Market Summary

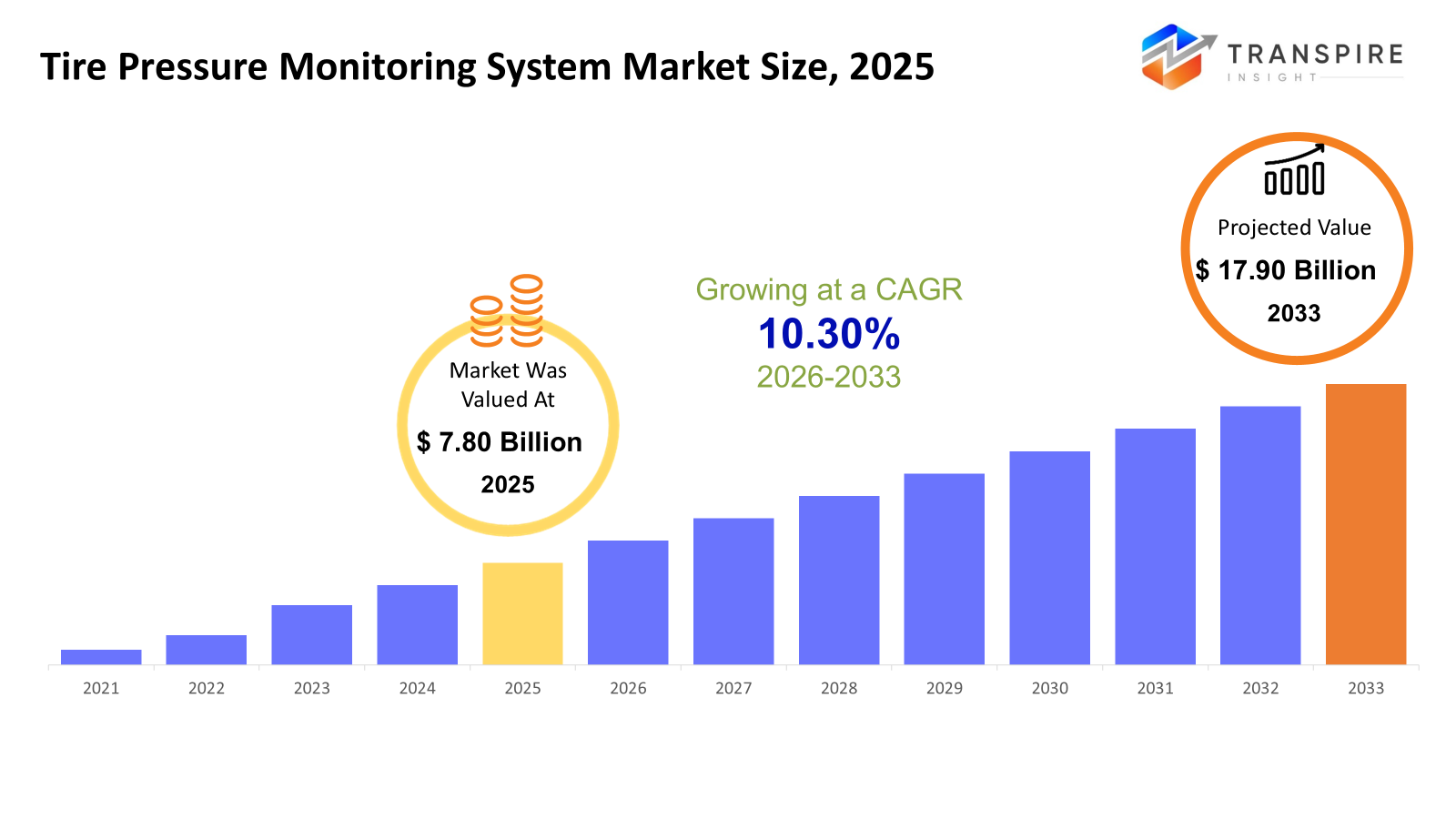

The global Tire Pressure Monitoring System market size was valued at USD 7.80 billion in 2025 and is projected to reach USD 17.90 billion by 2033, growing at a CAGR of 10.30% from 2026 to 2033. The market's Compound Annual Growth Rate is largely driven by the obligatory TPMS regulation in the prominent car markets, thereby securing continuous demand from the OEM segment. The rising number of car productions and the growing number of vehicles on the road are boosting sales in the OEM as well as the aftermarket. Advancements in technologies, such as the integration of the TPMS system in the IoT segment, are adding value to the TPMS system.

Market Size & Forecast

- 2025 Market Size: USD 7.80 Billion

- 2033 Projected Market Size: USD 17.90 Billion

- CAGR (2026-2033): 10.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America has robust TPMS segmentation, particularly in response to safety regulations, waning vehicle stock, and the maturity of OEM technology, while the increasing replacement business also reflects the growing volumes of aged vehicle sales in the region

- United States is the most developed market for TPMS, aided by the enactment of regulatory measures and the widespread deployment of direct TPMS, and the trend of the digitalization of the fleets further supports the utilization of TPMS in the logistics-oriented commercial vehicles market.

