Market Summary

The global Waste Heat to Power market size was valued at USD 6.20 billion in 2025 and is projected to reach USD 12.80 billion by 2033, growing at a CAGR of 9.20% from 2026 to 2033. Waste heat turned into power sees more demand as industries focus harder on saving energy and cutting expenses. Because rules now push firms to pollute less, companies install these recovery setups faster. New progress in ORC, Kalina, and supercritical CO₂ methods lifts how well they work and pay off over time.

Market Size & Forecast

- 2025 Market Size: USD 6.20 Billion

- 2033 Projected Market Size: USD 12.80 Billion

- CAGR (2026-2033): 9.20%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 42% in 2026. Fuel savings drive new rules here. Because of that, factories and power providers pour money into systems capturing wasted heat. Progress shows up most where steam and smoke once escaped freely. Little by little, old losses turn into usable power. Rules push change just as much as rising costs do.

- United States with fresh incentives and a push to power factories differently, America now sees more value in older energy tech like ORC and upgraded waste heat systems.

- Out of nowhere, Asia Pacific pulls ahead as growth surges, fueled by factories rising fast, hunger for power climbing, while policies in China and India push to capture wasted heat. Though overlooked at times, change moves quickly where industry spreads.

- Organic Rankine Cycle shares approximately 35% in 2026. The Organic Rankine Cycle handles it well without draining budgets. Its edge comes from running efficiently where others struggle, especially in high heat ranges. Price tags stay lower while output stays strong, making it a go-to choice across industries.

- Between 1 and 5 megawatts sits the most common size choice. Industries lean toward these mid-sized waste heat setups because they strike a workable middle ground. Cost stays manageable while still pulling useful energy from wasted heat. This scale shows up more often than others across facilities. It just fits how operations tend to balance investment against returns.

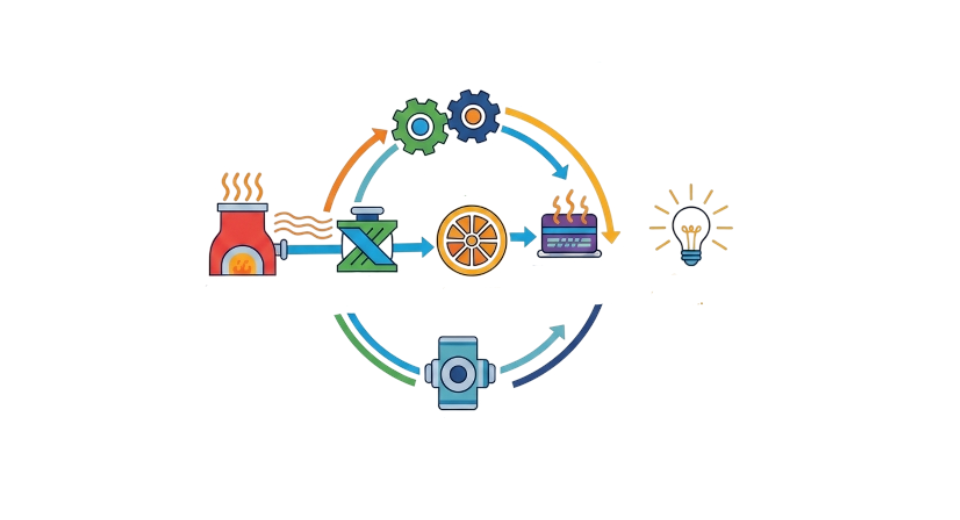

- Most systems rely on bottoming cycles since they grab leftover heat from current power setups. These designs work well by using warmth that would otherwise go to waste.

- Fueled by massive heat output, factories making steel or cement lead the pack. Where smokestacks spew warmth, recovery systems step in, turning lost energy into usable power. Chemical plants join in, simply because so much excess heat pours out daily. Heavy industry rules here, mainly due to the sheer volume of wasted thermal energy. Big machines run hot, creating chances others overlook.

