Market Summary

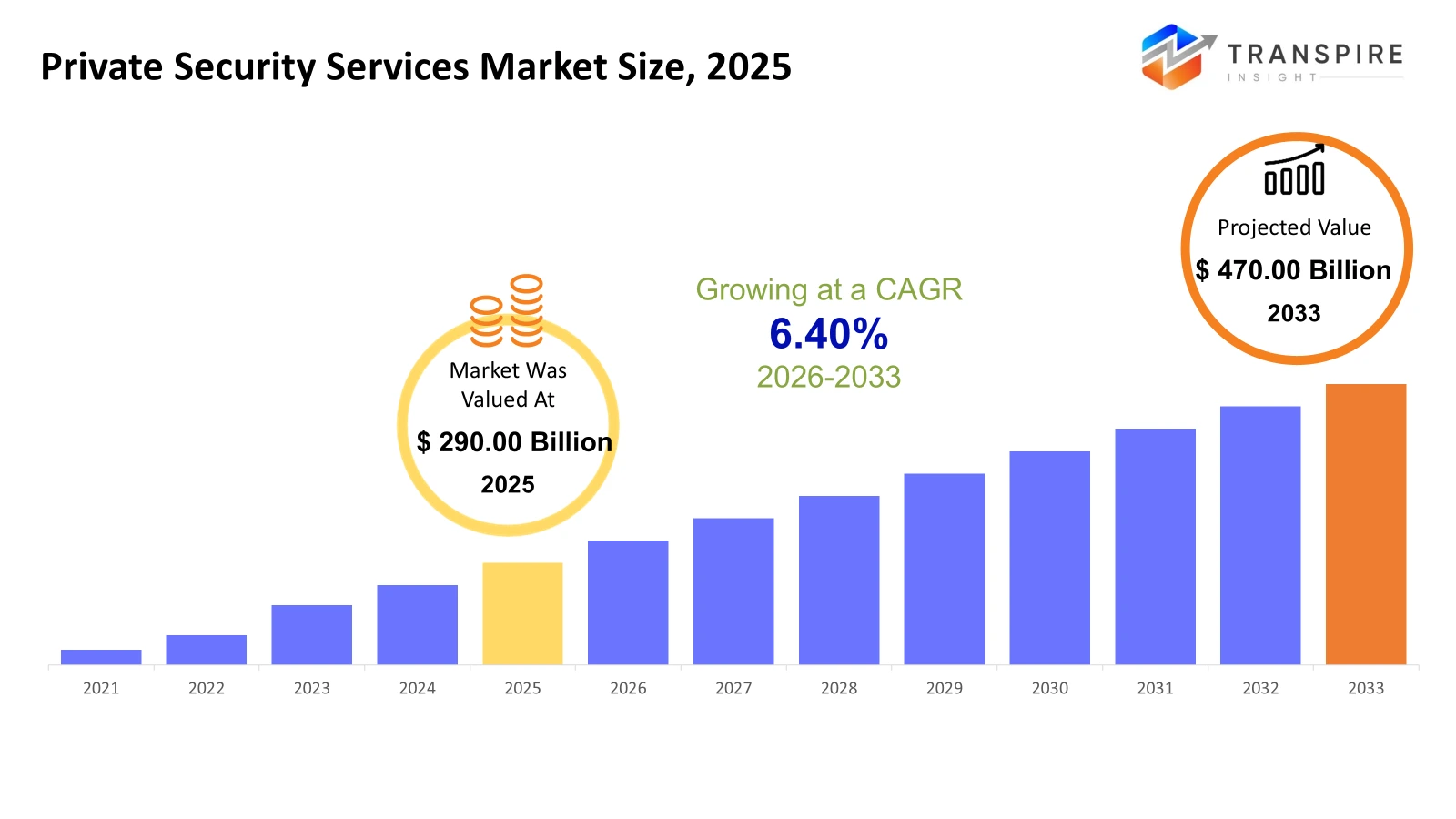

The global Private Security Services market size was valued at USD 290.00 billion in 2025 and is projected to reach USD 470.00 billion by 2033, growing at a CAGR of 6.40% from 2026 to 2033. Growing concerns about asset protection, occupational health and safety, and infrastructure security are driving the outsourcing of professional security services. The trend is being fueled by urbanization and the development of critical infrastructure.

