Market Summary

The global Iron Air Battery market size was valued at USD 0.65 billion in 2025 and is projected to reach USD 4.60 billion by 2033, growing at a CAGR of 28.20% from 2026 to 2033. The increasing investments in renewable energy infrastructure are further accelerating demand for grid modernization and long-duration energy storage solutions, thus leading to sustainable market growth. With cost advantages and scalability, iron air batteries improve adoption across utility-scale projects and contribute to steady CAGR growth in the market.

Market Size & Forecast

- 2025 Market Size: USD 0.65 Billion

- 2033 Projected Market Size: USD 4.60 Billion

- CAGR (2026-2033): 28.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America shows robust adoption driven by grid modernization schemes, renewable energy target integration, and substantial storage investments with utilities focusing on long-duration solutions to counteract the intermittency issues.

- The United States continues to be a significant growth contributor with the support of policy incentives, pilot programs, and the growing number of partnerships between utilities and storage developers leading to the accelerated commercialization of the iron air battery technology for utility-scale and renewable energy storage applications.

- Asia-Pacific countries are witnessing a growing demand fueled by escalating electricity demand, rising installations of renewable capacity and government policies that encourage the adoption of energy storage solutions. This is especially true in the case of highly industrialized economies.

- Component-wise, electrodes have established themselves as an industry segment with significant potential due to the continuous R&D activities that enhance the durability, efficiency and cost-effectiveness of iron materials, thus facilitating the scalability of iron air battery systems for large-scale projects.

- Above 1 MWh capacity dominates, considering the ever-growing demand for grid-scale and multi-day energy storage solution-segments where iron air batteries show strong economic competitiveness and operational suitability compared to short-duration storage technologies used in conventional energy storage systems.

- Grid energy storage represents the biggest application segment, as utilities look increasingly toward deploying long-duration batteries to manage renewable intermittency and improve grid flexibility while reducing dependence on fossil-based generation backup during increasingly disparate energy transition strategies throughout geographies.

- Utilities remain the largest end-user segment, since utilities have the capability of large-scale procurement along with increased investment in modernizing infrastructure. This makes iron air batteries fall in line with their long-term requirements relating to low-cost, scalable, and reliable energy storage.

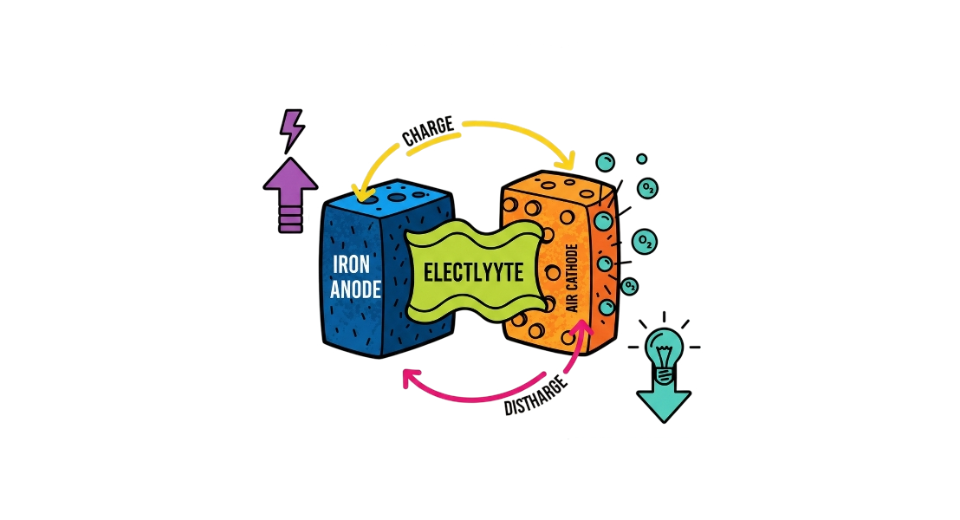

So, The iron air battery market can be defined as the concept and implementation of power storage systems with iron oxidation and air integrated for the storage of chemical energy via electrochemical means. This type of power storage is ideal due to the possibility of power storage over long periods for relatively low material costs compared to other Li-ion storage devices. This market is gaining increased interest due to the potential to solve the issue of intermittency in renewable sources. With increased integration of solar and wind energy into power systems, there exists a need for storage technologies that can supply energy over an extended period. Iron air batteries are considered an alternative for multi-day storage, thus addressing the concerns of utility companies and energy developers in terms of supply fluctuations. With advancements in the technology, it is slowly becoming feasible.

Additionally, the market growth can be attributed to increased investments in grid resilience, electrification, and decarbonization strategies in developed countries. During the transition from conventional to sustainable sources of energy, long-duration storage technologies play a crucial role for grid infrastructure developers. Batteries using iron and air are being perceived as additional technologies for diversified portfolios of energy storage.