More industries now turn wasted heat into power, helping save energy and cut expenses. From factories making steel to plants processing chemicals, leftover warmth gets reused instead of lost. Rules demanding cleaner operations plus higher electric bills push companies toward these systems. Newer methods, especially those using organic fluids in Rankine setups, make lower-grade heat worth collecting. Pressure to shrink carbon footprints grows, so does interest in smarter ways to reuse what was once thrown away.

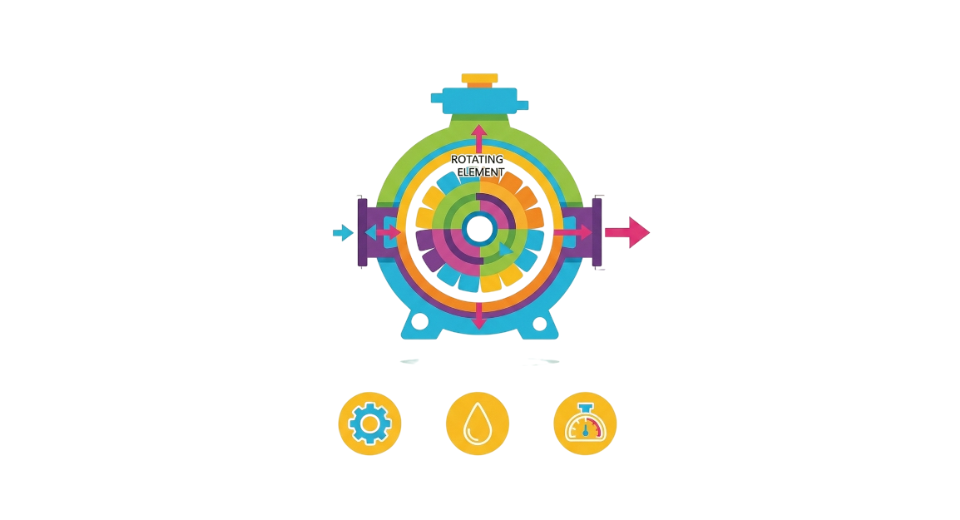

Right away, Organic Rankine Cycle units stand out across WHP options because they handle different heat levels well while turning wasted warmth into power. Not just limited to one setup type, these systems adapt easily to many factory conditions, so their footprint grows worldwide. What helps most is better fluid mixes and smarter layouts emerging over time; that keeps ORC relevant whether building fresh sites or updating old ones.

Out in front, the Asia Pacific area powers ahead in the WHP scene - industrial expansion, city growth, and determined policy moves on energy savings and lower emissions keep things rolling. Still setting the pace there, pouring money into capturing wasted heat across big industries. Over in Europe, strict eco rules plus serious climate targets are pushing uptake hard. North America is not far behind, fueled by factory upgrades, rule-based nudges, and an established appetite for high-end WHP tools. And inside that zone, the United States stands out, thanks to vast industry networks and solid green-energy backing that keeps these systems spreading.

New uses like local power production, capturing wasted heat for businesses, plus systems combining waste heat recovery with clean energy sources. Even though setup expenses are steep and linking these systems gets tricky, the outlook remains that firm growth should continue past 2030. Pressure to use less energy pushes adoption. So do lower running costs over time. Industry shifts toward greener practices worldwide add momentum too.

Waste Heat to Power Market Segmentation

By Technology

- Organic Rankine Cycle

Starting at lower heats, the Organic Rankine Cycle fits well where steam systems struggle. Efficiency stands out, especially when temperatures aren’t extreme. Flexibility in operation makes it a go-to across many setups. Its use spreads widely because it handles uneven inputs without failing.

- Steam Rankine Cycle

When heat runs really hot, you often see the Steam Rankine Cycle at work inside big factories or power stations. Its design fits best where temperatures climb sharply over time. This cycle shows up most in heavy-duty operations that need steady steam output. Large-scale setups lean on it because handling extreme heat is what it does well.

- Kalina Cycle

A twist on the usual setup, Kalina Cycle runs smarter where heat keeps changing. Instead of plain water, it mixes ammonia into the flow. Efficiency climbs when temperatures swing unpredictably. The blend adapts faster than traditional fluids. Performance holds strong even under uneven loads. This design leans on chemistry more than pressure alone. Heat recovery becomes sharper across shifting inputs.

