Market Summary

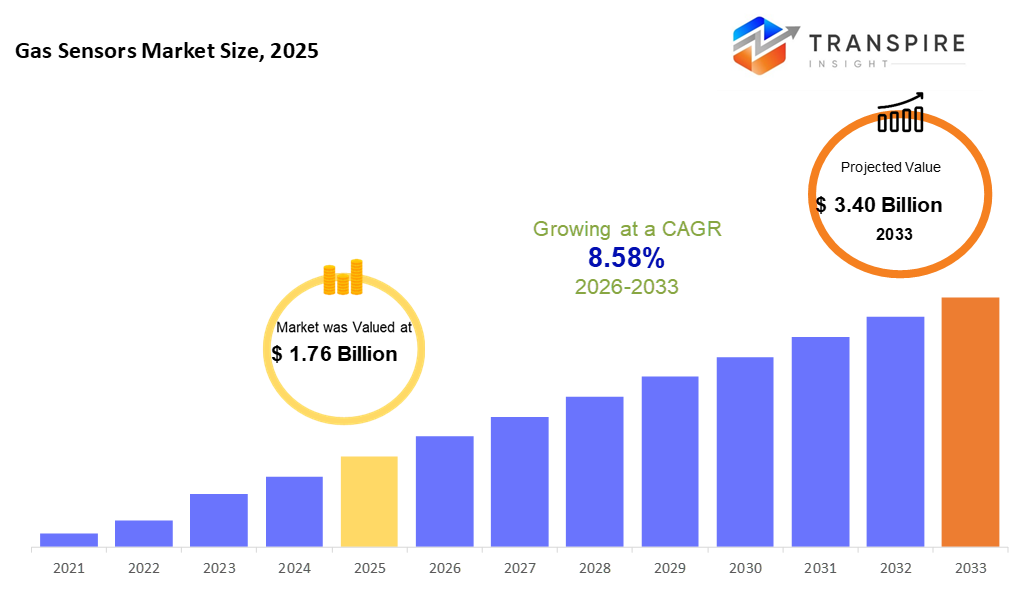

The global Gas Sensors market size was valued at USD 1.76 billion in 2025 and is projected to reach USD 3.40 billion by 2033, growing at a CAGR of 8.58% from 2026 to 2033. Market growth is driven by rising safety regulations, expanding industrial automation, and increasing awareness of air quality risks. Stricter occupational safety norms across oil & gas, mining, and manufacturing have accelerated adoption of electrochemical and infrared sensors. Rapid urbanization and smart building deployment are boosting residential and commercial demand. Automotive emission control requirements and healthcare monitoring needs further support growth, while wireless sensors gain traction due to lower installation costs and real-time monitoring efficiency.

Market Size & Forecast

- 2025 Market Size: USD 1.76 Billion

- 2033 Projected Market Size: USD 3.40 Billion

- CAGR (2026-2033): 8.58%

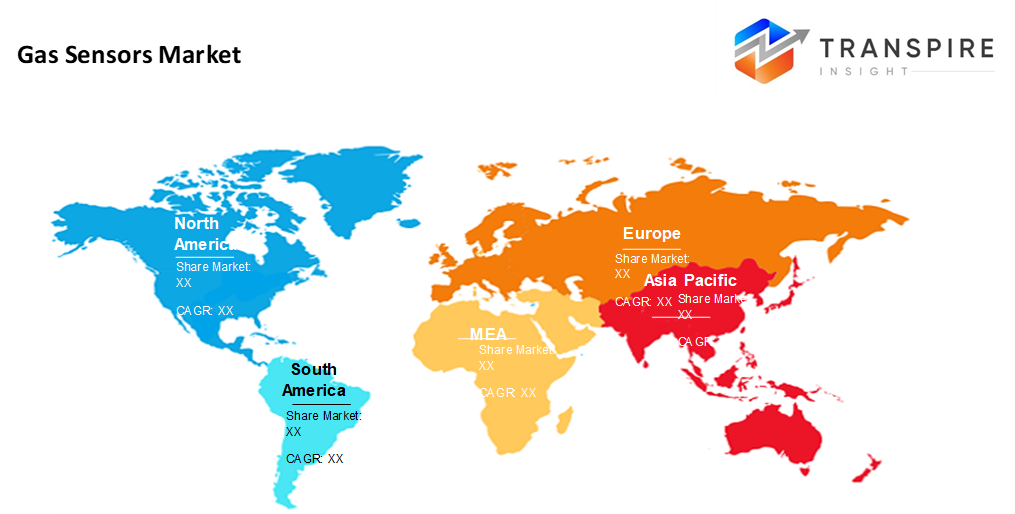

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America market share estimated to be approximately 38% in 2026. Over in North America, strict safety rules push progress forward, while industries everywhere start using smarter ways to spot risks. A clear focus on protecting workers, tied closely to new tools that work better than old ones.

