.40 Billion

- CAGR (2026-2033): 10.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America represents aggressive adoption of sophisticated cold chain packaging owing to the scale of mannufacturing of biologics, regulatory stringency, and the penetration level of reusable pallets in the pharmaceutical logistics network for long haul and inter-regional distribution of drugs

- The United States consumes the highest number of cold chain equipment containers in the regional market owing to large productions of vaccines, numerous clinical trials, and the need for high-performance insulated pallet containers, with a preference for polyurethane and reusable plastic variants for temperature stability for regulatory compliance

- The Asia Pacific region exhibits rapid growth driven by the growing pharmacy-based manufacturing infrastructure in China and India, vaccine exports, and domestic demand in Asia Pacific for economic EPS-based small boxes suited for small-package distribution in those regions

- The material with the greatest market share in this sector comprises plastic packaging materials due to the light weight and thermally functional capabilities of polyethylene and polypropylene and polyurethane materials, making them ideal for single and multi-use purposes in transporting pharmaceuticals over short and global distances

- Small boxes are the most used category because these are ideal for last-mile delivery solutions for vaccines, injectables, and samples within fragmented healthcare markets and pharmaceutical distribution networks

- The major end-users are the biopharmaceutical companies due to the need for validated cold chain solutions for the products of biologics, cell therapy, and temperature-sensitive injectable medicines.

So, the pharmaceutical cold chain packaging market pertains to insulated packaging solutions with the purpose of maintaining specified temperatures during the storage and transport of pharmaceuticals that are susceptible to temperatures. Such solutions are integral for preserving pharmaceutical potency, especially within the context of vaccines, biologics, biosimilars, and injectables. The market environment is influenced by harsh regulations that come with the involvement of organizations like FDA, EMA, and WHO, which emphasize approved temperature control throughout the pharmaceutical supply chain. Packaging solutions should then demonstrate temperature, durability, and trackability for a variety of logistical points. There has been an increasing adoption of advanced or reusable packaging materials by pharmaceutical manufacturers due to risks associated with temperature excursions. Moreover, the globalization of the pharmaceutical manufacturing and distribution process has led to a reliance on third-party logistics services further fueling the demand for standardized cold packaging. The increasing number of clinical studies and specifically within the growing markets has also made a contribution to the overall market development. The sustainability factor has started to influence the choice of materials, and the demand for recyclable plastics and hybrid insulation has started to emerge.

Pharmaceutical Cold Chain Packaging Market Segmentation

By Material

- Plastic

The plastic type is the foundation for pharmaceutical cold chain packaging systems based on the versatility, strength, and heat management properties of plastic. Polyethylene (PE)-plastic is mostly preferred for cold chain applications, as plastic is flexible, water-resistant, and light in weight, hence suitable for short to mid-range cold chain transportation. Polypropylene (PP)-plastic is more heat-resistant and chemical-resistant, hence suitable for cold chain applications using reusable containers in the developed market. PET plastic is preferred for cold chain packaging applications, including strength, clarity, and recycled preferences, thus aiding in the achievement of visibility and sustainability in cold chain packaging. Expanded polystyrene (EPS)-plastic currently leads the cold chain transportation market for the transportation of large quantities of vaccines or biologics, primarily because EPS plastic has remarkable heat management properties at an economical price, while PU plastic offers remarkable heat management at high-value products in long range cold chain transportation. Specialty plastics offering remarkable heat management features, giving prime importance to the environment, have presently initiated the rise in cold chain markets.

- Paper

Paper materials are primarily used in outer packaging or packaging components in cold chain logistics. The rising sustainable development concerns are promoting more use of recyclable paper materials, particularly in Europe.

- Metal

Metal materials are mainly used in durable containers and temperature control units. Their use is restricted but essential in transporting pharmaceuticals that require the utmost care and a long lifespan.

- Others

This category will include composite/hybrid materials that provide insulation, strength, and sustainability. These materials are currently receiving a lot of interest as the pharmaceutical industry looks to find a balance between performance and sustainability.

To learn more about this report, Download Free Sample Report

By Product

- Small Boxes

Smaller boxes are widely used for the dispatch of vaccines, injectables, and specialty drugs in small quantities. Smaller boxes are ideal for last-mile delivery and are used for clinical trials as well.

- Pallet

The cold chain pallet can also be used in the transportation of drugs in bulk. This is in relation to the supply chain, particularly in the regions and the international setting.

- Large Sized Pallet Containers

At present, these containers are meant for transporting drugs in large quantities and over long distances. They are mostly utilized in global pharmaceutical manufacturing and logistics organizations that produce large quantities of these drugs.

- Others

This group includes customized packaging and modular systems designed for particular pharmaceutical needs. The drivers for demand are personalized medicine and specialty pharmaceutical drugs.

By End Use

- Biopharmaceutical Companies

Biopharmaceuticals account for the highest market size in the end-use industry due to the sensitive nature of biopharmaceuticals/vaccines. The need for regulatory standards is responsible for the constant demand for high-quality cold chain packaging for biopharmaceuticals/vaccines.

