Market Summary

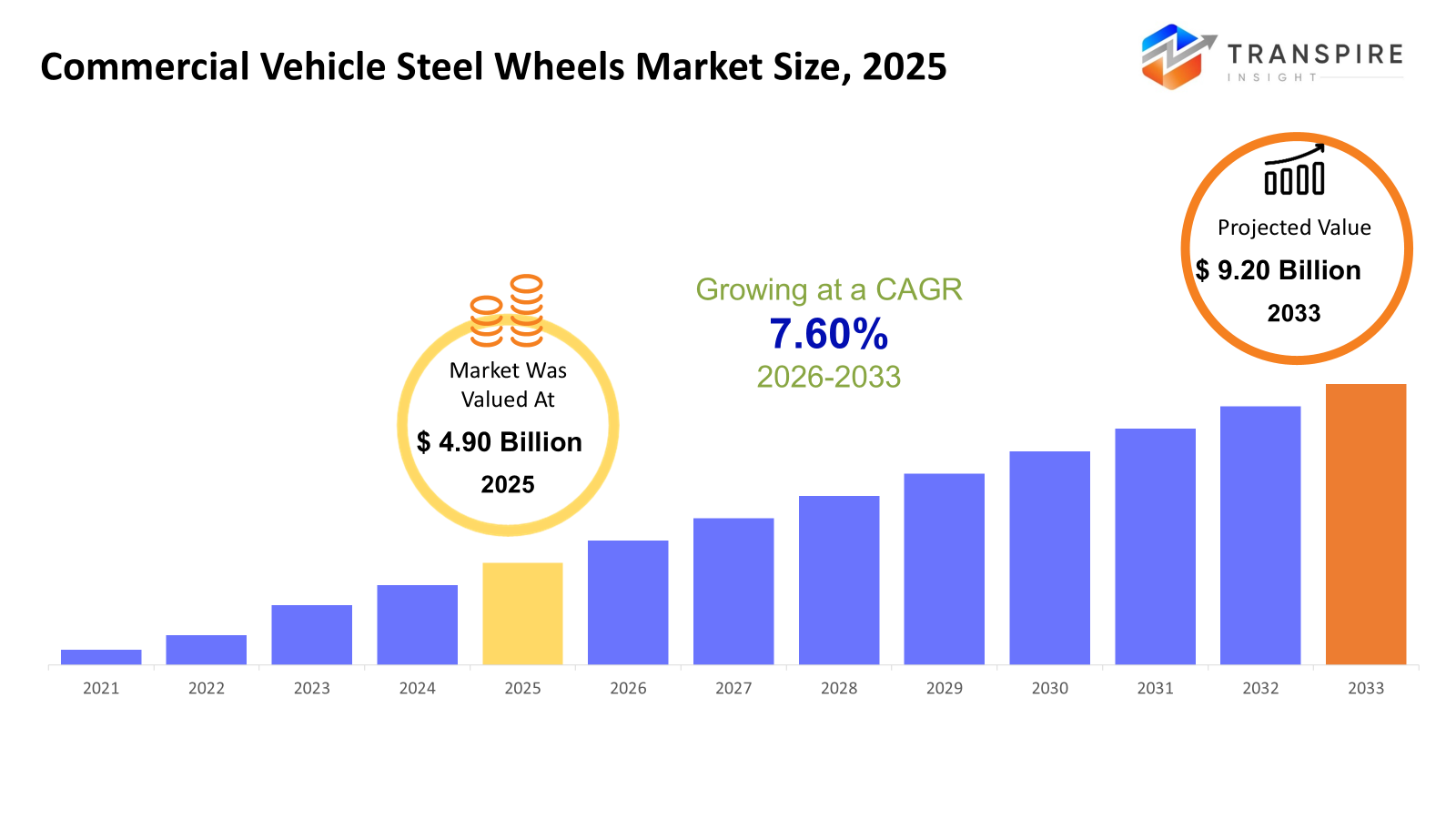

The global Commercial Vehicle Steel Wheels market size was valued at USD 4.90 billion in 2025 and is projected to reach USD 9.20 billion by 2033, growing at a CAGR of 7.60% from 2026 to 2033. Even though lighter options exist, medium and heavy trucks still lead the way because they need tough parts that last long; steel wheels fit well here. Thanks to sturdier roads going up and more building work popping up across growing regions, factories keep making more big rigs, replacing old ones too. Steel rims handle rough jobs without failing, can be fixed easily, plus they save money over time, keeping them popular where performance matters most.

