Market Summary

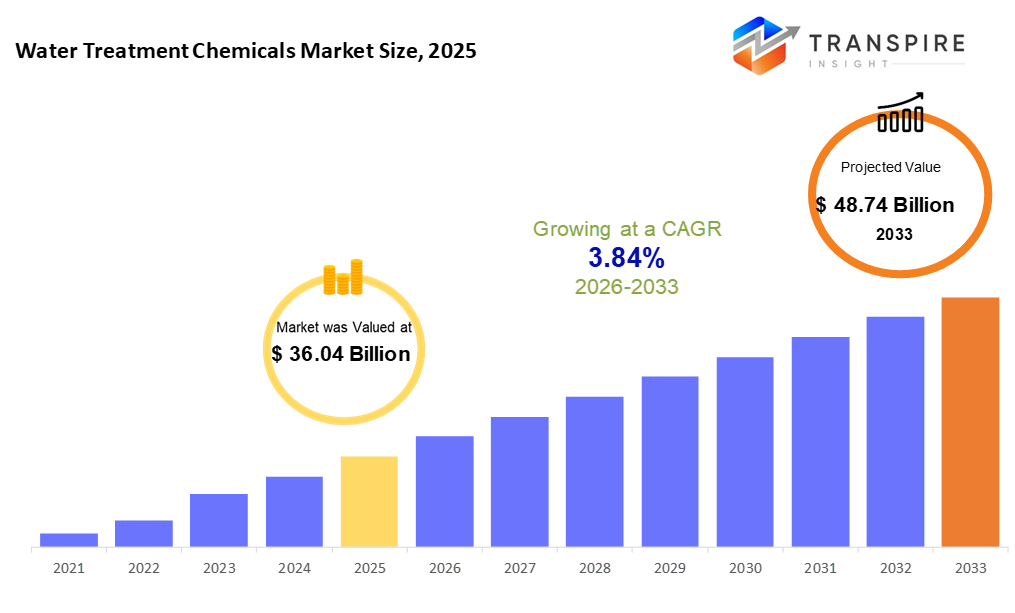

The global Water Treatment Chemicals market size was valued at USD 36.04 billion in 2025 and is projected to reach USD 48.74 billion by 2033, growing at a CAGR of 3.84% from 2026 to 2033. The market’s steady growth is driven by rising global demand for safe drinking water, increasing wastewater treatment requirements, and stricter environmental regulations. Continuous infrastructure upgrades, industrial water management needs, and growing investments in water reuse and desalination projects are further supporting sustained market expansion.

Market Size & Forecast

- 2025 Market Size: USD 36.04 Billion

- 2033 Projected Market Size: USD 48.74 Billion

- CAGR (2026-2033): 3.84%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 30% in 2026. Fueled by tough environmental rules, North America sees growth alongside upgraded treatment systems. Industrial spending rises, mirrored by city-level upgrades in cleaning water. Progress rolls on, backed by steady investment and strict standards.

- From sea to shining sea, new rules in Washington and across the United States push cleaner water through updated systems. A fresh wave of funding targets aging pipes plus eco-friendly cleanup methods. Some regions now reward towns that cut waste with smarter flow tracking. Old plants are swapping filters for tech that sips less energy. Progress crawls block by block where budgets allow. Quiet upgrades ripple beneath city streets without fanfare. Leaders bet long-term on resilience when storms hit harder.

- Urban areas across the Asia Pacific are expanding fast. Because of this, industries grow quickly, too. Wastewater needs more attention now than before. Factories and cities both require better water cleaning methods. Chemicals used in treatment are seeing higher use. Growth here outpaces other regions. Demand rises steadily alongside development.

