Market Summary

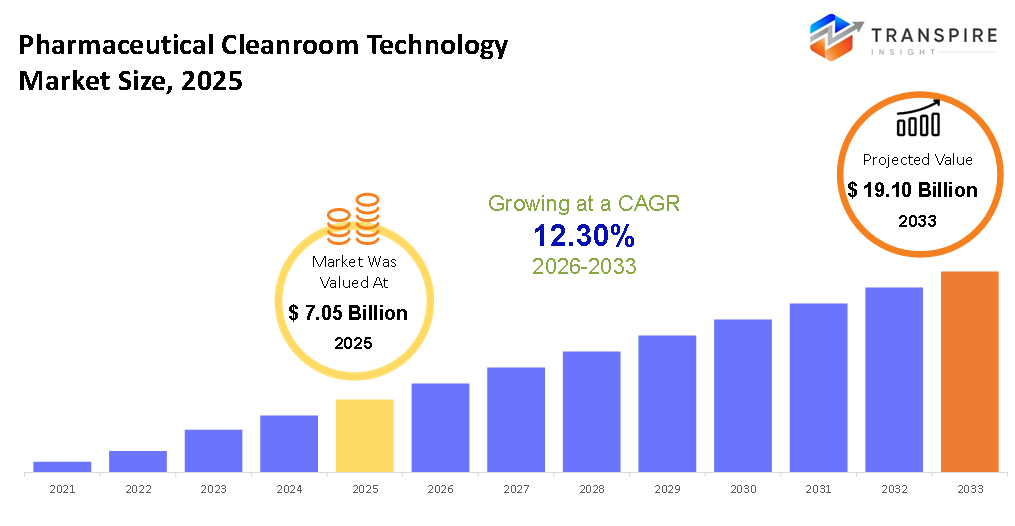

The global Pharmaceutical Cleanroom Technology market size was valued at USD 7.05 billion in 2025 and is projected to reach USD 19.10 billion by 2033, growing at a CAGR of 12.30% from 2026 to 2033. Sterile pharmaceutical cleanroom technology is at a rapid growth stage because the global demand for sterile drug manufacturing is very high and hence should not have traces of contamination. Increasing investments in biopharmaceuticals, strict rules, and more modular cleanrooms established are some of the factors that support people in accepting this technology. Moreover, advanced air filters with monitoring improve functionality, hence supporting market growth.

Market Size & Forecast

- 2025 Market Size: USD 7.05 billion

- 2033 Projected Market Size: USD 19.10 billion

- CAGR (2026-2033): 12.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Increasingly, North American Companies are adopting the more complex type of clean room technology due to the rise of biotech drugs, the demands of regulators for sterilized manufacturing processes, as well as the installation of clean room technology with scalable solutions for vaccines as well as other drugs.

- There is leadership by the U.S. regarding growth in terms of market due to the involvement of pharma as well as biotech companies. There is an increase in services related to validation/maintenance.

- There is rapid growth in the cleanroom market in the Asian-Pacific region because of the rise in the number of drug productions as well as biotech studies. This is assisted by the government policies that are promoting the local drug manufacturing industry, in addition to the use of modular cleanrooms that satisfy the strict global demands.

- The requirements for the equipment are rising as manufacturers around the globe are starting to install improved HVAC, filters, and monitoring systems to ensure the products remain sterile.

- The demand for consumables is steadily rising since personal protection equipment, gloves, and disinfectants are essential in maintaining a clean room in the biotech/pharma sector to ensure safety while producing a huge volume of the product.

The Global Pharmaceutical Cleanroom Technology Market is all about creating and taking care of super-clean rooms. These rooms stop pollution when making meds and biotech items. They're a big deal for keeping things germ-free, making sure products are safe, and following the rules. The market generally includes products such as air systems, filters, airflow systems, and supplies related to suits and cleaners. Additionally, the market includes related services related to setting up, testing, and repairing these rooms. Increasingly, we find a need for these products, which ensure the purity of substances, as we are stipulating more biologics, more vaccines, more emerging therapies. Having tougher regulations in North America and Europe to ensure companies upgrade their old cleanrooms or develop a newer model with improved tracking systems, as well as the Asian nations investing funds for a good cleanroom system to develop more medicines for their populations around the globe, all contribute to an expanding market, making it grow even faster. Additionally, more people are using modular, quick-to-set-up cleanrooms and investing more funds in biotech-related research.

The new technology will make the process of clean rooms more efficient and accessible for everybody. Since every firm will want quality and will be concerned about the protection of quality from pollution, the size of the market will continuously increase. The increasing demand for healthcare and the use of sterilized drugs and biopharmaceutical research will help the market grow even more.

Pharmaceutical Cleanroom Technology Market Segmentation

By Product

- Equipment

The need for equipment is up because drug and biotech companies are putting money into better HVAC, filtration, and monitoring to keep things sterile, run smoothly, and meet the rules..

- Consumables

Consumables like Gloves, wipes, and protective gear are must-haves for keeping things clean.

- Services

while services including installation, validation, and maintenance support complex cleanroom operations and ongoing compliance.

