Market Summary

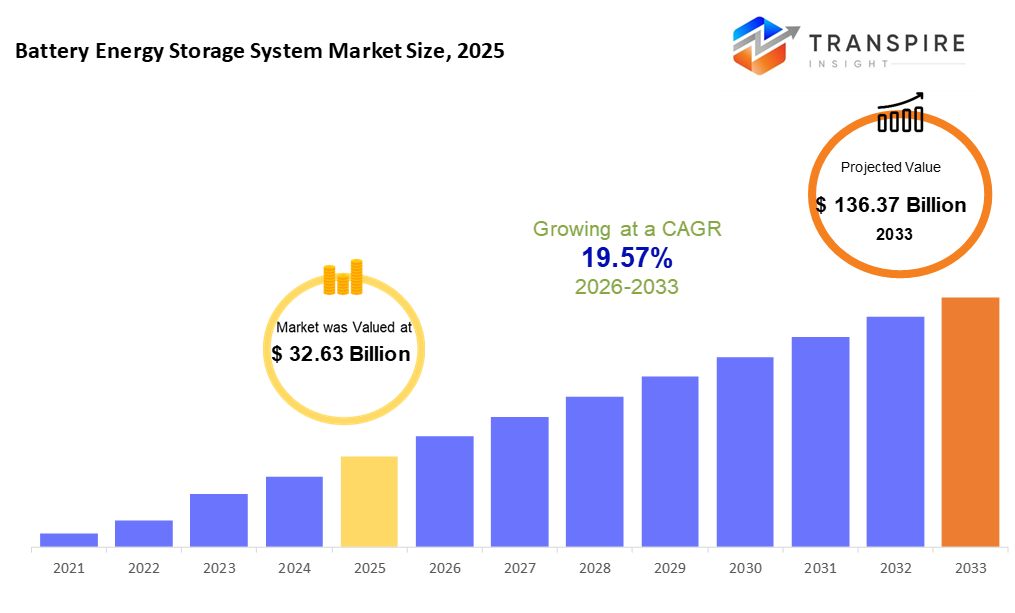

The global Battery Energy Storage System market size was valued at USD 32.63 billion in 2025 and is projected to reach USD 136.37 billion by 2033, growing at a CAGR of 19.57% from 2026 to 2033. The battery energy storage system market is growing due to increasing renewable energy integration and the need for grid stability. Lithium-ion batteries dominate thanks to high energy density and declining costs. Rising demand from utilities and commercial sectors for reliable backup and peak shaving solutions is accelerating adoption. Expansion of off-grid systems in remote areas and advancements in battery technology are further supporting sustained market growth.

Market Size & Forecast

- 2025 Market Size: USD 32.63 Billion

- 2033 Projected Market Size: USD 136.37 Billion

- CAGR (2026-2033): 19.57%

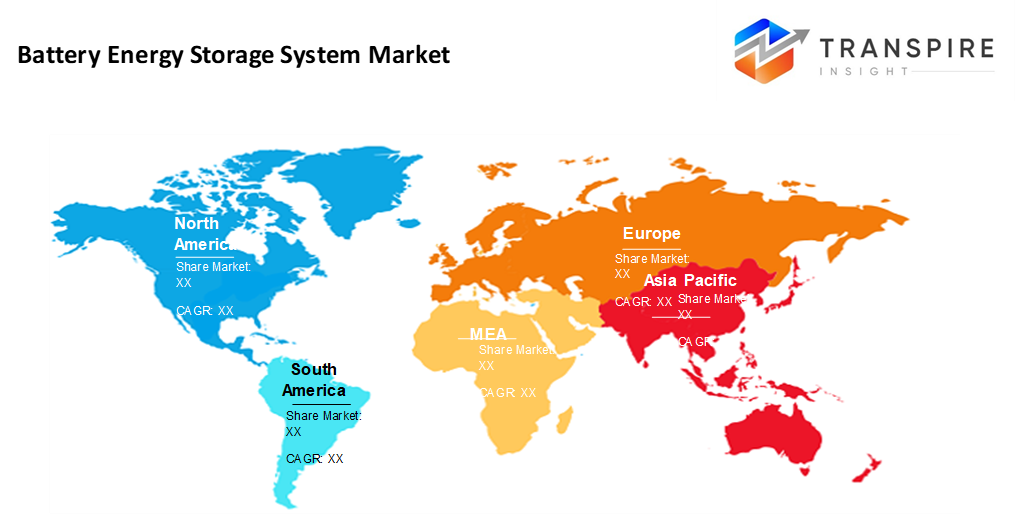

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 38% in 2026. Fueled by a push into renewables, North America sees steady gains, as upgraded power networks play a role too, while rules that back battery systems add momentum.

