Feb 10, 2026

The report “In-Vehicle Assistant Market By Assistant Type (Voice-Based Assistant, Text-Based Assistants, Gesture-Based Assistants, Multimodal Assistant), By Technology (Artificial Intelligence, Natural Language Processing, Speech Recognition, Computer Vision, Cloud-Based Assistant Platform), By Deployment (Cloud-Based Assistant, Hybrid Assistant, Fully Embedded In-Vehicle Assistant), By End-Users (Driver-Centric Assistant, Passenger-Centric Assistant)” is expected to reach USD 16.80 billion by 2033, registering a CAGR of 23.20% from 2026 to 2033, according to a new report by Transpire Insight.

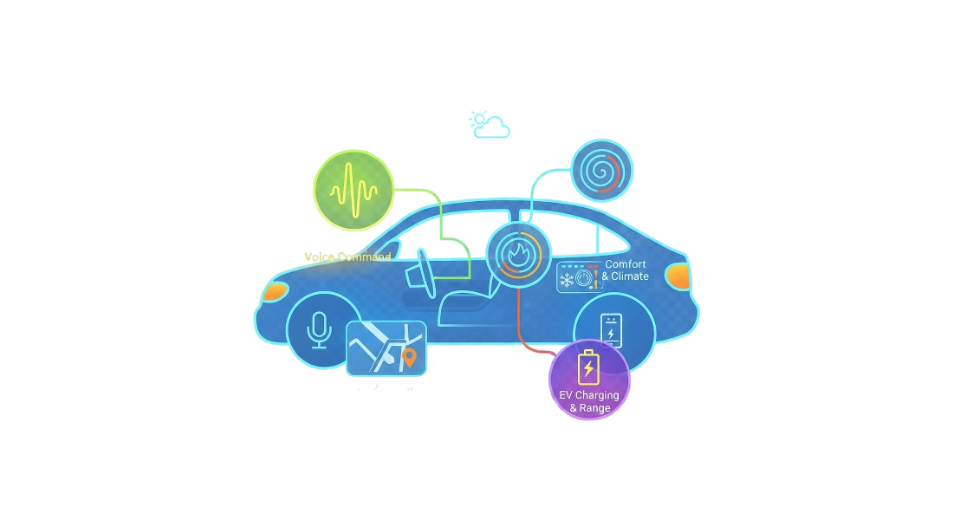

One-way cars now respond is through smart helpers built right inside, using voice smarts so people can talk instead of touch. Not just steering eyes free, they open maps, music, and even cabin temps by listening closely. Inside these tools live conversation brains linking ride controls without buttons or taps. Often starting small, such tech grows central as autos turn into rolling computers shaped by code. What once seemed extra now fits quietly under the dashboard, part of daily drives.

A sudden leap in how machines learn helps car helpers understand speech better. Because they tap into vast online systems, fresh data flows without delay. These links keep everything running smoothly while adapting to each person's habits. Connections stretch beyond the dashboard, reaching phones and apps effortlessly. Updates arrive quietly, keeping features sharp over time.

Drivers now rely more on built-in car helpers, thanks to clearer voices inside vehicles that keep attention on the road while handling tasks like spotting mechanical issues before they grow. Car makers team up tightly with tech firms so these tools fit smoothly into modern dashboards, working better when speech detection feels natural and adjusts fast to new models. Performance stands out based on how well software blends with hardware over time, especially as cars gain smarter driving aids and self-updating features.

The Voice-Based Assistant segment is projected to witness the highest CAGR in the In-Vehicle Assistant Market during the forecast period.

According to Transpire Insight, with more drivers wanting to keep their hands free, voice helpers inside cars are expected to grow faster than other types over the coming years. Because talking feels natural, people prefer using their voice to manage maps, music, temperature, or car settings without looking away from the road. Car makers now treat these spoken command tools as essential, fitting them into new models by default. Instead of pressing buttons, users speak, making driving smoother while staying focused up front.