Market Size & Forecast

- 2025 Market Size: USD 290.00 Billion

- 2033 Projected Market Size: USD 470.00 Billion

- CAGR (2026-2033): 6.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market is continuing to show robust adoption of integrated and technology-based private security solutions, fueled by high corporate outsourcing rates, well-developed infrastructure, and stringent compliance requirements. Demand is gradually shifting towards AI-based monitoring and cybersecurity solutions.

- The United States is the largest revenue-generating country, fueled by widespread commercial infrastructure, the need for critical asset protection, and high security expenditure in the BFSI, healthcare, and government segments. Consolidation activities among the major service players are enhancing integrated solution offerings.

- The Asia Pacific market is witnessing rapid growth, fueled by rapid urbanization, infrastructure development, and industrialization. Rising awareness about professional security standards and economical guarding solutions is fueling robust adoption in emerging and mature markets.

- Manned guarding services continue to be the largest market, driven by sustained demand for physical presence in commercial, industrial, and public sector establishments. However, service delivery optimization and workforce management solutions are transforming the services landscape.

- Full-scale businesses continue to dominate the largest enterprise size type due to the need for standardized security solutions that encompass physical security measures, monitoring solutions, and centralized risk management platforms for complex supply chains.

- Physical security continues to lead the market in terms of security type due to the need for regulatory compliance and deterrence, despite the integration of digital monitoring solutions that improve the efficiency of security operations.

- The commercial sector continues to lead the market in terms of end-user demand due to the need for customer safety and regulatory compliance in office buildings, retail establishments, and hospitality businesses that require a hybrid security approach that combines physical security personnel with electronic surveillance solutions.

So, The private security services market includes professional bodies offering protection solutions such as manned guarding, surveillance, monitoring, risk assessment, and comprehensive security management. These protection solutions are applied in commercial, industrial, residential, and public domains to counter physical and technological threats. The market is primarily driven by contract-based business models. The market forces are driven by growing awareness about security, risk management strategies by businesses, and development of high-value infrastructure. Businesses are increasingly outsourcing non-core business activities, such as security management, to professional bodies that can provide standardized solutions. Technology is also converging traditional security services into hybrid security platforms.

The competitive intensity is driven by regional and global service companies with diversified business portfolios. Strategic mergers and acquisitions, as well as technology collaborations, are common practices to expand market presence and service offerings. The shift towards integrated and data-driven security models is changing the value chains in the industry.

Private Security Services Market Segmentation

By Service Type

- Manned Guarding Services

Manned guarding services continue to be a prominent market segment because of the steady demand for the presence of security personnel at commercial, industrial, and public infrastructure sites. The market is driven by the growing need for physical security, access control, and regulatory compliance in high-risk settings. The outsourcing of security operations by businesses is also fueling market growth.

- Electronic Security Services

The electronic security services market is growing at a fast pace because of the increasing use of surveillance systems, access control solutions, and alarm monitoring systems. The integration of these solutions with AI-powered analytics and remote monitoring systems is improving efficiency and minimizing the need for manual security solutions. The market is driven by the growing use of smart building technologies and urban infrastructure development.

- Cash-in-Transit Services

The cash-in-transit services market continues to be relevant in regions with high cash circulation and retail banking activities. The market is driven by the need for secure logistics solutions for financial institutions and large retail chains. However, the adoption of digital payments is changing the market landscape and leading to the development of integrated secure logistics solutions.

- Event Security Services

Event security services are driven by the growing number of large-scale events, business events, and entertainment events. Mitigation of risk, crowd control, and emergency preparedness are major drivers for this segment. The flexibility of temporary deployment and training of specialized staff are factors that add to the operational significance of this segment.

- Risk Assessment & Consulting Services

Risk assessment and consulting services are emerging as a major trend, as businesses are increasingly adopting a proactive approach to threat identification and compliance strategies. Growing demand from critical infrastructure industries for vulnerability analysis and tailored security strategies is a major factor for this segment. Increased regulatory focus and enterprise risk management are also adding to the significance of this segment.

