Market Summary

The global Aircraft Survivability Equipment market size was valued at USD 3.20 billion in 2025 and is projected to reach USD 6.50 billion by 2033, growing at a CAGR of 8.80% from 2026 to 2033. The growing military expenditure of global nations and the upgrading of military aircraft are the major drivers that are propelling the demand for advanced survivability solutions. The threat posed by guided missiles and electronic warfare has increased, and this has led to the adoption of ECM, IRCM, and MAWS, which is growing with a strong CAGR. The advancements in sensor technology, jammers, and countermeasures have improved the efficiency of aircraft operations, thus driving the market growth.

Market Size & Forecast

- 2025 Market Size: USD 3.20 Billion

- 2033 Projected Market Size: USD 6.50 Billion

- CAGR (2026-2033): 8.80%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America continues to be the largest ASE market with high defense spending and modernization initiatives leading to the rapid adoption of electronic countermeasures, infrared countermeasures, missile warning systems, and integrated sensor suites in fixed-wing, rotary-wing, and UAV aircraft worldwide.

- The United States leads the North American ASE market due to extensive R&D spending, government procurement contracts, and the use of advanced survivability systems on fighter aircraft, bombers, and helicopters, solidifying its position of strength in electronic warfare and aerial threat protection.

- The Asia Pacific market is rapidly growing due to rising defense spending in China, India, Japan, and South Korea, with a focus on modernizing air forces, integrating UAVs, and adopting ECM, MAWS, IRCM, and advanced sensor systems.

- Electronic countermeasures remain on the rise worldwide as defense forces focus on disrupting radar and communication systems, using adaptive jammers and AI-powered signal processing to enhance survivability and effectiveness against emerging threats.

- Fixed-wing aircraft have the largest market share due to their long-range operational missions, incorporation of full-scale ECM and RWR systems, and upgrades of fighter aircraft and bombers to ensure air superiority in high-threat environments.

- Military use is the main driving force for the market, with emphasis on protecting tactical and strategic assets, minimizing operational risks, and ensuring successful mission execution through the use of ECM, IRCM, MAWS, flares, and countermeasure dispensers on manned and unmanned platforms.

- Sensors have the largest component market share due to the increasing need for real-time detection and awareness, utilizing infrared, radar, and laser detection principles combined with jammers and decoys for autonomous countermeasure release.

So, The Aircraft Survivability Equipment market is primarily concerned with the development of defensive solutions that can improve aircraft survivability in hostile environments, including protection against guided missiles, radar detection, and electronic attacks. Increasing geopolitical tensions, threats in modern warfare, and asymmetric warfare environments are currently fueling the demand for advanced ASE solutions worldwide. Advances in ECM, MAWS, IRCM, and RWR technology are increasingly being incorporated across fixed-wing, rotary-wing, and unmanned aircraft platforms to ensure operational survivability and success. In addition, defense manufacturers are heavily investing in R&D efforts to enhance compact and automated countermeasure technologies for UAVs, helicopters, and fighter aircraft. The ASE market development is also fueled by the modernization of air forces in North America, Europe, and Asia Pacific regions, with a focus on multi-layered defense capabilities. The use of automated flares, chaff dispensers, and decoys improves aircraft defense reaction time, while incorporation with avionics technology ensures real-time threat detection and elimination. In summary, the ASE market development is a result of the intersection of technological innovation, defense strategies, and the growing demand for operationally survivable aircraft systems.

Aircraft Survivability Equipment Market Segmentation

By Component

- Sensors

Infrared, radar, and laser sensors should be included. High demand is driven by the need for real-time threat detection and improved survivability of aircraft.

- Jammers

Electronic jammers are used to interfere with the enemy's radar and communication systems. Advances in technology, including frequency agility and mobility, are major drivers of growth.

- Decoys

Chaff and flare decoys can be deployed to distract missile threats. Their continued relevance in tactical defense applications ensures steady demand.

- Countermeasure Dispensers

Automated dispensers are essential for effective flare, chaff, and decoy deployment. Avionic integration improves effectiveness.

To learn more about this report, Download Free Sample Report

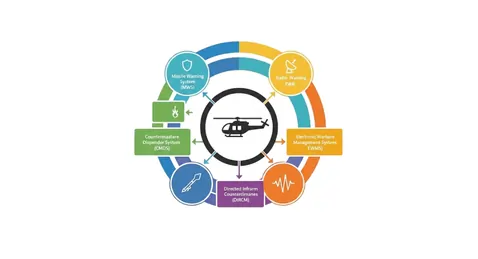

By Type

- Electronic Countermeasures (ECM)

ECM technology is essential for jamming enemy radar and communication networks. The use of ECM technology is on the rise due to the growing threat of electronic warfare and the need for modernization of military aircraft around the world.

- Infrared Countermeasures (IRCM)

IRCM technology is essential for protecting aircraft from heat-seeking missiles. The use of IRCM technology in rotary-wing aircraft and UAVs is driving the market, especially in high-threat environments.

- Radar Warning Receivers (RWR)

RWR technology alerts aircraft in real-time of potential threats from radar systems. The use of RWR technology in modern fighter aircraft and UAVs is a major factor in the growth of the market.

- Missile Approach Warning Systems (MAWS)

MAWS technology alerts aircraft to potential threats from incoming missiles and initiates countermeasures. The growing defense budget and the use of MAWS technology in combat aircraft are driving the market.