Now, coming into cars, smarter software understands voices better, plus learns how people really talk. These tools keep getting sharper at guessing what drivers mean, due to faster learning engines behind them. Updates roll in smoothly because they hook into big online networks, avoiding clunky fixes later on. Built right into dashboards, they blend with car brains instead of feeling tacked on. High-end models include them first, though everyday vehicles now carry similar tech just as fast.

The Artificial Intelligence & Natural Language Processing segment is projected to witness the highest CAGR in the In-Vehicle Assistant Market during the forecast period.

Modern cars are getting smarter because of artificial intelligence and how they handle human language. These tools sit at the heart of what makes voice helpers inside vehicles actually useful. Instead of needing exact phrases, drivers can speak more naturally due to systems that grasp meaning based on the situation. Responses feel less robotic, more tuned to individual habits. Performance improves too, making interactions smoother over time. This part of the market is growing faster than others right now.

Now machines learn faster, hear better, understand talk more clearly, so car helpers act less robotic. These smart helpers adjust on the fly, thanks to live data pulled from online hubs linked right into the car's brain. Updates arrive without wires, while constant feedback sharpens responses over time. Cars built around flexible code make room for these upgrades naturally. New models roll out already wired for this kind of growth.

The Hybrid Assistants segment is projected to witness the highest CAGR in the In-Vehicle Assistant Market during the forecast period.

According to Transpire Insight, A burst of momentum looks likely in the Hybrid Assistant corner of the In-Vehicle Assistant scene ahead. A mix of local smarts on board the car meets brainpower pulled from online networks. When split-second reactions matter, like handling urgent driving tasks, quick replies come straight from hardware inside. Yet at the same time, outside links feed richer tools: live map shifts, sharper speech understanding, custom-fit support drawn from remote servers. The blend holds appeal without tipping toward one extreme.

Even when signals fade, these systems keep running smoothly. Though online features grow over time, solid function remains guaranteed. Not every tech mix handles stress so well. What matters most? Steady responses, smart data handling, fewer hiccups at scale. Cars of tomorrow need that kind of backbone. More brands are choosing it, quietly spreading across models you’d recognize.

The Driver-Centric Assistants segment is projected to witness the highest CAGR in the In-Vehicle Assistant Market during the forecast period.

Focused on drivers, these tools are set to grow fast within car assistant tech as the years go by. Safety matters more now, staying focused counts, and so do simpler ways to manage how vehicles behave. Instead of touching buttons, people can speak commands for directions, calls, temperature settings, and even core operations under the hood. Built right into today’s dashboards, they quietly shape how humans interact with machines behind the wheel.

Smarter machines now understand speech better and notice surroundings more clearly, which helps driver helpers react fast while on the road. Because these tools link up with car sensors and smart driving aids, they do more to keep trips smooth and safe. As a result, cars, from basic models to high-end ones, are starting to include them without delay.

The North America region is projected to witness the highest CAGR in the In-Vehicle Assistant Market during the forecast period.

Despite global shifts, North America holds its ground in the In-Vehicle Assistant Market through the projected years. Early embrace of smart, software-driven cars lights the path here. Demand grows not just for features but richer digital moments inside the car. Voice tools and artificial intelligence slip into dashboards, added by local automakers aiming at safer driving. These systems do more than play music; they link controls, information, and response into one flow. Smooth interaction becomes a quiet priority behind every upgrade.

A web of carmakers, tech firms, and cloud networks powers fast progress in smart dashboard helpers here. Driven by leaps in voice understanding and self-learning systems, new vehicle software takes shape quickly. Because safety tools get serious attention, demand keeps rising steadily throughout North America. Progress does not slow; each piece feeds the next, quietly pushing what cars can do.

Key Players

Top companies include Apple Inc., Amazon.com, Inc., Google LLC, Microsoft Corporation, Nuance Communications, Cerence Inc., SoundHound Inc., Harman International (Samsung Electronics), Baidu, Inc., Alibaba Group Holding Limited, NVIDIA Corporation, Robert Bosch GmbH, Aptiv PLC, Visteon Corporation, LG Electronics Inc., Panasonic Corporation, and Hyundai Mobis Co., Ltd.

Drop us an email at:

Call us on:

+91 7666513636