- Fueled by quick uptake in oil and gas, factories, and building systems, the United States pulls ahead. Smart, networked gas detectors took root here first. That jump start carved a lead that others have not matched yet.

- In the Asia Pacific, fueled by rising factories, city expansion, along with tighter watch on air quality, the region sees a rapid rise in the need for gas detection tools. Growth surges here faster than anywhere else due to these shifting patterns across countries.

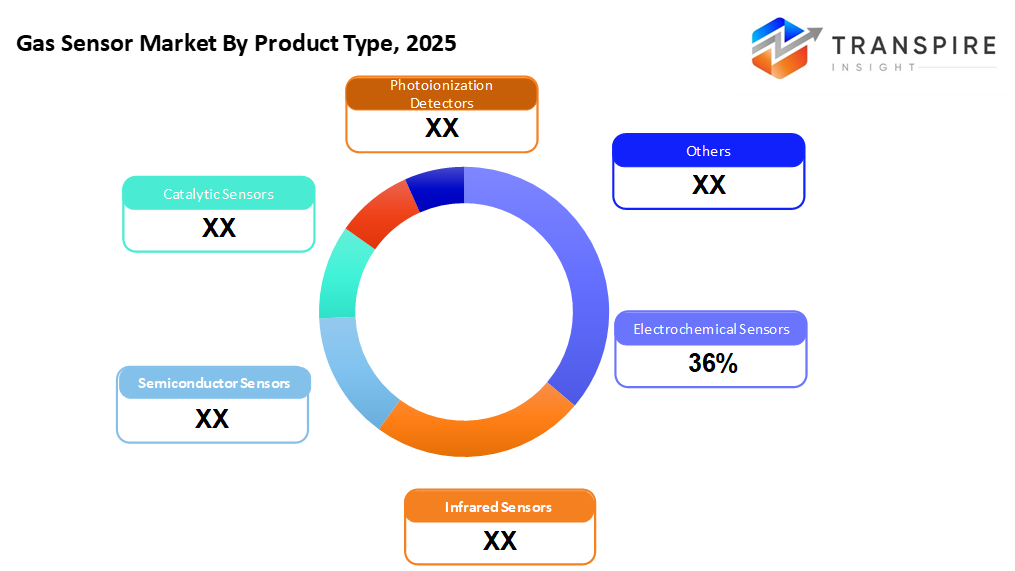

- Electrochemical Sensors share approximately 38% in 2026. A common choice when spotting harmful gases at worksites or where safety matters. These units show up most because they deliver reliable results. Their role in keeping environments safe drives broad adoption.

- When it comes to gas type, carbon monoxide takes the lead not just due to tight rules on indoor air, but also because protecting people at home or work is non-negotiable. Though other gases matter, this one shapes most demand simply by how dangerous unseen leaks can be.

- Faster growth shows up in wireless models because networked systems push needs for live data without wires. These tools adapt easily when tracking gases from a distance.

- Fuelled by strict regulations, industrial safety holds the top spot among uses, as its role in cutting workplace risks keeps it ahead of others. Not quite; it is simply where rules hit hard, and consequences matter most.

A growing number of factories, homes, and outdoor areas now rely on tools that detect harmful fumes, fire risks, or climate-affecting emissions. This demand keeps the gas sensor business moving forward. Instead of one single method, different detection types exist: some react chemically, others use light beams, heat changes, ion shifts, or electric signals to identify invisible threats. These devices show up where people work, breathe, drive, heal, or drill deep underground. When communities pay closer attention to what floats in the air, officials respond by tightening rules, which pushes companies to install better sensing gear.

Fueled by strict safety rules, industries need gas detectors just as much as they face rising worries about dirty air and dangerous job sites. Though electrochemical types lead because they catch tiny leaks without guzzling power, more folks now pick wireless models hooked into networks when watching faraway spots nonstop. Smart homes that think for themselves, cars laced with digital brains, even wind farms breathing clean energy, all quietly push demand higher, too.

What stands out now is how new sensor materials keep changing what devices can do. Small size matters more every day, pushing designs to shrink without losing function. Instead of just one gas, sensors detect several at once, thanks to smarter engineering. These tools link up easily with systems that make sense of large amounts of information. Making sensors last longer helps them work steadily in tough places. Accuracy gets better even when heat, moisture, or dust interferes. Factories rely on this progress to stay safe and measure air quality precisely.

