Market Summary

The global Hydrogen market size was valued at USD 215.00 billion in 2025 and is projected to reach USD 420.00 billion by 2033, growing at a CAGR of 8.70% from 2026 to 2033. A surge in worldwide hydrogen use comes mainly from refineries, chemical makers, and those producing ammonia, while cleaner energy projects begin pulling more supply too. Pushing to cut emissions faster helps grow the sector, since public funding flows into greener ways to make hydrogen at scale.

Market Size & Forecast

- 2025 Market Size: USD 215.00 Billion

- 2033 Projected Market Size: USD 420.00 Billion

- CAGR (2026-2033): 8.70%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 38% in 2026. Fueled by steady government backing, hydrogen gains ground where industrial zones begin blending it into operations. Clean energy clusters pop up more often, especially near ports or factories retooling old systems. Refineries shift part of their output to lower-carbon versions, while fertilizer plants keep pulling in supply without slowing down. Progress creeps forward, not through leaps but repeated small steps across regions, testing new infrastructure.

- Federal spending in the United States drives progress across North America, pushing hydrogen systems forward through laws like the Infrastructure Act. Progress leans heavily on cleaner production routes, shaping how energy networks grow. Support focuses on methods that cut carbon, setting direction without forcing outcomes.

- Starting strong, Asia Pacific leads worldwide in hydrogen activity, growing quicker than anywhere else. Industrial needs push its rise, while cleaner forms of the gas spread fast. Policies in nations like China shape progress, alongside moves in Japan, South Korea, and India. This region thrives on demand plus policy mix, setting the pace across the globe

- Green Hydrogen shares approximately 39% in 2026. Starting strong, green hydrogen expands quickly as renewable prices drop. Because policies back it, growth keeps rising. With the world aiming for lower emissions, this fuel gains ground.

- Now powering ahead, electrolysis sees big money flowing in as countries push cleaner energy goals. Growth forecasts are climbing fast due to rising demand for greener solutions across industries. More capacity appears on the horizon as support continues to build worldwide.

- Fuelled by farming needs, ammonia production takes up most of today’s hydrogen use. Its role in making fertilizers drives steady consumption across industries. Chemical processes lean heavily on this compound, too. Because crops depend on nitrogen-rich inputs, output stays high. Without it, the synthetic nutrient supply would slow down.

- H2 plays a big role in turning crude oil into fuel. Processing large-scale chemicals needs steady supplies, too. Factories running nonstop keep demand high. Heavy industry leans on this gas daily. Oil upgrades rely heavily on it. Making base materials uses more than most realize. Supply chains depend on a consistent flow. Production lines stall without enough. Energy-intensive steps require constant input. This sector takes up the largest share.

Nowhere else has seen such rapid growth lately as the hydrogen market, driven by industry demand for greener power sources along with reduced-emission inputs aimed at hitting environmental targets. What stands out about hydrogen is how easily it fits into different roles - serving not just as an energy source but also as a building block in various manufacturing steps. Because it works well where emissions are toughest to cut, it plays a unique part in shifting worldwide energy systems toward lower carbon outputs.

How things get made changes what people buy, whether it is old ways using oil and gas or new ones powered by wind and sun. Even though making hydrogen the usual way still dominates because systems exist and prices stay low, options that pollute less now draw more interest. As tools improve and rules tighten on emissions, movement grows stronger toward greener forms of hydrogen.

A fresh wave of tech advances keeps reshaping markets, pushing for better speed, size flexibility, and lower costs. Electrolysis stands out now because it works well alongside wind and solar power, though older techniques still run most heavy industries. Work in labs zeroes in on boosting output, using less electricity, and making systems ready for wider rollout. Progress rolls forward not through sudden leaps but steady tweaks behind the scenes.

Heavy industries rely on hydrogen every day, especially in making chemicals, processing fuels, and in factories - its everyday footprint runs wide. Moving beyond older roles, vehicles now tap into it, so do backup power systems and methods for holding surplus energy, quietly widening its reach. Factories turn to this gas not out of trend but necessity, aiming to let less smoke escape, shore up supply lines, and think ahead decades instead of days. When rules catch up, tools sharpen, business habits shift together, one outcome stands clear: hydrogen reshapes how we imagine tomorrow's power networks.

Hydrogen Market Segmentation

By Production Method

- Grey Hydrogen

A different kind of hydrogen appears when grey meets captured carbon. Storage steps in to trap what would escape. Emissions drop because the gas gets a second path. This version wears blue but carries traces of its past.

- Blue Hydrogen

Water splits apart when electricity passes through it. That power comes entirely from wind and sun. A clean fuel forms with nothing harmful released. This process leaves no trace behind. It runs on nature’s rhythm instead of fossil fuels.