To learn more about this report, Download Free Sample Report

By Cleanroom Type

- Standard Cleanrooms

Standard Cleanrooms are still a popular choice for factories that need a controlled space to meet rules and keep things running smoothly.

- Modular Cleanrooms

Modular cleanrooms are becoming increasingly popular because they can be set up quickly, are cost-saving, can easily grow, and are a match for new biotech labs and bigger manufacturing needs.

By End Use

- Pharmaceutical Companies

Pharmaceutical companies trigger the growth of the market because of the widespread manufacture of sterile medicaments and strict observance of high-quality standards, which require high-end clean room technologies.

- Biotechnology Companies

The use of cleanroom facilities is being adopted by biotechnology companies for biologics, cell and gene therapy, and vaccines in increasing numbers due to R&D expansion efforts.

Regional Insights

The regional market in North America, mainly in the United States of America, ensures an immensely favorable market for advanced clean room technology because of strong FDA regulations, large production of biotech drug manufacturers, and requirements for modular clean rooms.

The linear demand in Canada and Mexico could be observed to have huge investments in pharmaceutical production and technological advancements related to cleaner room technology.

The European region is next with steady growth in Germany, the UK, and France, which emerged at the top because of a strong pharma and biotech industry in these countries and increased biologic production. Spain, Italy, and Europe continue to invest in cleanrooms with a focus on efficiency and contamination control and a growing interest in standards compliant cleanrooms.

While China, India, and Japan have driven the growth, the Asia Pacific market is emerging rapidly to materialize as a market with healthy growth prospects. Growth is further led by government initiatives, a rise in domestic pharmaceutical manufacturing, and development in biotech R&D. Australia & New Zealand and other regional nations are increasingly adopting sophisticated equipment and services to meet international quality requirements. The South America market has seen steady growth, primarily due to the presence of Brazil and Argentina, although other countries are slowly developing the infrastructure for cleanrooms. Emerging developments in their countries have made the Middle East & Africa markets, such as Saudi Arabia, UAE, and South Africa, show growth in cleanroom technology applications in pharmaceuticals and biotechnology.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 2024, A modular cleanroom airlock solution designed to lower contamination risk and enhance personnel and material transition flow in highly regulated pharmaceutical and biotech environments, ES Clean Technology announced the launch of its CleanLock Module at INTERPHEX 2024. This invention demonstrates how cleanroom contamination control systems continue to advance technologically.

(Source: https://www.pharmtech.com/view/aes-clean-technology-launches-cleanlock-module)

- October 2025, At Lab Innovations 2025, Total Clean Air and Vanguard Healthcare Solutions started a new joint venture called Modular Clean Air. The goal of the venture is to make off-site manufactured, fully compliant modular cleanrooms for the pharmaceutical, life science, and biotech industries. The goal is to speed up cleanroom deployment while also making it safer and more compliant with regulations.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 7.05 billion |

|

Market size value in 2026 |

USD 8.50 Billion |

|

Revenue forecast in 2033 |

USD 19.10 billion |

|

Growth rate |

CAGR of 12.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

DuPont de Nemours, Inc., Kimberly‑Clark Corporation, Exyte AG, Illinois Tool Works, Inc., Azbil Corporation, Bouygues Group, Clean Air Products, Terra Universal, Inc., Labconco Corporation, Ardmac Ltd., ABN Cleanroom Technology, Airtech Japan, Ltd., Taikisha Ltd., Camfil, and Octanorm‑Vertriebs‑GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product (Equipment, Consumables, Services); By Cleanroom Type (Standard Cleanrooms, Modular Cleanrooms); By End Use (Pharmaceutical Companies, Biotechnology Companies) |

Key Pharmaceutical Cleanroom Technology Company Insights

DuPont de Nemours, Inc. is a well-known name in the Pharmaceutical Cleanroom Technology Market. This company sells advanced filter media, protective clothing, and ways to keep contamination under control. The company's global reach and extensive research and development work have made it possible for it to offer very reliable cleanroom solutions that meet the rules of the life sciences, biotechnology, and pharmaceutical industries.

The inventions brought about by the R&D activities of the company in high-performance materials and modular technologies have been enhancing the efficiency of the processes and ensuring that there are no risks of contamination in the manufacturing processes of the companies that use the cleanroom technology.

Key Pharmaceutical Cleanroom Technology Companies:

- DuPont de Nemours, Inc.

- Kimberly Clark Corporation

- Exyte AG

- Illinois Tool Works, Inc.

- Azbil Corporation

- Bouygues Group

- Clean Air Products

- Terra Universal, Inc.

- Labconco Corporation

- Ardmac Ltd.

- ABN Cleanroom Technology

- Airtech Japan, Ltd.

- Taikisha Ltd.

- Camfil

- Octanorm Vertriebs GmbH

Global Pharmaceutical Cleanroom Technology Market Report Segmentation

By Product

- Equipment

- Consumables

- Services

By Cleanroom Type

- Standard Cleanrooms

- Modular Cleanrooms

By End Use

- Pharmaceutical Companies

- Biotechnology Companies

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636