Iron Air Battery Market Segmentation

By Component

- Electrodes

Electrodes are considered one of the important components in iron air batteries, especially regarding their effect on energy density, cycle life, and efficiency. Better development of iron electrodes can ensure the longevity of the material as well as lower rates of degradation after charge/discharge cycles. Optimization of costs is also important to the manufacturers.

- Electrolyte

A crucial function of electrolytes revolves around ion transport and battery stability, directly affecting efficiency in battery performance. With studies focusing more on improving formulations of electrolytes, researchers intend to increase their efficiency with minimal associated costs of corrosion and maintenance.

- Air Cathode

The role of the air cathode in facilitating the exchange of oxygen makes it an essential part of the electrochemical process in the iron air battery. Innovations in the field, particularly in terms of catalysts, are contributing towards its efficiency. The segment has gained significant importance due to its impact on the system.

- Battery Management System (BMS)

Such BMS solutions can ensure operational safety, performance monitoring, and optimized charging cycles in iron air battery systems. Increasingly dense integrations in digital monitoring and predictive analytics have improved system efficiency while ensuring reduced operational risks. Large-scale deployment of storage projects is driving demand for advanced BMS technologies.

- Others

This segment comprises the secondary elements: enclosures, thermal management systems, and control electronics. Besides these, the components add to system stability, safety, and installation flexibility. The continuous improvements in system integration are enhancing overall battery performance while reducing operational complexity

To learn more about this report, Download Free Sample Report

By Capacity

- Below 100 kWh

Iron air batteries operating within that range of capacities are mainly appropriate for small-scale back-up power support and micro-scale localized energy storage needs. While the take-up remains small compared to larger-scale operations owing to the technology’s emphasis on long-term storage and not short-term operations, there is a gradual uptake of the technology in remote locations.

- 100 kWh – 1 MWh

This capacity segment serves the business and small-scale utility storage needs, especially for renewable energy balancing and peak load management. The demand for commercial use is increasing due to the requirement for cost-effective solutions other than the lithium-ion systems used for long discharge intervals. This segment also benefits from the increasing potential for microgrid development globally.

- Above 1 MWh

Large capacity systems hold the maximum share in the iron air batteries market, as these can efficiently fulfill the needs of grid-scale long-duration energy storage systems. The trend of large capacity systems can also be seen, as utilities and energy companies are moving forward to install iron air batteries in utility-scale energy storage projects.

By Application

- Grid Energy Storage

Grid energy storage is an essential application segment, encouraged by growing renewable energy penetration and a requirement to install storage solutions with longer durations. Iron air batteries are equipped with cost benefits regarding multi-day energy storage compared to other traditional storage options. These batteries are increasingly being adopted by utilities.

- Renewable Energy Integration

Iron-air batteries assist in the integration of renewables as they can store unused solar and wind power for future use. The long discharge duration ensures effective use of these batteries in the integration of renewables and thus their utilization rates. An increase in the use of decarbonization strategies has led to a surge in the use of iron-air batteries in the renewables application segment.

- Backup Power Systems

Backup power usage markets can utilize the tried-and-tested reliability and discharge duration of Iron Air Batteries. Various industries are looking for alternatives to traditional diesel generators for backup power requirements. The market segment has much potential with sustainable and emission-reduction-focused applications impacting backup power choices.

- Microgrids

Microgrid deployment in remote or energy-scarce areas is common. This creates demand for iron air batteries. The batteries offer a viable means of ensuring a stable power supply. This is done by balancing supply and demand fluctuations using these batteries. The low material cost of this device justifies its viability.

- Industrial Energy Storage

The primary areas of focus in industrial energy storage applications relate to peak shaving, cost optimization of energy, and continuity. The advantages offered by iron air batteries in meeting the prevalent demand in industries that require long-duration energy and experience changing patterns of usage include rising energy price volatility and sustainability.

By End User

- Utilities

The utilities represent the most significant end-user group owing to scalability needs in grid balancing and integration of variable renewable resources. The iron air batteries suit utilities' needs in long-duration, cost-effective storage. Growing investments in grid infrastructure development have propelled adoption in both developed and emerging economies.

- Commercial & Industrial

Commercial users and industries are increasingly using the iron air batteries for peak demand charges management and improving energy reliability. The technology helps in long-duration backup for optimization of energy costs. Corporate sustainability is increasingly driving the use of the batteries within the industries.

- Residential

Within the residential sector, adoption remains at an early stage because of the size of the systems and the prevailing cost structures, which favor larger systems. Nevertheless, solar adoption, as well as trends towards energy independence, might eventually contribute positively to residential-scale systems. Technological development might enhance the overall process in the long term.

- Energy Storage Developers

Energy storage developers are a core stakeholder for large-scale project deployment and technology commercialization. These stakeholders include companies focusing on the integration of iron air batteries for utility-scale and renewable projects to improve project economics. Strategic partnerships with utilities and renewable developers are accelerating market expansion.