- In the United States, fueled by massive power grid installations, Washington throws support through funding that pushes battery storage forward. Lithium-based systems see wide use across the country, driven by national programs. Big energy projects shape needs from coast to coast.

- Fueled by surging wind and solar rollouts, the Asia-Pacific area pulls ahead in growth. Grid improvements speed up progress here, especially where money flows into power updates across major nations. China pushes expansion, while India follows close behind with steady moves forward. Japan adds its own push through focused funding shifts toward cleaner sources.

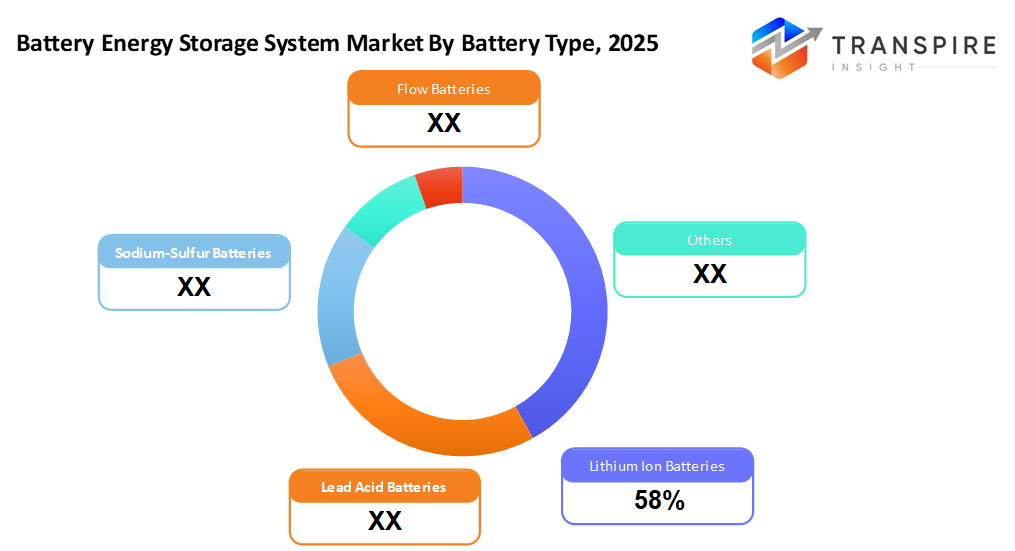

- Lithium-Ion Batteries' expected market share will be 60% in 2026. Fueled by strong demand, lithium-ion batteries dominate because their power capacity stands out. Costs keep dropping, which helps explain why they are common now. We see them everywhere, from electric vehicles to large grid systems, due to steady progress over the years. Their reach grows as more projects choose this type of storage.

- Power systems tied to the main network lead the market because more people need stable electricity flow, reduced high-demand charges, while adding solar and wind to existing lines. Though often unseen, their role grows where supply must match fluctuating needs efficiently.

- Starting strong, past 10 megawatt growth here outpaces the rest, driven by big grid-level batteries that smooth out wind and solar power swings.

- Big projects take the biggest slice because companies building them put more money into storing electricity. This helps when using sun and wind power, which come and go.

- Folks who run power systems are leading the way, with more cash flows into stronger grids, steadier supply timing, and cleaner energy moves. These efforts push them ahead as top users.

