Market Summary

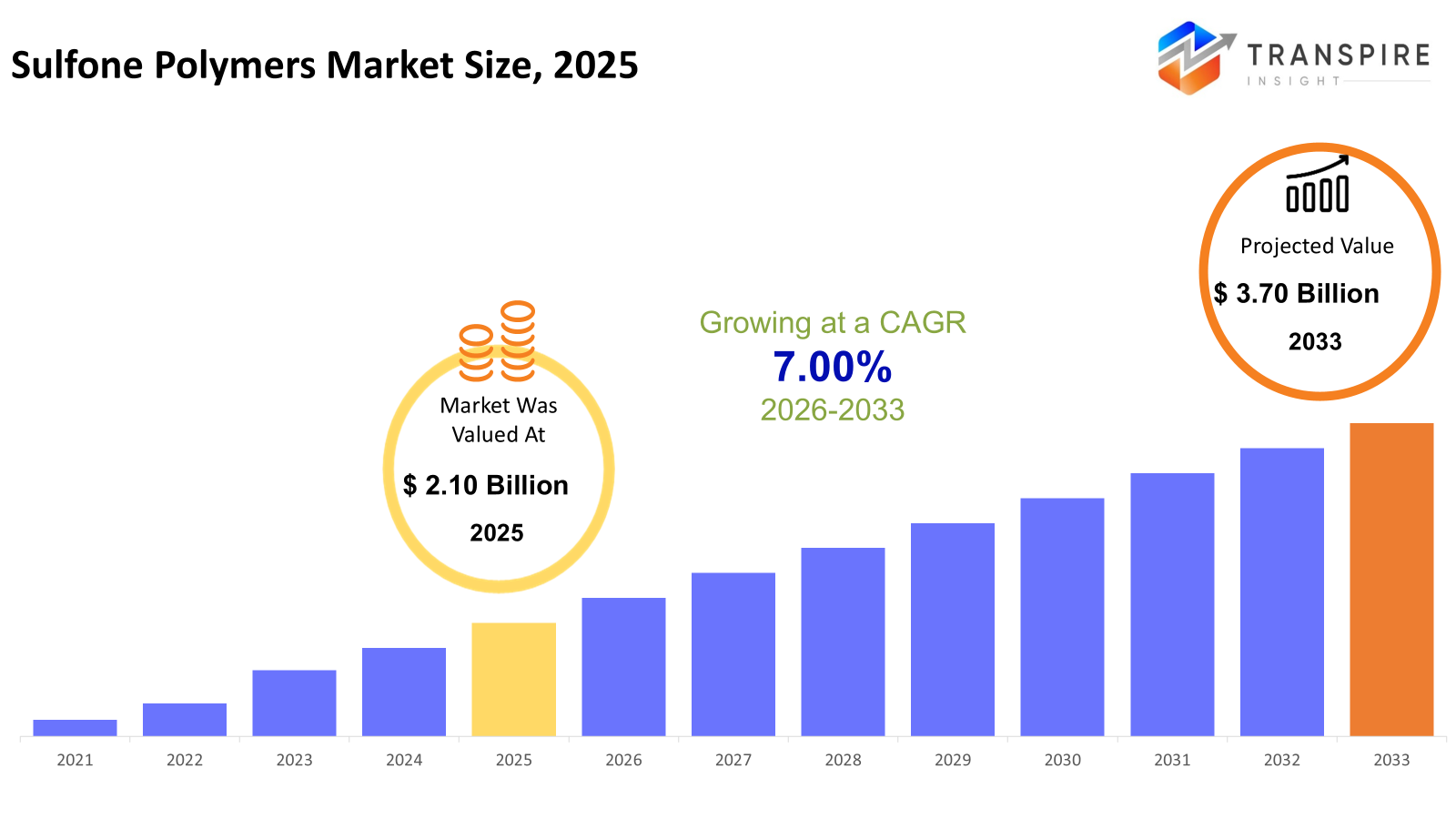

The global Sulfone Polymers market size was valued at USD 2.10 billion in 2025 and is projected to reach USD 3.70 billion by 2033, growing at a CAGR of 7.00% from 2026 to 2033. More people want sulfone polymers because they handle heat well, resist chemicals, and yet stay strong under pressure. Because these plastics work reliably in tough situations, industries like aviation and car manufacturing are using them more often. Electronics makers rely on them too, especially where durability matters alongside performance. Medical equipment builders find them useful for parts that must remain sterile and sturdy. Even water cleaning systems now include these materials due to their long life in harsh conditions. As engineers design lighter machines that run hotter, older materials fall short, making room for better alternatives. With new uses appearing regularly, the need keeps rising without signs of slowing down.

Market Size & Forecast

- 2025 Market Size: USD 2.10 Billion

- 2033 Projected Market Size: USD 3.70 Billion

- CAGR (2026-2033): 7.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 30% in 2026. Fueled by high-tech production needs, North America pulls in more sulfone polymers. Tough safety rules push adoption across industries. Automotive uses them because they hold up under heat. Medical devices rely on their stability. Electronics benefit from durability in small parts. Growth comes not just from one area but from many shifting demands.

- Fueled by heavy spending on medical tools, filter systems, and tough engineered materials, the United States pulls ahead in regional uptake, especially within defense and factory uses. Though other areas follow, they lag behind this pace set by consistent funding and focused innovation across key sectors.

- Fueled by growing industries, the Asia Pacific region sees sharper demand for tough sulfone plastics. Electronics manufacturing pushes needs higher. Water cleaning projects add pressure too. Chemical plants are part of it now. Expansion isn’t slowing down anytime soon.

- Polyethersulfone shares approximately 40% in 2026. Polyethersulfone PESU by Product Type

- Because it handles chemicals well, polyethersulfone has seen more use lately. Its ability to resist breakdown in water boosts appeal. Filters rely on this toughness. Medical tools benefit, too. Demand grows where performance matters most.