Regional Insights

North America, comprising the USA, Canada, and Mexico, is a high-performing territory with robust investment in innovation in energy storage. While the USA is at the forefront of pilot projects as well as commercialization actions in energy storage, Canada targets renewable energy as well as enhancement of grid reliability. Mexico is also gradually exploring opportunities in the deployment of energy storage to enhance the reliability of energy infrastructure. Europe, covering countries like Germany, the UK, France, Spain, Italy, and the Rest of Europe, shows strong growth rates backed by aggressive decarbonization strategies and renewable energy investment. Countries like Germany and the UK place high emphasis on grid flexibility and integration of storage to enable the renewable drive. Energy transition strategies, which rely on policy have also pushed the adoption of long-duration storage solutions in the European region. Asia Pacific, including Japan, China, Australia & New Zealand, South Korea, India, and the Rest of Asia Pacific, is seen as an emerging high-growth region based on increasing electricity demand and rapid deployment of renewables. While upcoming grid-scale storage markets can be found in China and India, Japan and South Korea place high priority on the equally important attributes of energy security and technological innovation. Australia and New Zealand utilize storage to support their renewable-based generation portfolios. South America, led by Brazil and Argentina together with the Rest of South America, is seeing gradual uptake supported by renewable energy additions and grid reliability. Brazil's rise in solar and wind energy is boosting demand for energy storage solutions. On the other hand, other countries are looking to improve energy stability and support decentralized energy

To learn more about this report, Download Free Sample Report

Recent Development News

- March 2025, ESS announced its first Energy Center installations, marking a milestone in its commercialization of iron-based long-duration storage systems, with multiple units being delivered to its utility clients. The move indicates the heightened demand for alternative safe storage technologies beyond traditional lithium-ion batteries, which are used in power storage solutions for extended periods.

- In January 2024, ESS released its announcement regarding the commissioning of new Energy Warehouse systems and the expansion of the deployment of iron-based long-duration energy storage systems. ESS emphasized the scaling of production and deployment of iron-based storage systems to drive the deployment of renewable systems and reduce fuel usage.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 0.65 Billion |

|

Market size value in 2026 |

USD 0.80 Billion |

|

Revenue forecast in 2033 |

USD 4.60 Billion |

|

Growth rate |

CAGR of 28.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Energy, Inc., ESS Inc., Zinc8 Energy Solutions Inc., NantEnergy, Inc., Green Energy Storage B.V., VoltStorage GmbH, Energy Vault Holdings, Inc., Enervault Corporation, PolyJoule, Inc., Phinergy Ltd., E-Zinc Inc., Sumitomo Electric Industries, Ltd., Lockheed Martin Energy, Primus Power Corporation, and Vionx Energy Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Electrodes, Electrolyte, Air Cathode, Battery Management System (BMS), Others), By Capacity (Below 100 kWh, 100 kWh – 1 MWh, Above 1 MWh), By Application (Grid Energy Storage, Renewable Energy Integration, Backup Power Systems, Microgrids, Industrial Energy Storage) and By End User (Utilities, Commercial & Industrial, Residential, Energy Storage Developers) |

Key Iron Air Battery Company Insights

Safran Transmission Systems is also an essential global supplier of aircraft types of gearboxes, starting with the better mechanical type of power transmission systems included in commercial as well as military aircraft types. The types of Iron Air Battery offered by Safran Translation Systems cover aircraft accessories, driving reductions, as well as aircraft component types included in various types of turbofans. The partnership of Safran Translation Systems with different types of aircraft OEMs, starting with R&D investments, mainly fuels Safran Translation Systems’s competitive advantage, ensuring the adaptation of aircraft types of gearboxes to different types of aircraft.

Key Iron Air Battery Companies:

- Form Energy, Inc.

- ESS Inc.

- Zinc8 Energy Solutions Inc.

- NantEnergy, Inc.

- Green Energy Storage B.V.

- VoltStorage GmbH

- Energy Vault Holdings, Inc.

- Enervault Corporation

- PolyJoule, Inc.

- Phinergy Ltd.

- E-Zinc Inc.

- Sumitomo Electric Industries, Ltd.

- Lockheed Martin Energy

- Primus Power Corporation

- Vionx Energy Corporation

Global Iron Air Battery Market Report Segmentation

By Component

- Electrodes

- Electrolyte

- Air Cathode

- Battery Management System (BMS)

- Others

By Capacity

- Below 100 kWh

- 100 kWh – 1 MWh

- Above 1 MWh

By Application

- Grid Energy Storage

- Renewable Energy Integration

- Backup Power Systems

- Microgrids

- Industrial Energy Storage

By End User

- Utilities

- Commercial & Industrial

- Residential

- Energy Storage Developers

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636