Market Summary

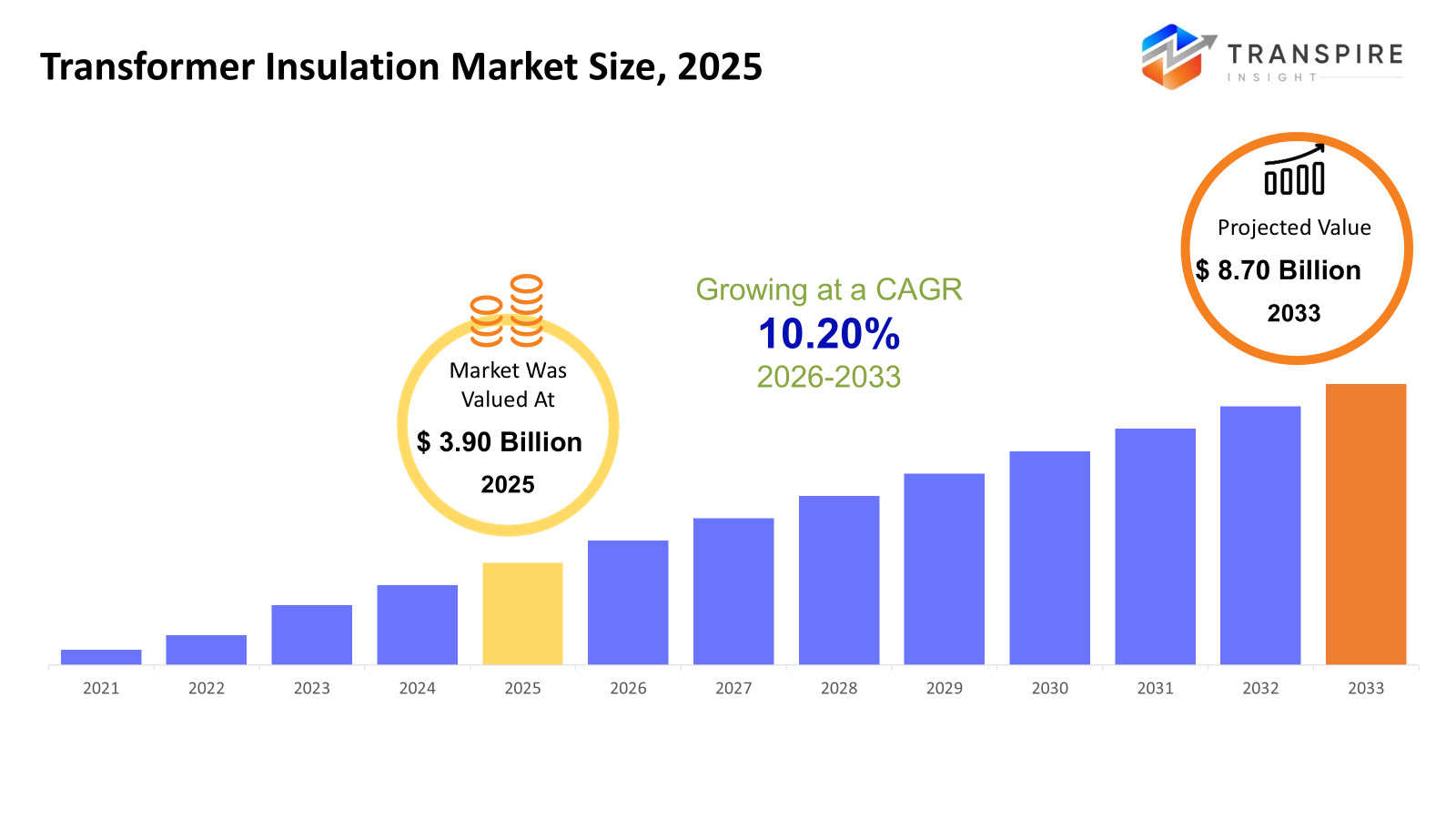

The global Transformer Insulation market size was valued at USD 3.90 billion in 2025 and is projected to reach USD 8.70 billion by 2033, growing at a CAGR of 10.20% from 2026 to 2033. Global grid modernization and the replacement of outdated power infrastructure are driving a steady growth in the transformer insulation industry. Transformer installations are rising as a result of increased energy consumption brought on by urbanization, industrialization, and electrification initiatives. The need for insulation is further strengthened by the growth of high-voltage transmission networks and the incorporation of renewable energy. Adoption of improved insulating materials is also being driven by more stringent safety, efficiency, and environmental laws.