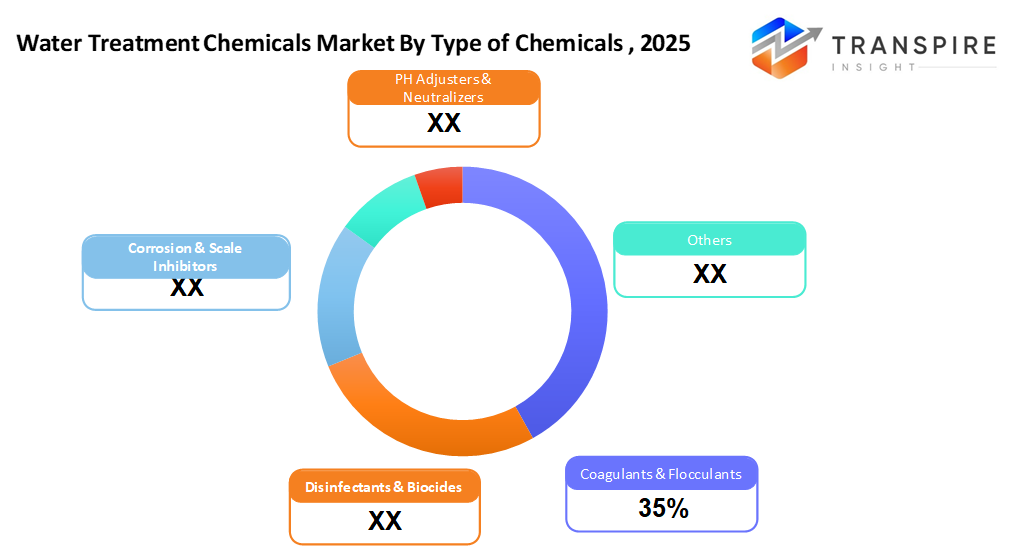

- Coagulants & Flocculants share approximately 38% in 2026. Those get cleared out fast. Coagulants plus flocculants handle that job in city and factory systems alike. These chemicals run the show simply because most cleanup steps won’t work without them first clumping gunk together.

- Liquid chemicals take the lead, handling is simpler, doses hit right every time, dissolves quickly too. Wastewater Treatment sees rapid expansion because rules on pollution grow tighter. Industries now face tougher demands to clean their runoff water this pushes growth even further.

- Municipal users still take the biggest share. This happens because cities keep adding more water pipes. Tougher rules on clean water also play a role.

Water gets cleaned using special substances that also handle dirty runoff from cities and factories. Cleaning liquids pull out harmful stuff, stop tiny living things from spreading, keep pipes from breaking down, and meet safety rules. More people worry about clean supplies, staying healthy, and protecting nature, so these cleaning helpers matter more now. Growing pressure on resources pushes communities to rely on such treatments across the planet.

More people living in cities pushes the need higher. Factories popping up faster add pressure, too. Water cleaning for towns still takes the biggest share. Rules getting tougher on pollution boost waste cleanup fast. Power plants, refineries, chemical makers, and mines are all using more chemicals now. They handle dirty runoff plus keep operations running. Growth shows no sign of slowing down yet.

Tougher rules from authorities play a part. Upgraded facilities help too. Projects that recycle water or pull it from seawater are growing fast. New chemical mixes work better than older ones. Some of these blends also happen to be gentler on nature. Efficiency goes up when treatments run more smoothly. Costs drop as operations get leaner. Money flowing in often comes through joint efforts between public agencies and private firms. Systems that track water use with digital tools are getting more attention. Growth gets a boost each time one of these pieces falls into place.

Fresh pressures show up in rising supply costs, even as demand climbs. Still, efforts to recycle water are gaining ground because rules push for cleaner systems. With more places treating water safety like a must-have, chemical use keeps moving upward. Growth sticks around, driven by needs nobody can ignore.

Water Treatment Chemicals Market Segmentation

By Type of Chemical

- Coagulants & Flocculants

Picking up speed in treatment plants, coagulants team up with flocculants to pull debris out of dirty water. These helpers clear cloudiness fast, making cleaner flows possible down the line.

