Market Summary

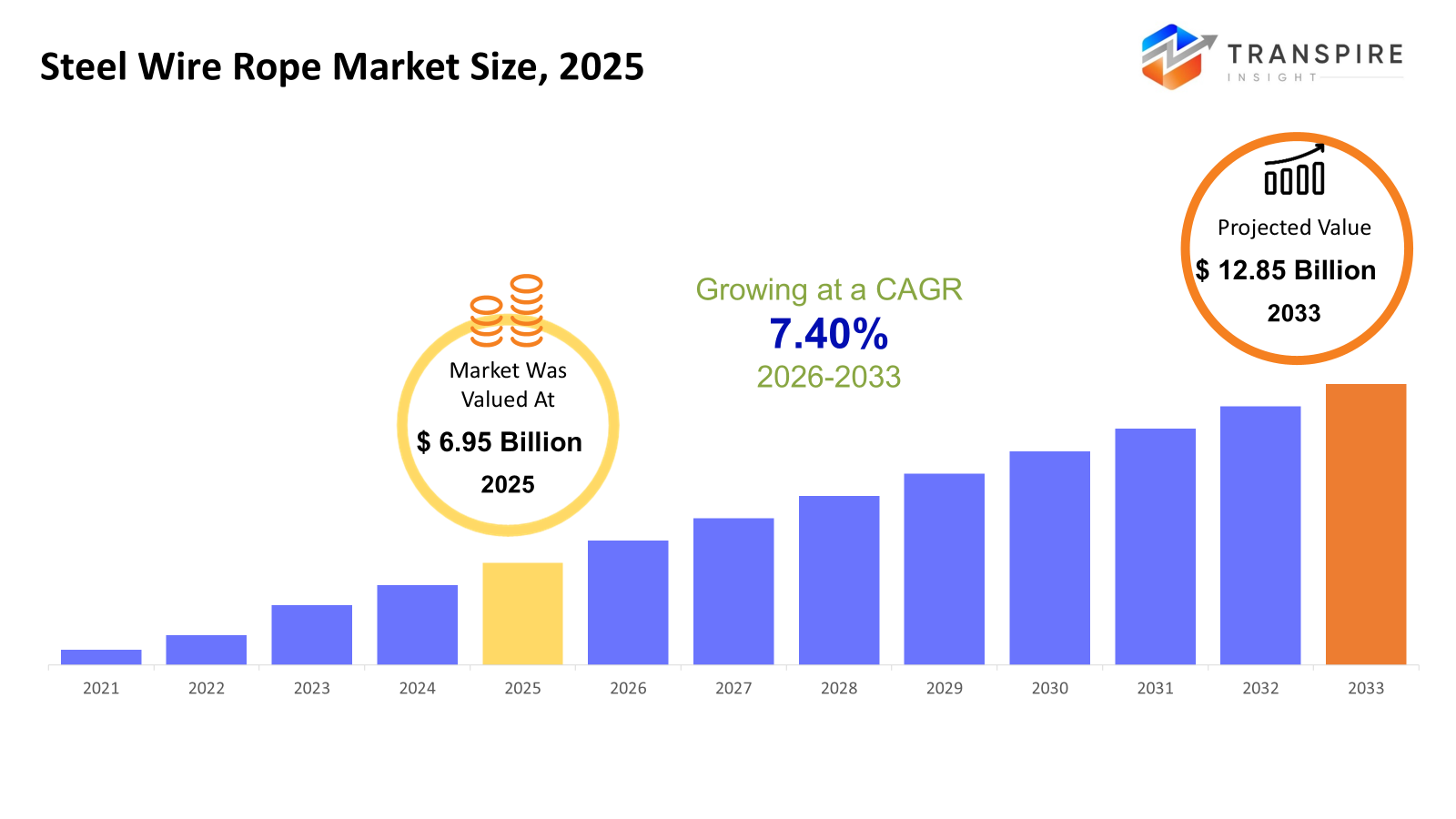

The global Steel Wire Rope market size was valued at USD 6.95 billion in 2025 and is projected to reach USD 12.85 billion by 2033, growing at a CAGR of 7.40% from 2026 to 2033. Steel wire ropes are expected to have an increasing market with increasing investment in infrastructural projects, mining activities, and projects in the energy sector in general around the world. There is also increasing industrial automation, port modernization, as well as crane replacements, thereby supporting increasing baseline demand in general. There is also increasing adoption of wire ropes with stronger characteristics or abilities such as resistance to high temperatures as well as corrosive substances in general.

Market Size & Forecast

- 2025 Market Size: USD 6.95 Billion

- 2033 Projected Market Size: USD 12.85 Billion

- CAGR (2026-2033): 7.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America exhibits growth at a constant rate due to infra rehab work, mining modernization, and energy transition projects. Demand in the US is driven by replacement consumption, while Canada and Mexico buttress demand with mining, manufacturing expansion, and logistics investments.