- The Asia Pacific market represents the fastest-growing market, driven by the increasing automotive manufacturing base in countries such as China and India, increasing safety awareness, and harmonization, which results in rapid adoption opportunities for cost-efficient indirect TPMS solutions

- Passenger car still leads the global market, driven by government legislations, high production volumes, and Increased consumer demand for safer and more frugal vehicles, especially in the smaller and mid-size segments in the regional markets of North America and Asia Pacific

- Direct TPMS is progressively getting popularity in regulated as well as high-end automobile sectors on account of higher accuracy levels and real-time monitoring capabilities, thereby further boosting the acceptance of the technology in North America and the Asia Pacific highly advanced automotive production centers

- OEM sales are largely dominant in the TPMS market, as stringent safety regulations guarantee OEM-installed systems, and greater integration of TPMS with ADAS and telematics systems will enhance their offerings in North America and Asia Pacific manufacturing bases.

So, The TPMS market includes electronic safety solutions that monitor tire air pressure continuously to alert drivers or fleet operators when the pressure falls outside recommended levels. Thereby, TPMS solutions are integrally important for ensuring vehicle safety, providing improved resistance against tire blowouts, enhancing fuel efficiency, and extending the life of tires. TPMS solutions are widely integrated across passenger and commercial vehicles and are delivered through both direct and indirect monitoring technologies, supporting regulatory compliance and preventive vehicle maintenance.

Stringent vehicle safety regulations in key automotive markets, such as North America and Europe, are the main causes of market demand due to mandated installation on new vehicles. These regulations are supported by a growing awareness among consumers with respect to road safety and operating efficiency of a vehicle. Development of sensor accuracy, battery life, wireless communication, and diagnostic features has eventually helped to improve reliability, and thus wider acceptance among automaker and fleet operators has grown. The market is aided by the growing number of vehicles produced across the globe, as well as the increasing number of vehicles on the road, especially in the Asia Pacific market, due to increasing disposable income. The commercial fleets of vehicles have started using TPMS systems that ensure minimum downtime, maintenance, or cost of ownership. The increasing number of connected cars will transform the TPMS system into one of the modules of the connected mobility ecosystem, thereby aiding the market.

Tire Pressure Monitoring System Market Segmentation

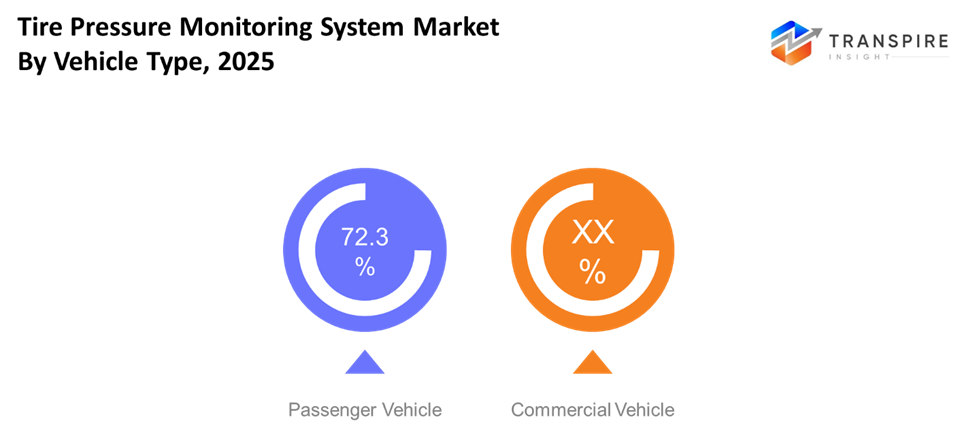

By Vehicle Type

- Passenger Vehicle

Passenger car segments account for the majority of global TPMS market penetration mainly because of their higher production volume and stronger emphasis on safety regulations in other markets. The primary contributory factor in this aspect is consumer education regarding fuel efficiency, tire wear, and safety associated with TPMS.

- Commercial Vehicle

The transportation sector, comprising trucks and buses, is seeing the integration of TPMS solutions for the optimization of fleet management. The adoption of TPMS technology for the transportation industry helps ensure safety of operations against blowouts, with the aspect of uptime being increasingly considered due to the optimization of cost of ownership.

To learn more about this report, Download Free Sample Report

By Type

- Direct TPMS

Direct TPMS utilizes a single pressure sensor mounted in each individual tire and provides specific, accurate, real-time pressure, and often temperature, information. Because this is so accurate, it is favored in countries that have strict safety requirements, such as North America and Europe, or whenever a high degree of performance is required for a vehicle. In fact, this situation also represents the outcome of regulatory compliance and solid OEM alignment.