- Clinical Research Organizations

Clinical research organizations use cold chain packaging in the transportation of investigational drugs and biological specimens. The rising use of clinical trials worldwide has sparked the demand for traceable cold chain packaging.

- Hospitals

The healthcare industry demands cold-chain packaging to be used in the storage and transportation of vaccines, blood, and special drugs. Increasing healthcare spending and immunization initiatives have driven the demand.

- Research Institutes

Research institutes employ the concept of cold chain packaging in the preservation of biological specimens as well as experimental drugs. Growing spending on research in the area of life science research advances the usage of temperature-controlled packages.

- Logistics and Distribution Companies

These firms are very important in maintaining temperature integrity throughout the pharmaceutical distribution channel. This has been driven by the outsourcing phenomenon as third-party cold chain logistics services continue to increase in popularity.

- Others

There are government organizations, pharmacies, and humanitarian organizations that fall into this market. The demand here depends on public health programs, emergency medical programs, and improved availability of temperature-sensitive drugs.

Regional Insights

North America is a mature market, with advanced pharmaceutical manufacturing, cold chain infrastructure, and stringent regulation. The United States is the major demanding market, with Canada and Mexico represented by the rise of clinical research studies, along with pharmaceutical trade between the two countries. The Europe market shows stable growth, led by Germany, the UK, France, Italy, and Spain, ably supported by tough GDP compliance and successful biologics programs. Tier-2 European countries are gradually embracing standardized cold chain solutions in response to growing pharmaceutical exports. The asia pacific market is estimated to experience the highest growth rate, with key countries including china, india, and japan. The intense development in pharmaceutical, vaccine, and contract research organization manufacturing is creating a substantial market, with tier 2 countries contributing due to healthcare infrastructure development.

The South America region exhibits a balanced growth trajectory with Brazil and Argentina being early adopters because of advancements in cold chain logistics capabilities in their respective regions. The Middle East & Africa market is slowly growing with new investments in their health infrastructure in countries such as Saudi Arabia, UAE, and South Africa in particular.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, CSafe Global introduced Silverskin RE, featuring its Silverskin RE reusable thermal panel designed for maintaining critical temperatures (2 °C - 8 °C & 15 °C - 25 °C), thus improving temperature protection for pharmaceuticals.

- In October 2025, Peli BioThermal has diversified its cold chain packaging solutions by acquiring the company Evo. This move has further strengthened the company's abilities for the logistics of cell and gene therapy (CGT) with sophisticated temperature-based solutions for high-value biologics.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 14.10 Billion |

|

Market size value in 2026 |

USD 16 Billion |

|

Revenue forecast in 2033 |

USD 18.5 Billion |

|

Growth rate |

CAGR of 31.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Sonoco ThermoSafe, Sealed Air Corporation, Peli BioThermal Limited, CSafe Global, Intelsius, Cryoport Systems, LLC, Envirotainer, SkyCell AG, va-Q-tec AG, Insulated Products Corporation, Smurfit Westrock, Chill-Pak, Practical Packaging Solutions, Inc., TESSOL, Softbox Systems Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material (Plastic,(Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Expanded Polystyrene (EPS), Polyurethane (PU),Others), Paper, Metal, Others), By Product (Small Boxes, Pallets, Large Sized Pallet Containers, Others), By End Use (Biopharmaceutical Companies, Clinical Research Organizations, Hospitals, Research Institutes, Logistics and Distribution Companies, Others) |

Key Pharmaceutical Cold Chain Packaging Company Insights

Sonoco ThermoSafe is a major player in the pharmaceutical cold chain packaging market, and its unique features include its ability to design, test, and validate. The firm's offerings include single use and reusable insulated containers which ensure better thermal protection for biologic and vaccine products. Sonoco ThermoSafe utilizes its ability to manufacture and source globally to satisfy difficult tomeet regulations, and by investing in its sustainable and circular packaging initiatives its offerings are strengthened. As this report analyzes, its focus on testing and validation, support, and reliable supply chains ensures that Sonoco ThermoSafe is considered a preferred supplier for large biopharmaceutical organizations and logistics companies serving difficult cold chain requirements.

Key Pharmaceutical Cold Chain Packaging Companies:

- Sonoco ThermoSafe

- Sealed Air Corporation

- Peli BioThermal Limited

- CSafe Global

- Intelsius

- Cryoport Systems, LLC

- Envirotainer

- SkyCell AG

- va-Q-tec AG

- Insulated Products Corporation

- Smurfit Westrock

- Chill-Pak

- Practical Packaging Solutions, Inc.

- TESSOL

- Softbox Systems Ltd.

Global Pharmaceutical Cold Chain Packaging Market Report Segmentation

By Material

- Plastic

- Paper

- Metal

- Others

By Product

- Small Boxes

- Pallets

- Large Sized Pallet Containers

- Others

By End Use

- Biopharmaceutical Companies

- Clinical Research Organizations

- Hospitals

- Research Institutes

- Logistics and Distribution Companies

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636