Feb 04, 2026

The report “Waste Heat to Power Market By Technology (Organic Rankine Cycle, Steam Rankine Cycle, Kalia Cycle, Supercritical Co2 Cycle, Thermoelectrical Generators), By Capacity Range (Below 1 MW, 1-1 MW, 5-20 MW, Above 20 MW), By System Configuration (Bottoming Cycle System Top Cycle System Hybrid Systems), By Application (Industral Waste Heat Recovery, Commercial Waste Heat Recovery, Utilities & Power Plants, Distributed Power Generation)” is expected to reach USD 12.80 billion by 2033, registering a CAGR of 9.20% from 2026 to 2033, according to a new report by Transpire Insight.

More factories now turn the heat they once wasted into usable electricity, pushing growth across the world. Because energy costs climb, businesses like cement and steel makers find value in reusing excess heat. Instead of releasing leftover heat, plants capture it to generate power internally. Tougher pollution rules push these sectors to rethink how much waste they produce. Oil, gas, and chemical operations follow similar paths, aiming to run smarter under tighter legal limits. Higher demand comes not just from savings but also from pressure to lower carbon footprints. As a result, more facilities integrate systems that transform excess temperature into real output. One industry after another shifts toward using what was previously lost. Plants operate longer without drawing extra supplies from outside sources. Efficiency becomes less about new tools, more about better use of existing flows.

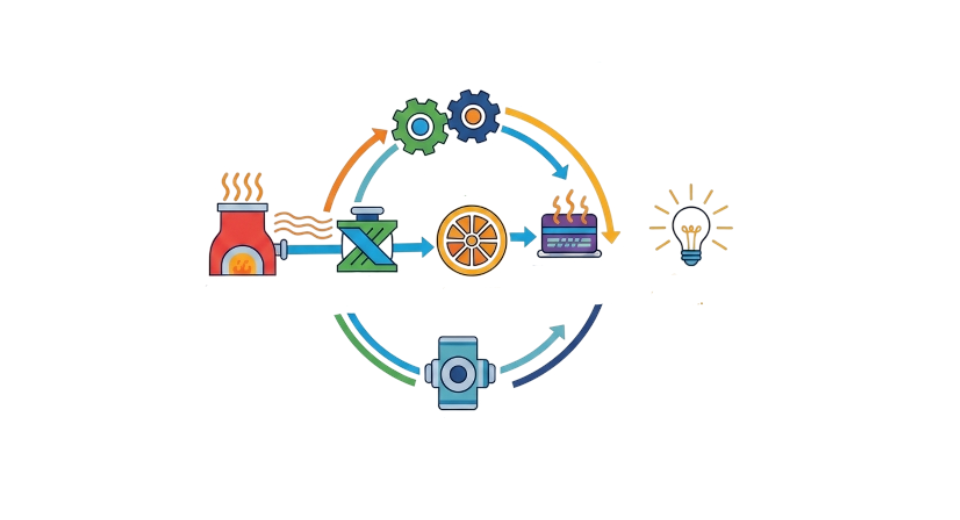

Looking at tech choices, ORC units lead because they turn low or mid-range waste heat into power quite well. Their setup adapts easily, fitting different plant layouts without hassle. These systems show up often in factories needing upgrades or starting fresh builds. Wherever heat output shifts during operations, ORC stays reliable. Alternatives like steam-based cycles step in when temperatures climb higher. So do ammonia-rich setups known as Kalina loops. Newer options using compressed carbon dioxide also appear, especially for massive plants running hot. Together, these methods spread out what kinds of jobs get done across the sector.

Over there, Asia Pacific sees the quickest rise in WHP use, thanks to fast industrial growth, strong need for power, and a national push for reusing waste heat, especially in places like China and India. The United States. pulls North America ahead, where upgrading factories, rewards for saving energy, plus growing use of high-tech ORC setups keep things moving. Rules that cut emissions tightly, paired with goals to reduce carbon, help Europe stay central in this space, all adding up to steady worldwide growth for turning wasted heat into electricity.

The Organic Rankine Cycle segment is projected to witness the highest CAGR in the Waste Heat to Power market during the forecast period.

According to Transpire Insight, with rising demand in industries like cement and chemicals, the Organic Rankine Cycle portion of the Waste Heat to Power market may grow fastest over the coming years due mainly to how well it handles low-heat leftovers. Instead of needing intense warmth, these setups rely on special organic liquids that turn heat into electricity more effectively than old-style steam methods. Because they work efficiently even when temperatures stay moderate, factories dealing with metal production or food manufacturing find them useful. Equipment built this way often comes in compact units, adapts easily to different conditions, and doesn’t need frequent servicing, which helps explain their spread not just in fresh builds but also upgrades to existing sites.

Technology keeps moving forward in ORC setups, bringing better heat handling, smarter fluid choices, and faster output. This helps save money and cut return time. Pressure builds from rules aimed at lowering emissions while electricity prices climb, pushing factories toward waste-heat recovery that powers their own operations more smoothly. Across North America and parts of the Asia Pacific, adoption runs high; support grows through public funding focused on using less energy and cleaning up processes. These forces shape a quicker rise for ORC use in the years ahead.

