Feb 05, 2026

The report “Pharmaceutical Manufacturing Equipment Market By Equipment Type (Formulation & Processing Equipment, Filling & Packaging Equipment, Other Product Types), By Application (Solid Dosage Forms, Liquid Dosage Forms, Parenteral / Injectable Products, Biopharmaceuticals & Vaccines, Herbal & Nutraceuticals, Oncology & Specialty Drugs) and By End User (Pharmaceutical Manufacturing Companies, Contract Manufacturing Organizations (CMOs) / CDMOs, Biotechnology Companies, Research Laboratories & Academic Institutions, Hospitals & Clinics, Nutraceutical / Veterinary Product Manufacturers)” is expected to reach USD 115.0 billion by 2033, registering a CAGR of 7.60% from 2026 to 2033, according to a new report by Transpire Insight.

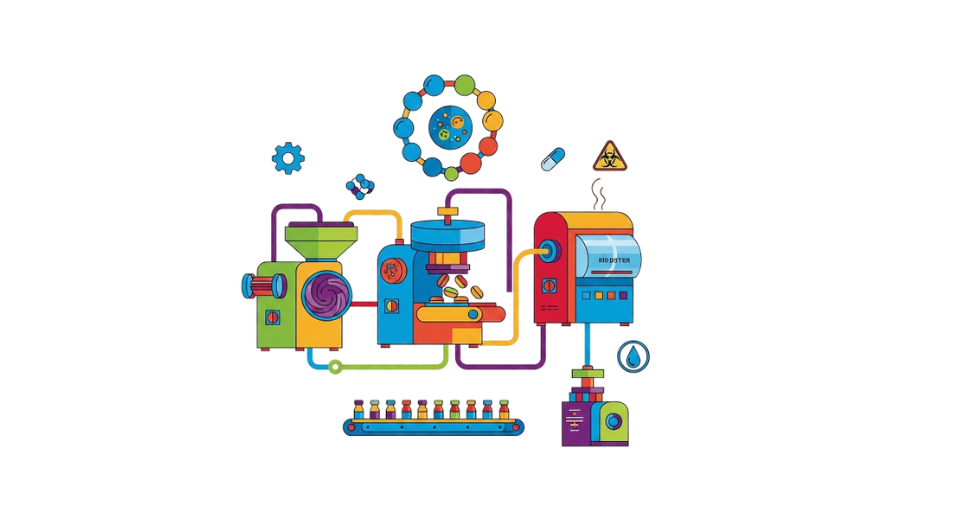

The market for pharmaceutical manufacturing equipment is expanding rapidly due to the rising need for biologics, vaccines, and high-quality medications worldwide. The market includes equipment and systems utilized in pharmaceutical product development, processing, filling and packaging, guaranteeing adherence to strict regulatory requirements. The necessity for scalable, cost-effective production, the growth of generic medicine production and the rising incidence of chronic illnesses are all driving market demand. Automation, continuous manufacturing systems, and single-use technologies are becoming more common as a result of technological breakthroughs that are changing pharmaceutical manufacturing processes. To maximize production efficiency, minimize downtime, and uphold quality standards, businesses are investing in digital integration and smart equipment solutions. In the manufacture of high-value biologics and vaccines, where accuracy, sterility and dependability are crucial, this tendency is especially evident.

To satisfy changing production needs, mid-size pharmaceutical companies and contract manufacturing organizations (CMOs) are progressively implementing equipment that is adaptable and capable of producing many products. Capital investment in advanced manufacturing technology is being driven by regulatory compliance constraints in North America and Europe, particularly with regard to serialization, traceability and aseptic processing. As a result, more effective, automated solutions are gradually replacing outdated systems. Growing local manufacturing capability, government incentives, and developing healthcare infrastructure are making emerging markets in Asia Pacific, Latin America, and the Middle East more significant. Businesses are making investments in cutting-edge machinery to meet growing domestic demand and export prospects. Market participants are positioned to take advantage of growth in both established and developing markets thanks to strategic alliances, modernized production lines and improved service offerings.

The Formulation & Processing Equipment segment is projected to witness the highest CAGR in the Pharmaceutical Manufacturing Equipment during the forecast period.

