Market Summary

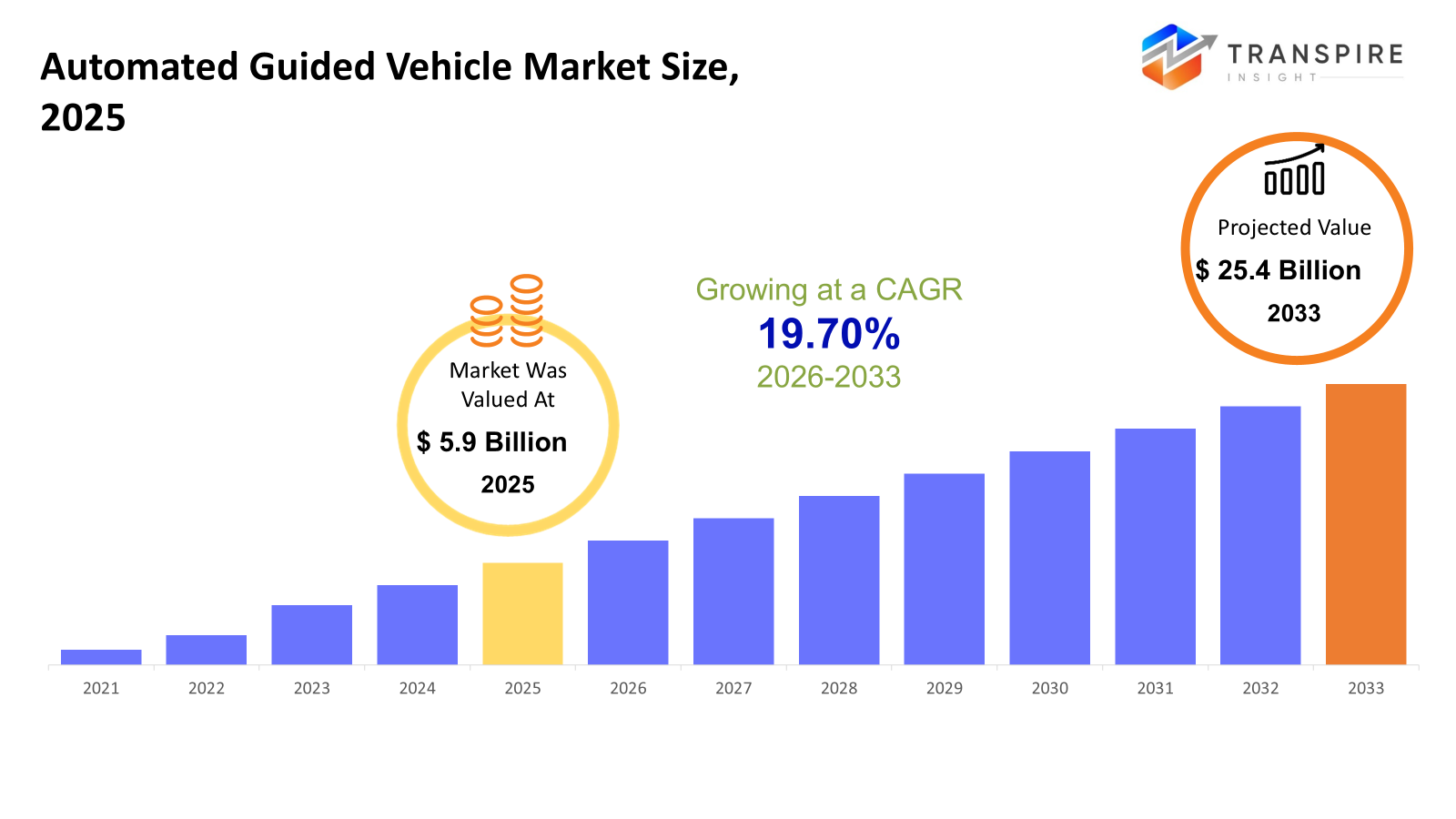

The global Automated Guided Vehicle market size was valued at USD 5.9 billion in 2025 and is projected to reach USD 25.4 billion by 2033, growing at a CAGR of 19.70% from 2026 to 2033. The accelerating pace of industrial automation, shortage of skilled labor, and the dire need for operational efficiency altogether drive the CAGR of the AGV market. Additional causative factors involve expansion in e-commerce logistics, integration of Industry 4.0, and AI-enabled navigation systems that further reinforce long-term sustained demand growth.

