Feb 11, 2026

The report “Sulfone Polymers Market By Product Type (Polysulfone, Polyethersulfone, Polyphenylsulfone), By Form (Granules, Powder, Sheet), By Processing Method (Injection Molding Extrusion, Blow Molding, Compression Molding), By End-Users (Automotive, Aerospace and Defense, Electrical and Electronics, Medical and Healthcare, Water Treatment and Filtration)” is expected to reach USD 3.70 billion by 2033, registering a CAGR of 7.00% from 2026 to 2033, according to a new report by Transpire Insight.

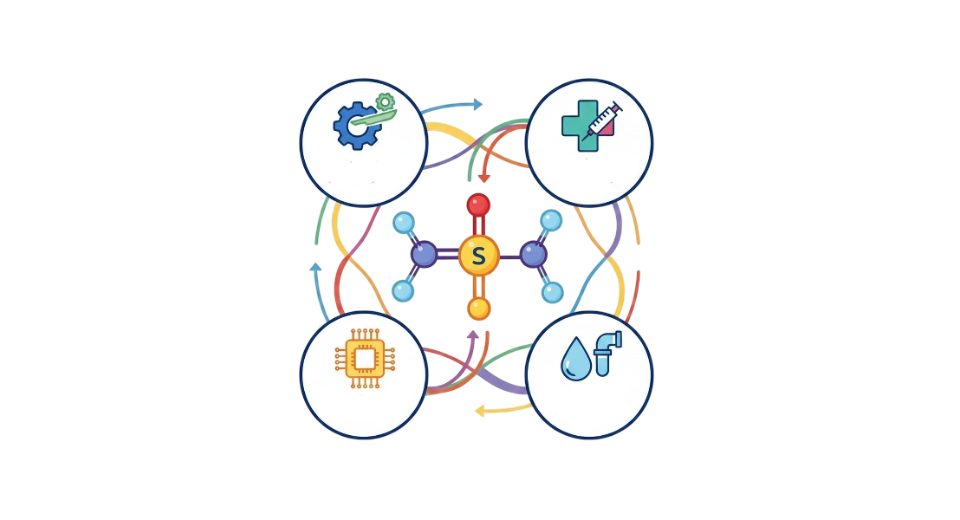

High heat tolerance defines the sulfone polymers market, whose structure is built to resist breakdown when most plastics would warp or dissolve. Where standard materials give way, these hold firm against aggressive chemicals plus extreme conditions. Performance stays strong over time, even when sitting in caustic settings or near continuous thermal stress. Engineering choices shift once the temperature climbs. This class of plastic keeps working while others stop. Long life under pressure makes them fit for roles where failure is not an option. Reliability matters most in tough spots, and here it comes baked into the molecular design. No melting out of shape, no crumbling after weeks in harsh solvents, it just holds on. Industries rely on this behavior when safety ties directly to material performance. Stability over the years sets a clear line between average plastics and these advanced forms. Use cases grow wherever environments push past normal limits.

Beginning with their sturdy makeup, sulfone polymers like polysulfone, polyethersulfone, and polyphenylsulfone hold shape well under stress. Because they resist flames, these materials often appear in settings where heat could pose problems. When water enters the picture, they stay intact rather than breaking down. Since they behave predictably even in tough conditions, industries rely on them without second thoughts. Precision tasks lean on their steady nature, especially when uniformity matters most.

Lighter materials keep replacing metals and old-style plastics, pushing demand up. Because scientists tweak how these new plastics mix together, they work better now than before. New ways to shape them during production help too, opening doors we did not expect earlier. Sulfone-based types fit into tougher jobs thanks to custom versions made for exact needs. Performance jumps mean industries rely on them more each year without making a big announcement.

The Polyethersulfone Tools segment is projected to witness the highest CAGR in the Sulfone Polymers market during the forecast period.

According to Transpire Insight, despite growing fast, PESU stands out simply because it handles heat well, resists chemicals, and yet stays strong. When things get hot, even after many cleanings, it keeps working without failing. This matters most in tough settings like factories or hospitals. What you see here is not luck; it’s material behaving predictably when pushed hard.

