Market Summary

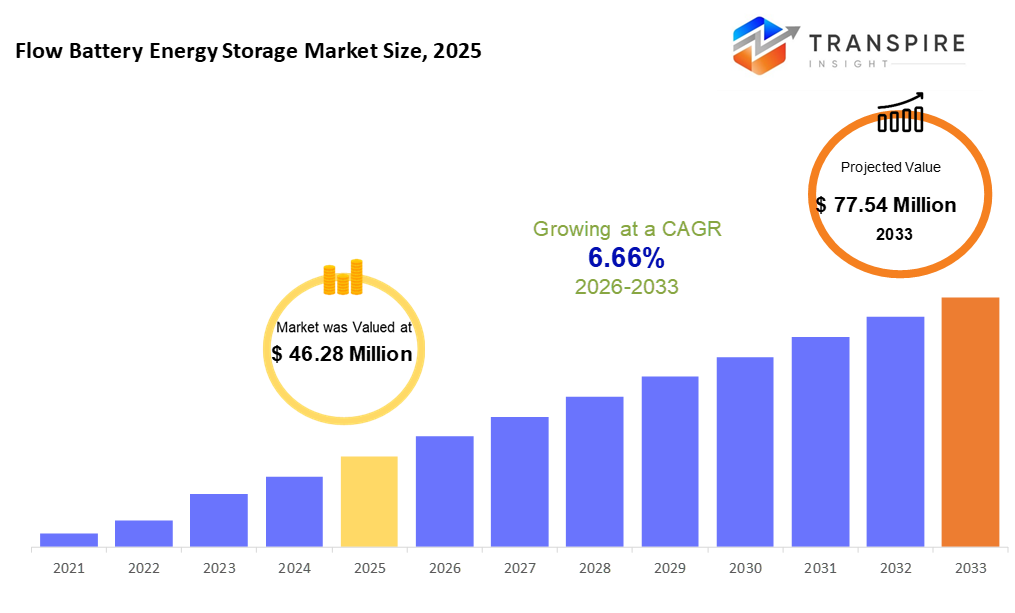

The global Flow Battery Energy Storage market size was valued at USD 46.28 million in 2025 and is projected to reach USD 77.54 million by 2033, growing at a CAGR of 6.66% from 2026 to 2033. The flow battery energy storage market is expanding as power grids require reliable, long-duration storage to support rising renewable penetration. Utilities favor flow batteries for their scalability, long operational life, and low fire risk. Growing investments in grid resilience, peak load management, and decentralized energy systems across industrial and commercial sectors are further accelerating adoption.

Market Size & Forecast

- 2025 Market Size: USD 46.28 Million

- 2033 Projected Market Size: USD 77.54 Million

- CAGR (2026-2033): 6.66%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 45% in 2026. Clear rules favoring clean power, steady upgrades to electricity networks, plus a habit of trying new tech in big energy setups. That mix shows up clearly on the map; this region stays ahead. Not every place moves at this pace, but here it sticks.

- Across North America, it is the United States leading the way in adopting flow batteries. Support from both federal and local governments pushes larger energy storage projects forward. Microgrids are also seeing growth thanks to these policies.

- Fueled by a surge in solar and wind power, the Asia Pacific area sees rising demand for flow batteries. Big power initiatives in China shift momentum toward longer-lasting storage. Japan moves forward with backing from national policies. In South Korea, infrastructure upgrades open doors for new battery systems. Government incentives play a role behind the scenes. Growth here outpaces other regions quietly but steadily.