- Disinfectants & Biocides

That is where disinfectants step in. Water meant to be drunk or used at factories stays clean because of biocides. Safety flows through these treatments; without them, risks rise fast.

- Corrosion & Scale Inhibitor

Mineral buildup slows pipes down. Rust eats through metal parts over time. Chemical treatments keep the insides smooth. Systems run longer when treated regularly. Metal surfaces stay cleaner with steady protection.

- PH Adjusters & Neutralizers

Keeping water balanced helps treatments work better. Chemicals tweak acidity levels just right. A proper mix prevents harm during cleaning steps. Balance shifts are corrected fast when needed.

- Others

Chelating agents, along with coagulant aids, play specific roles in fine-tuning how water gets treated. These specialty chemicals step in where standard methods fall short. Their job kicks in during particular stages of purification. Not every system uses them, yet they matter when precision is needed. Performance shifts noticeably when these additives are part of the mix.

To learn more about this report, Download Free Sample Report

By Form

- Liquid Chemicals

Starting, liquid chemicals come in forms that flow easily. These versions mix quickly when added to solutions. Dosing stays consistent because they pour smoothly. Handling feels simpler compared to powders or solids. Their fast-dissolving nature saves time during use.

- Powder

- When kept as powder or granules, substances stay stable during storage. Transport becomes easier due to the compact form. In big facilities, spreading them out happens more precisely this way.

By Application

- Drinking Water Treatment

Water meant for drinking gets treated so it stays safe. Communities rely on this process to keep taps clean. Cities use these methods to protect public health.

- Wastewater Treatment

Purifying used water from cities and factories helps satisfy rules meant to protect nature. This process makes sure what flows out does less harm.

- Industrial Water Treatment

Fresh from factories, water used in making things needs careful handling. Cooling gear relies on steady flows that stay clean over time. Steam makers at plants demand pure supplies to run without hiccups.

- Desalination

Water cleaning systems rely on careful management of mineral buildup, blockages, and slow material decay. These methods help reverse osmosis work smoothly. Some techniques prevent crusty deposits inside pipes. Others stop the gunk from slowing the flow. Protection against rust keeps parts lasting longer. Each step makes salty water safer to use. Without control, machines clog or wear out fast.

- Swimming Pool & Recreational Water

A splash of clean water starts with steady care. Clear pools stay safe when chemicals mix just right. Keeping levels stable stops cloudiness before it shows up. Proper balance means fewer problems down the line. Attention at each step keeps everything running smoothly.

By End-Users

- Municipal

Municipal groups make up the main audience needing big setups to clean drinking water plus handle wastewater. These cities rely on advanced methods to manage supplies safely every day.

- Power & Energy

Fuel flows through systems where substances adjust how heat moves. Water used for cooling gets treated, so it works right. Boilers rely on additives to keep performance steady. Chemicals shape how liquids behave during production steps.

- Oil & Gas

Fuel work runs deep where earth gives up its thick black rivers. Pipes move liquid through stages of change under rough ground. Factories sort out what comes up, cleaning it piece by piece. Water mixes into steps that shape raw flow for daily use. Pressure stays high where drills turn below the silent rock layers.

- Chemical & Pharmaceutical

Water used in making chemicals is cleaned carefully. Waste fluids go through treatment too. Strict rules for cleanliness must be met. Purity levels stay high by design.

- Metal and Mining

Water used in mining needs handling at every stage. From extraction to waste, the flow must stay under control. Treatment keeps runoff safe before release. Cooling systems rely on a steady supply and cleanliness. Operations depend on smart management of liquid streams throughout.

- Pulp & Paper

Water in paper mills gets treated to stop gunk buildup, rust, plus environmental harm.

- Others

Fabrics, cars, and gadgets each rely on clean water during production. Factories beyond these also depend on treating their water supply.