- Fabrication of high-performance polymers often leans on granules' familiarity with common processing, which plays a big role here. Their widespread fit across standard techniques keeps them in favor, mainly because handling feels straightforward most of the time.

- Built for tough jobs, injection molding stays ahead by delivering exact shapes over and over again. Complex parts come out right every time, due to steady results found in many fields.

- Fueled by rising needs, the electrical world leans on heat-tough, fire-safe plastics especially inside plugs, casings, and wraps. Materials that will melt easily are now essential, pushed forward each time devices run hotter or pack tighter circuits.

- When things get hot or corrosive, these plastics keep working without breaking down. They hold up. Their durability fits roles where failure is not an option.

Even when soaked in harsh chemicals, sulfone polymers hold their shape well. Because they resist flames, parts made from them remain reliable in high-risk environments. Polysulfone, along with related materials such as polyethersulfone, continues to perform under constant pressure and elevated temperatures. Their strong durability supports critical applications ranging from medical equipment to aerospace components, contributing to steady growth in the sulfone polymers market. Over time, even under mechanical and thermal stress, these materials resist degradation.

Lightweight stuff that lasts long and handles heat well is replacing metal and regular plastic more often these days. Because of this shift, sulfone polymers show up more in tough jobs where things must work right every time. Strict rules guide how parts are made in fields like high-end production and detailed machine design. These materials fit right in. Performance matters most when failure is not an option, which pushes demand higher without making a fuss about it.

New versions of plastic keep appearing, thanks to fresh ideas in how they are made and what they can do. Making these materials easier to recycle matters more now, along with keeping quality steady across uses. Different mixes are being shaped for particular jobs, fitting tighter demands from industries. Sulfone-based plastics are stepping into the spotlight, built for tougher tasks ahead. Progress does not wait; what works today shifts fast tomorrow.