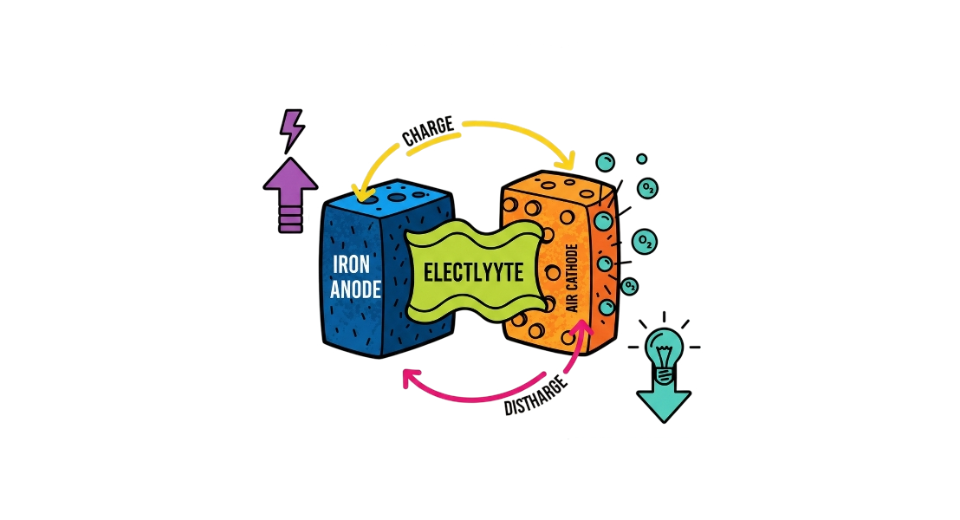

Storing electricity for future use is what the Battery Energy Storage System market focuses on. Different types of batteries make up these setups - lithium-ion, lead-acid, flow cells, and even sodium-sulfur find their place here. Alongside them sit inverters, gear to convert power, plus smart software that guides how energy moves. Power networks gain stability because of this tech. Renewables link into the grid more smoothly when storage backs them up. Homes, businesses, and larger infrastructure all benefit quietly behind the scenes. Shifting away from high-emission energy models becomes easier with such tools in play.

A surge in solar plus wind projects is needed to smooth out supply gaps. Big power companies lead the buying, using massive storage units to manage grid stability and handle high usage times. On top of that, homes, businesses, and factories want more reliable backup as blackouts grow common. Rising energy use adds fuel to this shift, storage stops being optional, and starts feeling necessary.

What stands out is how North America leads because of clear policy backing, upgrades to power networks, strong support through rules and financial perks, plus big battery systems mainly seen in the United States. Growth there gets a boost from requirements favoring clean energy use alongside storage rollout. Over in Europe, movement is not as fast but still consistent, thanks to efforts aimed at cutting emissions while adding more renewables into grids and making sure supply stays reliable.

One thing about today’s tech scene - lithium-ion still leads because it packs a lot of power, works well, yet now costs much less than before. Still, longer-term storage needs are pushing interest toward flow batteries and newer chemical types. Performance gets sharper when smart software helps manage charge cycles while renewable setups team up more often with backup cells. These shifts quietly reshape what’s possible across large-scale battery networks worldwide.

Battery Energy Storage System Market Segmentation

By Battery Type

- Lithium-Ion Batteries

Battery tech runs on lithium ions because they pack a lot of power without taking up much space. These units work well even when used heavily throughout the day. Prices have dropped steadily over recent years, helping them spread across different uses. Homes rely on them just as much as large facilities do now.

- Lead Acid Batteries

Old-school lead-acid batteries stick around because they are cheap and common. These units show up often where backup juice is needed. Even with less oomph per pound, folks still reach for them. Their role stays strong in modest storage jobs across many setups.

- Sodium-Sulfur Batteries

Fueled by intense heat, sodium-sulfur batteries handle heavy-duty power needs across vast networks. Their strength lies in lasting output, making them fit for extended use where storage matters most.

- Flow Batteries

Flow batteries handle that well. Their setup grows easily when more capacity is needed. Operation shifts smoothly with changing power demands. Renewable sources pair naturally with this kind of system.

- Others

Besides lithium types, some batteries use nickel materials. These are power-specific high-end tools or unique devices. Solid versions stay stable under stress. New designs appear as researchers test different chemicals. Each tries to solve old problems in fresh ways.

To learn more about this report, Download Free Sample Report

By Connection Type

- On-Grid Systems

Frequency control happens through links to the power network. These setups manage high-demand times by pulling extra supply when needed. Power from the sun or wind joins the flow due to grid ties. Utility connections make balancing easier during shifts in usage.

- Off-Grid Systems

Sunlight runs these setups where wires can not reach. Power stays on even when no utility lines show up nearby. Some homes far out depend entirely on their panels and batteries. When the city grid ends, this energy keeps going anyway.

By Power Rating

- Below 1MW

Folks at home or small businesses often need just a little power held back. These setups usually run under one megawatt. Storage needs stay modest here. Think quiet systems tucked behind walls or beneath floors.

- 1-10MW

Used by medium-sized businesses, factories, or small power networks needing more output. While some need a steady supply, others rely on it for local grids.

By End-Users

- Residential

At home, batteries store solar energy for later use during outages or peak times. These setups help cut electricity bills while providing reliable power when needed most.

