Feb 04, 2026

The report “Transformer Insulation Market By Material Type (Liquid Insulation Materials, Solid Insulation Materials, Gaseous Insulation, Composite & Hybrid Materials / Others), By Voltage Class (Low Voltage (35 kV)), By Application (Power Transformers, Distribution Transformers, Dry-Type Transformers, Instrument Transformers / Specialty Transformers) and By End-Use Industry (Utilities / Power Industry, Industrial, Data Centers, Residential & Commercial, Others)” is expected to reach USD 8.70 billion by 2033, registering a CAGR of 10.20% from 2026 to 2033, according to a new report by Transpire Insight.

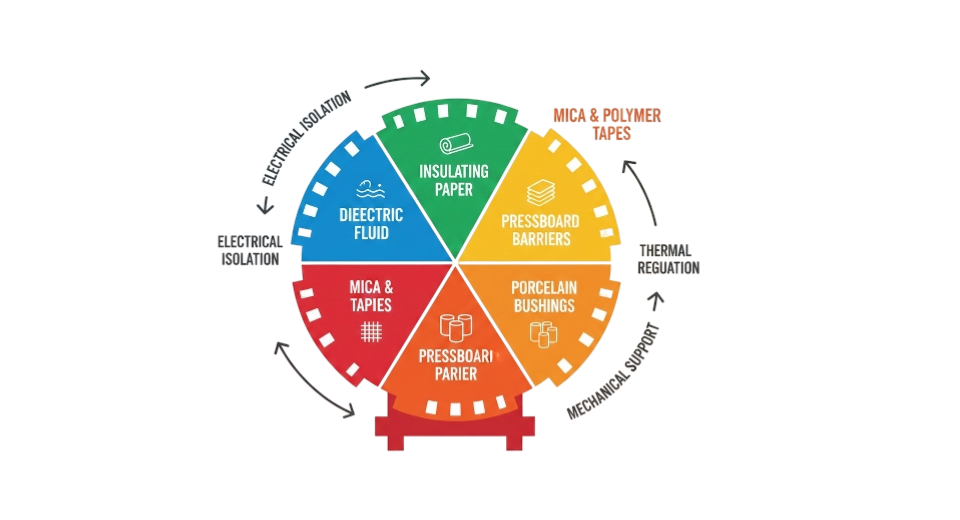

A vital part of the worldwide power infrastructure ecosystem, the transformer insulation market supports the long-term, safe, and effective operation of transformers throughout transmission, distribution, and generation networks. Transformer insulation systems are made to offer mechanical protection, thermal stability, and electrical isolation, guaranteeing continuous power flow in a variety of voltage and load scenarios. Liquid, solid, gaseous, and hybrid insulation materials used in various voltage classes and transformer layouts are all included in the market. Global electrical grid upgrading and growth are intimately related to market demand. While emerging regions continue to invest in new transformer installations to satisfy rising energy consumption, established economies are replacing aging transformer fleets to increase grid resilience and efficiency.

The need for dependable transformer insulation solutions is further increased by the growing electrification of the transportation, industrial, and residential sectors. Insulation needs are changing due to the incorporation of renewable energy, especially for long-distance and high-voltage transmission lines. Advanced insulation materials with enhanced dielectric strength and thermal endurance are being adopted as a result of wind and solar projects' need for transformers that can manage variable loads and increased thermal stress. High-performance liquid and composite insulation methods are therefore becoming more widely used. Simultaneously, material selection is being influenced by regulatory emphasis on environmental sustainability, fire resistance, and safety. In order to comply with environmental regulations, utilities and industrial operators are increasingly using low-emission and biodegradable insulation materials. Transformer insulation is positioned as a strategically significant and gradually growing market segment within the global power industry as a result of these structural changes.

The Liquid Insulation Materials segment is projected to witness the highest CAGR in the Transformer Insulation during the forecast period.

According to Transpire Insight, Because of their dual functions as cooling and electrical insulation, liquid insulation materials are the industry leader in transformer insulation. Because of their demonstrated effectiveness, accessibility, and affordability, mineral oils still account for the majority of installed capacity. However, the increasing use of big power and distribution transformers, especially in high-voltage applications, highlights the structural significance of liquid insulation systems in preserving operational dependability and thermal balance.