Market Size & Forecast

- 2025 Market Size: USD 5.9 Billion

- 2033 Projected Market Size: USD 25.4 Billion

- CAGR (2026-2033): 19.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Unlike other regions in the world, the case is different in the North American continent. Here, the penetration is quite large due to the developments made in warehouse automation, which involves higher labor costs as well as the increasing adoption of AI-driven enterprise-wide logistics solutions.

- United States dominates regional markets in large-scale e-commerce centers, smart factory deployment, and automobile-related automation, backed by capital investment capacity and demand drivers from the necessity of efficient and labor-intensive-free logistics platforms.

- Asia Pacific has the highest growth rate due to high rates of industrialization, expansion of manufacturing sectors in both China and India, smart factory projects in Japan and South Korea, and automation projects supported by both governments to enhance robotics usage in logistics, electronic devices, and automotive industries.

- Forklift AGVs lead in terms of vehicle type demands due to the need in the market for vertical storage options, high-density warehousing options, along with other automated pallet handling options owing to the rise in smart warehouses.

- Laser and Vision Guidance lead the industry in terms of adoption of lead navigation technologies. Laser and Vision Guidance technologies offer flexibility and scalability to the layout and integration with AI.

- Transportation and distribution again dominates as the key use case; this is because industries are moving in ways that involve internal logistics automation, material flow optimization, and throughputs in terms of demand for high-speed systems with minimal error rates in industrial ecosystems.

- Automotive and logistics & warehousing dominate end-user demand due to high automation maturity, capital investment capability, and large-scale operational footprints wherein AGVs directly contribute to productivity gains, cost reduction, and operational reliability in complex industrial operations.

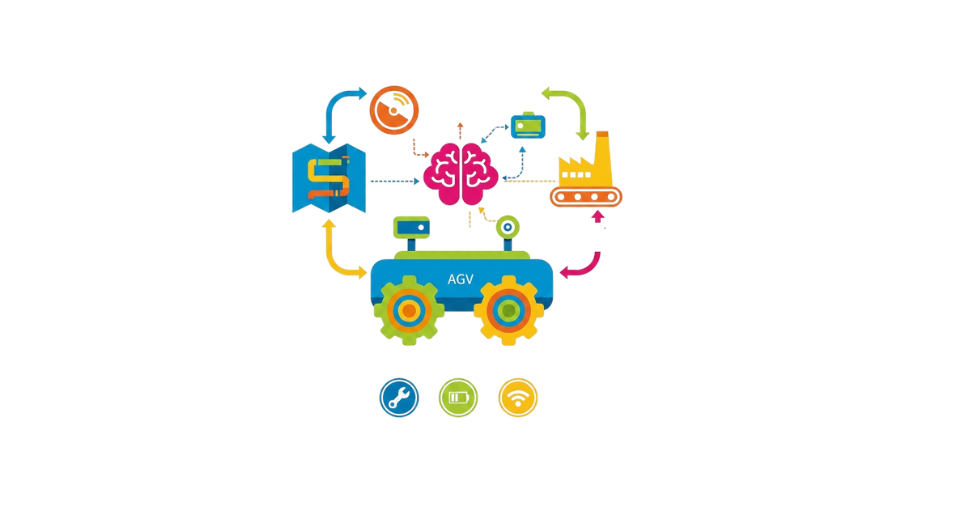

So, The Automated Guided Vehicles market encompasses a fundamental part of industrial automation infrastructure, allowing for automated and independent material handling, transportation, and logistics activities in industrial settings. AGVs eliminate dependency on manual labor in industrial settings in addition to furnishing enhanced safety, precision, and standardization. AGV system integration leads towards lean manufacturing, just-in-time production, and automated warehouse settings. There has been significant change in the market through the use of technology in the form of AI navigation, sensor integration, IoT interconnectivity, together with data-driven fleet management systems. AGVs nowadays have become part of modern warehouse management systems, enterprise management systems, together with predictive maintenance management systems, facilitating their integration with modern Industry 4.0 concepts.

Market growth will also be sustained by macro-economic factors such as labor gaps, heightening wage structures, growth in e-commerce, and greater imperatives for businesses to increase the resilience of their supply chains. Capital investment in smart factories and automated logistics points will continue to grow worldwide. Nevertheless, AGVs will evolve from optional investments in industrial automation to key asset infrastructures that will sustain long-term plant-based competitiveness.

Automated Guided Vehicle Market Segmentation

By Vehicle Type

- Tow Vehicles

These AGVS robots are used for towing multiple loads over long distances and can be cost-effectively used for repetitive material movements. These robots can be commonly found in the automotive and the big industries that require batch transportability.