- Rurquoise Hydrogen

Burning natural gas without oxygen creates turquoise hydrogen. This method traps carbon as a black powder. The process skips greenhouse gases entirely. Heat breaks molecules apart cleanly. Solid charcoal results alongside the fuel. No carbon dioxide escapes into the air. Methane splits when isolated from combustion.

- Red Hydrogen

Fueled by reactors, red hydrogen forms when electricity splits water molecules. Emissions stay minimal once systems run. Nuclear power drives the process from start to finish.

To learn more about this report, Download Free Sample Report

By Technology

- Steam Methane Reforming

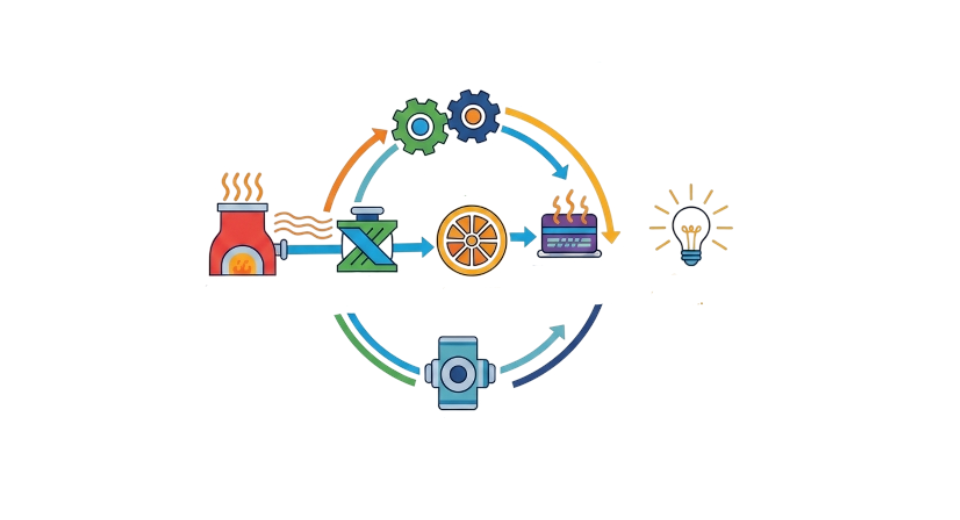

Fuel is turned into gas, and SMR splits it using steam. This way, hydrogen shows up alongside carbon dioxide. A common path that many plants follow today.

- Partial Oxidation

A bit of oxygen helps break down heavy fuels in partial oxidation. This method works well when the starting material is thick or complex. Instead of burning it all, just a portion reacts, leaving useful byproducts behind. Heat drives the process, making it fit for tougher raw inputs.

- Coal Gasification

Apart from burning it directly, coal can be turned into a gas filled with hydrogen through processing. This method shows up often where coal lies in large amounts across the landscape. The resulting fuel mix powers various industrial tasks without relying on oil.

- Electrolysis

A single drop of water can break apart when electricity moves through it. This process pulls out hydrogen while leaving oxygen behind. Power from renewable sources makes the split happen cleanly. The result is a fuel that burns without pollution. Clean energy flows both ways here.

By Application

- Petroleum Refining

Fuel processing at refineries relies on methods like breaking down heavy oils under high pressure. Removing sulfur also happens during these steps, helping meet quality standards.

- Ammonia Production

Fertilizer needs a main ingredient made through ammonia production.

- Methanol Production

A key ingredient in making methanol comes from this process. Its role begins before the main reaction takes shape. What follows is part of an industrial chain others rely on. Step by step, it feeds into larger systems quietly.

- Transportation

Fuel cells move people by powering cars, while also running city buses that roll down streets. Trains glide on tracks using this energy source instead of diesel engines. Heavy trucks carry goods across regions thanks to the same technology under their hoods.

- Power Generation

Fuel cells rely on it, and some gas turbines produce power because of it. Electricity comes from these systems, where it plays a key role behind the scenes. Not always visible, yet present in every spark those setups deliver.

- Energy Storage

Battery systems hold leftover power from wind or sunlight, keeping it ready over weeks or through winter months.

By End-Users

- Chemical Industry

A big part of making chemicals like ammonia and methanol comes from companies in this field. Production needs show up most here when building specialized compounds. These materials often start their life inside factories focused on chemical work. What happens next depends heavily on how much gets made locally. Plants using these substances tend to cluster where output is high.

- Oil & Gas Industry

Fuel production relies on it during the processing of raw petroleum. While heavy oils get transformed, this element plays a key role. Though often unseen, its presence marks nearly every stage. From thick tar-like inputs to lighter outputs, change happens because of it. Even when results seem distant, the process stays rooted in its function.

- Automotive

Seen working inside hydrogen-powered cars.