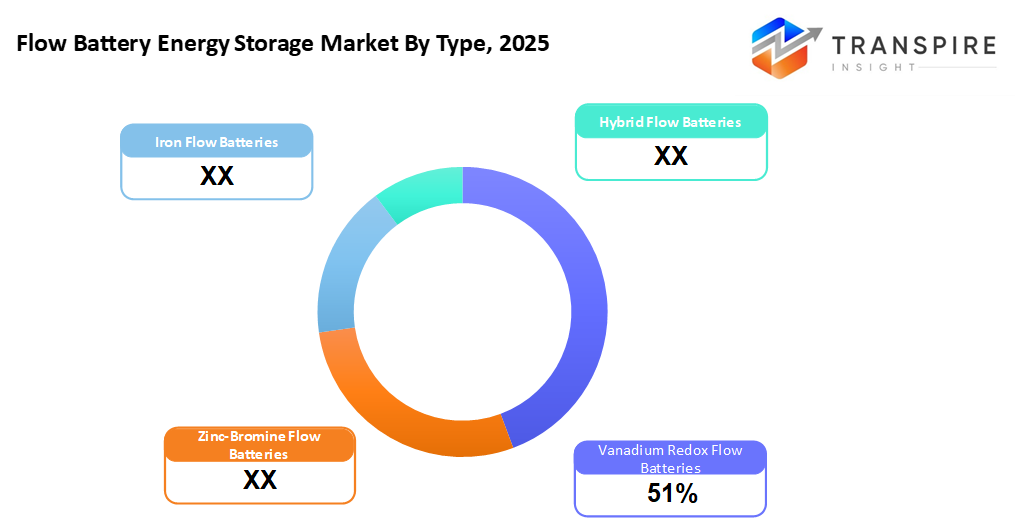

- Vanadium Redox Flow Batteries share approximately 54% in 2026. Vanadium redox flow batteries. Their tech is not new; it works reliably. These units handle thousands of cycles without failing. Utilities lean on them often. Big installations favor this type. Grid storage projects pick them regularly. Years of real-world use back their position.

- Redox flow types beat hybrids due to room to grow, steady performance, plus fitting well into massive green power systems.

- When it comes to who uses flow batteries most, utilities take the lead. These systems help manage power peaks while keeping grids stable. Instead of short bursts, they store energy over extended periods. Renewables gain a stronger backup because of this setup. Long runs matter more than quick hits here.

Liquids hold the charge in a type of battery built for big jobs. Flow batteries run on chemical soups pumped through cells. One kind uses vanadium, another mixes zinc with bromine, while some rely on iron-based formulas floating in tanks. Not everyone picks these, yet they shine when power must last many hours across industrial sites or city grids. Companies make them, test new blends, link them to solar farms, and hook them into buildings needing steady juice. Safety matters more now, and space efficiency; these units stack neatly without overheating risks. Grid operators lean on such tech to smooth out surges, balance windless nights, and keep lights on after blackouts strike. Long-term storage is not just about size; it is about how well it lasts, day after day.

A surge in renewable power pushes more places to choose flow battery storage. As cities grow, so does the push to upgrade aging grids. Flow batteries fit right into that shift. Instead of relying on old methods, utilities now lean on these systems to handle uneven solar and wind output. During high-use hours, they help stabilize supply without strain. Businesses see value, too, not just in steady electricity but in cutting long-term expenses. Factories and warehouses begin using them to smooth voltage dips and avoid disruptions. Sustainability goals matter more today; companies reach for cleaner options like these. Where policy supports change, adoption climbs faster. In nations pushing for lower emissions, projects gain speed due to funding and rules favoring clean tech. Across regions, momentum builds quietly but steadily.

What keeps vanadium redox flow batteries ahead is their durability over many cycles, ability to scale up easily, and solid track record. Still, newer types such as zinc-bromine and iron-based flow cells draw interest because they cost less and fit certain areas better. Some researchers mix different chemical setups into hybrid versions simply to get more from each charge, allowing varied uses. Progress in how systems manage charging, keep fluids stable, and build units in pieces helps companies adapt to what grids or factories need. All of this pushes wider use across countries without slowing down.

Right now, North America holds the top spot, thanks mainly to the United States pushing forward with clean power rules and big solar-plus-storage setups. Not far behind, Asia Pacific moves quickest, with China, Japan, and South Korea pouring money into battery systems that handle bursts of wind and solar power. Over in Europe, progress hums along quietly, backed by efforts to cut emissions and smarter electricity networks. Elsewhere, new economies show promise; so do mix-style batteries and solutions built for storing power over many hours. All these pieces fit together, pointing toward ongoing movement ahead.

Flow Battery Energy Storage Market Segmentation

By Type

- Vanadium Redox Flow Batteries

Fueled by lasting performance, these batteries handle heavy use over time. Their size can shift to fit different needs, making them flexible. Big operations choose them often because they work well at scale.

- Zinc-bromine flow batteries

These systems work well for big buildings and factories. Price helps make them easier to adopt. Movement toward larger setups favors their design. Not flashy, just steady progress in real-world use.

- Iron Flow Batteries

Battery tech using iron is gaining ground. These systems store energy for extended periods. Cost stays low thanks to abundant materials. Sustainability becomes easier with fewer rare elements. Long-term storage becomes a practical option. Iron plays a key role in scaling solutions. New designs favor durability over complexity. Performance improves without relying on expensive components.

- Hybrid Flow Batteries

A mix of different battery types works together, efficiency stays high, while costs come down. Performance finds a middle ground through blended materials.