- The US is still the major demand center in North America, driven by rehabilitation projects in infrastructure, developments in ports, and continuous replacement of lifting equipment in construction, energy sector, and other industries. Stringent regulations on safety and certification issues are fueling demand for high-spec galvanized wire ropes and IWRC wire ropes.

- Asia Pacific is the geography with the highest rate of growth, fueled by urbanization trends, industrial capacity addition, and major construction activities. China and India are the major countries by volume, with the focus in countries such as Japan, South Korea, and Australia being on the highest-performance wire ropes.

- Carbon wire ropes and galvanized steel wire ropes still dominate the material segment based on their cost efficiency characteristics and broad applicability to the industry requirements, with an upward demand for the material associated with the upgrading requirements of the industry, albeit with a move towards the use of the latter based on its long-term properties for the purpose of optimization.

- In terms of configuration, independent wire rope core configurations drive core type demand, supported largely by high-load applications in construction, mining, and crane support. This, in turn, relates to rising rates of safety regulation, as well as strength and dimensional stability requirements in lifting equipment.

- The market for non-plastic coated wire ropes still maintains its largest market share due to established usage and cost-effectiveness. Conversely, plastic-coated wire ropes are picking up well in regulated areas due to enhanced handling properties.

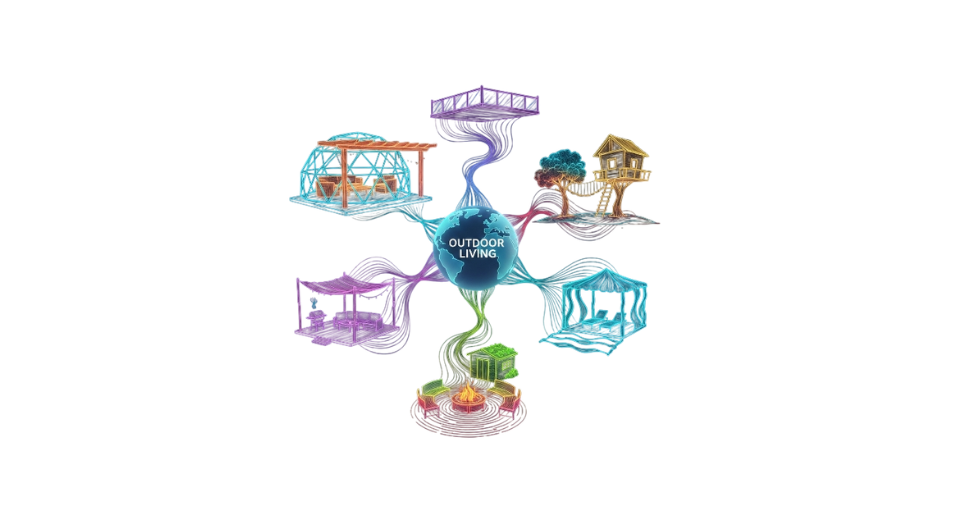

- The construction and infrastructure segment still dominates the applications, due primarily to investments and growth occurring in cities worldwide, transportation drives, and vertical growth. Industrial and crane segments are a strong second, thanks to automation and growth happening in factories, warehouses, and ports around the world.

So, Steel wire rope is a category within the industry involving the manufacture and supply of strong, robust, flexible, and durable cables fabricated from strong materials like steel, used for lifting, towing, and pulling, coupled with providing support to different bodies in the form of loads within different businesses and commercial settings. Market demand is also in close relation with capital expenditure patterns in the development of infrastructure, industrialization, and the exploration of natural resources. High volume consumption is required in construction, whereas high-performance products are required in the oil & gas and mining industries. In addition, there are developments in the fields of coating, cores, and materials as far as technology is concerned.

At the same time, the market is also seeing a gradual form of value enhancement, fuelled by the increased use of premium product varieties, particularly in the developed regions of the world. Government initiatives toward enhancing safety requirements for working environments and equipment are driving the replacement of ageing wire ropes with upgraded varieties. While fluctuations in raw materials are a natural concern, the diversification of end-user requirements ensures steady yet consistent growth for the wire ropes market.

Steel Wire Rope Market Segmentation

By Material Type

- Carbon Steel

The carbon steel wire ropes are widely adopted across the globe for their cost-effectiveness and good mechanical properties. The growth of construction and industrial activities provides overall volume growth for carbon steel wire ropes, though poor durability in harsh environments limits their use as lifting gear or pulling gear for offshore and oil & gas applications. The overall demand for wire ropes is dominated by carbon steel, particularly for building and growth-oriented sectors such as the Asia Pacific region and Middle East & Africa.