Market Size & Forecast

- 2025 Market Size: USD 3.90 Billion

- 2033 Projected Market Size: USD 8.70 Billion

- CAGR (2026-2033): 10.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Grid hardening efforts, renewable interconnections, and extensive transformer refurbishing programs have all contributed to North America's ongoing insulation need. In order to meet increasingly stringent environmental and operational dependability standards, utilities are increasingly using insulating materials that are biodegradable and fire-safe.

- Due to data center expansion, transmission upgrades, and the replacement of outdated transformers that were built more than thirty years ago, the United States leads the region in demand. The use of high-value insulating materials is directly supported by federal investments in clean energy transmission routes and grid resilience.

- As nations speed up industrialization, electrification, and the use of renewable energy, Asia Pacific has the highest growth momentum. The volume need for insulation systems is greatly increased by cross-regional transmission projects and large-scale distribution transformer installations in China and India.

- As they provide excellent cooling and dielectric performance for high-voltage transformers, liquid insulation materials continue to dominate the market. Despite the slow uptake of ester-based substitutes, the increasing use of power transformers for long-distance transmission and renewable integration maintains supremacy.

- As transmission and substation investments increase, the medium and high-voltage classes exhibit the strongest increases. Transformers must operate at higher voltages due to growing renewable energy capacity, which immediately raises the need for sophisticated, thermally stable insulating methods.

- As grid expansion and electrification initiatives pick up steam, power and distribution transformers continue to dominate application demand. Smart grid rollouts in emerging economies, urban infrastructure projects, and rural electrification all benefit distribution transformers in particular.

- Since utilities make up the bulk of transformer installations globally, they continue to be the top end-use group. Consistent insulation demand across voltage and transformer categories is ensured by long-term grid planning, transmission upgrades, and system reliability requirements.