- Flares and Chaff Dispensers

These traditional systems are still in use for immediate protection against missile threats. Technological advancements in automated dispensers are making these systems more relevant.

- Other Defensive Systems

These include laser-based and acoustic countermeasures. Although niche markets, these systems are gaining popularity in advanced military programs for overall survivability.

By Platform

- Fixed Wing Aircraft

ASE adoption is high due to long-range operations and the need to counter advanced threats. Fighter planes and bombers are the main users of ECM, MAWS, and RWR.

- Rotary Wing Aircraft

Helicopters use IRCM, MAWS, and flares because of their low-altitude flight operations. The increasing threat of asymmetric warfare and battlefield use is fueling demand.

- Unmanned Aerial Vehicles (UAVs)

The growing use of UAVs for military purposes, such as reconnaissance and combat, creates a need for miniaturized ASE solutions. The use of UAVs for ISR and autonomous systems is fueling demand.

By Application

- Military

The main target user, emphasizing survivability in contested airspace. Modernization initiatives, threat reduction, and multi-domain operations continue to fuel market growth.

- Defense Contractors

The defense contractors embrace ASE technology for incorporation within aircraft platforms they deliver to the military.

Regional Insights

North America continues to be the largest market, with the United States as the leading country, followed by Canada and Mexico, due to their large defense budgets, advanced air force capabilities, and large-scale deployment of ECM, MAWS, and IRCM systems. Europe is fueled by Germany, the United Kingdom, France, Spain, and Italy, with the modernization efforts led by NATO, and the development of defense systems for fighter and rotor-wing aircraft. The Asia Pacific market, led by Japan, China, Australia, South Korea, and India, is growing rapidly due to the increasing military capabilities, UAV deployment, and efforts to counter missiles, with the support of increasing defense spending in the Rest of Asia Pacific. The South America market, comprising Brazil and Argentina, is slowly embracing the latest ASE systems to modernize their existing aircraft, while the Rest of South America follows strategic procurement policies. The Middle East & Africa market, including Saudi Arabia, United Arab Emirates, South Africa, and other countries, is witnessing a rise in demand for countermeasure technologies due to security concerns in the region, modernization of air forces, and the procurement of advanced defense systems.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Elbit Systems Ltd. has announced that it was awarded contracts valued at around $275 million to provide advanced airborne self-protection electronic warfare (EW) systems and Direct Infra-Red Counter-Measure (DIRCM) systems to a country in the Asia-Pacific region. The contracts, which are multi-year and extend over five years, will improve the survivability and threat response capabilities of helicopters.

- In December 2024, Elbit Systems Ltd. has announced that it was awarded contracts valued at around $175 million to provide Electronic Warfare (EW) and Directed Infrared Countermeasure (DIRCM) self-protection systems to a NATO European country. The contracts are multi-year and involve the supply of advanced survivability systems capable of autonomously detecting and neutralizing various threats.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.20 Billion |

|

Market size value in 2026 |

USD 3.60 Billion |

|

Revenue forecast in 2033 |

USD 6.50 Billion |

|

Growth rate |

CAGR of 8.80% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Raytheon Technologies Corporation, Northrop Grumman Corporation, BAE Systems plc, Leonardo S.p.A, L3Harris Technologies, Inc., Thales Group, Saab AB, Elbit Systems Ltd., Israel Aerospace Industries Ltd., Safran, Chemring Group plc, ASELSAN A.S., RUAG Holding AG, Terma A/S, and Cobham Limited |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Sensors, Jammers, Decoys, Countermeasure Dispensers), By Type (Electronic Countermeasures (ECM), Infrared Countermeasures (IRCM), Radar Warning Receivers (RWR), Missile Approach Warning Systems (MAWS), Flares and Chaff Dispensers, Other Defensive Systems), By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft, Unmanned Aerial Vehicles (UAVs)) and By Application (Military, Defense Contractors) |

Key Aircraft Survivability Equipment Company Insights

Northrop Grumman Corporation is one of the leading players in the aircraft survivability equipment market because of its diversified range of electronic countermeasures, advanced missile approach warning systems, and survivability packages for fixed-wing, rotary-wing, and UAV aircraft. The company’s in-depth knowledge of electronic warfare and sensors allows it to develop modular and lightweight defense systems that are fully compatible with current avionics systems, thus improving threat detection and automated countermeasure response. Northrop Grumman’s continuous investment in R&D and defense contracts with militaries around the world have established the company’s presence in the region and international markets, making it a major force behind innovation and interoperability.

Key Aircraft Survivability Equipment Companies:

- Raytheon Technologies Corporation

- Northrop Grumman Corporation

- BAE Systems plc

- Leonardo S.p.A

- L3Harris Technologies, Inc.

- Thales Group

- Saab AB

- Elbit Systems Ltd.

- Israel Aerospace Industries Ltd.

- Safran

- Chemring Group plc

- ASELSAN A.S.

- RUAG Holding AG

- Terma A/S

- Cobham Limited

Global Aircraft Survivability Equipment Market Report Segmentation

By Component

- Silica

- Fiberglass

- Fumed Silica

- Perlite

- Others

By Type

- Flat Panels

- Special Shape Panels

By Platform

- Construction

- Cold Chain & Logistics

- Refrigeration & Freezers

- Appliances

- Automotive

- Others

By Application

- Residential

- Commercial

- Industrial

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636