- Surveillance & Monitoring Services

Surveillance and monitoring services are growing steadily, thanks to the growing use of remote monitoring centers and real-time analysis. Businesses are increasingly adopting centralized monitoring solutions to minimize operational expenses and still maintain high security standards. The trend towards 24/7 monitoring solutions is adding to the recurring service revenue streams.

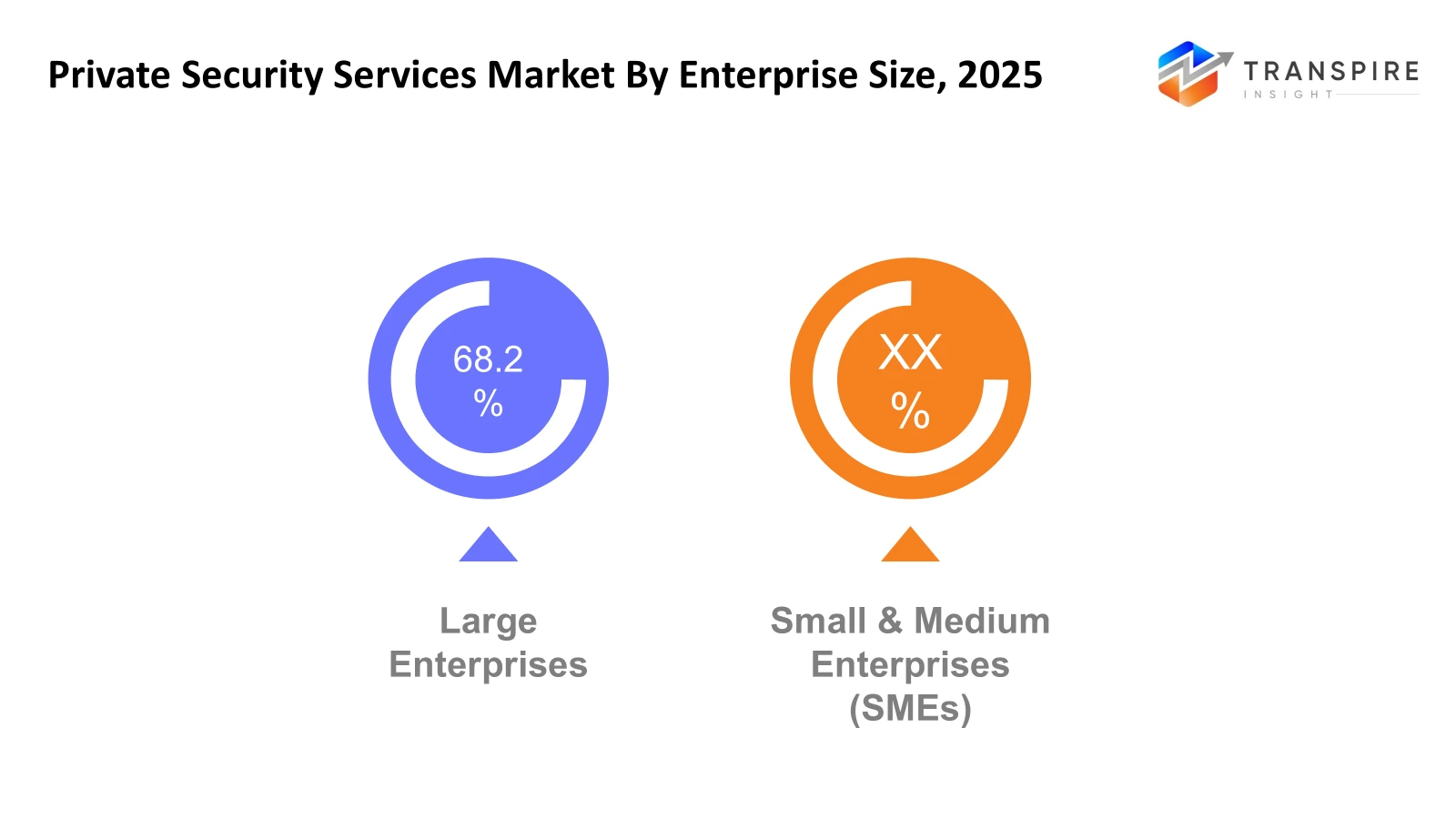

By Enterprise Size

- Large Enterprises

Large enterprises lead the demand due to their complex business structures and higher vulnerability to security threats. Large enterprises usually require comprehensive security solutions that integrate physical and digital security measures. This segment's revenue stability is ensured through long-term contracts and technology investments.