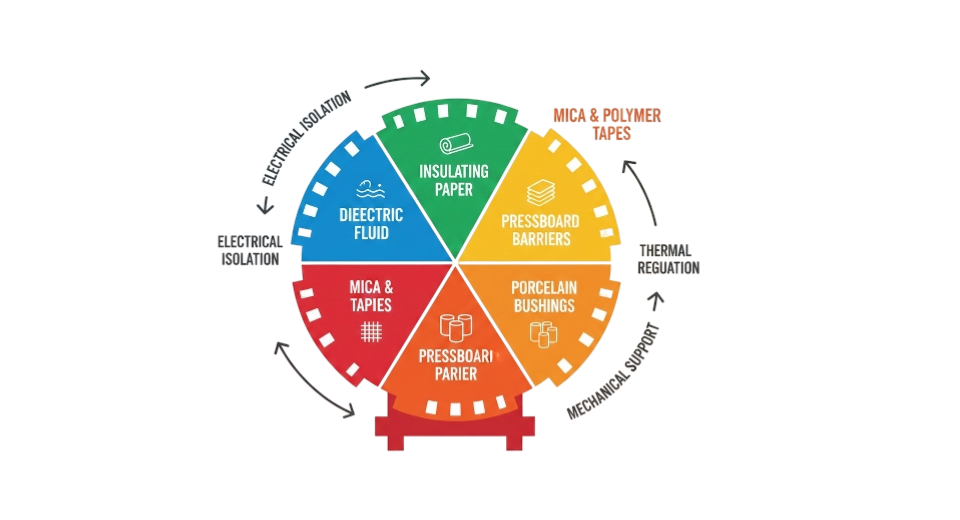

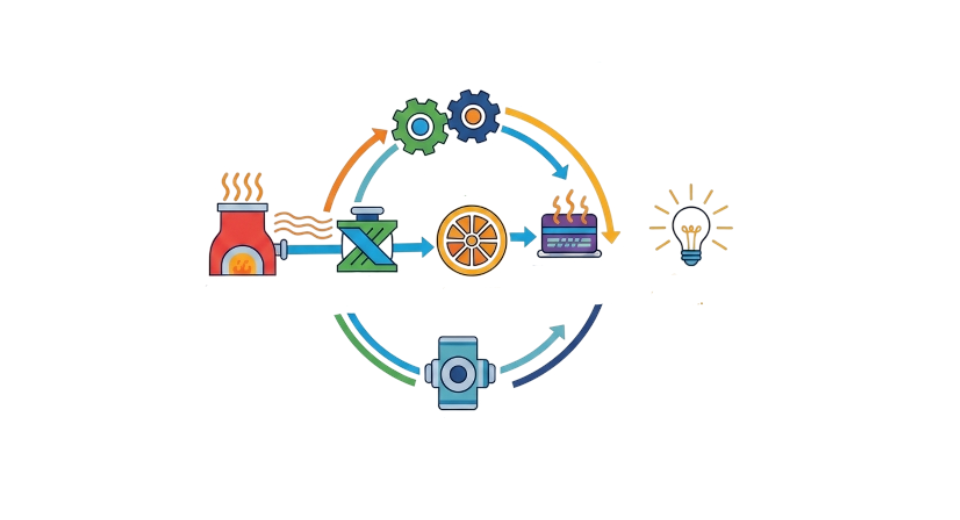

So, The materials and techniques used to thermally and electrically shield transformers in power generating, transmission, and distribution networks make up the transformer insulation market. By controlling heat dissipation and minimizing electrical failure, these insulation technologies guarantee operational safety, effectiveness, and longer transformer life. Liquid, solid, gaseous, and composite insulation materials used in different voltage classes and transformer types are available in the market. The expansion and upgrading of the world's electricity infrastructure are directly related to market growth. While emerging economies continue to build additional capacity to accommodate growing electricity consumption, established economies are replacing or upgrading their aging transformer fleets. The demand for high-capacity transformers with sophisticated insulation requirements to handle changing loads and increased thermal stress is further increased by the integration of renewable energy sources like solar and wind.

The preferences for insulation materials are changing due to technological improvements, with a greater emphasis now being placed on lifespan performance, environmental sustainability, and fire safety. Advanced solid composites, hybrid insulation solutions, and liquids based on natural and synthetic ester are becoming more and more popular. Transformer insulation is an essential part of contemporary power systems since purchase decisions are still influenced by regulatory emphasis on grid dependability, environmental compliance, and energy efficiency.

