Market Summary

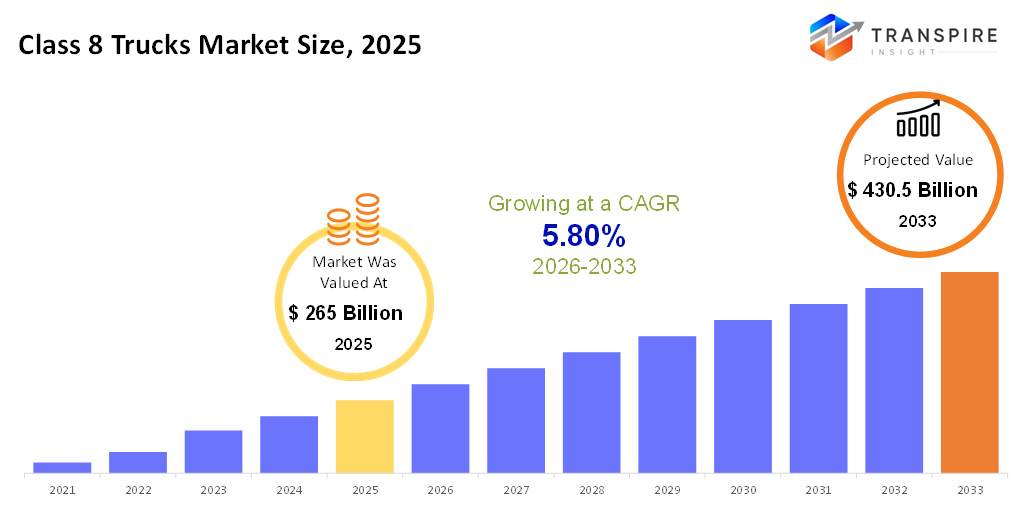

The global Class 8 Trucks Market size was valued at USD 265 billion in 2025 and is projected to reach USD 430.5 billion by 2033, growing at a CAGR of 5.80% from 2026 to 2033. The Class 8 Truck industry is of very large size. This industry is made up of the biggest trucks. These trucks are created to help transport large amounts of products to very long distances. They can be used for tasks such as building, mining, and transporting commodities. Class 8 trucks are basically the sort that includes rig dump trucks and cement mixers, which are above 33,000 pounds. The Class 8 trucks have a very significant impact on economies that trade with each other as well as facilitating the delivery of commodities from one place to another. Class 8 trucks can be regarded as the backbone of industry because they help commodities reach their destination.

There are a number of shifts happening in the world of e-commerce, freight, and trucks because of the available technologies as well as the need for a safe and efficient vehicle. There is also the need for tougher emission controls combined with a movement towards replacing the current generation of trucks. This will help the truck industry shift towards new class 8 trucks.

Market Size & Forecast

- 2025 Market Size: USD 265 Billion

- 2033 Projected Market Size: USD 430.5 Billion

- CAGR (2026-2033): 5.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- There is a requirement for Class 8 Trucks owing to the rise in online shopping and international shipping. Class 8 Trucks play an extremely significant role when it comes to the transportation of goods from one location to the other, especially when shipping the goods to the country or international locations. This is because Class 8 Trucks are the type of trucks used to ship the commodities over long-distance routes and play a significant part in the shipping of commodities. There is an increase in the requirement for Class 8 Trucks owing to the rise in online shopping and international shipping.

- Technologies such as fuel-efficient engines and predictive maintenance telematics. These technologies are comprised of ADAS safety systems. Technologies bring about numerous advantages. For instance, technologies allow us to experience performance. Technologies enable us to cut the costs of operating the product. Most importantly, technologies ensure the road is safe for the driver.

- They want to reduce stuff trucks put in the air, so they are making rules so that people use Class 8 trucks that are cleaner and get better gas mileage. This is going on around the world. The government is trying to reduce the things Class 8 trucks emit to the air. They want the Class 8 trucks to be cleaner and to use fuel in a conservative manner.

- Fleet Modernization and Replacement Trends: They want trucks that are capable of running for long periods without breakdown, a factor which has influenced the purchase of trucks by the truck owners. In addition, it can be said that most of the on-road trucks are getting older in these developed markets. Therefore, people are purchasing Class 8 trucks for reliable operation. They also need to replace trucks with new Class 8 trucks coming within the perimeter of new standards for safety and emission, because of fleet modernization and replacement trends.

