Feb 11, 2026

The report “Iron Air Battery Market By Component (Electrodes, Electrolyte, Air Cathode, Battery Management System (BMS), Others), By Capacity (Below 100 kWh, 100 kWh – 1 MWh, Above 1 MWh), By Application (Grid Energy Storage, Renewable Energy Integration, Backup Power Systems, Microgrids, Industrial Energy Storage) and By End User (Utilities, Commercial & Industrial, Residential, Energy Storage Developers)” is expected to reach USD 4.60 billion by 2033, registering a CAGR of 28.20% from 2026 to 2033, according to a new report by Transpire Insight.

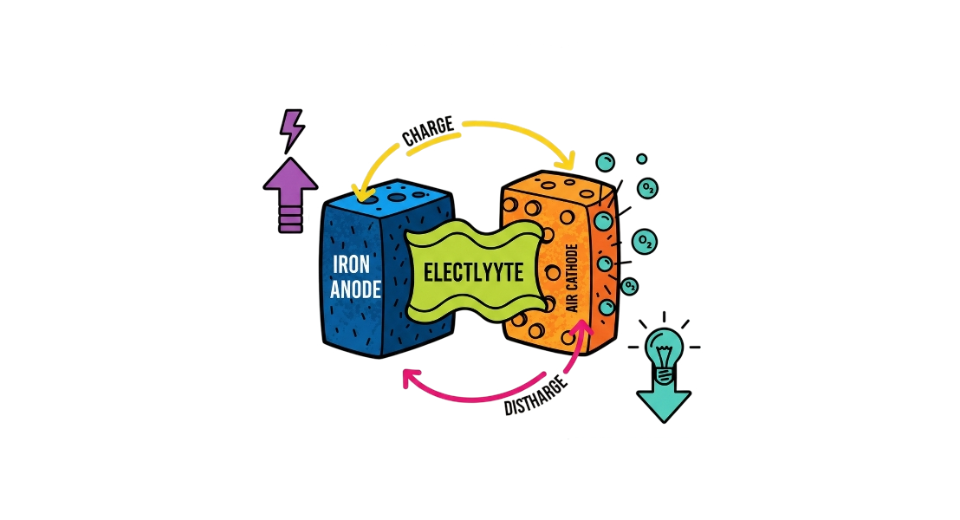

The iron air battery industry is receiving increasing attention as the energy industry continues to move forward and further rely on the utilization of different forms of renewable energy sources. Iron air batteries make use of primary materials that are abundant and cheap, such as iron, water, and air. The primary industry trend for iron air batteries is the need to resolve the issue of the intermittency of renewable energy sources. It has gained attention due to the movement away from using fossil fuel peaking power plants. Iron air ends up as an alternative to lithium-ion batteries. The demand for iron air batteries is rising due to the growing trend of renewable energy, particularly solar and wind power. As the use of renewable energy increases, there is growing need to provide longer discharge duration, and iron batteries have the potential to satisfy the above requirements by offering longer discharge duration at comparatively lower material costs. Pilot projects are underway, which would help establish investor confidence in long-duration energy storage solutions

Technological advancements are being made to improve material electrodes, electrolytes, and overall system integration. Battery management modes and air cathodes are playing a significant role in providing better operational efficiency to power storage systems. These innovations have led to an increase in energy storage projects that are being implemented, especially in regions with grid modernization and transition projects. Moreover, encouraging supportive regimes as well as the focus on the reduction of carbon emissions and the development of a resilient energy system are propelling the market towards further growth. Thus, it can be inferred that as the process of commercialization gathers further momentum with increasing production capacity, the role of iron air batteries in the energy market worldwide will continue to grow significantly.

The Electrodes segment is projected to witness the highest CAGR in the Iron Air Battery during the forecast period.

According to Transpire Insight, Electrodes are the leading segment in iron air batteries, since electrodes have a direct impact on the energy efficiency, cycling stability, and lifespan of an entire system. With continuous innovation, iron-based electrode material has hugely improved electrochemical performance while maintaining intrinsic cost advantages driven by abundant raw materials. Current manufacturing focuses on electrode durability for long-duration discharge cycles, an essential feature in grid-scale energy storage. With the advanced deployment of iron air batteries, the demand for sophisticated electrode designs with minimal degradation, better energy density, is on a continuous rise.

This will also help in optimizing operational expenses and enhancing system scalability. Material engineering and advances in manufacturing processes have resulted in better consistency and reliability of large-scale installations. As electrodes are the leading contributor to the outcomes of system performance, most investments in research and development are concentrated within the segment. Furthermore, with the increasing emphasis on long-duration storage solutions, demand for better electrode technologies would continue to see solid growth, reinforcing its dominant lead within the market.