According to Transpire Insight, The market for pharmaceutical manufacturing equipment is still dominated by the Formulation & Processing Equipment segment. The central components of drug manufacturing are mixers, blenders, granulators, dryers, reactors, and bioprocessing equipment. The requirement for accuracy in dosage form manufacturing to guarantee consistency, quality, and regulatory compliance is what drives the high adoption rate. Modern, automated systems with real-time monitoring are becoming more and more popular among manufacturers because they increase productivity while reducing human mistake and product waste.

The market for vaccines and biologics is expanding, which has increased demand for equipment used in formulation and processing. Faster production scale-up, flexibility across several product lines, and adherence to stringent cGMP standards are all made possible by the use of continuous manufacturing and modular technologies. Particularly in areas with significant pharmaceutical exports, investments in high-capacity dryers, lyophilizers and sophisticated reactors are rising. As a result, this sector holds a sizable portion of the global equipment market highlighting its strategic significance to pharmaceutical firms and CMOs across the globe.

The Solid Dosage Forms segment is projected to witness the highest CAGR in the Pharmaceutical Manufacturing Equipment during the forecast period.

Due to the widespread use of tablets and capsules worldwide, solid dosage forms are the most common application type. These types, which include over-the-counter medications, nutraceuticals, and generic medications, account for the majority of pharmaceutical consumption. To guarantee effectiveness and reliable dosage precision, manufacturers concentrate on high-throughput tablet presses, capsule fillers, and quality inspection methods. In order to comply with regulations and minimize production downtime, automation and inline quality control are being used more frequently.

Emerging markets in Asia Pacific and Latin America, where generic production is growing quickly, further support the need for solid dosage equipment. Continuous granulation, sophisticated coating systems, and integrated manufacturing lines are examples of technological advancements that enhance product quality, cut waste, and accelerate time to market. Precision equipment adoption is further fueled by regulatory compliance requirements in North America and Europe, making solid dosage processing the foundation of the pharmaceutical production industry.

The Automotive & Transportation segment is projected to witness the highest CAGR in the Pharmaceutical Manufacturing Equipment during the forecast period.

According to Transpire Insight, Large and mid-sized pharmaceutical manufacturing companies make up the majority of end users. Due to their high-volume manufacturing needs and concentration on complicated biologics, vaccines and specialty pharmaceuticals, large integrated enterprises dominate capital investment on modern equipment. They are able to maintain quality, maximize throughput and attain worldwide compliance across numerous facilities by investing in automation, continuous manufacturing, and single-use solutions.

Scalable, modular equipment is being used by mid-size businesses to maintain their competitiveness while manufacturing both generic and specialty goods. These businesses may increase operating efficiency, reduce downtime, and react swiftly to changing market demands by strategically upgrading their filling, packaging, and analytical systems. Due to their substantial regional and worldwide presence and high investment capacity, large and mid-sized pharmaceutical companies continue to be the primary growth drivers for the market.

The North America region is projected to witness the highest CAGR in the Pharmaceutical Manufacturing Equipment during the forecast period.

With the United States at the forefront, North America is the biggest and most developed market for pharmaceutical production equipment. Advanced regulatory frameworks, a robust R&D environment, and rising biologics, vaccine, and specialty medication production are driving the region's market expansion. To increase efficiency, lower errors, and guarantee FDA compliance, businesses are making significant investments in automation, continuous manufacturing, and intelligent monitoring systems.

Contract manufacturing and economical production methods are two ways that Canada and Mexico contribute. A dynamic ecosystem for equipment adoption is created when CMOs, large manufacturers, and mid-size pharmaceutical companies work well together. Additionally, North American businesses are early adopters of integrated process platforms, single-use systems, and Industry 4.0-enabled solutions. The region's dominance in the worldwide market is cemented by the combination of high-capacity facilities, strict quality standards, and technological innovation.

Key Players

The top 15 players in the Pharmaceutical Manufacturing Equipment market include GEA Group Aktiengesellschaft, I.M.A. Industria Macchine Automatiche S.p.A., Syntegon Technology GmbH, ACG, Thermo Fisher Scientific Inc., Sartorius AG, Bausch + Ströbel Maschinenfabrik Ilshofen GmbH + Co. KG, Romaco Group, Marchesini Group S.p.A., Glatt GmbH, Coperion GmbH, Fette Compacting GmbH, B. Bohle Maschinen + Verfahren GmbH, Tofflon Science and Technology Co., Ltd., and Agilent Technologies, Inc.

Drop us an email at:

Call us on:

+91 7666513636