Market Summary

The global Integrated Bridge Systems market size was valued at USD 3.20 billion in 2025 and is projected to reach USD 6.20 billion by 2033, growing at a CAGR of 8.10% from 2026 to 2033. Ship traffic around the world keeps climbing. As a result, more vessels are being built each year. Fleet upgrades happen faster now than before. Safety matters more today at sea. Because of that, better bridge systems find their way onto new ships. Rules set by international bodies push change forward, too. Navigation needs have shifted in recent years. Efficiency plays a bigger role these days. Equipment onboard must keep up smoothly. Modern setups help crews manage tasks with fewer errors. Progress comes slowly, but it does come.

Market Size & Forecast

- 2025 Market Size: USD 3.20 Billion

- 2033 Projected Market Size: USD 6.20 Billion

- CAGR (2026-2033): 8.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 30% in 2026. Fueled by modern dockyards, government spending on naval power is climbing here. Spending more brings smarter sea systems into play across ports and waterways. New tech finds its way onto vessels thanks to steady funding shifts in coastal areas.

- United States new ships push progress, while bigger military budgets help too because smart sea machines keep improving.

- Fleets across the Asia Pacific need advanced navigation tools, especially where Chinese yards turn out vessels at scale. Korean builders follow close behind, their output pushing tech uptake on cargo ships. Japanese production adds to the regional lead, each new vessel fitted with modern controls. Demand grows quietly amid these industrial rhythms, tied closely to how many hulls launch each year.

- Hardware share approximately 70% in 2026. Fleet upgrades keep rolling, pushing hardware ahead, radar systems now sharper, navigation screens smarter. Not just fresh ships but old ones getting refits too. Instead of standalone tools, everything links: sensors talk to displays, and data flows without hiccups. Performance matters more each year, so owners invest. Even minor delays get costly, making reliability non-negotiable. Upgrades spread fast when one vessel proves results.

- Out at sea, navigation tools are taking center stage. Rules now require them. Plus, smarter routes mean ships rely more on precise location tech. Digital maps follow close behind. Positioning is not just backup anymore - it’s built in. Demand grows quietly, pushed by efficiency needs. Not flash, just function. Progress shows up in software updates and sensor tweaks. What once was optional feels essential today.

- Out on the water, commercial ships dominate simply because worldwide sea trade keeps growing. Container fleets are getting bigger at the same time, adding to their lead.

- Folks who build ships still top the list, since they are fitting out vessels with integrated bridge systems right from the start. Smart-ship progress ties into this, too, pushing their lead further.

With ships requiring smarter navigation and communication capabilities, demand continues to rise within the integrated bridge systems market. As modern maritime operations grow more complex, crews increasingly rely on interconnected technologies that enhance visibility, coordination, and decision-making on the bridge. These unified systems combine navigation, radar, communication, and monitoring tools into a single streamlined interface.

Now, machines help define how industries evolve. Tied together through one screen, tools like digital maps, radar, auto-steer, and radios work better as a team. Because of smarter boats that think on their own, builders add live data feeds and distant control features to navigation centers. These updates link everything, making choices sharper during trips.

Out at sea, rules are tightening around safety and cleaner operations. Because of this shift, ships must now meet tougher navigation requirements set by global agreements. Upgrading old control setups has become common, thanks to these evolving expectations. New builds and military spending push more adoption of smart bridge tools. Demand stays strong, fed by efforts to bring fleets up to date.

They never stop improving their tech while teaming up through alliances that last for years. Instead of one-size-fits-all setups, they build flexible systems tailored to different ships and how they operate. With more cargo moving across oceans and work happening farther offshore, there's steady pressure to deliver bridge technology that works well, works reliably, and stays modern. Expect this need to keep shaping choices far into the future.

Integrated Bridge Systems Market Segmentation

By Component

- Hardware

Even though many products fade fast, this one sticks around; radars sell well alongside ECDIS units. Sensors help too because ships rely on them daily. Bridge control panels finish the lineup, pulling strong interest from buyers who need full systems. Demand keeps climbing without slowing down.

- Software

A steady rise in demand drives software development forward. Efficiency tools for planning paths gain more attention every day. Machines handle tasks once done by hand, shifting how work flows. Connecting separate data systems becomes a quiet priority across fields.

- Services

Repairs keep things running, while updates bring older ships up to speed. Older boats get new tech added later on. Contracts make sure work continues over time.

To learn more about this report, Download Free Sample Report

By Subsystem

- Navigation Systems

Holding the biggest share, navigation systems see the required adoption of modern positioning tech driving their lead.

- Control Systems

A single hub manages how the boat moves, streamlining tasks across systems. Movement decisions flow through one core point, linking actions smoothly behind the scenes.

- Communication Systems

From deck to dock, signals move without delay. One vessel reaches another as easily as it contacts land stations. Messages flow across waves the moment they are sent.

- Monitoring Systems

Performance checks happen through monitoring setups. These help teams stay aware of what is happening around them. Safety improves when systems track conditions in real time. Awareness grows stronger with constant data flow. Operations run smoother under watchful

tools.

- Alarm & Safety Systems

When alarms sound on ships, they are doing more than making noise; they are holding up legal standards. Staying safe at sea means these systems must work without fail. Because rules are not suggestions, protection relies heavily on constant readiness. A single fault could mean big trouble later. These tools stand between order and chaos when danger hits. Without them, even small risks grow fast.

By Vessel Type

- Commercial Vessels

A growing chunk of shipping activity belongs to commercial ships. These vessels move goods across oceans, feeding world markets. As international commerce climbs, so does its role in hauling freight. Their presence dominates sea routes where products travel nonstop.

