Market Summary

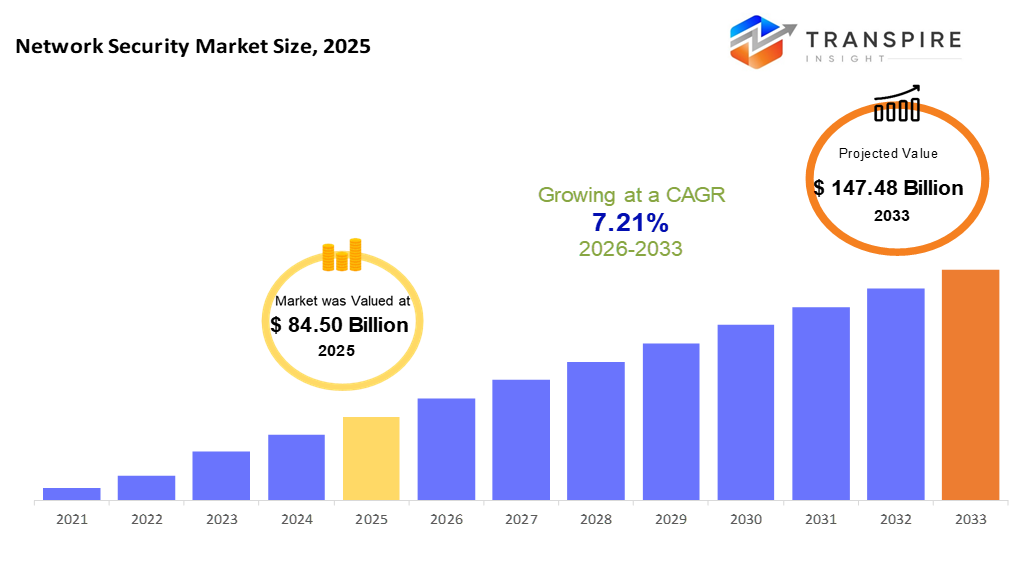

The Global Network Security Market is expected to reach USD 147.48 billion by 2033, driven by the expansion of network perimeters as companies adopt cloud computing, IoT, and remote working models, thereby creating more entry points for hackers to exploit. To prevent these types of security breaches, organizations have been compelled to upgrade their network security by acquiring cutting-edge equipment such as firewalls, intrusion detection and prevention systems, secure web gateways, and zero-trust architectures.

Market Size & Forecast

- 2025 Market Size: USD 84.50 Billion

- 2033 Projected Market Size: USD 147.48 BillionT

- CAGR (2026-2033): 7.21%

- North America: Major Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America Network Security market held the largest global share of 38% in 2025, driven by advanced digital infrastructure.

- The U.S. AI in the manufacturing industry is expected to grow significantly from 2026 to 2033, supported by growth is driven by increasing cyber threats, rapid adoption of cloud services, and digitalization across enterprises.

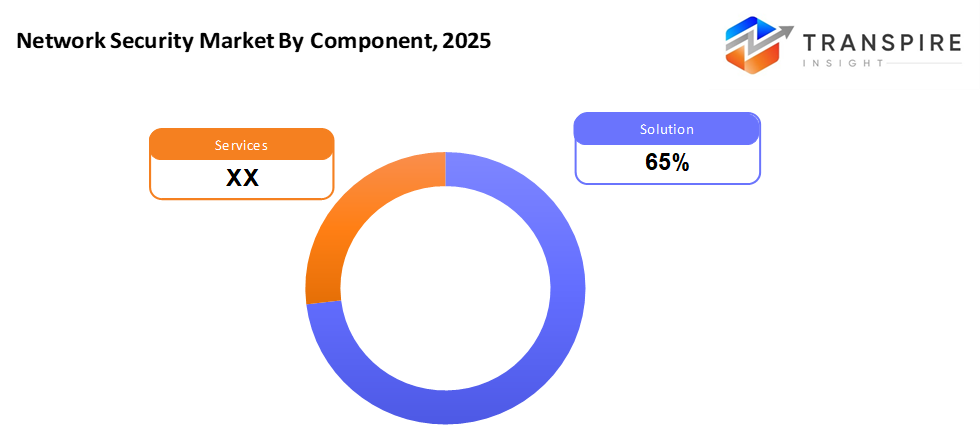

- By component type, the Solution segment held the highest market share of 65% in 2025, owing to intrusion detection and prevention systems and network access.

- Within Deployment, Cloud-Based accounted for the dominant share in 2025, due to growing cloud computing, AI Platforms, and hybrid work environments.