As natural and synthetic ester-based fluids gain popularity, the market is gradually changing. These substitutes are becoming more and more appealing for urban substations and environmentally sensitive areas because of their higher fire points, better moisture tolerance and environmental advantages. Adoption is being accelerated especially in developed economies, by utilities who prioritize operational safety and regulatory compliance. Liquid insulation materials are anticipated to maintain their dominance while moving toward more sustainable formulations as grid complexity rises and transformer operating conditions grow more demanding.

The High Voltage (>35 kV) segment is projected to witness the highest CAGR in the Transformer Insulation during the forecast period.

High-voltage insulation systems account for the highest number share of the market owing to their application in power transformers and transmission substations. The need for enhanced insulating materials is fueled by these systems' need for superior dielectric strength, thermal stability and long-term aging resistance. The need for high-voltage transformers is greatly increased by the expansion of renewable energy corridors and cross-regional transmission lines.

Growing investments in extra-high-voltage and ultra-high-voltage infrastructure, especially in areas updating their transmission grids are advantageous to the segment. Entry hurdles are created by high capital intensity and strict performance criteria which favor established providers with tested material technology. It is anticipated that high-voltage insulation will continue to be a key factor driving market expansion as global power flows rise in size and complexity.

The Power Transformers segment is projected to witness the highest CAGR in the Transformer Insulation during the forecast period.

According to Transpire Insight, With a significant share of the market value, power transformers are the most important application sector for transformer insulation. Because these transformers are subjected to high electrical and thermal loads, sophisticated insulating techniques are required to guarantee dependability and lifetime. Grid expansion, integration of renewable energy and replacement of outdated high-capacity transformers all directly contribute to growth.

Utilities are investing in higher-rating power transformers with improved insulation designs as a result of growing concerns about grid stability and transmission efficiency. To lower losses and extend operational life, sophisticated liquid and composite insulation methods are being used. Power transformers will continue to anchor insulation demand across voltage classes due to their strategic significance within national power systems.

The Utilities / Power Industry segment is projected to witness the highest CAGR in the Transformer Insulation during the forecast period.

The majority of transformer insulation demand worldwide is accounted for by utilities, which continue to be the leading end-use category. To ensure grid stability and handle load increases large-scale transmission and distribution networks need to continuously invest in transformers. Reliability indicators are directly impacted by insulation performance, thus utilities must carefully consider their options when choosing materials.

Utility operators' long-term demand is being maintained by ongoing grid modernization projects, renewable integration requirements and resilience planning. Adoption of premium and environmentally friendly insulating materials is also being fueled by utilities' growing emphasis on lifetime performance and environmental compliance. As a result, the utilities sector is positioned as the market's most reliable and significant demand center.

The North America region is projected to witness the highest CAGR in the Transformer Insulation during the forecast period.

Due primarily to massive grid renovation and asset replacement initiatives, North America is a strategically significant and technologically advanced market for transformer insulation. Due to its old transmission and distribution infrastructure, much of which was put in place more than thirty years ago, the United States is responsible for the majority of regional demand. Transformer renovations are a top priority for utilities throughout the region in an effort to increase operational efficiency, resilience to harsh weather events and dependability. Mexico promotes regional prosperity through industrial expansion and grid strengthening projects, while Canada consistently contributes through investments in cross-border transmission interconnections and renewable energy integration.

North American demand is becoming more and more influenced by regulations that prioritize grid resilience, safety, and environmental compliance. Advanced insulating materials with better thermal performance, reduced environmental effect, and increased fire resistance are being adopted by utilities and industrial operators. The demand for high-capacity transformers and related insulation systems is rising due to the quick development of data centers, electric vehicle infrastructure, and renewable energy projects. North America is positioned as a stable, high-value market with steady long-term demand for transformer insulation solutions because to strong domestic manufacturing capabilities and government-backed infrastructure expenditures.

Key Players

The top 15 players in the Transformer Insulation market include DuPont, 3M, Hitachi Energy Ltd., Weidmann Electrical Technology AG, Elantas (Altana AG), Cargill Incorporated, Siemens Energy, Krempel GmbH, Apar Industries, Huntsman International LLC, Ahlstrom, delfortgroup AG, Nordic Paper, TOMOEGAWA CORPORATION, and Mitsubishi Chemical Group.

Drop us an email at:

Call us on:

+91 7666513636