Jan 02, 2026

The report “Flow Battery Energy Storage Market By Type (Vanadium Redox Flow Batteries, Zinc-Bromine Flow Batteries, Iron Flow Batteries, Hybrid Flow Batteries), By Battery Type (Redox, Hybrid), By End-Users (Utility, Industrial, Residential & Commercial)” is expected to reach USD 77.54 million by 2033, registering a CAGR of 6.66% from 2026 to 2033, according to a new report by Transpire Insight.

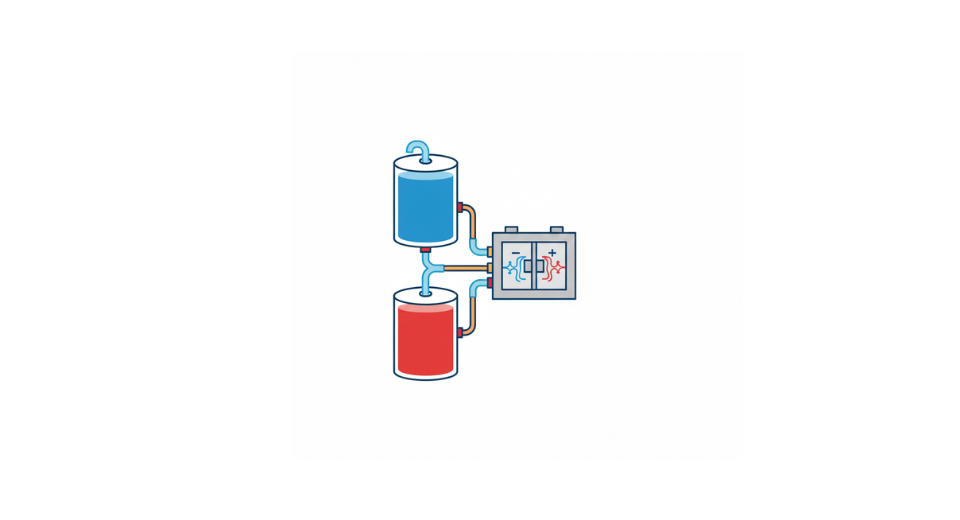

Energy demand pushes growth in flow battery storage across the world. What stands out is how well these systems handle extended use while scaling up easily. Instead of fading fast, they last many cycles without major wear. Safety matters too; these units do not catch fire often, making them reliable over time. Power levels can shift independently from total stored energy, which gives operators more control. Vanadium-based types lead because they balance performance and durability. Renewables work better when sudden drops or spikes get smoothed out. Grids stay steady during heavy usage periods due to timed releases from such batteries. Projects using them now span continents, quietly storing excess power until it is needed.

Renewable power, like sunlight and moving air pushes more interest in flow battery systems. Growth happens fast, where grids get upgrades or small networks form. Big electricity providers take charge first, yet factories and stores begin using these batteries too. Stable supply, lower bills, fewer emissions. Better tech helps them work well, and materials become cheaper over time. Rules that push cleaner choices also give markets a boost.

What powers much of North America's lead is its strong grid network and rules that push renewables, along with a head start on big utility ventures; the United States handles most installations here. Moving into Asia Pacific, growth zooms ahead fastest, sparked by national spending in China, Japan, and South Korea aimed at storing power from clean sources. Over in Europe, quiet but steady progress rolls forward thanks to policies focused on cutting carbon emissions. New designs such as hybrid flow batteries are gaining ground, while materials like iron or zinc-bromine begin finding space in factories and businesses looking for cheaper, scalable options.

The Vanadium Redox Flow Batteries segment is projected to witness the highest CAGR in the Flow Battery Energy Storage market during the forecast period.