Transformer Insulation Market Segmentation

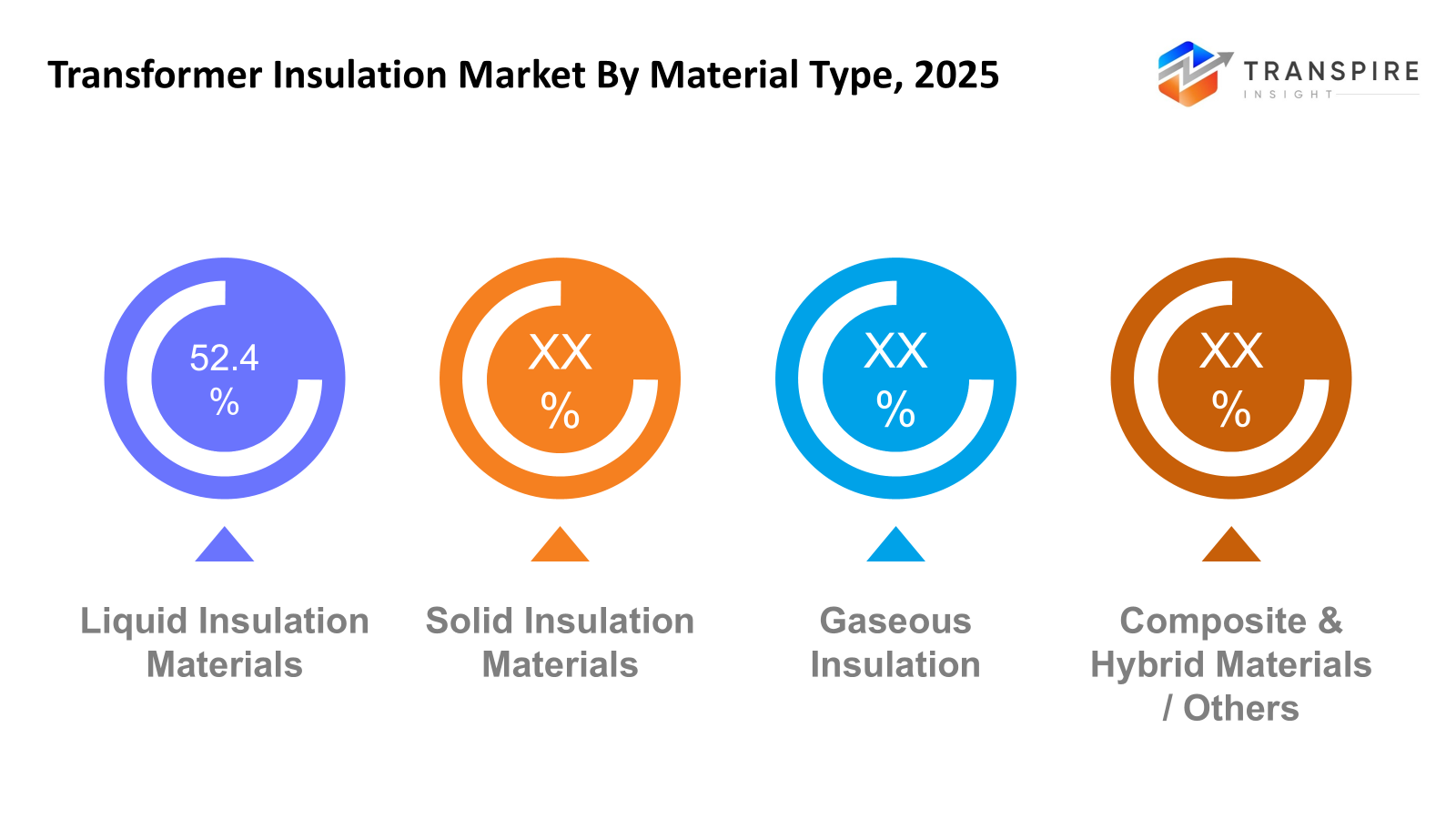

By Material Type

- Liquid Insulation Materials

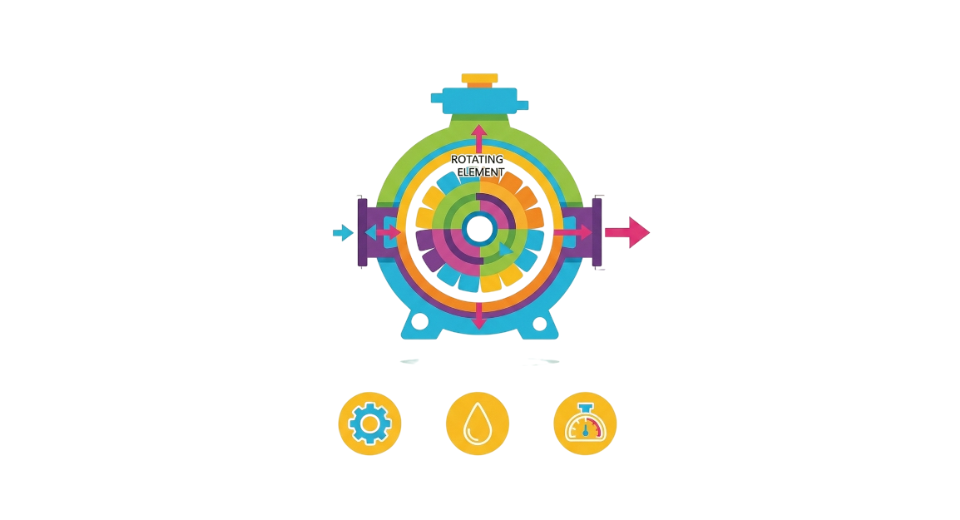

Because liquid insulation materials serve both electrical insulation and thermal dissipation, they dominate the transformer insulation industry. Natural and synthetic esters are becoming more popular because of their increased fire safety and biodegradability, although mineral oils are still used extensively because of their affordability and well-established infrastructure. In high-capacity power and distribution transformers, these materials are very important. Sustained demand is supported by expanding transformer replacement programs and grid expansion.

- Solid Insulation Materials

Pressboard, aramid paper, cellulose paper, epoxy resins, and other solid insulation materials offer dielectric stability and mechanical robustness. They are essential to transformers' structural stability and winding insulation. The growing use of small and high-efficiency transformer designs is driving demand. Transformer longevity and dependability are being enhanced by developments in thermal endurance and aging resistance.

- Gaseous Insulation

Dry-type and specialty transformers are the main applications for gaseous insulation, which includes SF₃ and dry air. These materials are appropriate for limited spaces or environmentally sensitive installations because of their exceptional dielectric strength. However, research into alternate gasses is being encouraged by environmental regulations surrounding SF₆ emissions. Although technologically important, this market is still niche.