Regional Insights

Tough rules on pollution, solid system setups, and older plants needing updates. Spending by both public and private sides stays high to protect clean water standards. Across the Atlantic, European priorities lean into recycling water, reusing waste streams, and building closed-loop systems. Their long-standing laws shape how cities and factories use cleanup chemicals daily. Progress there links closely to lasting design choices, not quick fixes.

Fast city growth, factory expansion, and big building efforts across places like China, India, Japan, and parts of Southeast Asia push demand up. Worry over less water, dirty environments, and sick people pushes governments to spend more on cleaning systems for cities and factories. New saltwater plants pop up where supplies run low. Better chemical solutions help industries meet rules when releasing used water this boosts activity across the area.

Across Latin America, growth ticks upward as officials pour funds into cleaner water systems, better waste processing, stronger rules. Freshwater shortages push the Middle East and Africa toward massive desalination efforts, this pulls up the use of treatment chemicals. Industry's thirst for managed water adds pressure too. Obstacles like weak infrastructure and tight budgets still linger. Yet deals between private firms and state bodies grow. Outside money flows in. That opens space for chemical providers where markets are just taking shape.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 16, 2025 – Kemira expands into industrial water treatment services with the acquisition of Water Engineering Inc.

- April 16, 2025 – Gradiant, a global solution provider for advanced water and wastewater treatment, announced the launch of CURE Chemicals.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 36.04 Billion |

|

Market size value in 2026 |

USD 37.42 Billion |

|

Revenue forecast in 2033 |

USD 48.74 Billion |

|

Growth rate |

CAGR of 3.84% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Kemira Oyj, BASF SE, Ecolab Inc., Solenis LLC, Suez, Dow Chemical Company, SNF Group, Akzo Nobel NV, Solvay S.A., Kurita Water Industries Ltd, Buckman Laboratories, Chemtrade Logistics, Aditya Birla Chemicals, BWA Water Additives, Hydrite Chemical Co., and Ion Exchange Ltd. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type of Chemical (Coagulants & Flocculants, Disinfectants & Biocides, Corrosion & Scale Inhibitors, PH Adjusters & Neutralizers, Others), By Form(Liquid Chemicals, Powder) By Application (Drinking Water Treatment, Wastewater Treatment, Industrial Water Treatment, Desalination, Swimming Pool & Recreational Water) By End-Users (Municipal, Power and Energy, Oil & Gas, Chemical & Pharmaceuticals, Metal & Mining, Pulp & Papers, Others) |

Key Water Treatment Chemicals Company Insights

Water care work at Ecolab Inc. happens mainly through its Nalco Water arm, reaching cities and factories worldwide. Their range covers substances that clean water, help particles clump, fight rust, and stop microbes, tools built to last under pressure. Tech-driven tracking systems come alongside these products, adding smart oversight without slowing things down. Across continents, teams apply know-how to cut water waste while lifting performance where it counts. Tough rules on pollution? They assist with those, too. New methods are often here, shaping how others approach cleanliness in the water system.

Key Water Treatment Chemicals Companies:

- Kemira Oyj

- BASF SE

- Ecolab Inc.

- Solenis LLC

- Suez

- Dow Chemical Company

- SNF Group

- Akzo Nobel NV

- Solvay S.A.

- Kurita Water Industries Ltd

- Buckman Laboratories

- Chemtrade Logistics

- Aditya Birla Chemicals

- BWA Water Additives

- Hydrite Chemical Co.

- Ion Exchange Ltd.

Global Water Treatment Chemicals Market Report Segmentation

By Type of Chemical

- Coagulants & Flocculants

- Disinfectants & Biocides

- Corrosion & Scale Inhibitors

- PH Adjusters & Neutralizers

- Others

By Form

- Liquid Chemicals

- Powder

By Application

- Drinking Water Treatment

- Wastewater Treatment

- Industrial Water Treatment

- Desalination

- Swimming Pool & Recreational Water

By End-Users

- Municipal

- Power and Energy

- Oil & Gas

- Chemical & Pharmaceuticals

- Metal & Mining

- Pulp & Papers

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636