- Supercritical CO2 Cycle

A fresh approach to power cycles uses carbon dioxide above its critical point. This method fits more output into a smaller footprint. Efficiency climbs when heat converts faster under pressure. Size shrinks while performance lifts beyond older models. Design stays tight without losing power capacity.

- Thermoelectric Generators

Pulling power straight from warmth, thermoelectric generators work quietly in compact setups where only a little electricity is needed. Heat flows through them, creating current without moving parts, useful when standard systems are too bulky or impractical.

To learn more about this report, Download Free Sample Report

By Technology

- Below 1MW

That fits neatly into modest factory setups, also works well where waste heat gets reused on a local scale.

- 1-5 MW

A single unit might cover a factory’s needs, where energy runs machines through steady output. Usually, these systems fit well inside midsize production sites needing a reliable supply. Some setups use them when backup matters just as much as daily operation. Power flows without relying on distant grids, cutting downtime risks. Size keeps projects manageable without oversizing capacity.

- 5-20 MW

From 5 to 20 megawatts, operations in heavy sectors like cement take it on board. Steel production lines begin using this range once output demands rise. Chemical plants follow a similar path when power needs grow beyond lower thresholds.

- Above 20 MW

Starting at more than 20 megawatts, these systems run where big plants churn out serious heat. Heavy industry setups often tap into such output when demand spikes sharply.

By System Configuration

- Bottoming Cycle Systems

Heat gets caught when machines run. Exhaust flows carry warmth away afterward. Some systems grab that leftover heat instead of losing it. These setups reuse what would escape into the air. Energy moves on, but part of it circles back. Waste turns useful once redirected. After power does its main job, extra warmth still has purpose. Flow paths shift slightly, so recovery happens midstream.

- Top Cycle Systems

Capture high-temperature heat before the main power generation process.

- Hybrid Systems

Energy gets saved when different recovery techniques work together instead of alone. Mixing approaches boosts performance beyond what one method can do on its own. Efficiency climbs because weaknesses in one system get balanced by strengths in another. The whole setup adapts better to changing demands than single-method setups ever could.

By Application

- Industrial Waste Heat Recovery

Waste heat from factories takes up most of the market, so much energy slips away during production. What sticks around is how common those lost thermal outputs are across plants. Even now, operations keep leaking warmth that could be reused. That leftover heat? It shapes the whole scene simply by being everywhere. Heavy industries run hot, which means recovery systems show up more often than alternatives.

- Commercial Waste Heat Recovery

Growing adoption in large commercial buildings and data centers.

- Utilities & Power Plants

Power plants and utilities tap into WHP to get more output without burning extra fuel. Efficiency climbs when waste heat finds a second purpose instead of escaping. Every unit of energy works harder because leftover warmth drives additional processes. Less wasted heat means less need for fresh fuel inputs. Operations keep running while using what they already produce.

- Distributed Power Generation

Power made in many places helps spread out the supply while keeping the system steady. Sometimes, small sources add up without relying on one central hub.

Regional Insights

Big factories across the Asia Pacific drive the worldwide market for turning wasted heat into power. Fast-growing industries there rely heavily on making better use of energy, especially in nations like China, India, Japan, and South Korea. Instead of losing excess warmth from production, plants capture it to generate electricity, cutting both costs and pollution. Cement, steel, chemicals, and refineries are key areas using these methods widely. Growth does not stop there rising need for power pushes more companies to adopt smart solutions. Systems such as ORC and Kalina Cycle spread quickly thanks to strong economies and rules favoring cleaner operations. Government support adds fuel, helping new projects take root without delay. Momentum builds naturally when savings meet sustainability at large scale.