Market Size & Forecast

- 2025 Market Size: USD 4.90 Billion

- 2033 Projected Market Size: USD 9.20 Billion

- CAGR (2026-2033): 7.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 28% in 2026. Heavy truck usage across North America helps maintain a steady demand for steel wheels. Because fleets operate constantly, replacements happen at regular intervals. Demand stays firm thanks to ongoing cargo movement throughout the region. A large number of commercial vehicles already on the roads supports continued market presence. Replacement patterns remain predictable year after year.

- Out west, a vast network of trucks rolls nonstop across state lines. Money keeps flowing into roads and rail because moving goods fast matters here. One country pulls ahead just by how much it ships within its own borders.

- China and India push ahead, pulling the Asia Pacific zone upward through factory growth, city expansion, new roads, bridges, alongside heavier output of trucks and delivery vehicles. Growth here outpaces elsewhere thanks to these forces quietly building momentum behind the scenes

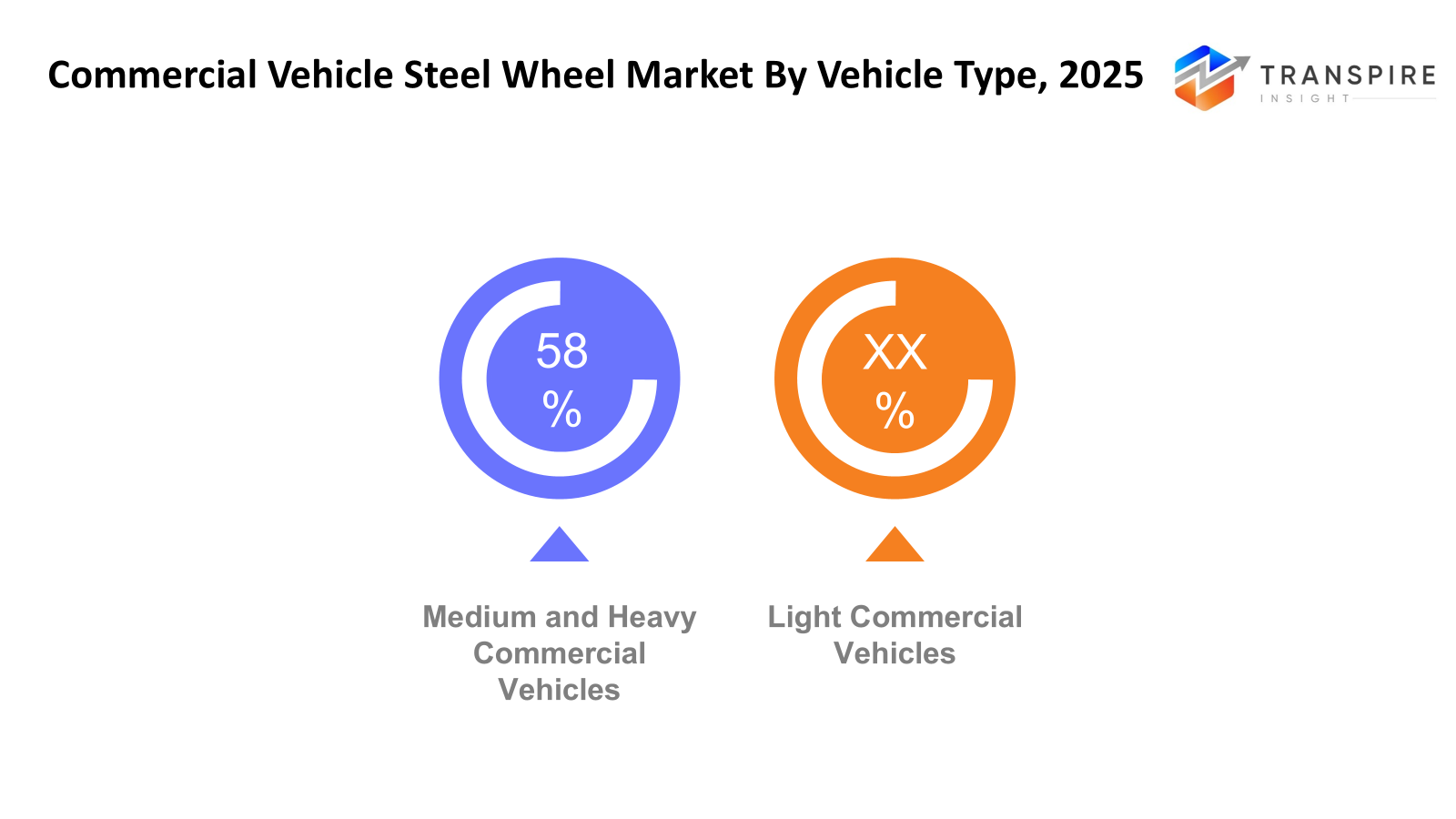