- Energy & Utilities

Fuel needs shift when the wind slows. Hydrogen steps in, filling gaps at power stations. Storage turns surplus into a steady supply later. Grids stay stable, even during peak drains. Plants swap old inputs, using cleaner molecules now. Pressure drops on backup systems, thanks to steady flow options. Operators gain flexibility without massive retools. Supply adjusts, matching demand swings smoothly.

- Metal & Mining

Furnaces hum where iron meets limestone under intense heat. Steel rolls out cleaner when carbon steps back during smelting. Mines deliver raw elements that reshape heavy industry’s footprint. Processing plants transform ore through reactions without fossil fuels. Decarbonizing metals begins underground, far below surface roads.

- Food & Beverages

Hydrogenation steps rely on it in food and drink production. Packaging tasks also put it to work across the sector.

Regional Insights

Some places see hydrogen growing fast, others move more slowly. Differences come down to how governments handle energy rules, factory needs, and maybe how ready pipelines and storage are. Where economies are more advanced, shifting away from old-style hydrogen happens quicker, thanks mainly to strict climate laws plus clear net-zero targets set decades ahead. New ideas pop up there often: tests in real conditions, experimental setups, big builds meant to link hydrogen smoothly with power, heating, and transport networks already in place.

Hydrogen still powers key industries like fuel processing and fertilizer making in developing areas, even as greener ways to produce it slowly gain ground. Because raw materials are plentiful and power needs keep rising, governments back projects that make and use hydrogen. Step by step, these places see hydrogen not just as fuel but as a backbone for stable energy and stronger factories.

Early moves in some areas show cautious steps toward using hydrogen, where testing ideas comes before big plans. Instead of rushing ahead, groups team up to learn what might work locally. Curiosity grows because clean power options feel necessary now. Shifting away from old fuel habits opens space for new thinking. When countries share knowledge, progress spreads differently than before. Over the years, efforts may link in ways few expect today.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 12, 2026 – India launched a major biomass-to-hydrogen funding programme.

(Source:https://www.bioenergy-news.com/news/india-launches-major-biomass-to-hydrogen-fundin)

- May 19, 2025– Samsung E&A launched new hydrogen solution compassH2.

(Source:https://www.indianchemicalnews.com/hydrogen/samsung-ea-launch-new-hydrogen-solution-compassh2-26194)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 215.00 Billion |

|

Market size value in 2026 |

USD 235.00 Billion |

|

Revenue forecast in 2033 |

USD 420.00 Billion |

|

Growth rate |

CAGR of 8.70% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Air Liquide, Linde plc, Air Products and Chemicals, Inc., Nel ASA, Siemens Energy, Plug Power Inc., Bloom Energy, ITM Power, Cummins Inc., Engie, Shell, BP, TotalEnergies, Mitsubishi Heavy Industries, Iwatani Corporation, Chart Industries, McPhy Energy |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Production Method (Grey Hydrogen, Blue Hydrogen, Green Hydrogen, Turquoise Hydrogen, Red Hydrogen), By Technology (Steam Methane Reforming, Partial Oxidation, Coal Gasification, Electrolysis), By Application (Petroleum Refining, Ammonia Production, Methanol Production, Transportation, Power Generation, Energy Storage), By End-Users (Chemical Industry, Oil & Gas Industry, Automotive, Energy & Utilities, Metal & Mining, Food & Beverage) |

Key Hydrogen Company Insights

A major name in hydrogen worldwide, Linde plc operates widely in making, holding, and moving the gas. Industrial gas know-how runs deep here, alongside innovation in modern hydrogen systems used by refineries, chemical makers, and renewable energy efforts. Backing initiatives that cut emissions, the firm pushes forward with cleaner hydrogen forms - steering toward climate targets set far and wide. Its work stretches across tech development and large-scale deployment, shaping how hydrogen supports future industries.

Key Hydrogen Companies:

- Air Liquide

- Linde plc,

- Air Products and Chemicals, Inc.

- Nel ASA

- Siemens Energy

- Plug Power Inc.

- Bloom Energy

- ITM Power

- Cummins Inc.

- Engie

- Shell

- BP

- TotalEnergies

- Mitsubishi Heavy Industries

- Iwatani Corporation

- Chart Industries

- McPhy Energy

Global Hydrogen Market Report Segmentation

By Production Method

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

- Turquoise Hydrogen

- Red Hydrogen

By Technology

- Steam Methane Reforming

- Partial Oxidation

- Coal Gasification

- Electrolysis

By Application

- Petroleum Refining

- Ammonia Production

- Methanol Production

- Transportation

- Power Generation

- Energy Storage

By End-Users

- Chemical Industry

- Oil & Gas Industry

- Automotive

- Energy & Utilities

- Metal & Mining

- Food & Beverage

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636