The Above 1 MWh segment is projected to witness the highest CAGR in the Iron Air Battery during the forecast period.

The segment Above 1 MWh, leads the iron air battery market, as it matches the energy storage requirements of large-scale applications. The iron air battery is naturally meant to serve applications with large-scale discharging requirements, as it can endure a prolonged period of discharge. A large capacity system facilitates grid stabilization by storing available excess energy generated by renewable sources. This helps in avoiding the use of traditional power sources, which increases overall operational costs.

Moreover, an increasing investment pattern in grid modernization and renewable infrastructure is increasing the demand for high-capacity energy storage systems. Utilities and energy developers seek high-capacity systems to realize economies of scale due to their cost implications. As penetration levels from renewables rise globally, there will be an increasing need for multi-day storage solutions, thus cementing the dominance of the above 1 MWh segment. This represents an increasing trend within the global industry towards storage technologies with longer durations.

The Grid Energy Storage segment is projected to witness the highest CAGR in the Iron Air Battery during the forecast period.

According to Transpire Insight, Grid energy storage is the major application sector served by the iron air batteries market, mostly due to the increasing adoption of renewable power sources and the need for improved grid flexibility. This is because iron air batteries offer the advantage of increased discharge duration, which can better help the utility industry deal with the intermittency challenges experienced in renewable power sources compared to other conventional power storage solutions that offer relatively shorter discharge duration.

Additionally, electrical grid operators have been incorporating long-duration storage technologies to reduce their reliance on fossil-fueled peaker plants and maximize the efficiency of the grid. Iron air batteries provide a cost-effective method of addressing storage needs, especially where a long duration of operation is required. With the increased uptake of clean electrical energy technologies, the use of grid-scale storage technologies is constantly increasing, cementing the ground of the application segment’s dominance and increasing the value of the iron air battery technology.

The Utilities segment is projected to witness the highest CAGR in the Iron Air Battery during the forecast period.

Utilities dominate as the most prominent end-user group as they play a pivotal role in balancing and managing grid stability, particularly while harnessing renewable resources of energy. Iron air batteries perfectly suit the present utility market as it fulfills the demand for utility-scale batteries that can carry out the task of peak load management, energy balancing, and backup power supply while reducing the operational costs of existing power generation systems. Additionally, with increasing regulatory demands for reduction of emissions and raising energy efficiencies, modern storage technologies are being adopted by utilities to meet these needs. Iron Air Batteries have a high life and low material costs, making them favorable for infrastructure projects. Therefore, with ongoing infrastructure additions for renewable energy sources, this segment is expected to do well, retaining their position on top of the market share landscape.

The North America region is projected to witness the highest CAGR in the Iron Air Battery during the forecast period.

North America acts as a leading market for iron air batteries, owing to the substantial investments in the innovation of energy storage solutions and the smooth policy landscape that encourages the integration of renewable sources into the energy mix. The United States acts as a driver for the North American market; with grid modernization activities and changing renewable integration in the region, considerable demand exists for storage solutions that assist in the discharge of large levels of energy.

Moreover, the emergence of technology developers, along with active collaboration between utilities and storage providers, has hastened the commercialization process in the region. The entire region, particularly Canada, has deposited its concentration in grid reliability, while Mexico sluggishly attempts to explore the commercialization of storage systems to boost energy infrastructure resilience. The growing trend of decarbonization and energy security is contributing immensely to the commercialization prospects of iron air batteries.

North America also has strong investment activities and conducive regulatory mechanisms, creating an environment for improvements in innovation and infrastructural development. Utility-scale energy storage projects are increasingly adopting long-duration technologies in order to mitigate the reliability challenges arising due to variability. Consequently, North America would retain the leadership position in the global iron air battery market in the coming period as policy incentives and actual funding initiatives for clean energy would persist.

Key Players

The top 15 players in the Iron Air Battery market include Form Energy, Inc., ESS Inc., Zinc8 Energy Solutions Inc., NantEnergy, Inc., Green Energy Storage B.V., VoltStorage GmbH, Energy Vault Holdings, Inc., Enervault Corporation, PolyJoule, Inc., Phinergy Ltd., E-Zinc Inc., Sumitomo Electric Industries, Ltd., Lockheed Martin Energy, Primus Power Corporation, and Vionx Energy Corporation.

Drop us an email at:

Call us on:

+91 7666513636