- Medium and Heavy Commercial Vehicles share approximately 60% in 2026. Fueled by growing freight needs, medium and heavy-duty commercial vehicles dominate the sector. Infrastructure expansion pushes usage forward. Long-distance hauling adds pressure on durability, making strong steel wheels essential here. High-capacity loads keep this area ahead of others.

- Firms on roads because of how they spread weight, dual wheels show up most where trucks travel far and carry heavy loads. Their strength and balance make them stick around in tough hauling jobs.

- Most of the demand comes from vehicles on public roads, driven by bigger delivery systems, and rising online shopping activity, while businesses run their truck fleets more often.

- OEMs hold it, thanks to ongoing output of commercial trucks plus contracts that last years with makers of wheels. Production never really stops, so demand stays firm.

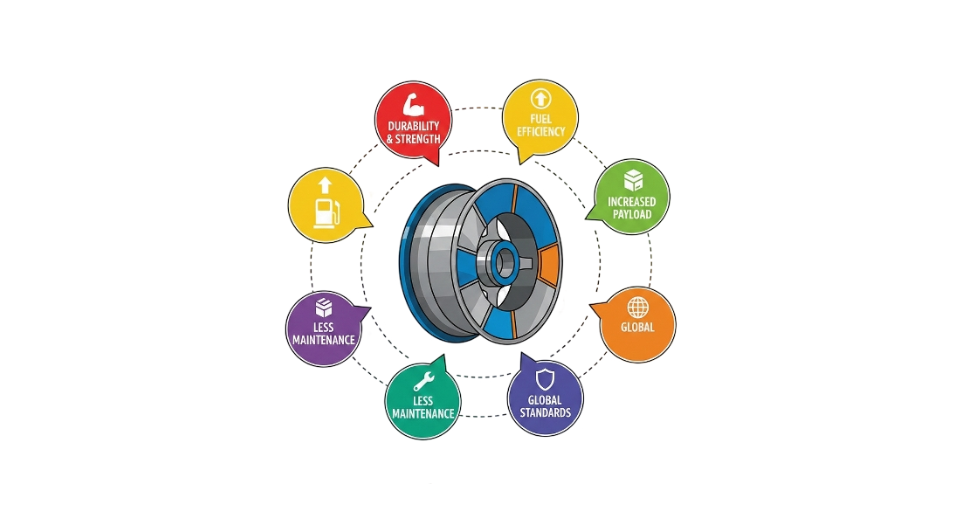

Steel wheels matter a lot in trucks and delivery vans worldwide, mainly because they handle tough jobs without failing. Built strong, they resist dents, last longer, stand up to bumps, plus cost less than other options. Rugged performance keeps them common on highways, job sites, quarries, city streets, anywhere loads weigh heavily, surfaces beat down hard, and daily use wears fast. Their toughness fits what real driving demands when miles pile up, and conditions turn harsh.