In conclusion, the global market for Class 8 trucks is in good condition. This is because the market is increasing in size as more people buy Class 8 trucks. More people buy Class 8 trucks as more people buy goods from the internet, and there is a need for logistics. However, there is an issue with the negative effects that Class 8 trucks release into the atmosphere. This is because manufacturers have come up with Class 8 trucks that use fuel and batteries. This will impact the nature of Class 8 trucks in the future. Class 8 trucks will differ in the future owing to the concept that has been proposed. As such, the relationship presented in this scenario points towards the market that sustains the analysis and focus on the sustainability, efficiency, and enhancement of Class 8 trucks, thus leading to the inevitable role played by Class 8 trucks in global transport services.

Class 8 Trucks Market Segmentation

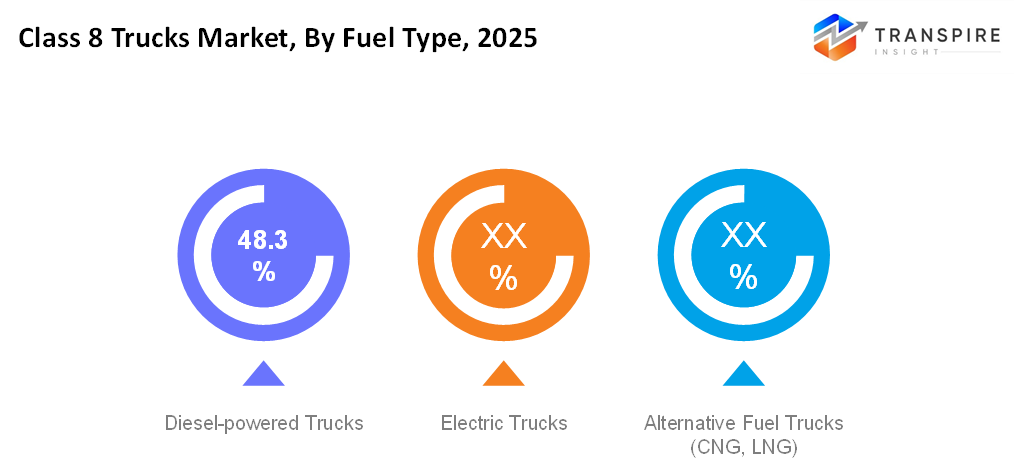

By Fuel Type

- Diesel Powered Trucks

Diesel trucks are currently the leaders in the Class 8 segment because of the torque and range they provide. They were always the vehicle of choice when it comes to long haul and heavyweight payloads.

- Electric Trucks

Battery-powered Class 8 trucks also continue to gain momentum because of the efforts of the transportation fleet to reduce the environmental impact of the trucks and reduce fuel costs. The advancement of battery technology and the offers by the government play a significant role in the promotion of the use of battery trucks, especially for intrastate deliveries.

- Alternative Fuel Trucks (CNG, LNG)

CNG and LNG trucks give a cleaner alternative for trucks that use diesel fuels. They produce fewer emissions, conserve fuel expenses as they become popular within vehicle fleets to meet the environmental standards without limiting the carrying ability.

To learn more about this report, Download Free Sample Report

By Application

- Freight and Logistics

Long haul transport, coupled with increasing e-commerce demand, drives Class 8 trucks as the biggest application segment. These trucks ensure bulk goods are moved efficiently across regional and international routes.

- Construction

The construction sector additionally has a demand for Class 8 trucks for the purpose of carrying heavy loads of cement, sand, and equipment. This demand has been sustained by infrastructure development as well as urbanization.

- Waste Management

Class 8 trucks hold importance regarding the collection and transportation of municipal and industrial waste, since their strong resistance, paired with their high load-carrying capacity, allows them to bear continuous heavy-duty work.

- Mining

The class 8 trucks are used in the mining process to transport ores, minerals, and overburden material. These trucks and their rugged design and high performance are essential in unconducive and remote locations.