A big slice of the world's WHP market sits in North America, thanks to long-established industry setups and widespread use of smart heat recovery methods. Leading the charge is the United States, where rules pushing energy savings, helpful policies, along with perks like tax breaks and shared-cost schemes, fuel uptake in refineries, cement plants, and chemical factories. On the same path, Canada and Mexico add momentum through focused drives on cutting emissions and using energy wisely, helping bring WHP into heavy industrial zones. Over in Europe, tough eco-laws plus firm plans to cut carbon push more sites toward adopting WHP systems. Nations such as Germany, France, Italy, and the UK place a high value on reusing wasted heat under official energy-saving guidelines, putting the area solidly behind only North America in need, backed by steady spending on new tech aimed at hitting green milestones.

Down south, places like Latin America and parts of Africa are starting to pay more attention to waste heat recovery due to faster factory growth and a sharper focus on smarter energy use. Not far behind, Brazil, along with Mexico, stand out across that region, where big players in cement and mining push ahead, chasing lower power bills and a stronger market position. Over in the Middle East and Africa, nations including Saudi Arabia, the United Arab Emirates, and South Africa dive into these systems during refining or metal processing, aiming for smoother operations while cutting emissions, even if they are still playing catch-up compared to Europe, North America, and much of Asia.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 3, 2026 – Mitsubishi Heavy Industries Thermal Systems Has Launched "ETI-W."

Centrifugal Heat Pump Using Waste Heat Capable of Supplying Hot Water at 90℃.

- September 4, 2026 – Ramco launched an 8 MW waste heat recovery system.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 6.20 Billion |

|

Market size value in 2026 |

USD 6.90 Billion |

|

Revenue forecast in 2033 |

USD 12.80 Billion |

|

Growth rate |

CAGR of 9.20% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Ormat Technologies, Siemens AG, ABB Ltd., Mitsubishi Heavy Industries, MAN Energy Solutions, Danfoss, Thermax, Veolia, Atlas Copco, General Electric, Hitachi Zosen Corporation, Turboden, Babcock & Wilcox, Kalina Power, Exergy S.p.A., ElectraTherm, Thermax Ltd., Alstom, and Cleanergy AB |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology (Organic Rankine Cycle, Steam Rankine Cycle, Kalia Cycle, Supercritical Co2 Cycle, Thermoelectrical Generators), By Capacity Range (Below 1 MW, 1-1 MW, 5-20 MW, above 20 MW), By System Configuration (Bottoming Cycle System Top Cycle System Hybrid Systems), By Application (Industral Waste Heat Recovery, Commercial Waste Heat Recovery, Utilities & Power Plants, Distributed Power Generation) |

Key Waste Heat to Power Company Insights

Waste heat becomes power through Ormat Technologies, a firm rooted in geothermal and ORC-based systems worldwide. Across North America, Europe, and parts of the Asia Pacific, operations unfold using fully built solutions tailored for industry, commerce, or grid-scale needs. Efficiency stands out because its gear runs well even when temperatures stay moderate. Modules come ready-made, fit together smoothly, and last long under pressure. Turning excess warmth into usable heat cuts down both spending on energy and pollution released. Progress does not stop; each job adds insight, shapes smarter builds ahead. That steady push forward sets the pace others follow in turning overlooked thermal output into real electric gain.

Key Waste Heat to Power Companies:

- Ormat Technologies

- Siemens AG

- ABB Ltd.

- Mitsubishi Heavy Industries

- MAN Energy Solutions

- Danfoss

- Thermax

- Veolia

- Atlas Copco

- General Electric

- Hitachi Zosen Corporation

- Turboden

- Babcock & Wilcox

- Kalina Power

- Exergy S.p.A.

- ElectraTherm

- Thermax Ltd.

- Alstom

- Cleanergy AB

Global Waste Heat to Power Market Report Segmentation

By Technology

- Organic Rankine Cycle

- Steam Rankine Cycle

- Kalia Cycle

- Supercritical Co2 Cycle

- Thermoelectrical Generators

By Capacity Range

- Below 1 MW

- 1-1 MW

- 5-20 MW

- Above 20 MW

By System Configuration

- Bottoming Cycle System

- Top Cycle System

- Hybrid Systems

By Application

- Industrial Waste Heat Recovery

- Commercial Waste Heat Recovery

- Utilities & Power Plants

- Distributed Power Generation

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636