Out on roads, more trucks mean more need for trade climbs, cities grow, and online shopping pushes movement. These rigs rely heavily on strong axles and tough rims just to keep rolling mile after mile. Instead of fancy parts, many companies stick with steel since fixing them takes less time and less money, too. Over months, those small savings start adding up without drawing attention.

Most need comes from vehicles on roads, thanks to delivery trucks, city buses, and transport companies keeping things moving. Construction sites, farms, and mines keep adding steady pressure too; those jobs push wheels hard, so strong builds are non-negotiable. New machines rolling off assembly lines create one kind of pull; factories order parts in bulk when building them. Older machines doing daily work add another layer; their wheels wear out, needing swaps during routine checkups. Demand holds firm either way.

From a regional standpoint, mature markets rely on long-standing transport networks plus sizable fleets of commercial vehicles; meanwhile, developing nations see rising demand because roads and industries expand together. Though often overlooked, wheels made of steel now resist rust better - thanks to smarter engineering and weigh less even though they stay just as tough, making them more appealing across uses. Because freight movement powers economies, builds cities, and keeps supply chains moving, heavy-duty vehicles keep needing strong rolling parts, keeping steady momentum in their steel wheel market.

Commercial Vehicle Steel Wheels Market Segmentation

By Vehicle Type

- Light Commercial Vehicles

Starting off, light commercial vehicles often roll on steel wheels because they handle heavy loads without trouble. These wheels stick around longer, even when roads get rough. Their price tag makes them a go-to for city deliveries where budgets matter just as much as strength. Urban logistics teams pick them not only for toughness but also for how easily they fit into daily operations.

- Medium & Heavy Commercial Vehicles

Heavy-duty trucks roll on steel wheels because they handle heavy loads without trouble. Distance means nothing when it comes to how far they can go carrying goods. Construction sites rely on them just as much as factories do. Freight moves steadily thanks to their strength under pressure.

To learn more about this report, Download Free Sample Report

By Wheel Type

- Single Wheel

One wheel at a time, steel singles show up often on lighter work trucks and upfront rigs. They weigh less than bulkier options. Fixing them takes less effort when things go wrong. These models also save money over time.

- Dual Wheel

Sure thing rolls better with two steel twins on the back ends of big rigs, handles weight well, holds things steady, keeps rides safe.

By Application

- On-Road

Most of the demand comes from on-road uses, thanks to trucks moving goods, delivery fleets staying busy, and buses carrying passengers every day.

- Off-Road

Fueled by heavy-duty needs, off-road setups lean on tough wheels built to handle rough terrain. Construction sites push demand, just like mines, where gear must endure constant punishment. Farms rely on durable rigs, their machinery moving across uneven ground daily. Military operations add another layer, needing wheels that survive extreme conditions without fail.

By End-Users

- OEM

Starting fresh each time OEMs order parts when building new trucks and buses. Their need grows alongside factory output, tied closely to multiyear agreements with vehicle makers.

- Aftermarket

Wheel replacements happen often, so the aftermarket sees steady demand. Fleet upkeep schedules help keep business flowing. More commercial vehicles on the roads means more need for parts later. Replacement needs grow as vehicle numbers rise across regions.

Regional Insights

Trucks keep rolling across North American roads, relying heavily on steel wheels built to last. Because freight moves so much here, demand stays stable year after year. Fleet owners replace worn parts often, keeping suppliers busy without sudden spikes. Even though alternatives exist, most still choose steel when outfitting new rigs. Regulations push for reliability, which plays right into what steel delivers under hard use. On highways and service lanes alike, these wheels remain the go-to pick for tough jobs. Replacement cycles stretch out but never really stop, feeding steady needs in workshops and factories.