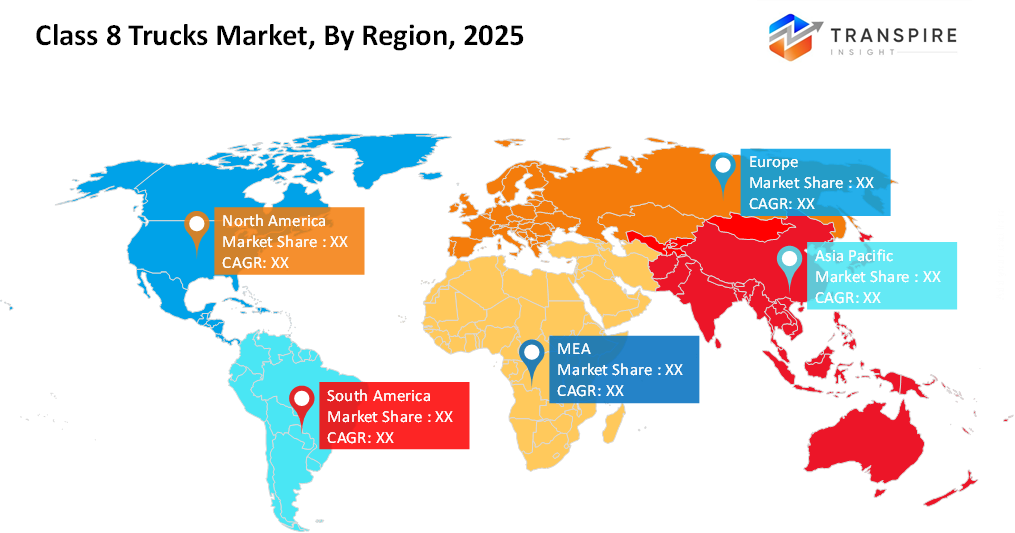

Regional Insights

North America is the most mature market by the size of class 8 trucks, and this is attributed to the presence of huge freight and logistics operations, developed highway infrastructure, and domestic demand for transportation services. This is led by the US and Canada, as truckers are replacing their old trucks with the installation of telematic and safety features that improve range and comply with emissions standards.

The Europe market contributes substantially as far as the Global Class 8 Truck Market is concerned due to strict emission regulations, investments in cleaner technologies, and constant cargo movement between various European nations. Major nations like Germany, the UK, and France are promoting alternative fuel trucks or electric trucks as part of sustainable development strategies and improving logistics infrastructure.

The Asia Pacific market leads and is expected to maintain its position in the Class 8 market, with rising industrialization and development in the areas of e-commerce and infrastructural development in the Chinese, Indian, Japanese, and South Korean markets. Increasing usage in the construction, mining, and logistics industries and support from the governments for environmentally friendly vehicles drive the market.

To learn more about this report, Download Free Sample Report

Recent Development News

- In April 2024, the Volvo Group announced its plan to build a new heavy-duty truck manufacturing plant in Mexico, parallel to their existing US-based operations. If this plan comes to fruition, Volvo would likely be the only active OEM in the US Class 8 segment operating a plant in Mexico by the year 2026, allowing them to further improve their supply flexibility and cost competitiveness.

- In January 2025, ReVolt introduced a new hybrid powertrain retrofit design for class 8 trucks that is less expensive than buying new battery electric vehicles. The series hybrid system includes a CATL 210 kWh battery alongside an onboard Scania diesel engine, which serves as a generator to charge the battery when in use. It enables 670 horsepower with 3,500 lb-ft of torque, supports 130,000 lbs gross vehicle weight rating, and has a combined range of 1200 miles.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 265 Billion |

|

Market size value in 2026 |

USD 290.00 Billion |

|

Revenue forecast in 2033 |

USD 430.00 Billion |

|

Growth rate |

CAGR of 5.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Daimler, Freightliner, International Motors, Isuzu Motors, Kenworth, Mack Trucks, MAN, Peterbilt, Scania, Volvo Trucks, Bell Trucks America, John Deere, Hitachi |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Fuel Type (Diesel-powered Trucks, Electric Trucks, Alternative Fuel Trucks (CNG, LNG)), By Application (Freight and Logistics, Construction, Waste Management, Mining) |

Key Class 8 Trucks Company Insights

With its broad portfolio-including IoT-enabled precision equipment, autonomous machinery, and data analytics platforms-Deere & Company is a clear market leader. Its global presence and significant investment in research and development allow the company to continue to innovate, providing scalable solutions for farmers that help improve operational efficiency and sustainability. Deere's ability to integrate hardware and software ecosystems provides a competitive advantage, which fosters wide diffusion across large commercial farms worldwide.

Key Class 8 Trucks Companies:

- Daimler

- Freightliner

- International Motors

- Isuzu Motors

- Kenworth

- Mack Trucks

- MAN

- Peterbilt

- Scania

- Volvo Trucks

- Bell Trucks America

- John Deere

- Hitachi

Global Class 8 Trucks Market Report Segmentation

By Fuel Type

- Diesel-powered Trucks

- Electric Trucks

- Alternative Fuel Trucks (CNG, LNG)

By Application

- Freight and Logistics

- Construction

- Waste Management

- Mining

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636