Jan 20, 2026

The report “Tire Pressure Monitoring System Market By Vehicle Type (Passenger Vehicle , Commercial Vehicle), By Type (Direct TPMS, Indirect TPMS), By Sales Channel (OEM, Aftermarket)” is expected to reach USD 17.90 billion by 2033, registering a CAGR of 10.30% from 2026 to 2033, according to a new report by Transpire Insight.

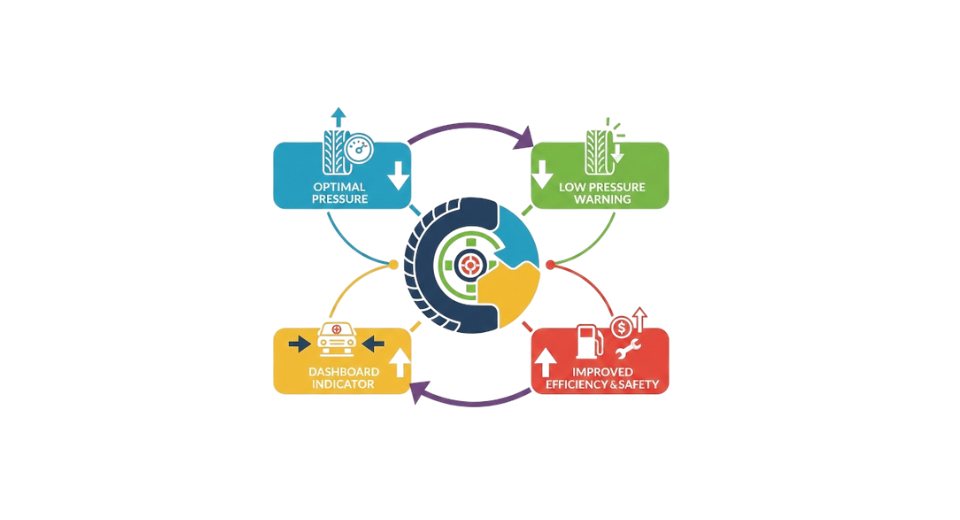

The Tire Pressure Monitoring System has become an integral part of the automotive safety ecosystem on a global scale, as these systems provide real-time monitoring of tire pressure for various benefits, including vehicle safety, reduced wear and tear on tires, and improved fuel economy. The regulatory mandates across key automotive markets, such as North America and Europe, have spurred the growth of TPMS, wherein manufacturers are compelled to fit TPMS in new passenger and commercial vehicles. Growing emphasis on vehicle safety standards coupled with awareness among drivers is further driving the aftermarket demand for retrofitted TPMS solutions across fleets of aging vehicles. Technological advancements have strengthened the market's appeal, under which direct TPMS systems can provide precise, per-tire pressure readings, while indirect systems address cost-effective alternatives for budget and entry-level vehicles. Additionally, improved diagnostic tools, predictive maintenance, and IoT-enabled TPMS solutions grant fleet operators and consumers real-time access to the health of a vehicle's tires, enabling better operational efficiency and performance. The market further receives support from increasing global automotive production and urbanization, where higher sales in the Asia Pacific have driven greater adoption due to improved disposable incomes.

The aftermarket is growing steadily with the rise in sensor replacements, retrofits, along with the rise in general consumer acceptance for the benefits of TPMS. The adoption of TPMS systems is increasing, particularly in commercial fleets such as trucks, buses, and logistics vehicles, thereby enhancing safety against risks associated with tire blowouts. The adoption rate of OEM continues steadily, with increasing vehicle telematics, ADAS, and connected mobility solutions.

The Passenger Vehicle segment is projected to witness the highest CAGR in the Tire Pressure Monitoring System market during the forecast period.

