Jan 02, 2026

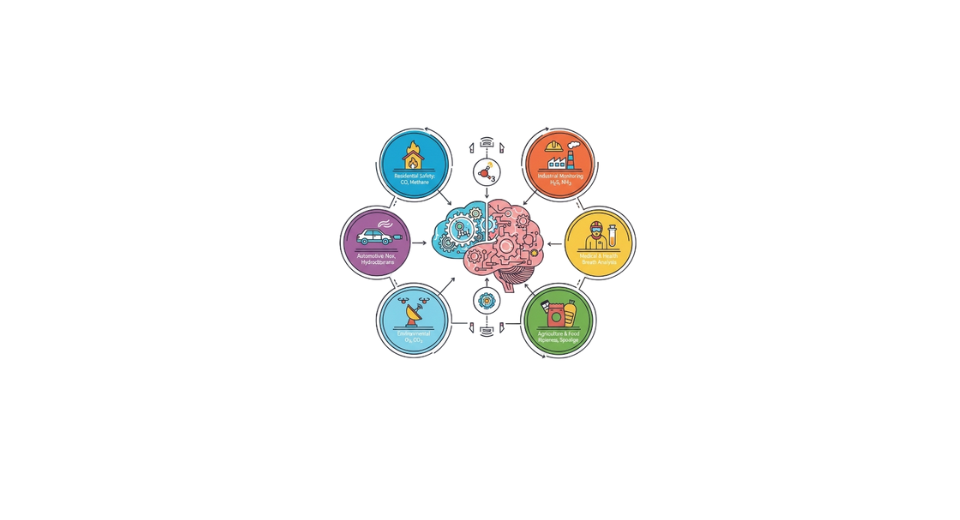

The report “Gas Sensors Market By Product Type (Electrochemical Sensors, Infrared Sensors, Semiconductor Sensors, Catalytic Sensors, Photoionization Detectors, Others), By Gas Type(Oxygen, Carbon Monoxide, Carbon Dioxide, Hydrogen, Methane, Nitrogen Oxide, Others), By Type (Wired, Wireless), By Application (Industrial Safety & Monitoring, Environmental Monitoring, Medical & Healthcare, Automotive, Residential & Commercial Building, Oil & Gas, Others)” is expected to reach USD 3.40 billion by 2033, registering a CAGR of 8.58% from 2026 to 2033, according to a new report by Transpire Insight.

Fueled by a growing push to track harmful, flammable, and climate-affecting gases, demand for gas sensors climbs in factories, homes, hospitals, and outdoor settings. Instead of relying on older methods, industries now lean heavily on electrochemical, infrared, and semiconductor types alongside catalytic and photoionization designs for critical checks in places like refineries, city air stations, cars, and worksites. Because people pay closer attention to what's in the air they breathe, rules get tighter, pushing smarter sensor tech into wider use.

Fueled by strict safety rules, industries need reliable tools to meet standards. Electrochemical models lead because they react sharply even with minimal energy. Though small, these devices pack a punch when tracking invisible threats across factories and plants. Meanwhile, gadgets that connect through wireless networks grow more common, especially where live updates matter far from central hubs. Out in the field or on wheels, instant data flow keeps operations aware and alert. As buildings get smarter, vehicles link up, and clean power spreads, the push for constant sensing grows stronger. Not just backup parts anymore, sensors now sit at the core of how modern setups run day to day.

Nowhere else do tiny sensors evolve faster than here, where new materials meet smarter designs. These devices detect more gases at once, fitting into smaller spaces without losing performance. Performance matters most when conditions turn tough, and factories and outdoor sites demand reliability. Progress comes not just from better parts but from how they connect to data systems afterward. Firms now bet on partnerships that last years, locking in supplies before demand spikes. Growth will come slowly but steadily, fed by interest in cleaner air and safer workplaces. New regions open up as cities monitor pollution like never before.

The Electrochemical Sensors segment is projected to witness the highest CAGR in the Gas Sensors market during the forecast period.

