Market Summary

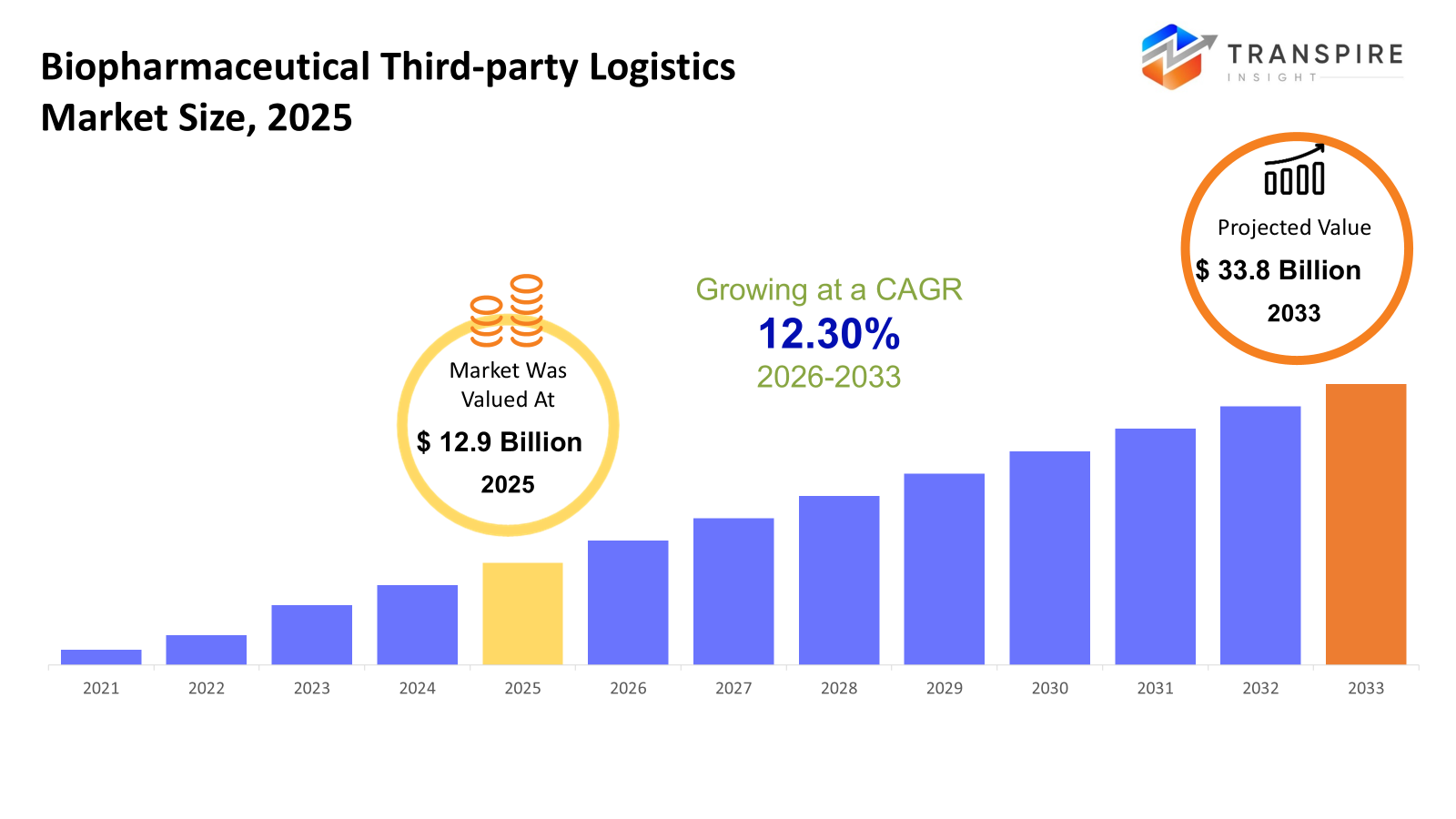

The global Biopharmaceutical Third-party Logistics market size was valued at USD 12.9 billion in 2025 and is projected to reach USD 33.8 billion by 2033, growing at a CAGR of 12.30% from 2026 to 2033 The third-party logistics market in the biopharmaceutical industry is increasing steadily because of the increase in the production of biologics, the growth in the number of vaccine shipments, and the tightening of temperature regulation requirements. Additionally, the pharma sector’s increase in the outsourcing of logistics along with the expansion of clinical trials and the growth of the cold-chain infrastructure base are fueling the growth of the market.

Market Size & Forecast

- 2025 Market Size: USD 12.9 Billion

- 2033 Projected Market Size: USD 33.8 Billion

- CAGR (2026-2033): 12.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America grows consistently due to its advanced cold chain logistics solutions, strict GDP practices, and strong volumes of biologics commercialized. High outsourcing practices among large pharma players continue to fuel their use of third-party logistics facilities at all stages of the supply chains.