- Indirect TPMS

Indirect TPMS estimates the pressure by means of wheel speed sensors, based on ABS/ESC data. This enables a lower-cost alternative to direct TPMS. While less accurate, indirect TPMS finds favor in more price-sensitive markets and economy vehicle classes where safety regulations are less stringent. Growth in this area will be driven by easier integration and cost lower barriers.

By Sales Channel

- OEM

The main sales segment for TPMS is through the original equipment manufacturer (OEM), owing to mandates stipulating the use of TPMS in new vehicle sales in prominent markets, besides more recent convergences towards advanced vehicle safety systems in association with telematics. The penetration in regulated markets is quite strong in the case of passenger as well as commercial vehicles.

- Aftermarket

The aftermarket business is seeing growth with the increasing vehicle parc, especially for a replacement or upgraded sensor (e.g., from an indirect to a direct system). Also, the growth of aftermarket sales is fueled by universal kits of TPMS and consumer acceptance of its safety advantage, especially in emerging markets.

Regional Insights

North America is an established market for TPMS, which is supported by stringent regulations and a higher rate of vehicle ownership. Demand for TPMS in North America is currently driven by the United States, and is followed by Canada and Mexico. Europe is growing steadily, thanks to safety regulations and advanced car production technologies. The tier one markets in Europe include Germany, the United Kingdom, France, Italy, and Spain, while the other markets in Europe experience marginal growth because of harmonized regulations. The Asia Pacific represents the greatest source of growth, led by China, Japan, India, and South Korea. The Tier one markets offer a strong ability for automotive production, alongside stricter safety requirements, while Tier two markets will grow through affordable technology push adoption. The growth in South America is moderate and improving, but the main markets in this region are Brazil and Argentina. The regulatory developments and par-k upgrades in the region promote the penetration of TPMS. Middle East Africa is classified as an emerging market, led by Saudi Arabia, the UAE, and South Africa. Premium sales, commercial fleet business, as well as retrofits in the second-tier economies, are contributing factors for this market.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 2025, Bosch unveiled the QUICK FIT+ TPMS sensors and the related Tire Pressure Analyzer 400 device to facilitate the programming and handling of TPMS modules in workshops with enhanced processes and broader support for vehicles. The sensors enable versatility in the design of the valve system and allow longer battery life and ease of programming. The device supports in excess of 95% of vehicles and universal sensors from diverse manufacturers.

- In June 2022, Sensata Technologies has incorporated a next-generation Tire Pressure Monitoring System (TPMS), named Intelligent TPMS, which meets the requirements of an Internet of Things (IoT)-enabled auto sector. This next generation of TPMS relies on Bluetooth Low Energy (BLE) wireless communication and enables both-way or bi-directional communication, which can offer advanced safety and authentication features as compared to earlier systems.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.80 Billion |

|

Market size value in 2026 |

USD 9.00 Billion |

|

Revenue forecast in 2033 |

USD 17.90 Billion |

|

Growth rate |

CAGR of 10.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Continental AG, Sensata Technologies (Schrader), ZF Friedrichshafen AG, Denso Corporation, Pacific Industrial Co., Ltd., Robert Bosch GmbH, Valeo SA, Huf Hülsbeck & Fürst, Delphi Technologies, NXP Semiconductors, ATEQ, Bartec USA LLC, Hamaton Automotive Technology, Sate Auto Electronic, Bendix Commercial Vehicle Systems LLC |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Vehicle Type (Direct TPMS, Indirect TPMS), By Sales Channel (OEM, Aftermarket) |

Key Tire Pressure Monitoring System Company Insights

Continental AG is a leader in TPMS solutions worldwide, combining high-precision sensors with advanced automotive electronics for real-time tire status and predictive analysis. Continental AG's TPMS solutions stand out for their ability to connect to the cloud, utilize Artificial Intelligence analytics, and integrate easily into other automotive safety solutions. This makes their solutions extremely desirable for global automotive OEMs and auto manufacturers in both private and commercial vehicles. Continental's advantage is its strong OEM relationships and its global manufacturing presence, as well as their continued investment in innovation and R&D. Of course, their strategy of focusing on connected mobility and fleet optimization puts them at a strong advantage in the future of TPMS, as it develops into more than simply automotive safety solutions.

Key Tire Pressure Monitoring System Companies:

- Continental AG

- Sensata Technologies (Schrader)

- ZF Friedrichshafen AG

- Denso Corporation

- Pacific Industrial Co., Ltd.

- Robert Bosch GmbH

- Valeo SA

- Huf Hülsbeck & Fürst

- Delphi Technologies

- NXP Semiconductors

- ATEQ

- Bartec USA LLC

- Hamaton Automotive Technology

- Sate Auto Electronic

- Bendix Commercial Vehicle Systems LLC

Global Tire Pressure Monitoring System Market Report Segmentation

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Type

- Direct TPMS

- Indirect TPMS

- Bottles

By Sales Channel

- OEM

- Aftermarket

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636