According to Transpire Insight, a surge in demand could push electrochemical sensors ahead in the gas detection race over the coming years. Because they respond sharply to trace gases while using little energy, these units show strong promise. Detection of dangerous fumes like carbon monoxide or lack of oxygen keeps factories, homes, and outdoor sites safer. Nitrogen oxide warnings also come into play where air quality matters most. Performance consistency helps users trust readings without constant recalibration. Precision in targeting specific gases sets them apart from broader alternatives. Critical environments lean on this trait when lives depend on early alerts.

A surge in need for cleaner indoor air, safer workplaces, and tighter pollution rules pushes more users toward electrochemical sensors. Alongside this shift, a growing move to smart, linked devices - like wireless networks and internet-connected monitors keeps expanding their use across factories, offices, and homes around the globe.

The Carbon Monoxide segment is projected to witness the highest CAGR in the Gas Sensors market during the forecast period.

Faster demand might lift electrochemical sensors above others in gas detection soon. Sharp reactions to tiny amounts of gas, along with low power needs, give them an edge. Factories, houses, and open areas stay safer when toxic smoke or missing oxygen is caught early. In places where clean air counts, spotting nitrogen oxides becomes key. Steady results mean people rely on them more, even after long stretches without adjustments. What makes these systems different is how they spot only certain gases. In places where timing matters, people rely on that sharp focus. Alerts come fast because of it.

More people want cleaner air indoors, healthier work areas, and stricter emissions controls, which is pulling them toward electrochemical sensors. Devices that talk to each other without wires, systems that connect through the web, are spreading fast into buildings, plants, and living spaces worldwide, feeding the trend steadily along the way.

The Wireless segment is projected to witness the highest CAGR in the Gas Sensors market during the forecast period.

According to Transpire Insight, despite challenges with wiring, more industries now choose wireless options because they send updates instantly. These devices connect smoothly to smart systems without needing complex setups nearby. Factories, offices, and homes find them useful when constant air checks matter most. Their growth outpaces others simply due to practical benefits in tough spots. Remote alerts keep people informed even from faraway locations. Flexibility gives them an edge wherever movement or layout changes often.

Fuel for wireless gas sensors comes from smarter factories, networked buildings, and lighting up demand. Another driver placement is easy in risky spots where wires will not go. Cloud links grow tighter, feeding data flows into remote dashboards far away. Mobility meets measurement, pushing adoption across borders, slowly rising.

The Industrial Safety & Monitoring segment is projected to witness the highest CAGR in the Gas Sensors market during the forecast period.

Faster growth ahead for industrial safety and monitoring within the gas sensors market, due to tough rules on worker protection, plus rising demand to track dangerous fumes at job sites. Factories lead the way here alongside chemical plants, refineries, pipelines, and similar settings where unseen vapors can turn deadly without warning.

More attention on protecting workers, along with rules companies must follow and newer tools that watch conditions closely, pushes up the need here. Systems that sense danger instantly, send data without wires, connect through smart networks for spotting gases make workplaces safer, work smoother, handle threats better, boosting expansion worldwide in how industries monitor and protect their teams.

The North America region is projected to witness the highest CAGR in the Gas Sensors market during the forecast period.

Ahead of other regions, North America sees steady momentum in demand for gas sensors thanks to tighter rules on workplace safety and emissions control. What helps even more is the growing trust in modern detection tools that offer reliable performance under tough conditions. Factories, refineries, and chemical plants now lean heavily on automated oversight systems, often networked and responsive in real time. Funding flows into tech upgrades, especially where buildings think for themselves, or machines talk to one another. Standards keep rising, pushing companies to monitor air quality with sharper precision than before.

Fuelled by needs for instant gas tracking and safer workspaces, North American uptake of sensing tech climbs fast, wired into smart systems across factories and fields. Leading the pack, the United Kingdom pushes ahead thanks to dense industrial zones and tight rules on emissions. Meanwhile, up north, Canada gains ground slowly, applying these tools more each year in industry tasks plus nature watch efforts.

Key Players

Top companies include ABB Ltd, Alphasense, Honeywell International, Figaro, Amphenol Advanced Sensors, Dynament Ltd, SGX Sensortech, Spec Sensors Inc., Dragerwerk Ag & Co. KGaA, FLIR Systems Inc., Siemens, Robert Bosch, Nemoto & Co. Ltd, Membrapor, Alvi Automation, SmartGas Mikrosensorik GmbH.

Drop us an email at:

Call us on:

+91 7666513636