- Composite & Hybrid Materials / Others

In order to improve performance under extreme thermal and electrical stress, composite and hybrid insulating materials mix solid and liquid qualities. High-voltage and next-generation transformers are increasingly using these materials. Their capacity to increase productivity and lower maintenance costs facilitates steady market expansion. Premium transformer applications and technologically advanced grids have greater adoption rates

To learn more about this report, Download Free Sample Report

By Voltage Class

- Low Voltage (<1 kV)

The primary uses of low-voltage transformer insulation are in light industrial, commercial, and residential settings. Less complicated insulation specifications favor solid and dry insulation systems that are reasonably priced. Development of urban infrastructure and decentralized power distribution are associated with growth. Demand for this category is consistent yet moderate.

- Medium Voltage (1–35 kV)

Due to their extensive use in commercial grids and industrial facilities, medium-voltage transformers account for a sizeable portion of the insulation requirement. Thermal performance and cost effectiveness must be balanced in this segment's insulation solutions. Growth is fueled by the integration of renewable energy sources and the expansion of industrial automation. Insulation materials, both liquid and solid, are widely utilized.

- High Voltage (>35 kV)

Power and transmission transformers require high-voltage insulation, which calls for superior dielectric strength and thermal stability. Because liquid insulation materials have better cooling and insulating qualities, they are the most popular. Ultra-high-voltage projects, cross-border connections and transmission network development all contribute to growth.

By Application

- Power Transformers

Because of their large capacity and voltage needs, power transformers make up a significant portion of the insulating demand. Long operating life under severe electrical and thermal stress is a need for insulation systems. Grid upgrade, the transmission of renewable energy, and the replacement of outdated infrastructure are the main drivers of growth. To increase efficiency, more advanced insulating materials are being used.

- Distribution Transformers

A high-volume application segment with a steady need for insulation is represented by distribution transformers. In both urban and rural locations, these transformers are crucial for last-mile power distribution. Infrastructure development, smart grid deployment and increased electrification all contribute to growth. Reliability and cost effectiveness are important factors when choosing insulation.

- Dry-Type Transformers

Dry-type transformers are favored in commercial, indoor, and environmentally sensitive settings because they employ solid or gaseous insulation. They provide reduced maintenance needs and enhanced fire safety. Data centers, hospitals and commercial buildings are seeing an increase in demand. This segment benefits from stricter environmental and safety standards.

- Instrument Transformers / Specialty Transformers

Transformers for measurement, protection, and specific industrial uses are included in this category. Rather of focusing on high capacity, insulation requirements prioritize accuracy, stability, and dependability. Substations, industrial automation and grid monitoring support demand. The segment delivers higher margins despite having a smaller volume.

By End-Use Industry

- Utilities / Power Industry

The biggest end-use market for transformer insulation is the utilities and power sector. For grid stability, large-scale transmission and distribution networks need dependable insulating solutions. Demand is driven by investments in electrification projects, grid upgrades and renewable integration. Sustained market growth is supported by long-term infrastructure spending.

- Industrial

Strong transformer insulation is necessary for large industries, refineries, and manufacturing facilities. Systems for insulation must be able to endure challenging operating circumstances and fluctuating loads. Initiatives for energy efficiency, process electrification, and industrial expansion are the main drivers of growth. In this market medium- and high-voltage transformers are frequently utilized.

- Data Centers

Due to increased digitalization and cloud use, data centers are a new and rapidly expanding end-use market. High dependability, fire safety, and a continuous power supply must all be guaranteed by transformer insulation. Eco-friendly and dry-type insulating materials are becoming more and more popular. In areas with growing digital infrastructure growth is robust.

- Residential & Commercial

Transformers utilized in residential complexes, commercial buildings, and urban infrastructure are included in this category. Urbanization, real estate development, and smart city projects are the main drivers of demand. The majority of insulation systems are low- and medium-voltage. Safety, cost effectiveness and compact design are prioritized.

- Others

Railroads, mining, oil and gas, and renewable energy plants are further end-use industries. For harsh or distant operating circumstances, these applications frequently call for specialized insulating solutions. Demand is cyclical and project-based. Nonetheless, renewable energy initiatives are increasingly driving this market's expansion.