- Utilities

- Folks running power networks use big setups like these to steady the flow, handle demand shifts, while folding in wind and solar energy.

- Commercial and Industrial

Factories, offices, and stores use commercial systems to lower high electricity bills. Instead of paying more during busy times, they store power when rates are low. When demand spikes, stored energy steps in to cut costs quietly. These setups keep lights on without delay.

Regional Insights

Across North America and Europe, demand for battery storage grows fast due to rising clean power use and upgrades to aging electricity networks. The United States and Canada stand out, backed by big utility ventures, smart rules, and financial perks that push lithium-based systems forward. Meanwhile, places like Mexico and bits of Central America move more slowly, focusing mostly on factories and business buildings. Over in Europe, Germany, the United Kingdom, and France set the pace, handling lots of wind and solar through solid grid setups. Countries such as Italy, Spain, and those up north follow close behind, using batteries more each year to steady supply and back green generation.

Out of nowhere, Asia-Pacific has become the top spot for battery storage growth, driven by factories rising fast, more power needed every year, and people aiming high with clean energy plans. Leading the pack, nations like China, India, and Japan pull ahead, thanks to massive projects storing energy for cities and businesses alike. Then come places such as South Korea, Thailand, Indonesia, Vietnam - quietly stepping up, their leaders and companies putting money into smarter grids and backup systems that help renewables work better, keep lights on steady.

Out in Latin America, places like Brazil and Mexico lead the way with big battery systems for power grids and factories. Following behind, nations including Argentina, Chile, and Colombia are starting to bring similar setups online at a slower pace. Over in the Middle East and Africa, countries such as the United Arab Emirates, Saudi Arabia, and South Africa push forward by adding storage to strengthen electricity networks and support solar or wind power. Elsewhere across that region, most countries remain near the beginning of this journey, yet the room to grow grows clearer as roads, plants, and clean energy plans take shape.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 25, 2025 – Northland acquired two battery storage projects in Poland.

- November 13, 2025 – Enectron launched a large-scale battery energy storage system to power India’s energy transition.

- May 10, 2025 – ABB introduced battery energy storage system-as-a-service to simplify renewable energy adoption.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 32.63 Billion |

|

Market size value in 2026 |

USD 39.02 Billion |

|

Revenue forecast in 2033 |

USD 136.37 Billion |

|

Growth rate |

CAGR of 19.57% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

EnerSys, BYD, Tesla Group A.s., LG ESS Battery, Samsung SDI, Panasonic, Siemens Energy, General Electric, Nissan, and Volvo Energy. Total Energies, Enel Group, Enertechups, Nidec, Avaada, Schneider Electric, Scu Power, Rolls-Royce Plc, and Others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Battery Type (Lithium-Ion Batteries, Lead-Acid Batteries, Sodium-Sulfur Batteries, Flow Batteries, Others), By Connection Type (On-Grid Systems, Off-Grid Systems), By Power Rating (Below 1MW, 1-10MW), By End-Users (Residential, Utilities, Commercial and Industrial) |

Key Battery Energy Storage System Company Insights

Tesla is leading the battery storage market. Innovative energy solutions worldwide. Pioneering sustainable technology advancements. Expanding global footprint in clean energy. From the United States, Tesla runs worldwide operations focused on batteries and electric cars. Homeowners get Powerwall, businesses use Powerpack, while entire grids rely on Megapack units. Efficiency, room to grow, plus links to solar and wind, define their battery systems. Lithium-ion cells form the core, managed by custom software that sharpens performance. Grids gain balance, and buildings keep lights on during outages. This setup makes a difference. Bold moves across continents have made them stand out in how we store energy now.

Key Battery Energy Storage System Companies:

- EnerSys

- BYD

- Tesla Group A.s.

- LG ESS Battery

- Samsung SDI

- Panasonic

- Siemens Energy

- General Electric

- Nissan

- Volvo Energy

- Total Energies

- Enel Group

- Enertechups

- Nidec

- Avaada

- Schneider Electric,

- Scu Power

- Rolls-Royce Plc

- Others

Global Battery Energy Storage System Market Report Segmentation

By Battery Type

- Lithium-Ion Batteries

- Lead-Acid Batteries

- Sodium-Sulfur Batteries

- Flow Batteries

- Others

By Connection Type

- On-Grid Systems

- Off-Grid Systems

By Power Rating

- Below 1MW

- 1-10MW

By End-Users

- Residential

- Utilities

- Commercial and Industrial

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636