The 1-5 MW segment is projected to witness the highest CAGR in the Waste Heat to Power market during the forecast period.

One of the fastest-growing segments in the Waste Heat to Power sector will likely be the 1–5 megawatt range, simply because it fits well with what most mid-sized and big factories actually need. Cement plants, chemical operations, and metal producers, along with general manufacturing sites, tend to produce enough leftover heat that works especially well when paired with equipment sized right around here. Instead of chasing massive scale, these projects hit a sweet spot: decent electricity generation without the steep price jump seen once systems go beyond 20 megawatts.

Midway through the power scale, units between 1 and 5 megawatts gain ground as older facilities update with waste heat recovery. Since leftover thermal output and room inside plants often suit these sizes best, bigger or tinier setups lose appeal by comparison. Supported because they fit neatly into public schemes, pushing lower energy bills and shorter return timelines. Factories aiming to trim expenses while cutting fumes lean toward this range when upgrading. Growth here likely shapes broader industry momentum, especially where production hubs cluster, think Southeast supply chains or legacy sites across the United States zones and Western Europe.

The Bottoming Cycle Systems segment is projected to witness the highest CAGR in the Waste Heat to Power market during the forecast period.

According to Transpire Insight, A surge in demand appears likely for bottoming cycle setups within the waste heat to power sector over the coming years. This happens because they pull usable warmth from industrial operations once the main tasks finish. Once steam, ovens, motors, or generators release excess heat, these systems turn that spill into electric output instead of letting it vanish. No extra fuel needed means lower running costs alongside greener outcomes, which pulls interest from sectors like metal refining, construction materials, chemical manufacturing, and petroleum processing, all places where hot exhaust flows freely during production runs.

Now more than ever, new tech boosts and flexible setups help bottoming cycle units run better and grow smoother inside current facilities. Retrofit jobs find them useful, since factories want higher performance at lower running expense while keeping core operations untouched. Energy savings matter more today, pollution rules are tightening, plus public funding appears to be pushing these systems ahead in waste heat recovery across North America, Europe, and parts of Asia. Growth looks strong through the years ahead as a result.

The Industrial Waste Heat Recovery segment is projected to witness the highest CAGR in the Waste Heat to Power market during the forecast period.

Growth looks strongest in the Industrial Waste Heat Recovery area when it comes to turning excess heat into power over the coming years. Factories pour out huge amounts of unused thermal energy while making steel, cement, chemicals, or refining oil. Instead of letting that warmth vanish, some plants now turn it into usable electric output, trimming bills along the way. Efficiency gets a quiet boost at the same time emissions dip slightly. Because these sites run hot nonstop, setups like ORC, SRC, and Kalina systems find steady work here. Steady flow means fewer hiccups for gear designed to harvest wasted temperature swings.

Nowhere else has the push for cleaner operations grown faster than in heavy industries adopting waste heat recovery. A shift toward lower emissions comes alongside tighter power rules pushing firms to act. Some factories upgrade old systems while others build fresh setups, aiming to trim wasted energy. Less reliance on outside electricity becomes possible when exhaust warmth gets reused wisely. Regions like Asia Pacific, North America, and Europe host dense industrial zones where such changes spread quickly. Where government rewards exist for smarter tech, progress tends to accelerate further. Growth in this field looks set to hold steady as long as these forces remain active.

The North America region is projected to witness the highest CAGR in the Waste Heat to Power market during the forecast period.

Big industries across North America are likely to keep playing a major role in the Waste Heat to Power scene ahead. A well-established industrial setup helps, combined with the quick uptake of modern tech there. Rules that favor cleaner energy choices add momentum, too. The United States takes the front seat, where cement plants, steel mills, chemical factories, and oil operations turn waste heat into power. Cutting electricity bills matters just as much as hitting tough pollution rules. Efficiency gains pull interest steadily upward. Systems based on Organic Rankine Cycles spread widely through large-scale operations. Steam-based versions join them closely behind. These tools pop up often inside both manufacturing units and public utilities. Their growing footprint lifts the entire regional outlook higher.

On top of that, money-saving policies from governments across the United States and Canada are pushing more companies to add waste heat recovery tech into both new builds and older plants. Because cutting emissions matters now and electric bills keep climbing, factories are turning toward reusing wasted thermal energy instead of ignoring it. Meanwhile, small-scale power setups paired with combined heat methods are spreading throughout North America, shifting how electricity flows locally while strengthening backup capacity. This shift in where and how power gets made should sustain steady industry growth until at least 2033.

Key Players

Top companies include Ormat Technologies, Siemens AG, ABB Ltd., Mitsubishi Heavy Industries, MAN Energy Solutions, Danfoss, Thermax, Veolia, Atlas Copco, General Electric, Hitachi Zosen Corporation, Turboden, Babcock & Wilcox, Kalina Power, Exergy S.p.A., ElectraTherm, Thermax Ltd., Alstom, and Cleanergy AB.

Drop us an email at:

Call us on:

+91 7666513636