- The US is still the primary growth driver because of its leading biopharma R&D base and its adoption of cell and gene therapies at a faster rate than other countries. There exists an increasing demand for accurate logistics, online monitoring, and regulatory-scientific storage solutions.

- Asia Pacific shows rapid progress based on the expansion of pharmaceutical manufacturing in China and India, biologics exports, and improved healthcare infrastructure. Investments in cold-chain logistics projects by governments, along with trade expansion, help improve penetration by the third-party logistics industry in Emerging and Developed markets.

- Cold chain logistics trends are characterized by growing reliance on temperature-sensitive biologics, vaccines, and advanced therapies. This growing government oversight and product complexity is fueling the need for validated storage solutions with real-time locationing and specialized transportation solutions.

- The current trends in warehousing and storage revolve around automation, temperature zoning, and inventory management based on compliance requirements. The pharmaceutical industry is increasingly making use of facilities from third-party sources for managing buffer stock, inspections, and value-added activities in proximity to demand hubs.

So, Biopharmaceutical Third-Party Logistics Market: It can be defined as the specialized companies that offer logistics services for the biopharmaceutical industry. It covers the logistics services that must be performed to the specialized products such as biologics, vaccines, biosimilars, or any other biopharmaceutical product. The demands of the market can be attributed to the increasing complexities of biological pharmaceuticals, which need handling and monitoring based on specific temperatures and time constraints. The need for the pharmaceutical and biological industries to minimize risks and reduce costs related to logistics operations has led to increased outsourcing.

In addition, the increase in the number of clinical trials worldwide, the growth of the biologics industry, and the growth of cross-border pharmaceutical shipments are solidifying the need for reliable third party logistics partners. In addition, innovations in the areas of cold chain technology, tracking, and warehousing technology are increasing the role of 3PL in the value chains of the biopharma industry.

Biopharmaceutical Third-party Logistics Market Segmentation

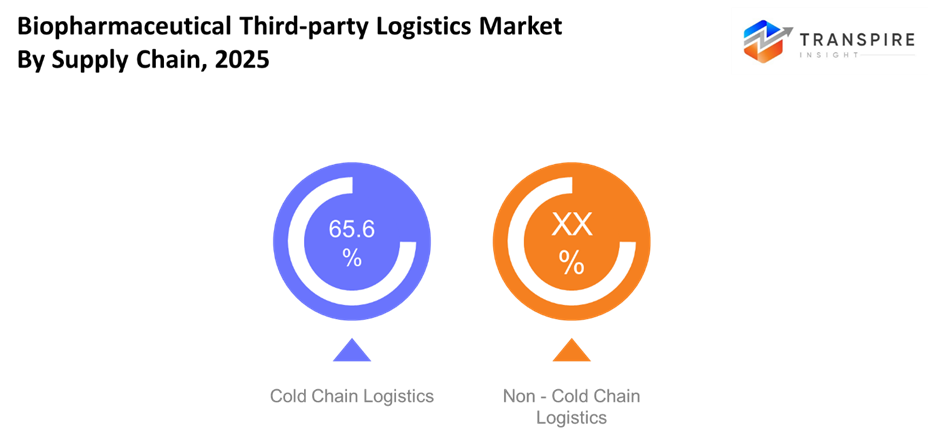

By Supply Chain

- Cold Chain Logistics

The cold chain logistics sector is related to the transportation of heat-sensitive biopharmaceuticals such as vaccines, biologics, or cell therapies. The level of interest in this segment is increasing rapidly as a result of a growing dependence on a controlled cold chain by the biopharma industry.

- Non-Cold Chain Logistics

This type of logistics handles products that are not temperature-sensitive, for instance, oral drugs. This, as compared to the cold chain, is still not as complicated but forms an integral part of 3PL.

To learn more about this report, Download Free Sample Report

By Service Type

- Transportation

Transportation refers to moving biopharma cargo from producers, 3PL facilities, and hospitals, clinics, and pharmacies.This ensures delivery and tracking services among others that are carried out to achieve speed. Air freight would be the quickest option for crossing long distances, including the transportation of vaccines or emergency goods. It is preferred in cases where time sensitivity and rapid transportation take precedence over the issue of costs. Sea Freight is considered to be the best economical means of transporting bulk consignments across continents, especially where there are no time constraints. It is preferred for world-wide exports/imports where the speed factor is of less importance compared to price or capacity. Over-land or truck/rail is considered essential for regional or last-mile distribution within or across borders. This type of mode strikes a balance between cost considerations and the need for flexibility, especially when there is infrastructure support for a reliable road

- Warehousing and Storage

These types of facilities include those which are climate-controlled as well as secure environments where the items are warehoused pending transportation. High-end warehousing also provides functions such as, advanced warehousing inventory, repackaging, labeling, real-time tracking

- Other Services

Other services that the company may offer could be packaging, customs, reverse logistics, and value-added services. These distinguish the 3PL companies by improving overall visibility for the supply chain and by simplifying various operations for the biopharma companies.