- Within Organization Size, Large Enterprises accounted for the dominant share in 2025, due to working in complex work environments, there is a need for multi-layer network security.

- By application, Firewall & VPN Security inspection dominated the market in 2025, driven by growing demand for network security perimeters.

- By end-user industry, the BSFI sector held the highest market share in 2025, supported by increasing transaction activities that require network security.

- Asia-Pacific is expected to record the fastest growth from 2026 to 2033, led by China, Japan, and South Korea’s rising investments in network security.

The term Network is used to refer to all the various technologies, policies, and practices employed in ensuring that no unauthorized person has access to a computer network or the data being passed through the network. It ensures that the networks are not affected by various types of attacks and also misuse, and disruption. Network security is a big area and encompasses any type of solution that includes firewalls, intrusion detection and prevention systems (IDPS), virtual private networks (VPNs), network access control, secure web gateways, and data loss prevention solutions. Network security is a feature that ensures that a network is confidential, integral, and available irrespective of whether the network is an on-premises, cloud, or hybrid network environment. Essentially, the foundation of the modern digital infrastructure is network security is the fundamental building block of the modern digital infrastructure.

The necessity for network security solutions is growing exponentially as the number of cyberattacks in the world continues to rise and the attacks are becoming more difficult and more expensive. Some of the reasons that have led to the massive growth of the attack surface of organizations include the ones that lead to the increased use of cloud computing, remote and hybrid working models, Internet of Things (IoT) devices, and mobile networks. Industries like BFSI, healthcare, government, and IT and telecom are facing high cybersecurity threats, thus resulting in high demand for advanced network security solutions that can offer features of real-time threat detection, secure remote access, and regulatory compliance.

The network security market is also growing strongly and is aided by innovations, which continue to be made. Some of these innovations would be AI-based threat intelligence, zero-trust network access, along next-generation firewalls. The shift towards integrated and cloud-native security architecture is increasingly taking place among more and more companies that are no longer focusing on the periphery of the network with their security measures. Enterprise choice and movement to the implementation of Software-Defined Networking (SDN) and 5G infrastructure is becoming the primary generator of the surge of investments in scalable and flexible network security solutions, which remains ongoing.

Besides, the development of the market is influenced by the alterations in the competitive environment and expansion in the region. Where North America is leading the market with its well-established digital infrastructure and the rapid adoption of advanced cybersecurity tools, the Asia Pacific is gaining momentum to become one of the regions with the rapid growth rate caused by the rapid digitalization and the growing number of cyber threats. The market leaders are considering customer-relevant strategies, customer innovation, and managed security services, including the establishment of strategic alliances, to address the constantly changing needs and demands of their clients, thus making network security a continuously changing and highest priority of importance globally.

Network Security Market Segmentation

By Component

- Solutions

It should have firewall, intrusion detection and prevention systems, secure web gateways, and data loss prevention tools that are incorporated to secure networks against cyber threats.

- Services

Include consulting, integration, maintenance, and managed security service, which facilitates the successful deployment and maintenance of security solutions.

To learn more about this report, Download Free Sample Report

By Deployment Mode

- On-Premises

This security solution is installed on the infrastructure of a company and is mostly favored in an industry where there is a high demand to have tight control and compliance.

- Cloud-Based

They are provided over cloud platforms, which are scalable, flexible, and provide real-time updates that are suitable for the modern and remote working environment.

- Hybrid

On-premises and Cloud security can be combined to allow organizations to create a balance between data control and scalability.

By Organization Size

- Large Enterprises

An advanced multi-layered network security infrastructure is an option to protect complex systems with large amounts of confidential data.

- Small & Medium Enterprises (SMEs)

To reduce the increasing number of cyber threats, an increasing small & medium-sized enterprises are adopting secure and cost-effective methods and cloud-based security systems.

By Application

- Network Access Control

This protects banned users and devices from accessing the network.

- Firewall and VPN Security

Secures the boundaries of the network and provides secure remote access.

- Intrusion Detection & Prevention

It finds and blocks any harmful actions in real time.

- Data Loss Prevention

Data leakage across networks is prevented authoritatively.

- Secure Web Gateway

secures the users from web threats and implements an internet usage policy.

- Others

Email security, network monitoring, and advanced threat protection.

By End-Users

- BFSI

It needs strong network security to secure financial information and avoid fraud.

- IT & Telecom

Guarantees massive networks and data traffic.

- Government & defense

The emphasis of this is on infrastructure protection and data security.

- Healthcare

Data protection and regulatory guard.