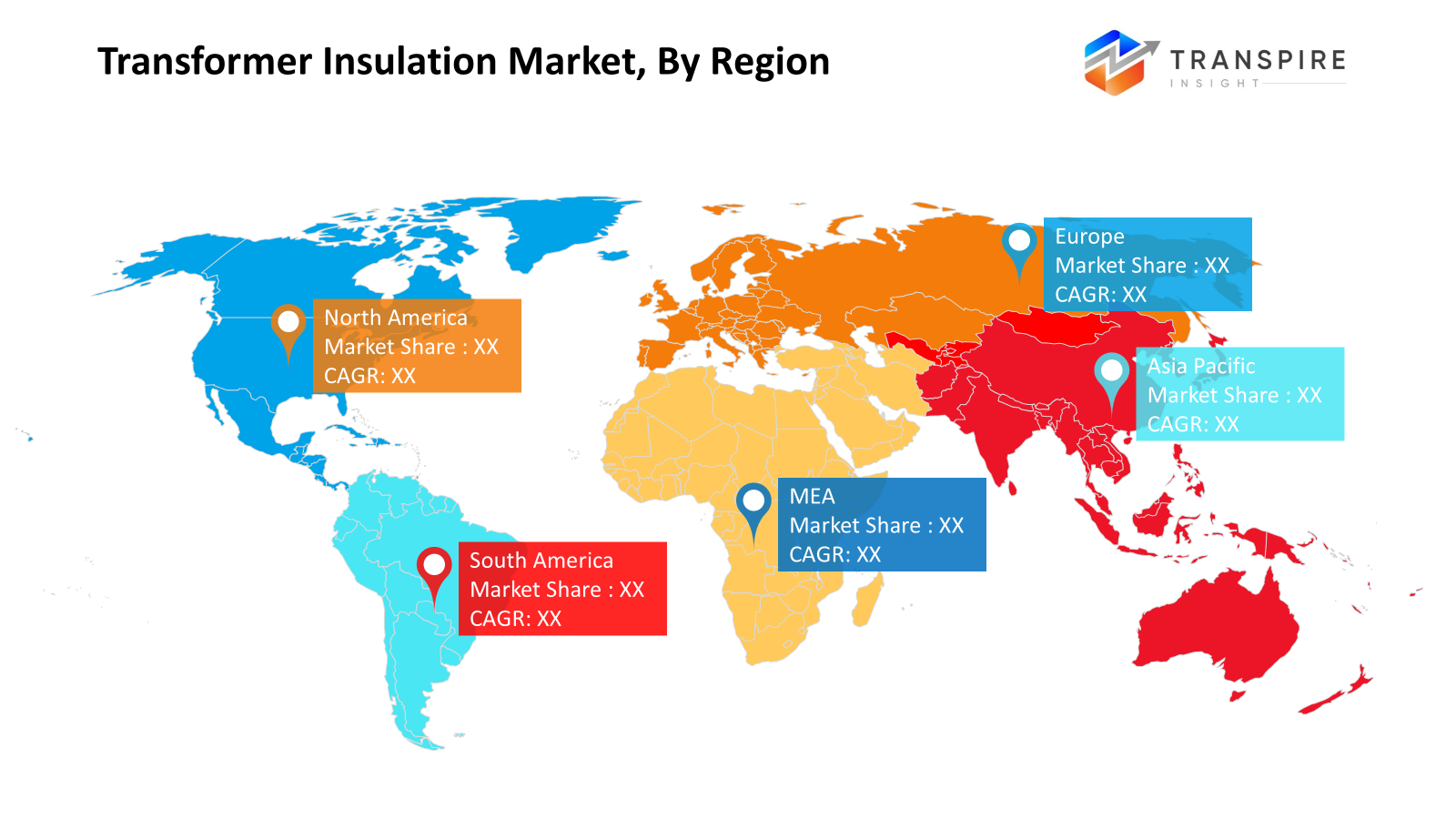

Regional Insights

The United States leads the developed transformer insulation industry in North America, which is bolstered by vast transmission networks and outdated grid infrastructure. The United States and Canada are Tier-1 demand centers, whereas Mexico is a Tier-2 growth market propelled by industrial development and grid expansion. Regional consumption is dominated by replacement demand. With Tier-1 nations like Germany, the UK, France, Italy, and Spain prioritizing grid efficiency and environmental compliance, Europe exhibits consistent growth. With the help of cross-border transmission projects and renewable integration, the remainder of Europe creates Tier-2 demand. Sustainable insulating products are more widely used in the area.