- Unit Load Carriers

These types of AGVs are specific to the movement of a single load like a container or a pallet. They are preferred for precision. There is an increasing need for AGVs in the electronics and food processing sectors.

- Pallet Trucks

It automates horizontal pallet movements and minimizes labor requirements. It is also being incorporated in various logistics and distribution centers to increase efficiency in throughput movements.

- Forklift AGVs

The forklift AGVs do vertical lifting and stacking and, hence, are intended for high-bay warehouses. The adoption is strong in regions with advanced infrastructure in warehousing, particularly North America and Europe.

- Assembly Line Vehicles

These are designed to perform synchronized operations and, therefore, support just-in-time manufacturing. AGVs play a vital role in automotive and electronics assembly lines, maintaining consistency in work flows.

- Special/Hybrid Types

Hybrid AGVs are capable of more than one function, like towing and lifting, which provides operational flexibility. These finds increased applications in the complex industrial environment involving several kinds of material handling.

- Others

It includes customized and specialty AGVs tailored for more niche industrial tasks. Demand is generally project-oriented and specialized, manufacturing-based.

By Navigation Technology

- Laser Guidance

The precision and flexibility of laser guidance in AGVs are valuable assets in order to navigate changes in the warehouse space. Initial cost burdens are outweighed by lower maintenance requirements.

- Magnetic Guidance

On the one hand, while magnetic navigation techniques are reliable and cost-effective, they lack flexibility after being integrated. They remain an essential tool in many well-established and high-volume manufacturing facilities.

- Vision Guidance

The One type of AGV employs the use of cameras and artificial intelligence to aid navigation in its operation. Such technology for AGV operation allows for the dynamic change of warehouse layouts without the use of physical identifiers, a technology whose adoption is being propelled.

- Inductive Guidance

Inductive navigation systems depend on embedded wires for navigation that is robust and interference-free. However, the installation cost of these systems is high and thus applicable in fixed setups that are industrial in nature.

- Optical Tape / Other Guidance

Such systems are easy to deploy and cost-effective for low-scale operations. They are often utilized within the context of SMEs

To learn more about this report, Download Free Sample Report

By Application

- Transportation & Distribution

AGVs help streamline internal logistics through automation of repetitive movements. The highest use of AGVs is in large manufacturing plants in their internal logistics.

- Storage & Assembly

Used in automated inventory storage and line-side delivery, AGVs increase the precision of inventory data. The market is spurred by the increasing global warehouse automation.

- Packaging

AGVs increase efficiency on packages lines through continuous material flow and delivery. They have high application in the food, beverages, and consumer goods sectors.

- Trailer Loading/Unloading

This application reduces the turnaround time and labor dependency of the latter at their logistics hubs. Adoption is growing in North America and Europe because of a shortage of labor.

- Raw Material Handling

AGVs allow heavy or hazardous material to be moved with safety and speed. Industries such as metal processing and chemicals have been key adopters.

- Waste Management

AGVs support fully automated waste collection and disposal in manufacturing plants. Demand is niche but growing along with the sustainability initiative.

By End User

- Automotive

Automotive is the largest user of AGV technology because of the high degree of automation used in the industry. AGV technology helps the automotive industry in assembly activities, painting activities, and the transport of materials.

- Manufacturing

The general manufacturing sector utilizes AGVs in order to enhance operational efficiency and curtail labor costs. AGVs are increasingly being implemented across Asia Pacific countries owing to rapid industrialization.

- Logistics & Warehousing

AGVs inside the smart warehouse are an integral part, allowing fast order fulfillment. They are driven by large distribution centers in North America and Europe.

- E-commerce & Retail

With growing online sales contributing to increased demand for automated guided vehicles in these facilities, scalability and speed of AGVs are important drivers of this trend.

- Food & Beverage

AGVs are commonly used in clean room environments with controlled temperatures. Notable growth can also be found in Europe and Asia-Pacific due to safety regulations.

- Healthcare & Others

In the healthcare industry, AGVs are employed to transport medicines as well as other supplies. Its adoption still continues to be at a moderate rate but will likely improve as hospital automation picks up.