- Galvanized Steel

Galvanized steel products have made use of their ability to counter corrosion and high durability in order to gain popularity in outdoor exposure applications or marine environments. Europe and North America demonstrate high adoption rates of galvanized materials with high regard for quality outputs with high lifespan requirements. While high prices compared with carbon steels are drawbacks, they are justified with an increase in lifespan as well as lower maintenance requirements in marine or harsh industrial exposures. Competitive dangers come in the forms of coatings and new hybrids of materials.

- Stainless Steel

The prices are higher for stainless steel varieties owing to the properties of better corrosion resistance and strength retention across various industries such as the chemical, oil & gas, and marine industries.The sensitivity towards fluctuations in raw material costs relating to stainless steel, including nickel and chromium, also plays a role.

- Others

Alloy steels and specialty material have their performance tailored for certain heavy-duty situations. The adoption pattern for alloy steels and other specialty materials remains niche in nature within high-technology operations in the fields of heavy engineering, mining, etc. Though its market size remains smaller in nature, it grows with the development of technology in high-end engineering works and its substitution from other conventional steels where its high performance justifies cost.

To learn more about this report, Download Free Sample Report

By Core Type

- Independent Wire Rope Core (IWRC)

IWRC cores provide increased strength and stability, desired when heavy loads and long service life are paramount. North American and European construction, crane operations, and mining rely heavily on IWRC. Cost and rigidity versus fiber cores make IWRC the premium choice in engineered systems with predictable load cycles.

- Fiber Core (FC)

The cores of fibers provide flexibility and toughness while absorbing the impact. This reduces shock loads, which is helpful in dynamic applications. The cheaper and lighter weight further increases their applications in general industries and small-scale lifting. In the Asia-Pacific region, FC has a higher penetration rate because of cost sensitivity and applicability to most medium-duty sectors. However, FCs are also prone to performance degradation in corrosive or wetting conditions due to moisture susceptibility.

- Wire Strand Core (WSC)

WSC balances strength and flexibility, addressing some IWRC stiffness limitations while improving upon fiber core load capacity. It appeals in applications where moderate strength with enhanced handling is desired. Adoption is notable in industrial operations where performance is optimized in support of equipment longevity, without extreme cost increments.

By Coating

- Non-plastic coated

Established non-plastic materials, mostly galvanized finishes, retain market leadership due to continued pre-eminence of corrosion resistance at competitive cost. The market has strong traction for construction, industrial, and junior maritime segments. Demand is supported by familiarization and accessibility, especially across emerging regions such as Asia Pacific and South American country groups.

- Plastic-Coated (PVC/PE/Nylon)

Plastic-Coated includes high-quality plastic-coated materials, such as PVC, PE, or nylon, enable better resistance, reduced wear, and improved handling safety, which is a highly desired attribute. However, premium cost keeps the product out of widespread use compared with galvanized but helps in increasing market demand.

By Application

- Construction & Infrastructure

Construction will again be the leading application due to continued global urbanization. Wire ropes will be important in cranes, elevators, and material handling devices. The Asia Pacific will lead in volume terms, with support in hand from India, China, and Southeast Asian project pipelines. Cost/performance will be a large factor in material and coating specification.

- Industrial & Crane Operations

Industrial usage includes manufacturing, warehousing, and logistics. Under this usage, predictability and reliability are given priority. North America and Europe have higher specification products or materials, including galvanized and plastic-coated, matching safety and maintenance standards. There are also automation usage trends for ropes.

- Mining

Mining demands strong performance under rigorous conditions, against high-stress values. This means that a strong material would be used for core. Australia, South Africa, Latin American countries are often identified with mining. It does play a role in material selection.

- Oil & Gas / Energy

The energy segment has stringent wire rope demands, where offshore drilling and platform activities require wire rope with corrosion resistance and fatigue durability. Stainless steels and alloy steels with better coatings are seeing good demand. Project cycles play a significant role, particularly for the Middle East & Africa and North Sea markets.

- Marine & Fishing

Marine and fishing industry applications require corrosion resistance, for which stainless steel, galvanized, and coated ropes are preferred. Industries operating on coastal geography, such as those in Asia Pacific and European regions, contribute to market growth. Aquaculture segments also exhibit niche market contributions.

- Others

Other areas where the wire ropes have applications include transportation, entertainment and specialty lifts. These areas have specific uses involving a mix of material approaches based on stress requirements or regulatory considerations. New markets, such as renewable energy/wind farms, ensure customers’ requirements for special wire rope products continue to grow.