According to Transpire Insight, their tech has had time to prove itself. Longevity counts here; these batteries handle repeated charging without wearing down fast. What also shifts attention their way is how easily they scale up or down depending on need. Utilities lean into them more now, especially for big projects tied to power infrastructure. Unlike some systems, stored energy and delivery strength are not locked together in these units. That separation means storing vast quantities becomes smoother while keeping steady release rates. They hold up well when feeding solar or wind power smoothly into electrical networks. Steady performance fits tightly with managing surges and balancing supply across regions. Because of this role, interest grows steadily from countries expanding clean energy setups.

More renewable energy setups now going live, while supportive rules and rewards for storing green power help push vanadium flow batteries into wider use. Better chemistry control, flexible system layouts, and smarter monitoring make these units run smoother at lower expense, giving them an edge on alternatives. This part of the field looks set to outpace others, taking the largest portion ahead in the years to come.

The Redox Flow Batteries segment is projected to witness the highest CAGR in the Flow Battery Energy Storage market during the forecast period.

Redox flow batteries are growing in the flow battery market. Their edge comes from storing large amounts of energy for extended periods, scaling easily when needed. Power and storage can be sized separately. Vanadium systems lead, though other types also play a role. Utilities and industries lean on them because they last many cycles without major wear. Design flexibility helps adapt them to different setups. Growth follows where stable, long-term storage matters most.

More need for steady power grids, handling high usage times, and better integration of clean energy keep pushing redox flow batteries forward worldwide. Progress in liquid mixtures used inside, flexible system designs, and smarter control tech brings higher output, lower expense, and stronger results. Backed by helpful regulations, expanding green power projects, and greater factory-level electricity demands, this part of the storage field looks set to grow fast while staying ahead among similar technologies.

The Utility Sectors segment is projected to witness the highest CAGR in the Flow Battery Energy Storage market during the forecast period.

According to Transpire Insight, Stability on the grid pushes utilities to explore new storage paths. Instead of short-term fixes, many now look toward flow batteries for longer solutions. Vanadium redox models stand out because they handle irregular solar and wind output well. Power providers favor these systems since they last through thousands of cycles without major wear. Unlike some alternatives, they do not degrade quickly under constant use. Their design allows expansion without redesigning entire setups. Safety plays a role, too; fewer risks mean easier approvals. As demand grows, so does adoption across big infrastructure projects. Steady performance makes them fit for tasks where failure is not an option. These traits together explain why this segment leads in growth right now.

Fueled by steady policy backing, clear, clean energy goals, and upgrades to intelligent power networks, flow batteries are gaining ground fast among electric providers. New advances in flexible setups, smarter energy use, and control tech have lowered running expenses while boosting output, giving these systems an edge for extended, stable storage needs. Because of this momentum, the utility area will likely stay ahead, shaping expansion across the entire flow battery storage landscape.

The North America region is projected to witness the highest CAGR in the Flow Battery Energy Storage market during the forecast period.

Strong support for renewables sets the pace. Early moves into big energy storage shape progress there. Modernizing power networks adds momentum across states. Infrastructure here works well because it evolved fast. Money flows into green tech thanks to steady backing. United States-based makers lead the field, pushing innovation forward. These companies anchor development throughout the area. Vanadium systems handle heavy-duty tasks on grids. They manage supply peaks while soaking up solar and wind output. Projects at scale now run regularly in several regions. Growth climbs steadily as needs shift toward flexibility.

Fueled by steady policy backing and clearer rules on deployment, while curiosity around localized power networks grows, the movement picks up speed throughout North America. Battery gains not just longer life but smarter assembly approaches along with sharper control software lift capability while pressing down expenses, pulling grid operators and big manufacturers closer. With momentum building from these shifts, dominance in this sector looks set to stay rooted here, claiming a notable piece of worldwide flow battery capacity ahead.

Key Players

Top companies include Invinity Energy System Plc., RKP Storage, Sumitomo Electric, Vizn Energy Energy Systems, Cellcube, VRB Energy, Enel Group, Kemiwatt, Stryten Energy, Everflow, Primus Power, Lockheed Martin, Honeywell, Invinity, C&R Technologies, ESS Tech, Inc.

Drop us an email at:

Call us on:

+91 7666513636