Regional Insights

North America represents an established and high-value market with advanced biopharma innovation and logistics infrastructure. The United States serves as Tier 1 market with advanced cold chain infrastructure and regulatory sophistication, with Canada and Mexico serving as Tier 2 markets to support regional distribution chains. By geography, Asia Pacific is the fastest-growing region of the world, powered by Tier 1 markets such as China, Japan, and India that benefit from the manufacturing scale and increasing biologics export. Australia, South Korea, and the rest of emerging Asia Pacific form the Tier 2 markets with a focus on infrastructure development and the expansion of healthcare.

South America currently represents an emerging region, with Brazil as a Tier 1 market driven by pharmaceutical consumption, and Argentina and remaining countries acting as Tier 2 distribution centers. The Middle East & Africa region is growing incrementally, spearheaded by Tier 1 markets such as Saudi Arabia and the UAE; other countries, such as South Africa, are at the core of second-tier growth opportunities from healthcare modernization.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 2025, Cencora, a worldwide pharmaceutical services company, is developing its third-party logistics (3PL) offering within the U.S. and Europe by increasing its worldwide network with more specialty logistics solutions for pharmaceutical companies globally. With an increasing number of specialty drugs on the market, coupled with a steady rise in the demands for drug supply management, Cencora continues to expand its quality offerings within key markets in Europe with the acquisition of NextPharma Logistics, which focuses on healthcare logistics solutions for the delivery of its products in Germany, Austria, & Switzerland. Cencora is also set to establish its 3PL facility in 2026 in Italy.

- In April 2025, The company plans to buy Andlauer Healthcare Group Inc., a company based in Canada that provides cold chain logistics services in the health care industry, in a cash transaction worth $1.6 billion. Like its international competitors FedEx Corporation, DHL, and UPS (NYSE: UPS), health care logistics has been a major focal point in UPS’s expansion strategy as pharmaceuticals require high-margin specialized warehousing and transportation infrastructure. This follows a similar transaction in January this year in which UPS purchased Frigo-Trans, along with its sister firm BPL, which provides temperature-regulated warehousing and transportation logistics in Europe for pharmaceutical biotechnology companies. The terms of this transaction were not disclosed.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 12.9 Billion |

|

Market size value in 2026 |

USD 15 Billion |

|

Revenue forecast in 2033 |

USD 33.8 Billion |

|

Growth rate |

CAGR of 12.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

DHL International GmbH, FedEx Corporation, United Parcel Service (UPS), Kuehne + Nagel International AG, DB Schenker Logistics, AmerisourceBergen Corporation, SF Express, Agility Public Warehousing Co. K.S.C.P., Cencora, Inc., McKesson Corporation, Cardinal Health, Kerry Logistics Network Limited, CEVA Logistics AG, XPO Logistics, Inc., Nippon Express Co., Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Cold Chain Logistics, Non-cold Chain Logistics), By Application (Transportation (Air Freight, Sea Freight, Overland), Warehousing and Storage, Other Services |

Key Biopharmaceutical Third-party Logistics Company Insights

DHL International GmbH continues to be an industry leader in the biopharmaceutical Third-Party Logistics industry because of their strong global network, advanced cold chain network, and investments in tracking solutions. To cater specifically to the life sciences & healthcare industry, DHL’s offerings include temperature-controlled transport solutions, GDP-compliant warehousing, and real-time visibility solutions for biologics & vaccines. Such focused expertise in pharma supply chains through acquisitions and collaborations makes DHL the preferred partner for biopharmaceutical companies in the global industry. It also meets evolving demands, which makes DHL a pioneer in managing complex & temperature-sensitive supply chains.

Key Biopharmaceutical Third-party Logistics Companies:

- DHL International GmbH

- FedEx Corporation

- United Parcel Service (UPS)

- Kuehne + Nagel International AG

- DB Schenker Logistics

- AmerisourceBergen Corporation

- SF Express

- Agility Public Warehousing Co. K.S.C.P.

- Cencora, Inc.

- McKesson Corporation

- Cardinal Health

- Kerry Logistics Network Limited

- CEVA Logistics AG

- XPO Logistics, Inc.

- Nippon Express Co., Ltd.

Global Biopharmaceutical Third-party Logistics market Report Segmentation

By Supply Chain

- Cold Chain Logistics

- Non-cold Chain Logistics

By Service Type

- Transportation (Air Freight, Sea Freight,Overland)

- Warehousing and Storage

- Other Services

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636