Steady appetite across Europe for steel wheels on commercial vehicles stems from border-hopping freight, building projects, and bus networks. Firms there build them efficiently thanks to skilled production setups and clear rules focused on safe, greener transport gear. Even though lighter designs and substitute substances get more notice lately, steel still holds ground because it withstands stress well, fits into recycling loops easily, and works reliably where loads are heavy or routes are short. Despite shifts nearby, its place stays firm when toughness matters most.

Off the back of quick industrial growth, the Asia Pacific surges ahead, cities spread wider, and building booms spark more spending on roads and shipping networks. Because factories push out more trucks and heavy equipment, especially in developing nations, the need for steel wheels climbs sharply, whether on highways or rough terrain. Down south, Latin American markets inch upward; mines run deeper, new structures go up, and delivery vans multiply. Across Africa and the Middle East, similar patterns unfold: construction gains ground, hauling operations stretch further, quietly lifting appetite for durable wheels. These areas may move more slowly, yet they anchor future reach for suppliers eyeing a wider footprint.

To learn more about this report, Download Free Sample Report

Recent Development News

- May 2, 2025 – JK Tyre expands retail presence with new steel wheel model in rural India.

(Source:https://trucks.tractorjunction.com/en/news/jk-tyre-launches-steel-wheels-retail-model-in-rural-india)

- September 26, 2022 – Maxion launched Europe’s lightest steel truck wheel.

(Source:https://www.tyrepress.com/2022/09/maxion-launches-europes-lightest-steel-truck-wheel/)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.90 Billion |

|

Market size value in 2026 |

USD 5.50 Billion |

|

Revenue forecast in 2033 |

USD 9.20 Billion |

|

Growth rate |

CAGR of 7.60% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Maxion Wheels, Accuride Corporation, Hayes Lemmerz International, Janta Wheels, Sumitomo Steel, Bharat Forge, Mefro Wheels, ALCOA Wheels, Steel Strips Wheels, Wheels India Limited, Titan Wheel Corporation, CIE Automotive, Jiangsu Xingye Alloy Wheels, Kosei Aluminium Wheels, Nippon Steel & Sumitomo Metal, SSW Wheels, and Rimex Group |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles), By Wheel Type (Single Wheels, Dual Wheels), By Application (On-Road, Off-Road), By End-Users (Original Equipment Manufacturer, Aftermarket) |

Key Commercial Vehicle Steel Wheels Company Insights

A top name worldwide, Maxion Wheels builds steel wheels for trucks and vans. Their lineup fits small to large vehicles. Quality matters most here; each wheel is built tough, meant to last. Safety rules are strict; they follow everyone without exception. Everyone will find these wheels on new rigs from makers and replacements, too. From Brazil to Berlin, buyers rely on their supply network. Factories stay sharp through fresh tech, smart upgrades rolled out often. Leaders keep pushing forward, always refining how things are made.

Key Commercial Vehicle Steel Wheels Companies:

- Maxion Wheels

- Accuride Corporation

- Hayes Lemmerz International

- Janta Wheels

- Sumitomo Steel

- Bharat Forge

- Mefro Wheels

- ALCOA Wheels

- Steel Strips Wheels

- Wheels India Limited

- Titan Wheel Corporation

- CIE Automotive

- Jiangsu Xingye Alloy Wheels

- Kosei Aluminium Wheels

- Nippon Steel & Sumitomo Metal

- SSW Wheels

- Rimex Group

Global Commercial Vehicle Steel Wheels Market Report Segmentation

By Vehicle Type

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

By Wheel Type

- Single Wheels

- Dual Wheels

By Application

- On-Road

- Off-Road)

By End-Users

- Original Equipment Manufacturer

- Aftermarket

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636