- Small & Medium Enterprises (SMEs)

SMEs are also increasingly turning to private security solutions due to rising awareness about asset protection and workplace security. SMEs are attracted to cost-effective electronic security solutions. The industry is seeing scalable and subscription-based models being offered by service providers due to budget constraints.

To learn more about this report, Download Free Sample Report

By Security Type

- Physical Security

The physical security market is the base component, fueled by the need for guarding, patrol, and protection services. Sectors like manufacturing, retail, and government infrastructure are highly dependent on physical presence for security. Even after the digital revolution, the physical security market still constitutes a substantial portion of the total service requirements.

- Cybersecurity Services

The cybersecurity services market is emerging as a new focus area for security companies, which are now venturing into digital risk protection. The rising number of cyber-attacks, data breaches, and interconnected devices are pushing companies to implement a holistic security strategy. The convergence of cybersecurity with physical security is becoming a major differentiator for companies.

- Integrated Security Services

The integrated security services market encompasses physical security, electronic surveillance, and cybersecurity services under a single umbrella. Companies are opting for integrated security services to enhance response time, operational visibility, and vendor management. This market is growing rapidly with the adoption of smart infrastructure and IoT technology.

By End User

- Commercial

The commercial sector holds a substantial market share owing to the high level of security needed in office buildings, shopping malls, and hotels. Urbanization and the increasing number of people visiting these areas are boosting the demand for both manual and electronic security systems. Customization of services is an important differentiator in this market.

- Industrial

Industrial establishments demand customized security services for the safety of their resources, value chains, and business continuity. The increasing number of manufacturing and logistics facilities is boosting the demand for perimeter security and surveillance services. Safety standards and risk management approaches play an important role in shaping demand.

- Residential

The residential security services market is growing with the development of gated communities and smart homes. There is an increasing awareness about personal and property safety, which is promoting the adoption of surveillance and monitoring services. Technology-based security services are gaining popularity among urban households.

- Government & Public Sector

The government and public sector market is fueled by the need for critical infrastructure protection, public safety, and national security. This market is marked by long-term contracts and stringent government regulations. Infrastructure development and public security programs are driving the growth of this market.

- Transportation & Logistics

The transportation and logistics industry needs security services for cargo protection, warehouse security, and transit security. The rise in e-commerce and international trade is fueling the demand for surveillance and comprehensive security solutions. Business continuity and theft prevention are the top priorities of this market.

- Banking, Financial Services & Insurance (BFSI)

The BFSI industry is a significant user of private security services owing to the need for high-value asset protection. Branch security, ATM security, and cash logistics security services are the major demand drivers. Compliance with regulations and fraud prevention programs are driving the long-term engagement of security services in this market.

- Healthcare

Healthcare organizations need specialized security solutions to address patient safety, data protection, and emergency response. Rising cases of workplace violence and asset protection are fueling the demand for security services. Integration of monitoring systems with access control systems is becoming more prevalent.

- Retail

The demand for retail security solutions is fueled by loss prevention, inventory protection, and customer safety needs. The rise in organized retailing and shopping malls creates a favorable environment for the continuous deployment of surveillance and guarding solutions. Advanced analytics and monitoring solutions are being leveraged to mitigate shrinkage and operational risks.

Regional Insights

In North America, tier 1 markets like the United States lead in terms of revenue, due to mature outsourcing models and high security investments. Canada is a stable tier 2 market with consistent adoption of integrated solutions, and Mexico is a growing market with emerging growth in industrial and logistics development. The Europe region comprises tier 1 markets like Germany, United Kingdom, and France, which are driven by regulatory compliance and infrastructure security. Spain and Italy are tier 2 markets, and the Rest of Europe represents moderate but consistent demand growth. The Asia Pacific region is led by tier 1 economies like Japan and China, which are driven by infrastructure development. Australia & New Zealand and South Korea are advanced tier 2 markets, and India and the Rest of Asia Pacific represent high growth opportunities. South America is led by tier 1 market Brazil, followed by Argentina, a developing tier 2 market. The Rest of South America exhibits a gradual adoption rate based on economic factors and security requirements in urban areas.