The fastest-growing region is Asia Pacific, which is dominated by Tier-1 markets including China, India and Japan. Transformer deployment is driven by large-scale electrification, industrialization and investments in renewable energy. Through grid expansion and infrastructure improvements, Tier-2 markets like Australia, South Korea, and Southeast Asia provide steady contributions. Growth in South America is moderate, with Tier-1 Brazil, Tier-2 Argentina, and surrounding nations leading the way. Although investment cycles affect growth stability, transmission expansion and renewable projects stimulate demand. Tier-1 markets like Saudi Arabia, the United Arab Emirates, and South Africa dominate the Middle East and Africa region, while Tier-2 nations make investments in industrial electrification, urbanization and power infrastructure.

To learn more about this report, Download Free Sample Report

Recent Development News

- August 2025, In order to double capacity and introduce an ultra-low carbon production process using fossil fuel-free energy, Hitachi Energy India Ltd. announced a substantial investment of INR 300 crores to boost the production of transformer-grade pressboard and laminated insulation materials at its Mysuru site. By strengthening global supply, supporting the increasing need for grid infrastructure, and enhancing the integration of renewable energy sources, this expansion seeks to improve supply chain resilience.

- In March 2025, Hitachi Energy plans to invest an extra $250 million USD to increase production of insulating materials and other essential transformer components worldwide. In the face of rising global demand for transformer parts due to electrification and infrastructure improvements, this investment strengthens the supply chain and increases production capacity throughout the United States.

(Source:https://www.hitachi.com/New/cnews/month/2025/03/250311a.html)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.90 Billion |

|

Market size value in 2026 |

USD 4.40 Billion |

|

Revenue forecast in 2033 |

USD 8.70 Billion |

|

Growth rate |

CAGR of 11.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

DuPont, 3M, Hitachi Energy Ltd., Weidmann Electrical Technology AG, Elantas (Altana AG), Cargill, Incorporated, Siemens Energy, Krempel GmbH, Apar Industries, ZIEHL-ABEGG SE, Huntsman International LLC, Ahlstrom, delfortgroup AG, Nordic Paper, TOMOEGAWA CORPORATION |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Material Type (Liquid Insulation Materials, Solid Insulation Materials, Gaseous Insulation, Composite & Hybrid Materials / Others), By Voltage Class (Low Voltage (<1 kV), Medium Voltage (1–35 kV), High Voltage (>35 kV)), By Application (Power Transformers, Distribution Transformers, Dry-Type Transformers, Instrument Transformers / Specialty Transformers) and By End-Use Industry (Utilities / Power Industry, Industrial, Data Centers, Residential & Commercial, Others) |

Key Transformer Insulation Company Insights

DuPont is a leading global materials science company well positioned in the transformer insulation market through its advanced insulation solutions such as Nomex and high-performance polymer materials that deliver excellent dielectric strength and thermal endurance. Its products are extensively used in industrial and utility sectors for high-voltage transformer applications. The business makes significant investments in R&D to improve productivity and dependability while meeting legal and environmental obligations. Strong market influence and long-term competitive advantage are made possible by DuPont's wide worldwide reach, reliable supply chain and varied product line.

Key Transformer Insulation Companies:

- DuPont

- 3M

- Hitachi Energy Ltd.

- Weidmann Electrical Technology AG

- Elantas (Altana AG)

- Cargill, Incorporated

- Siemens Energy

- Krempel GmbH

- Apar Industries

- ZIEHL-ABEGG SE

- Huntsman International LLC

- Ahlstrom

- delfortgroup AG

- Nordic Paper

- TOMOEGAWA CORPORATION

Global Transformer Insulation Market Report Segmentation

By Material Type

- Liquid Insulation Materials

- Solid Insulation Materials

- Gaseous Insulation

- Composite & Hybrid Materials / Others

By Voltage Class

- Low Voltage (<1 kV)

- Medium Voltage (1–35 kV)

- High Voltage (>35 kV)

By Application

- Power Transformers

- Distribution Transformers

- Dry-Type Transformers

- Instrument Transformers / Specialty Transformers

By End-Use Industry

- Utilities / Power Industry

- Industrial

- Data Centers

- Residential & Commercial

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636