Sulfone Polymers Market Segmentation

By Product Type

- Polysulfone

Polymer known as polysulfone stands up well under heat, plus it resists breaking when bent or stressed. Common in systems that clean fluids, tools for healthcare, and parts inside electronic gear. Toughness stays strong even at higher temperatures, making it fit for long-term uses where reliability matters.

- Polyethersulfone

Starting strong, polyethersulfone stands up well when faced with harsh chemicals. It holds its own even when water tries to break it down over time. Because of this toughness, it finds a home in filter systems. Medical gear also benefits from its steady performance under pressure.

- Polyphenylsulfone

Starting strong under pressure, polyphenylsulfone, often called PPSU, handles intense heat better than most. It bends without breaking when struck hard, making it a go-to where failure isn’t an option. Think of hospital tools that face sterilization daily, or parts inside aircraft systems exposed to extreme conditions. Toughness here comes paired with stability, even after repeated stress cycles.

To learn more about this report, Download Free Sample Report

By Form

- Granules

Fine particles work better when it comes to moving and using them with common plastic-making machines.

- Powder

Mixtures made with powder work well when an even spread matters during specific production steps. Some methods depend on this consistency to perform properly across complex blends.

- Sheet

When heat shaping materials, it goes into making tough parts. Built for heavy-duty uses where strength matters most. During forming processes, this material takes on complex shapes easily. Used widely when durability is a key concern. Found in structures needing both resilience and precision work. Through fabrication steps, it maintains reliability under stress. Common where performance cannot afford to drop.

By Processing Method

- Injection Molding

Starting with injection molding, it handles tricky shapes while keeping measurements exact. This method builds parts carefully through steady pressure and control. Precision sticks around even when forms get complicated. Instead of guessing, machines follow tight rules to shape each piece. Accuracy stays strong across many copies made one after another.

- Extrusion

Pipes, films, or membranes often come from extrusion. Moving material through a shaped opening creates them steadily. What emerges keeps the same form all along its length. This method runs without stopping, shaping soft matter into long pieces. Profiles like these hold their design thanks to consistent pressure and flow.

- Blow Molding

When it comes to making hollow parts that need to stand up to chemicals and stay strong, blow molding fits well. Shape forms through air pressure, material stretches thin yet tough. Holds up under stress, resists breakdown from substances. Process works best when durability matters inside empty spaces.

- Compression Molding

A method shaping sturdy, thick components, compression molding ensures even material behavior throughout. Strength spreads evenly where it matters most. Uniformity comes through slow, steady pressure rather than speed. Thick sections form without weak spots due to balanced flow under heat. This process favors durability over quick runs.

By End-Users

- Automotive

Parts in cars stay light yet tough when hot, thanks to materials made for high-heat zones near engines. These pieces handle stress without adding weight, especially where things get warm during operation.

- Aerospace & Defense

Flying machines and military gear rely on materials that resist fire while standing up to tough conditions. Durable performance matters most when things get intense in extreme environments.

- Electrical & Electronics

Fine wiring work relies on it because heat does not warp the material. Components stay put inside casings made from this stuff. Not even high temps make connections loosen when insulation holds firm.

- Medical & Healthcare

When it comes to tools that need constant cleaning, this material shows up often in hospitals. Because patient safety matters most, many choose it for critical gear. Its ability to handle repeated sterilization makes it stand out. Equipment exposed to tough conditions tends to rely on its durability. Strict rules shape these choices. This option fits right into those demands.

- Water Treatment and Filtration

Besides handling high heat, it stands up well to harsh chemicals. That's why you find it working quietly inside many water filters. Not every material lasts as long when things get tough. Because of its toughness, engineers choose it again and again. Even under pressure, performance stays steady. Resistance is not just a bonus, it’s built in.

Regional Insights

Fueled by sturdy industrial demand, North America stands out in the sulfone polymer landscape. Aerospace, cars, healthcare tools, and gadgets rely on these tough plastics thanks to their ability to withstand heat and chemicals. Innovation thrives here, backed by solid science efforts and rules that favor cutting-edge materials. Progress moves forward where funding flows into eco-conscious plastic alternatives, quietly shaping next-gen sulfone applications.