In Middle East & Africa, tier 1 markets like Saudi Arabia and United Arab Emirates are aided by infrastructure megaprojects and oil & gas asset protection. South Africa is a major market in Africa, while the Rest of Middle East & Africa exhibits expanding but diverse demand trends.

To learn more about this report, Download Free Sample Report

Recent Development News

- September 2025, G4S released the findings of its World Security Report, pointing out the rising security threats such as fraud, information leakage, and physical attacks on company executives. The report highlighted the growing corporate need for improved physical and integrated security solutions, which is a result of increased enterprise spending on professional private security services.

- In March 2025, In March 2025, Allied Universal announced the completion of six strategic acquisitions in 2024 in the areas of guarding, security technology, investigations, and event services. These acquisitions contributed more than USD 240 million to the annual revenues of the company and helped to expand its presence in North America, Europe, Asia Pacific, and other regions.

(Source:https://ausnewsroom.aus.com/news/allied-universal-details-2024-merger-and-acquisition-activities)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 290.00 Billion |

|

Market size value in 2026 |

USD 305.00 Billion |

|

Revenue forecast in 2033 |

USD 470.00 Billion |

|

Growth rate |

CAGR of 6.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Allied Universal, Securitas AB, G4S plc, GardaWorld, Prosegur Compañía de Seguridad S.A., ADT Inc., The Brink’s Company, Loomis AB, Secom Co., Ltd., Control Risks Group Holdings Ltd., Convergint Technologies LLC, Pinkerton Consulting & Investigations, Inc., Security and Intelligence Services (India) Limited, ISS A/S, and ICTS Europe S.A |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Service Type (Manned Guarding Services, Electronic Security Services, Cash-in-Transit Services, Event Security Services, Risk Assessment & Consulting Services, Surveillance & Monitoring Services), By Enterprise Size (Large Enterprises, Small & Medium Enterprises (SMEs)), By Security Type (Physical Security, Cybersecurity Services, Integrated Security Services) and By End User (Commercial, Industrial, Residential, Government & Public Sector, Transportation & Logistics, Banking, Financial Services & Insurance (BFSI), Healthcare, Retail) |

Key Private Security Services Company Insights

Allied Universal symbolically represents one of the most prominent players in the private security services industry because of its size, diversified service offerings, and widespread presence in North America and Europe. The company’s dominant position in the industry is established by its large manned guarding business, event security offerings, and growing investments in technology-based monitoring and analytics offerings. Its business model of expansion through acquisitions has helped the company enhance its presence across the globe and offer diversified services to commercial, industrial, and government clients. The company’s employee base of over hundreds of thousands, with a focus on AI-based surveillance and integrated security solutions, helps it generate steady revenue streams.

Key Private Security Services Companies:

- Allied Universal

- Securitas AB

- G4S plc

- GardaWorld

- Prosegur Compañía de Seguridad S.A.

- ADT Inc.

- The Brink’s Company

- Loomis AB

- Secom Co., Ltd.

- Control Risks Group Holdings Ltd.

- Convergint Technologies LLC

- Pinkerton Consulting & Investigations, Inc.

- Security and Intelligence Services (India) Limited

- ISS A/S

- ICTS Europe S.A.

Global Private Security Services Market Report Segmentation

By Service Type

- Manned Guarding Services

- Electronic Security Services

- Cash-in-Transit Services

- Event Security Services

- Risk Assessment & Consulting Services

- Surveillance & Monitoring Services

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Security Type

- Physical Security

- Cybersecurity Services

- Integrated Security Services

By End User

- Commercial

- Industrial

- Residential

- Government & Public Sector

- Transportation & Logistics

- Banking, Financial Services & Insurance (BFSI)

- Healthcare

- Retail

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636