Regional Insights

The market in the continent of North America includes the countries of Canada, the United States, and Mexico. It is a mature market for AGVs with automation infrastructure well-established in the US. It has a large labor cost and hence the market is well-invested in the area of logistics. The US is well-established in warehouse automation as well as the area of intelligent manufacturing. Europe, which comprises Germany, the UK, France, Spain, Italy, and Rest of Europe, exhibits a well-established growth pattern of AGVs through numerous programs related to Industry 4.0, smart factories, and regulatory-driven industrialization. Germany holds a strong position in industrial robotics, while Western Europe excels in warehouse robotics, and Southern Europe shows potential in industrial robotics.

Asia Pacific, encompassing countries such as Japan, China, Australia/New Zealand, South Korea, India, along with the ‘Rest of Asia Pacific’ countries, represents the highest growth rate segment in the regional landscape. Countries such as China, Japan, Korea are leaders in the manufacturing automation space, while India depicts a rising adoption rate in a fledgling space marked by modernization in the logistics industry along with growth in industries in the country. The value of the AGV industry in this region, including Brazil, Argentina, and the Rest of South America, is growing as this is still an emerging market in the region. The Middle East & Africa region, including Saudi Arabia, UAE, Africa, and the Rest of Middle East & Africa, reflects AGV adoption on a growing scale through smart infrastructure development across the region, industrial diversification, and logistics development in this region.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Jungheinrich AG has plans to grow beyond its typical role in providing forklift products and into a data-driven intralogistics and automation platform. This plan represents its strategic growth into automated systems and software.

- In June 2025, During the event at company Automatika, Siemens announced integration of Copilot, an operations AI tool from Siemens, into autonomous transport robots, with an indication of more robust integration between AGVs/AMRs and AI.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 5.9 Billion |

|

Market size value in 2026 |

USD 7.2 Billion |

|

Revenue forecast in 2033 |

USD 25.4 Billion |

|

Growth rate |

CAGR of 19.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Toyota Industries Corporation, Daifuku Co., Ltd., KION Group AG, Jungheinrich AG, SSI Schaefer Group, Murata Machinery, Ltd., Mitsubishi Logisnext Co., Ltd., Hyster-Yale Materials Handling, Inc., Seegrid Corporation, Dematic Group, E&K Automation GmbH, KNAPP AG, Rocla Oy, BALYO SA, Omron Corporation |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Vehicle Type (Tow Vehicles , Unit Load Carriers, Pallet Trucks, Forklift AGVs, Assembly Line Vehicles , Special/Hybrid Types, Others), By Navigation Technology (Laser Guidance , Magnetic Guidance, Vision Guidance, Inductive Guidance, Other Guidance), By Application (Transportation & Distribution, Storage & Assembly, Packaging, Trailer Loading/Unloading, Raw Material Handling, Waste Management) and By End User (Automotive, Manufacturing, Logistics & Warehousing, E‑commerce & Retail, Food & Beverage, Healthcare & Others) |

Key Automated Guided Vehicle Company Insights

Toyota Industries Corporation is a leading player in the AGV industry backed by the strong foundation of having an in-built presence in material handling through their manufacturing capabilities across the globe. The enterprise has great technological strengths as they have combined AGVs, AMRs, material handling machines like forklifts, along with warehouse management software, providing endutomation solutions in this sector to their esteemed clients across industries like the automotive industry, logistics, manufacturing, etc., in places like North America, Europe, and the Asian Pacific region. Safety, scalability, innovation from these perspectives, they have maintained their strong grip in this industry through their strong financial base.

Key Automated Guided Vehicle Companies:

- Toyota Industries Corporation

- Daifuku Co., Ltd.

- KION Group AG

- Jungheinrich AG

- SSI Schaefer Group

- Murata Machinery, Ltd.

- Mitsubishi Logisnext Co., Ltd.

- Hyster-Yale Materials Handling, Inc.

- Seegrid Corporation

- Dematic Group

- E&K Automation GmbH

- KNAPP AG

- Rocla Oy

- BALYO SA

- Omron Corporation

Global Automated Guided Vehicle Market Report Segmentation

By Vehicle Type

- Tow Vehicles

- Unit Load Carriers

- Pallet Trucks

- Forklift AGVs

- Assembly Line Vehicles

- Special/Hybrid Types

- Others

By Navigation Technology

- Laser Guidance

- Magnetic Guidance

- Vision Guidance

- Inductive Guidance

- Other Guidance

By Application

- Transportation & Distribution

- Storage & Assembly

- Packaging

- Trailer Loading/Unloading

- Raw Material Handling

- Waste Management

By End User

- Automotive

- Manufacturing

- Logistics & Warehousing

- E‑commerce & Retail

- Food & Beverage

- Healthcare & Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636