Regional Insights

Geographically Speaking, North America Ensures a Mature but Stable Market with the U.S. as a Tier 1 Market with Good Levels of Replacement Business in all Areas within Construction, Mining, and Industrial Lifting; Canada Supports Tier 1 Levels in the Mining and Energy Markets; and the Region Also Includes a Tier 2 Market in Mexico Focused around Manufacturing. Europe, with balanced demand in Tier 1 countries like Germany, the United Kingdom, France, Italy, and Spain, is backed by industrial automation, infrastructure, and safety. Rest of Europe is considered a Zone of Growth under Tier 2, which is supported by infrastructure and manufacturing. Asia Pacific is also noted to be the biggest and fastest-growing market, with China and India being deemed to be Tier 1, infrastructure-intensity driven markets. Furthermore, other Tier 1-Tier 2 segments comprising quality and nich market segments, driven by regions including Japan, South Korea, and Australia, can also be found.

South America is dominated by Brazil and Argentina as Tier 2 markets assisted by mining and construction activity. The ME&A finds its demand centers in Tier 1 jurisdictions as Saudi Arabia, UAE, and South Africa, fueled by energy, infrastructure development, as well as port growth in the ecosystem.

To learn more about this report, Download Free Sample Report

Recent Development News

- July 2025, Bekaert disclosed that it had finalized the sale of its steel wire solutions assets situated in Costa Rica, Ecuador, and Venezuela to Grupo AG. The sale falls under Bekaert's strategy for transforming its portfolios. With this sale, Bekaert aims at increasing its growth strategy as well as cutting exposure risks. The deal was valued at $73 million.

- In May 2024, Bekaert announced its acquisition of BEXCO nv, a global player for synthetic offshore lifting & mooring solutions, for €40m. This strategic move strengthens its activities in offshore energy & marine ropes to include floating wind & deep water solutions for Bridon-Bekaert’s portfolio of industrial ropes.

(Source:https://www.bekaert.com/en/about-us/news-room/news/bekaert-acquires-bexco)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.95 Billion |

|

Market size value in 2026 |

USD 7.8 Billion |

|

Revenue forecast in 2033 |

USD 12.85 Billion |

|

Growth rate |

CAGR of 7.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Kiswire Ltd, Bridon-Bekaert The Ropes Group, WireCo World Group Inc, Usha Martin Limited, Teufelberger Holding AG, Tokyo Rope Mfg Co Ltd, Jiangsu Langshan Wire Rope Co Ltd, PFEIFER Drahtseilwerk GmbH, Guizhou Steel Rope Group, DSR Wire Corporation, Brugg Lifting AG, Juli Sling Co Ltd, Gustav Wolf GmbH, Fasten Group, Kobelco Wire Co Ltd |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Carbon Steel, Galvanized Steel, Stainless Steel, Others), By Core Type (Independent Wire Rope Core (IWRC), Fiber Core (FC), Wire Strand Core (WSC)), By Coating (Non-plastic coated, Plastic-Coated (PVC/PE/Nylon)) and By Application (Construction & Infrastructure, Industrial & Crane Operations, Mining, Oil & Gas / Energy, Marine & Fishing, Others) |

Key Steel Wire Rope Company Insights

Kiswire Ltd is an exceptional case in the list of world-class suppliers of steel wire rope products, utilizing robust production capacity as well as its wide range of products utilized in the construction sector, mining sector, and offshore oil rigs. This kind of strategic focus in the production of high-quality performance-driven products in the category of steel wire rope is highly appreciable, and the robust R&D also provides chances for the production of differentiated products as per the requirements of buyers in the market. Wide geographic coverage from Asia, Europe, and North America is advantageous for Kiswire in terms of market outreach as well as addressing regional demand patterns in the market.

Key Steel Wire Rope Companies:

- Kiswire Ltd

- Bridon-Bekaert The Ropes Group

- WireCo World Group Inc

- Usha Martin Limited

- Teufelberger Holding AG

- Tokyo Rope Mfg Co Ltd

- Jiangsu Langshan Wire Rope Co Ltd

- PFEIFER Drahtseilwerk GmbH

- Guizhou Steel Rope Group

- DSR Wire Corporation

- Brugg Lifting AG

- Juli Sling Co Ltd

- Gustav Wolf GmbH

- Fasten Group

- Kobelco Wire Co Ltd

Global Steel Wire Rope Market Report Segmentation

By Material Type

- Carbon Steel

- Galvanized Steel

- Stainless Steel

- Others

By Core Type

- Independent Wire Rope Core (IWRC)

- Fiber Core (FC)

- Wire Strand Core (WSC)

By Coating

- Non-plastic coated

- Plastic-Coated (PVC/PE/Nylon)

By Application

- Construction & Infrastructure

- Industrial & Crane Operations

- Mining

- Oil & Gas / Energy

- Marine & Fishing

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636