Heavy cars are getting lighter across Europe, pushing material needs upward. Medical gear uses more of it now, too. Tough rules on safety and planet impact help shape choices toward better plastics that can be reused later. Germany leads with tight teamwork among makers and factories. France adds momentum through skilled production networks. The United Kingdom joins in with strong industry links, guiding output. Growth holds firm where policy meets innovation.

Down south of the globe, industries push fast into sulfone factories grow, gadgets multiply, and vehicles roll out steadily. China leads not because it tries harder but because machines run longer there, built to resist the heat that no regular plastic can handle. Japan follows closely, its labs mixing chemistry with daily function, creating materials that last under pressure. Not far behind, South Korea stitches tech into thin layers where weight matters less than strength. India adds force too, hospitals needing sturdier tools now than ten years back. Together, these places pull demand upward without saying so; their output just keeps climbing.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 1, 2025 – Syensqo pioneers innovative recycling technology for circular sulfone polymers.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 2.10 Billion |

|

Market size value in 2026 |

USD 2.30 Billion |

|

Revenue forecast in 2033 |

USD 3.70 Billion |

|

Growth rate |

CAGR of 7.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Solvay S.A., BASF SE, Sumitomo Chemical Co., Ltd., SABIC, RTP Company, Ensinger GmbH, Quadrant AG (Mitsubishi Chemical Advanced Materials), Polymer Dynamix, Jiangmen Youju New Materials Co., Ltd., Jiangsu Yoke Technology Co., Ltd., Shandong Horan New Material Technology Co., Ltd., Evonik Industries AG, Polyplastics Co., Ltd., Celanese Corporation, DIC Corporation, and Westlake Plastics Company |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Polysulfone, Polyethersulfone, Polyphenylsulfone), By Form (Granules, Powder, Sheet), By Processing Method (Injection Molding, Extrusion, Blow Molding, Compression Molding), By End-Users (Automotive, Aerospace and Defense, Electrical and Electronics, Medical and Healthcare, Water Treatment and Filtration) |

Key Sulfone Polymers Company Insights

One name stands out in the world of sulfone polymers: Solvay S.A. Known widely for tough, heat-resistant plastics, it builds materials that push through extreme conditions without breaking down. Its lineup features PSU, PESU, and PPSU, each shaped for serious jobs where most plastics would fail. These are not just lab experiments; they live inside planes, cars, medical tools, and power systems. Heat does not weaken them. Chemicals do not eat them away. Stress does not bend their shape easily. Factories across continents make these compounds, feeding a supply chain built on precision. Scientists keep testing new forms while working side by side with big manufacturers and tech teams. Progress happens quietly here, layer by layer, test after test. This steady rhythm keeps Solvay ahead, moving at a pace others try to match.

Key Sulfone Polymers Companies:

- Solvay S.A.

- BASF SE

- Sumitomo Chemical Co., Ltd.

- SABIC

- RTP Company

- Ensinger GmbH

- Quadrant AG (Mitsubishi Chemical Advanced Materials)

- Polymer Dynamix

- Jiangmen Youju New Materials Co., Ltd.

- Jiangsu Yoke Technology Co., Ltd.

- Shandong Horan New Material Technology Co., Ltd.

- Evonik Industries AG

- Polyplastics Co., Ltd.

- Celanese Corporation

- DIC Corporation

- Westlake Plastics Company

Global Sulfone Polymers Market Report Segmentation

By Product Type

- Polysulfone

- Polyethersulfone

- Polyphenylsulfone

By Form

- Granules

- Powder

- Sheet

By Processing Method

- Injection Molding Extrusion

- Blow Molding

- Compression Molding

By End-Users

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Medical and Healthcare

- Water Treatment and Filtration

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636