- Naval Vessels

Fleet expansion follows new needs in coastal monitoring and updated security strategies. Shipbuilding rises as nations update maritime defenses.

- Offshore Support Vessels

Fuelled by sea-based drilling, these ships serve distant platforms. Powering wind farms at sea keeps them busy, too.

- Passenger Ships

Fewer risks on water as new tech helps keep travelers secure. Moving through waves feels smoother thanks to smarter steering systems. Safety improves when crews rely on updated tools during trips. Comfort grows without slowing down arrival times. Smarter routes mean fewer delays even in rough conditions.

By End-Users

- Shipbuilders

Key adopters are integrating IBS in new vessel construction.

- Fleet Operators

Focus on retrofitting and upgrading fleets for operational efficiency.

- Naval & Defense Authorities

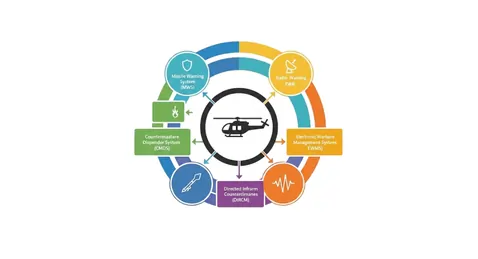

Fleets now rely on smarter bridge systems to handle complex missions at sea. Control centers get upgraded with tools that sharpen decision-making during maneuvers. Modern command setups respond faster because they link navigation and sensor data smoothly. These changes let officers manage vessels more precisely under pressure. Defense planners see value in tech that reduces human error onboard ships.

Regional Insights

Out at sea, the Asia Pacific area pulls ahead as the top spot for Integrated Bridge Systems, thanks to booming shipyards and a surge in commercial vessels. China, South Korea, and Japan set the pace as new ships roll out fast, fleets get upgrades, fueling demand for smarter bridge tech on freighters, tankers, and even cruise boats. Trade routes stay busy, cash flows into smart navigation tools, and automated controls give these waters an edge that others struggle to match. What you see here is not just growth, it’s reshaping how ships operate from the inside out.

A key player on the global stage, North America benefits from well-established sea routes, strong military budgets, and tough rules around safety at sea. Naval updates and newer cargo fleets push growth in the United States, where builders fit vessels with smarter steering, live data links, and real-time tracking tools instead of older models. Because companies keep funding tech shifts like self-adjusting controls and networked decks, the move toward unified command setups spreads steadily among workboats, freighters, and even coast guard units. These changes stick because they match how ships operate now: less guesswork, more linked-up thinking across every voyage phase.

Moving forward, Europe pushes ahead thanks to tight shipping rules, green goals, and clusters of skilled shipbuilders and tech suppliers. IBS systems spread reliably through military and cargo vessels. Not far behind, parts of the Middle East and Africa gain ground as oil exploration at sea rises, navies update equipment, and ports get upgrades. Meanwhile, activity picks up slowly across Latin American waters where older ships receive updates and cross-sea commerce widens its reach.

To learn more about this report, Download Free Sample Report

Recent Development News

- February 16, 2026 – Gremsy & Sierra BASE to showcase integrated bridge inspection solution at Drone Show Korea 2026.

- September 22, 2025 – Sperry Marine to Deliver Integrated Bridge Systems for Hydrogen-Powered, Autonomous-Ready Sam skip ships.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.20 Billion |

|

Market size value in 2026 |

USD 3.60 Billion |

|

Revenue forecast in 2033 |

USD 6.20 Billion |

|

Growth rate |

CAGR of 8.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Northrop Grumman, Kongsberg Gruppen, Wärtsilä, Raytheon Anschütz, Furuno Electric, Tokyo Keiki, Transas Marine, L3Harris Technologies, Consilium AB, Marine Technologies, Rolls-Royce, Praxis Automation Technology, NORIS Group, Mitsubishi Electric, Japan Radio Co., Navis Engineering, and SAM Electronics |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Hardware, Software, Services), By Subsystem (Navigation, Control System, Communication Systems, Monitoring Systems, Alarm & Safety Systems), By Vessel Type (Commercial Vessel, Naval Vessels, Offshore Support Vessels, Passenger Ships), By End-Users (Shipbuilder, Fleet Operators, Naval & Defense Authorities) |

Key Integrated Bridge Systems Company Insights

One name stands out in the world of Integrated Bridge Systems: Kongsberg Gruppen. Their tools guide ships across oceans, working just as well on navy craft as they do on oil rigs at sea. Instead of separate gadgets cluttering the deck, everything connects through unified bridge setups made by this firm. That comes from their dynamic control tech built into each system. Digital upgrades for vessels also roll out under their watch, reshaping how crews manage long journeys. Because of these efforts, many rely on them when modernizing fleets around the globe. Not flashy, but always precise, they have become essential behind the scenes of today’s seafaring operations.

Key Integrated Bridge Systems Companies:

- Northrop Grumman

- Kongsberg Gruppen

- Wärtsilä

- Raytheon Anschütz

- Furuno Electric

- Tokyo Keiki

- Transas Marine

- L3Harris Technologies

- Consilium AB

- Marine Technologies

- Rolls-Royce

- Praxis Automation Technology

- NORIS Group

- Mitsubishi Electric

- Japan Radio Co.

- Navis Engineering

- SAM Electronics

Global Integrated Bridge Systems Market Report Segmentation

By Component

- Hardware

- Software

- Services

By Subsystem

- Navigation

- Control System

- Communication Systems

- Monitoring Systems

- Alarm & Safety Systems

By Vessel Type

- Commercial Vessel

- Naval Vessels

- Offshore Support Vessels

- Passenger Ships

By End-Users

- Shipbuilder

- Fleet Operators

- Naval & Defense Authorities

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636