- Manufacturing

secures industrial networks and systems.

- Retail & E-Commerce

Guarantees payment systems and customer information.

- Others

Incorporate the education, energy, and transportation sectors.

Regional Insights

The network security market is characterized by a high level of regional diversity in terms of the level of digital maturity, regulatory, and cybersecurity awareness. The region most dominated by advanced network security solutions is North America, where there is a great uptake in the BFSI, government, healthcare, and IT and telecom sectors by the U.S and Canada (Tier 1 countries). The region has a high level of cloud adoption, a zero-trust setup, and large vendors of cybersecurity to use Tier 2 markets, which favors the ongoing market growth.

Europe leans toward strict rules, especially in top-tier spots like Germany, the UK, or France - these places take data safety seriously. With hacking risks growing, companies keep needing solid network defenses. In second-level regions, Italy, Spain, Nordic areas, plus parts of Eastern Europe, firms are shifting to cloud-style and mixed security setups. This shift happens as they modernize tech systems while adjusting to new digital safety laws.

Asia Pacific moves quickly, China, Japan, and South Korea lead by spending big on safe tech setups, 5G systems, or automated manufacturing. India, parts of Southeast Asia, plus Australia gain speed thanks to more web access, small firms going online, or rising hacking threats. In shifting areas like Latin America, the Middle East, and Africa, top nations, say Brazil, Mexico, the UAE, and Saudi Arabia, are strengthening defenses against cyber risks; smaller ones inch forward using basic protection tools as new digital spaces take shape.

To learn more about this report, Download Free Sample Report

Recent Development News

- October 29, 2025 – Huawei launched Xinghe AI network security to defend against AI-driven attacks.(Source: capacityglobal News https://capacityglobal.com/news/huawei-launches-xinghe-ai-network-security-to-defend-against-ai-driven-attacks/

- August 5, 2025 – HPE launched an offering at Black Hat to strengthen network security(Source: https://siliconangle.com/2025/08/05/hpe-launches-new-offerings-black-hat-strengthen-network-security-data-protection-cyber-resiliency/)

- September 30, 2025 – Adva Network Security launched a security director for automated cryptographic operations and network security. (businesswire https://www.businesswire.com/news/home/20250929431154/en/Adva-Network-Security-launches-Security-Director-to-automate-cryptographic-operations-and-network-security

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 84.50 Billion |

|

Market size value in 2026 |

USD 90.59 Billion |

|

Revenue forecast in 2033 |

USD 147.48 Billion |

|

Growth rate |

CAGR of 7.21% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key company profiled |

Cisco Systems, Palo Alto Networks, Fortinet, Check Point Software, Trend Micro, IBM, Broadcom, Zscaler, Sophos, SonicWall, F5 Networks, Others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Component (Solutions, Services) By Deployment Mode (On-Premises, Cloud-Based, Hybrid) By Organization Size (Large Enterprises, Small & Medium Enterprises) By Application (Network Access Control, Firewall & VPN Security, Intrusion Detection & Prevention, Data Loss Prevention, Secure Web Gateway, Others) By End Users (BFSI, IT & Telecom, Government & Defense, Healthcare, Manufacturing, Retail & E-Commerce, Others) |

Key Network Security Company Insights

Palo Alto Networks from the US stands out with advanced firewalls and a full-scale take on cyber protection. Instead of separate tools, they bundle network, cloud, and security management using Strata, Prisma, and Cortex systems. Because they prioritize Zero Trust models, SASE frameworks, and smart threat detection powered by AI, big companies relying on hybrid setups lean on their tech. Ongoing upgrades, key buyouts, along wide corporate use keep them ahead across markets.

Key Network Security Companies:

- Cisco Systems

- Palo Alto Networks

- Fortinet

- Check Point Software

- Trend Micro

- IBM

- Broadcom

- Zscaler

- Sophos

- SonicWall

- F5 Networks

- Others

Global Network Security Market Report Segmentation

By Component

- Solutions

- Services

By Deployment Mode

- On-Premises

- Cloud-Based

- Hybrid

By Organization Size

- Large Enterprises

- Small & Medium Enterprises

By Application

- Network Access Control

- Firewall & VPN Security

- Intrusion Detection & Prevention

- Data Loss Prevention

- Secure Web Gateway

- Others

By End-Users

- BFSI

- IT & Telecom

- Government & Defense

- Healthcare

- Manufacturing

- Retail & E-Commerce

- Others

Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia & New Zealand

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr1.png)

APAC:+91 7666513636

APAC:+91 7666513636