Jan 30, 2026

The report “Commercial Vehicle Steel Wheels Market By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles), By Wheel Type (Single Wheels, Dual Wheels), By Application (On-Road, Off-Road), By End-Users (Original Equipment Manufacturer, Aftermarket)” is expected to reach USD 9.20 billion by 2033, registering a CAGR of 7.60% from 2026 to 2033, according to a new report by Transpire Insight.

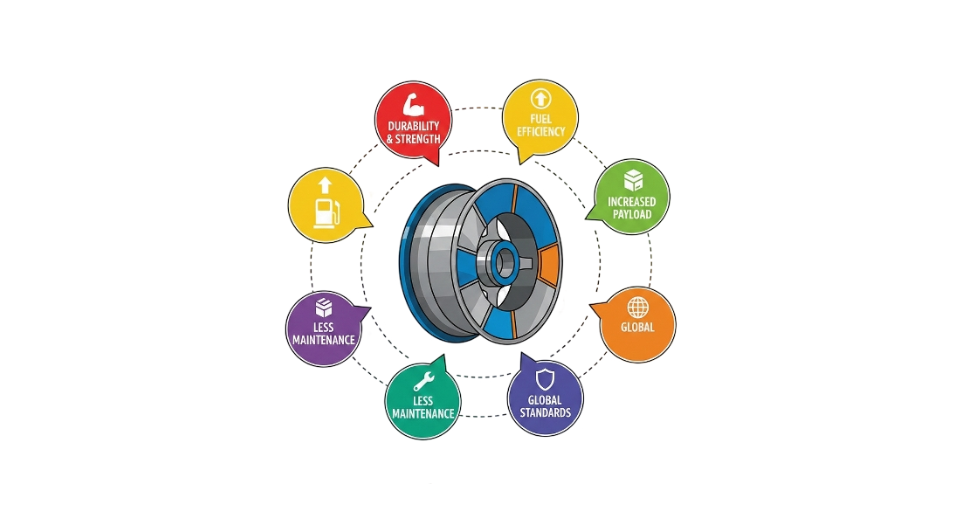

Steel wheels play a key role in how commercial trucks move goods worldwide, especially in lighter to heavier vehicle classes. Because they handle stress so well, these wheels stay strong even after long periods on bumpy roads. Toughness matters when carrying big weights day after day, which is why many fleets stick with steel. They resist dents and shocks better than some alternatives, holding up under pressure without needing constant replacement. In industries like freight, building, or factory hauling, reliability becomes more valuable over time. Fewer breakdowns mean smoother operations where delays cost too much.

Freight movement keeps climbing, pushing need upward along with construction projects popping up everywhere, and cities swelling too. Trucks that weigh more pull stronger demand because they carry heavier loads nonstop across regions, far and near. These big rigs often pick steel wheels; they last longer, fix easier, and cost less over time. For companies running many trucks, those traits matter deeply when trimming expenses and keeping downtime short. What sticks around through rough use wins every time in busy fleets.

Driving roads uses most steel wheels, thanks to delivery trucks, city buses, and freight services. Meanwhile, heavy machines in mines, farms, and building sites keep needing them too. Vehicle makers install these wheels at the factory, yet many get swapped later during repairs or upkeep. In developed areas, strong shipping routes help maintain stable sales. Elsewhere, growing road projects and more work trucks being built push usage upward slowly over time.

The Medium & Heavy Commercial Vehicles segment is projected to witness the highest CAGR in the Commercial Vehicle Steel Wheels market during the forecast period.

According to Transpire Insight, Heavy trucks and large delivery vans keep more goods moving today than ever before. Because roads carry bigger loads now, stronger parts become necessary under those rigs. Steel rims handle tough treatment better than most alternatives out there. Construction sites never stop needing materials hauled in day after day. Warehouses pop up further apart, demanding longer trips between them. Rugged terrain does not slow these machines down when built right. Demand climbs as cities stretch outward with new projects rising constantly. Long shifts wear out weaker components faster during nonstop runs. Sturdy metal wheels last through rough usage without failing unexpectedly. Transport needs grow, so do the numbers of big vehicles on highways.

Still, those who run large vehicle groups keep focusing on toughness, protection, and saving money; this keeps interest high here. Because steel rims hold their shape well, get fixed without trouble, and last a long time, they matter most when trucks can not afford delays or big repair bills. Over time, swapping out wheels on larger transport machines adds up, especially as more companies add vehicles, whether in established markets or growing economies, and that pattern will likely push consistent gains ahead.