With rivals pushing hard, firms now lean on partnerships instead of going solo. Long deals for steady supplies matter more than ever. Moving into new regions opens doors they can not ignore. Research gets serious cash when it comes to smarter sensors. Meeting global safety rules is not optional; it’s built in from the start. Green thinking shapes what gets made, down to how much power each piece uses. Growth hangs on these choices, slow but sure.

Gas Sensors Market Segmentation

By Product Type

- Electrochemical Sensors

These sensors spot nasty gases fast. Accuracy stands out, sure, yet they sip power like it is scarce. Pick one, because it knows what to watch for. Tough to beat when precision matters.

- Infrared Sensors

Few sensors last as long as infrared ones, especially when spotting carbon dioxide or hydrocarbons. Their lifespan stretches far beyond most. Stability stays consistent over time, year after year. They work without using up any internal parts.

- Semiconductor Sensors

Found in everyday gadgets and factories, semiconductor sensors spot flammable gases without breaking the bank. These tools rely on materials that change behavior when exposed to certain fumes. Often tucked inside alarms or monitoring gear, they bring reliable detection at a modest price. Their widespread use comes from balancing performance with affordability. Not the most precise option around, yet still trusted where budget matters.

- Catalytic Sensors

Fires need fuel, so sensors that react to vapors work best where leaks might happen - factories, rigs, pipelines. These tools spot what could ignite before it does.

- Photoionization Detectors

A small sensor lights up when it finds invisible fumes floating in factory air. This tool spots trace gases that might harm workers or leak into nature. It runs quietly during checks without slowing down inspections.

- Others

Devices like ultrasonic, optical, or solid-state types show up where specific needs call for newer tech.

To learn more about this report, Download Free Sample Report

By Gas Type

- Oxygen

Oxygen levels get checked where people work, heal, or enter tight areas; too little or too much matters. Monitoring happens using gas-specific tools made just for oxygen. These devices spot when concentrations drift beyond safe limits. They help avoid danger without needing constant attention.

- Carbon Monoxide

Smokeless fumes need watching where people live, work, or ride. Spotting them early keeps air spaces safer. Vehicles, offices, and homes each rely on alerts when gas builds up unseen. Silent detection matters most when danger has no smell.

- Carbon Dioxide

Indoor spaces track carbon dioxide levels to manage ventilation needs. Machines adjust airflow based on readings from sensors placed throughout buildings. Factories rely on consistent measurements during production tasks. These checks help maintain stable conditions without interruptions.

- Hydrogen

Fuel cells hum quietly while hydrogen proves useful beyond power. Leak checks grow common where safety matters most. Machines in factories rely on it just as much as cars do. Energy sites watch for escapes with sharp precision. This gas moves through sectors without drawing attention.

- Methane

That is where methane sensors step in, common across drilling sites and deep underground tunnels. Detection of fire-prone gases becomes routine in these spots, thanks to their steady presence.

- Nitrogen Oxide

A gas that helps track pollution levels pops up in checks meant to meet environmental rules. It shows what vehicles or factories release into the air during routine testing.

- Others

Fumes like ammonia show up here, mixed with sulfur dioxide, both tracked in factories or out in nature. VOCs appear, too, as part of the same watchlist when checking the air around sites or ecosystems.

By Type

- Wired

Firm connections define wired setups, delivering steady oversight where operations stay put. Fixed locations benefit most - factories, offices, the kind of places that run best when things do not move around much.

- Wireless

- Moving without wires makes setup easier in distant or shifting locations. Where signals travel through the air, machines keep watch instantly. Not tied down, they adapt to tough spots fast. Remote checks happen smoothly when cables are left behind.

By Application

- Industrial Safety and Monitoring

Safety checks at work take up the biggest chunk, simply because rules are tight and risks need careful handling. Where dangers exist, oversight follows close behind.

- Environmental Monitoring

Sensors track what is in the air, helping officials manage emissions. These tools give data that shapes how rules are enforced across cities.

- Medical & Healthcare

Breathing checks, tools for sleep meds, and lab tests are uses that pop up in hospitals. Machines that track air flow, devices numbing patients, gear spotting illness, all are part of modern care scenes.

- Automotive

Exhaust gases get checked by sensors that help manage emissions. These parts also keep the air inside cars cleaner over time. Instead of just cutting pollution, they track how well the system works overall.

- Residential & Commercial Building

Air quality matters at home or work. Inside buildings, devices help control ventilation alongside alert systems that warn of risks. These tools run quietly in the background, keeping spaces safe through steady monitoring.