According to Transpire Insight, The passenger car segment currently accounts for the largest market share because of the high volume of production as well as the stringent safety norms in the advanced as well as emerging auto markets. The adoption of TPMS in this segment enables enhanced safety features, fuel efficiency, and tire life. The direct TPMS system is widely adopted in the passenger car segment because it offers real-time clarity, thus improving the overall driving experience along with enhanced levels of car safety. Increasing awareness about tire efficiency is also boosting this segment.

The aftermarket for passenger cars also provides an attractive growth prospect, as older vehicles need an overhaul or replacement of the TPMS sensor itself. With the rising trend of urbanization and growing disposal incomes in the Asia Pacific region, in particular, the passenger car vehicle type will continue to drive major growth in the TPMS market. OEMs' efforts in incorporating TPMS in their vehicles, as well as the availability of diagnostic equipment in workshops and service centers, continue to make its dominance inevitable.

The Direct TPMS segment is projected to witness the highest CAGR in the Tire Pressure Monitoring System market during the forecast period.

Direct TPMS remains the preferred technology of choice in global markets as it provides real-time readings for tire pressures with high levels of accuracy. It has been widely used in high-end vehicles as well as commercial vehicles where the aspect of road safety and meeting the requirements of the latest regulatory norms could be accessed easily. The prompt pressurer deviation detection capability of the technology prevents road accidents related to tires.

Innovation in direct TPMS, such as increased battery life, wireless communication, and compatibility with vehicle telematics, stimulates increased adoption. The adoption of direct TPMS in new vehicles by manufacturers is fueled by its compliance with international safety regulations, in addition to which the aftermarket market is gaining traction through retrofits in older vehicles. The increased reliability and improved service features further support direct TPMS as the major segment in the market.

The OEM segment is projected to witness the highest CAGR in the Tire Pressure Monitoring System market during the forecast period.

According to Transpire Insight, Sales via the OEM are the most prominent type of distribution, largely supported by the government mandate for the Installation of TPMS in the vehicles. The incorporation of advanced driver assist systems, telematics, and intelligent vehicular systems has made the OEM a more strategic option for automakers in order to improve the safety and performance of the vehicles. The OEM will also help the automakers to use the same software and sensors.

The OEM segment is aided by global safety regulations in North America, Europe, and Asia Pacific, thereby creating a continuous and increasing demand in TPMS systems. The collaboration between TPMS suppliers and vehicle manufacturers has resulted in new innovations such as predictive monitoring, remote diagnostics, and IoT, thereby increasing the offerings in the OEM segment. The global increase in vehicle production is expected to be an important factor in boosting the OEM distribution in the TPMS market.

The North America region is projected to witness the highest CAGR in the Tire Pressure Monitoring System market during the forecast period.

The North American market remains at the forefront of the TPMS industry due to early adoption rates, well-developed regulatory environments, and large numbers of passenger cars in use in the market. OEM acceptance of TPMS is obligatory in new passenger cars and commercial vehicles in the market. Best practices in fleet management in the US have spurred the acceptance of TPMS in commercial fleets for predictive maintenance. Consumer awareness about tire condition and fuel economy is propelling the adoption of TPMS in the aftermarket.

Technological innovations are another major factor that has been playing an important role in keeping North America at the top position. Direct TPMS solutions are leading the market because of their accuracy and adherence to federal as well as state laws, but diagnostic equipment has been gaining popularity for servicing both OEM and aftermarket TPMS solutions within workshops. Large-scale representation from major TPMS solution providers makes North America a major zone for both global and local TPMS companies.

Key Players

The top 15 players in the Tire Pressure Monitoring System market include Continental AG, Sensata Technologies (Schrader), ZF Friedrichshafen AG, Denso Corporation, Pacific Industrial Co., Ltd., Robert Bosch GmbH, Valeo SA, Huf Hülsbeck & Fürst, Delphi Technologies, NXP Semiconductors, ATEQ, Bartec USA LLC, Hamaton Automotive Technology, Sate Auto Electronic, and Bendix Commercial Vehicle Systems LLC.

Drop us an email at:

Call us on:

+91 7666513636