The Dual Wheels segment is projected to witness the highest CAGR in the Commercial Vehicle Steel Wheels market during the forecast period.

It handles heavier loads better across tough jobs. Since medium and big trucks need stronger support, they often rely on these setups just to stay steady. Heavy-duty hauling, building sites, rugged hauls, those areas depend on twin wheels when work gets rough. Weight spread out across two wheels means less strain, smoother handling, and safer rides overall. Long trips loaded down tend to run safer because of how force spreads between paired rims.

Fleet managers often choose double-rim setups because they last longer under tough conditions. Though single setups exist, steel twins handle heavy loads better while reducing blowout chances during long hauls. When road projects multiply across regions, so does the need for sturdy axle pairs that keep cargo moving without delay. With shipping demands climbing worldwide, these paired rims stay essential gear for transport networks relying on steady performance year after year.

The On-Road segment is projected to witness the highest CAGR in the Commercial Vehicle Steel Wheels market during the forecast period.

According to Transpire Insight, with more goods moving by truck every day, demand for steel wheels climbs steadily on highways and city streets alike. Because online shopping expands constantly, delivery trucks roll more often, wearing out roads and tires just the same. These heavy-duty jobs favor steel wheels, not so much for flash but for lasting through rough routes without failing. They handle it all, mile after grueling mile.

Moving constantly across highways, commercial trucks face ongoing damage that keeps spare parts orders steady year after year. Because they cost less over time, resist harm better, and meet strict rules, most fleet managers choose metal rims for highway rigs. With delivery systems growing wider and trucking still moving most products, demand for these parts should stay high in the coming years.

The OEM segment is projected to witness the highest CAGR in the Commercial Vehicle Steel Wheels market during the forecast period.

From behind the scenes, original equipment makers shape much of how steel wheels move into commercial trucks today. Because these companies build everything from small delivery vans to massive haulers, output stays high. Instead of switching materials, builders stick with steel, which handles bumps, loads, and weather without issue. Price matters too; it simply works better on tight budgets. When roads fill up, and goods need moving, factories keep turning out vehicles, and each one needs durable wheels fastened early.

Steel wheels fit right into what manufacturers need when it comes to lasting tough conditions, meeting safety rules, yet sliding smoothly onto various truck models. When it comes to heavier trucks, makers often pick steel ones because they keep weight balanced and hold up year after year. Factories building more commercial rigs these days, paired with a move toward common wheel patterns, should help factory-fit sales stay strong in the years ahead.

The North America region is projected to witness the highest CAGR in the Commercial Vehicle Steel Wheels market during the forecast period.

Steel wheels stay popular in North America because trucks and transport systems rely on them heavily. Because roads stretch far and goods move constantly, these wheels get steady use. Trucks hauling cargo over long distances choose steel for its toughness under pressure. Construction sites depend on heavy machinery equipped with strong wheel bases, too. Across industries, the need grows just as fast as highways expand. Durability matters most when loads weigh tons and travel nonstop. Fleets replacing worn parts keep factories busy making more. Even as technology shifts elsewhere, this region sticks with what handles strain without failing. Demand stays firm thanks to daily wear across vast delivery routes. Relentless movement of materials through established trade corridors.

Not far off, big truck companies set a pace that keeps steel wheels common across North America. Because rules around safety and function stay tight, older designs hold their ground. Maintenance schedules pop up often, which means replacements are always needed. That rhythm feeds the parts market steadily. At the same time, factories keep building commercial trucks at reliable rates, helping original equipment sales stay flat but firm. Roads get upgraded regularly, adding life to existing trends. Shipments of cargo grow just enough to matter. All of it together ensures the region will not fade from view in the world of heavy-duty steel wheel use through the years ahead.

Key Players

Top companies include Maxion Wheels, Accuride Corporation, Hayes Lemmerz International, Janta Wheels, Sumitomo Steel, Bharat Forge, Mefro Wheels, ALCOA Wheels, Steel Strips Wheels, Wheels India Limited, Titan Wheel Corporation, CIE Automotive, Jiangsu Xingye Alloy Wheels, Kosei Aluminium Wheels, Nippon Steel & Sumitomo Metal, SSW Wheels, and Rimex Group.

Drop us an email at:

Call us on:

+91 7666513636