To learn more about this report, Download Free Sample Report

By Battery Type

- Redox Flow Batteries

Redox flow batteries lead the pack when it comes to big setups needing lengthy power hold times. These systems fit well where solar or wind feeds into the grid, simply because they last longer between charges.

- Hybrid Flow Batteries

Battery systems that mix redox with different chemical types bring more options plus better results. These hybrid setups adapt easily while boosting how well they work.

By End-Users

- Utility

Utilities make up the biggest group of users, relying on it to balance the grid, reduce high demand periods, while also supporting solar and wind power use.

- Industrial

Factories often rely on microgrids to keep operations running smoothly when the main grid fails. Equipment that runs constantly needs steady electricity, making reliable sources essential. Some sites generate their own power instead of depending solely on outside supply.

- Residential & Commercial

Homes and businesses alike now lean on backup systems where energy gets stored close to use, supporting greener goals without relying solely on distant grids.

Regional Insights

Across North America, the United States leads the way in adopting flow battery systems because of strict green power rules and upgrades to aging infrastructure. Long-term storage needs are pushing interest in vanadium and iron-based models. Instead of falling behind, Canada is stepping up with funding for clean tech and off-grid solutions in isolated regions. Meanwhile, progress in Mexico moves at a steady pace due to large solar and wind installations feeding into public grids.

Across Europe, progress moves at a steady pace. Leading nations like Germany and the UK push forward by expanding renewables alongside robust storage networks. Grid stability, localized power setups, and factory demands now rely more on flow battery technology. Meanwhile, areas in Southern Europe and Nordic countries turn to these systems not just for cleaner energy but also for resilience and decentralized grids. Growth here ties closely to cutting emissions and keeping supply lines strong.

China and Japan lead the charge across Asia Pacific, where growth outpaces other regions thanks to massive vanadium flow battery installations boosting clean power and stable grids. Government-driven storage programs push South Korea forward at a steady pace. Elsewhere, nations like India, Australia, and parts of Southeast Asia gain momentum fast, fueled by climbing energy needs plus expanding renewables. In contrast, early moves in the Middle East and Latin America stem from big-grid shifts toward sustainable sources.

To learn more about this report, Download Free Sample Report

Recent Development News

- April 11, 2025 – Startup XL Batteries commissions first organic flow battery pilot project in Texas.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 46.28 Million |

|

Market size value in 2026 |

USD 49.36 Million |

|

Revenue forecast in 2033 |

USD 77.54 Million |

|

Growth rate |

CAGR of 6.66% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Invinity Energy System Plc., RKP Storage, Sumitomo Electric, Vizn Energy Energy Systems, Cellcube, VRB Energy, Enel Group, Kemiwatt, Stryten Energy, Everflow, Primus Power, Lockheed Martin, Honeywell, Invinity, C&R Technologies, ESS Tech, Inc. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Vanadium Redox Flow Batteries, Zinc-Bromine Flow Batteries, Iron Flow Batteries, Hybrid Flow Batteries) By Battery Type (Redox, Hybrid) By End-Users (Utility, Industrial, Residential & Commercial) |

Key Flow Battery Energy Storage Company Insights

One name stands out when talking about flow batteries: Invinity Energy Systems. Built through the joining of redT Energy and Avalon Battery, it now ranks among the biggest firms focused solely on this tech. Their VRFB units pop up where steady power matters most: factories, cities, and solar farms. These setups last many cycles without degrading fast, handle stress safely, and grow to fit demand. Projects stretch from Canada to Scotland to Singapore, showing reach and real-world trust. Designs like the VS3 and ENDURIUM let users pick how much power they store and for how long. Trading under a public ticker, the firm pulls strength from alliances and funding aimed at scaling clean storage worldwide.

Key Flow Battery Energy Storage Companies:

- Amagen Inc.

- Invinity Energy System Plc.

- RKP Storage

- Sumitomo Electric

- Vizn Energy Systems

- Cellcube

- VRB Energy

- Enel Group

- Kemiwatt

- Stryten Energy

- Everflow

- Primus Power

- Lockheed Martin

- Honeywell

- Invinity

- C&R Technologies

- ESS Tech, Inc.

Global Flow Battery Energy Storage Market Report Segmentation

By Type

- Vanadium Redox Flow Batteries

- Zinc-Bromine Flow Batteries

- Iron Flow Batteries

- Hybrid Flow Batteries

By Battery Type

- Redox

- Hybrid

By End-Users

- Utility

- Industrial

- Residential & Commercial

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636