- Oil & Gas

Fumes underground need watching closely. A spark could mean trouble out on rigs. Safety checks keep workers clear of danger zones. Pipes moving crude must stay sealed tight. Fires start easily near storage tanks. Monitoring systems run nonstop through the night. Early warnings make space to react before things spread. Refineries rely on sensors that never sleep. Pressure shifts tell stories before disasters strike.

- Others

Fishing out bits from deep underground, making what we eat and drink, building machines that fly high, working on tools meant to protect.

Regional Insights

Fueled by tough safety rules, North America stands out in the gas sensor world. Its factories rely on modern systems that support high-tech detection tools. Across the border, one country sets the pace, focusing heavily on safer worksites and cleaner air tracking. Elsewhere in the region, another nation follows behind, slowly embracing similar uses in industry and nature watch. Progress there moves at a steadier clip, yet interest keeps rising.

Fueled by quick industrial growth, city expansion, and stronger attention to nature, the Asia Pacific moves ahead fast. In places like China, Japan, South Korea, and Taiwan, factories making computer chips, vehicles, and chemicals create big needs. Meanwhile, India, Malaysia, and Vietnam see more usage as new plants rise alongside smarter buildings. Growth spreads differently - fastest where tech leads, steadily where space opens.

Across Europe, countries such as Germany, France, and the Netherlands lead in using gas sensors for workplace safety and meeting pollution rules. Other areas like Italy, Spain, and the Nordic countries follow at a slower pace. In Latin America, Brazil and Mexico are seeing more need due to growing factories and city projects. The United Arab Emirates and South Africa also show rising interest, tied to construction and new industries. Though smaller players now, these regions matter more each year.

To learn more about this report, Download Free Sample Report

Recent Development News

- June 17, 2025 – Anybotics launched a new gas leak & presence detection solution for its Anymal inspection robot.

(Source: https://www.anybotics.com/news/robotic-gas-leak-detection-anymal/

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 1.76 Billion |

|

Market size value in 2026 |

USD 1.91 Billion |

|

Revenue forecast in 2033 |

USD 3.40 Billion |

|

Growth rate |

CAGR of 8.58% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

ABB Ltd, Alphasense, Honeywell International, Figaro, Amphenol Advanced Sensors, Dynament td, SGX Sensortech, Spec Sensors Inc., Dragerwerk Ag & Co. KGaA, FLIR Systems Inc., Siemens, Robert Bosch, Nemoto & Co. Ltd, Membrapor, Alvi Automation, SmartGas Mikrosensorik GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Electrochemical Sensors, Infrared Sensors, Semiconductor Sensors, Catalytic Sensors, Photoionization Detectors, Others) By Gas Type(Oxygen, Carbon Monoxide, Carbon Dioxide, Hydrogen, Methane, Nitrogen Oxide, Others ) By Type (Wired, Wireless) By Application (Industrial Safety & Monitoring, Environmental Monitoring, Medical & Healthcare, Automotive, Residential & Commercial Building, Oil & Gas, Others) |

Key Gas Sensors Company Insights

Honeywell International Inc. is deeply involved it is in making gas sensors that work across many areas factories, homes, and outdoor spaces. Their gear is either bolted down permanently or carried around, connected by wires or running wirelessly. Electrochemical types sit beside infrared ones; catalytic versions share space with semiconductors, all built for spotting dangerous fumes or gases that could ignite. Behind each unit lies a serious research effort paired with factories spread worldwide, aiming at precision you can count on over time. Oil rigs rely on them just like refineries do, so do labs handling chemicals, modern office towers, and even car production lines. Because these systems keep showing up where safety matters most, the firm holds strong ground in this field.

Key Gas Sensors Companies:

- ABB Ltd

- Alphasense

- Honeywell International

- Figaro

- Amphenol Advanced Sensors

- Dynament td

- SGX Sensortech

- Spec Sensors Inc.

- Dragerwerk Ag & Co. KgaA

- FLIR Systems Inc

- Siemens

- Robert Bosch

- Nemoto & Co. Ltd

- Membrapor

- Alvi Automation

- SmartGas Mikrosensorik GmbH.

Global Gas Sensors Market Report Segmentation

By Product Type

- Electrochemical Sensors

- Infrared Sensors

- Semiconductor Sensors

- Catalytic Sensors

- Photoionization Detectors

- Others

By Gas Type

- Oxygen

- Carbon Monoxide

- Carbon Dioxide

- Hydrogen

- Methane

- Nitrogen Oxide

- Others

By Type

- Wired

- Wireless

By Application

- Industrial Safety & Monitoring

- Environmental Monitoring

- Medical & Healthcare

- Automotive

- Residential & Commercial Building

- Oil & Gas

- Others

Regional Outlook

- North America

- United States

- Canada

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636