More people now choose PESU for medical tools, filters, plane parts, and tech-heavy electric gear. This pushes up the need. Firms pick polyethersulfone instead of older plastics since sectors move toward strong, light, long-lasting stuff meeting tough safety rules, which keeps this market rising through the years ahead.

The Granules segment is projected to witness the highest CAGR in the Sulfone Polymers market during the forecast period.

From tiny factories to big ones, granules move smoothly through machines, making them a top pick where precision matters. Their uniform shape holds steady under heat and pressure, helping avoid hiccups in long runs. What stands out is how they flow into molds without jamming - less spill, more output. Over time, this reliability adds up on factory floors that run nonstop. Machines chew through these small forms faster than loose powders, cutting wait times between steps.

Sulfone polymer granules fit smoothly into injection molding and extrusion, especially in cars, gadgets, and healthcare gear. Because they handle large-scale production without fuss, these granules win favor among makers needing tough, intricate parts. Over the coming years, that practical edge keeps them in demand.

The Injection Molding segment is projected to witness the highest CAGR in the Sulfone Polymers market during the forecast period.

According to Transpire Insight, Heavy demand for intricate parts holds steady, pushing injection molding into sharper focus across sulfone polymer uses. Because these materials keep their shape under heat and stress, shaping them at scale becomes more practical through this route. Efficiency gains emerge not just from speed but also from how well the process respects the plastic's core strengths. Growth follows where precision and reliability overlap without compromise.

Heavy use in cars, health tools, gadgets, and machines pushes more companies toward injection molding. Because it saves money, works reliably every time, yet handles complex shapes well, this method stands out for shaping sulfone plastics ahead. While needs grow across fields, one thing remains clear: this process fits perfectly.

The Electrical and Electronics segment is projected to witness the highest CAGR in the Sulfone Polymers market during the forecast period.

Growth looks likely in electronics because sulfone polymers handle electricity safely, resist melting, and keep their shape under stress. Because of these traits, parts like plugs, boards, and casings built for heat rely on them.

Heavy use of tiny, powerful gadgets pushes makers toward sulfone-based plastics. Because these materials handle tough environments well, they fit neatly into tight safety rules. Even under heat and stress, they keep working without failing. Rules that demand fire resistance play a big role here. Growth in electronics keeps pace with how well these polymers perform. Over time, their reliability makes them harder to replace. Tougher device demands mean fewer alternatives stand up.

The North America region is projected to witness the highest CAGR in the Sulfone Polymers market during the forecast period.

Fueled by demand in vehicles, healthcare devices, wiring systems, and heavy-duty parts, North America holds steady as a central hub for sulfone polymers. Built on decades of production strength, factories there keep turning to these advanced plastics when durability matters most. Equipment used in tough settings often relies on this material simply because it lasts longer under pressure. Innovation in design has made it easier to shape sulfone into complex forms without losing stability. Even in extreme heat or chemical exposure, performance stays consistent across countless uses. What sets the region apart is not just output volume but how precisely the materials are applied. Manufacturers favor them where failure is not an option. Long-term reliability makes the difference in sectors that cannot afford breakdowns. As new models emerge, older versions get replaced not due to flaws but evolving needs. This shift keeps supply chains active and development ongoing.

Now driving ahead, fresh lab work alongside strict safety rules plus teamwork across plastic makers and their customers pushes new sulfone types forward. That sets North America up strong, helping the market grow faster through the years to come.

Key Players

Top companies include Solvay S.A., BASF SE, Sumitomo Chemical Co., Ltd., SABIC, RTP Company, Ensinger GmbH, Quadrant AG (Mitsubishi Chemical Advanced Materials), Polymer Dynamix, Jiangmen Youju New Materials Co., Ltd., Jiangsu Yoke Technology Co., Ltd., Shandong Horan New Material Technology Co., Ltd., Evonik Industries AG, Polyplastics Co., Ltd., Celanese Corporation, DIC Corporation, and Westlake Plastics Company.

Drop us an email at:

Call us on:

+91 7666513636