Market Summary

The global Decentralized Ventilation Systems market size was valued at USD 5.20 billion in 2025 and is projected to reach USD 9.20 billion by 2033, growing at a CAGR of 7.10% from 2026 to 2033. Homeowners choose smarter airflow setups more often these days. Because cities update energy codes, builders install updated models. Cleaner breathing spaces matter now after health scares worldwide. Offices retrofit old ductwork when upgrading climate control. People notice stuffier rooms, so they upgrade sooner. New tech fits tight spaces better than bulky units once did.

Market Size & Forecast

- 2025 Market Size: USD 5.20 Billion

- 2033 Projected Market Size: USD 9.20 Billion

- CAGR (2026-2033): 7.10%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North American market share is estimated to be approximately 36% in 2026. Fueled by tighter energy rules, homes and businesses across North America are slowly shifting toward smarter systems. Awareness of cleaner indoor air also plays a role. Older buildings getting updates also help push the trend forward.

- Ahead in regional earnings stands the United States, where homes, then offices, then clinics weave decentralized tech into daily function, driven not just by policy but by firm construction rules and quiet pushes toward greener operation. Though unseen, these frameworks shape adoption more than choice ever could.

- Out here in the Asia Pacific, cities keep expanding fast. Because of that, buildings go up quicker than before. Ventilation systems now matter more in homes and offices alike. Growth pushes new tech into everyday use. One thing leads to another infrastructure needs rise alongside living standards.

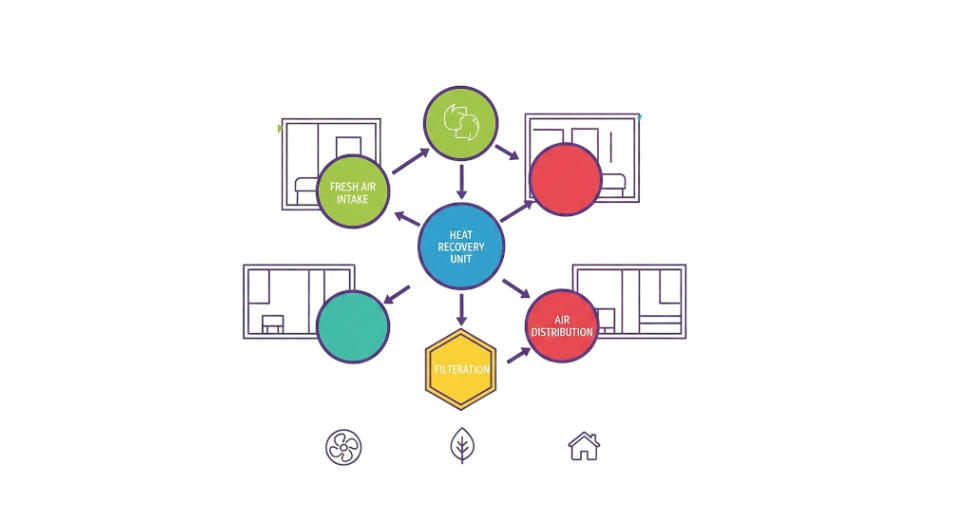

- Heat Recovery Ventilation shares approximately 38% in 2026. Fresh interest in energy efficiency is pushing more people toward heat recovery vents. Not only do they capture warmth, but they also clean the air inside buildings. What stands out is how well these systems balance efficiency with healthier breathing spaces. Their rise comes down to wanting less waste without sacrificing comfort.

- Hanging on walls, these units spread fast thanks to how simple they are to set up. Space stays clear since they sit off the floor. Homes getting updates find them a natural fit. Installation speed helps too.

- Folks are choosing decentralized setups in office spaces more quickly now because new rules demand better energy use while also caring about how people feel and perform indoors.

- Folks who install heating and cooling gear now lean toward split setups these allow room-by-room control while cutting power use, whether it’s an old building getting updated or a fresh construction job.

- Outside the usual trends, machines now think smarter inside factories. Because systems learn faster, production lines move without old delays. When software watches every step, mistakes drop while output climbs. Machines talk to one another through hidden signals across floors. With live feedback, adjustments happen before problems grow. Instead of waiting, responses come mid-action. Factories once stiff now shift on their own. Intelligence built into tools reshapes how things get made.

A fresh wave of interest hits the scene as more buildings lean into adaptable ways to manage airflow without guzzling power. Not tied together like older models, these standalone units work on their own, adjusting conditions right where needed, room by room if necessary. Because they skip the need for bulky channels through walls and ceilings, swapping them into existing spaces feels less like a renovation nightmare. Each piece clicks into place separately, offering sharper control over airflow, energy use, and indoor comfort. As a result, the decentralized ventilation systems market is gaining traction, driven by the need for flexible, efficient solutions that can scale easily. When building layouts shift or expand, these systems adapt without the need to rewire everything from scratch.

A shift in how people think about indoor spaces has quietly pushed decentralized ventilation into schools, offices, and homes. Fresh air now moves steadily through buildings because these setups filter out harmful particles while balancing moisture levels. Comfort matters more today, so does clean airflow, and that’s nudging decisions behind walls and windows. Rules keep changing, yet many choose to stay ahead by upgrading what breathes inside structures.

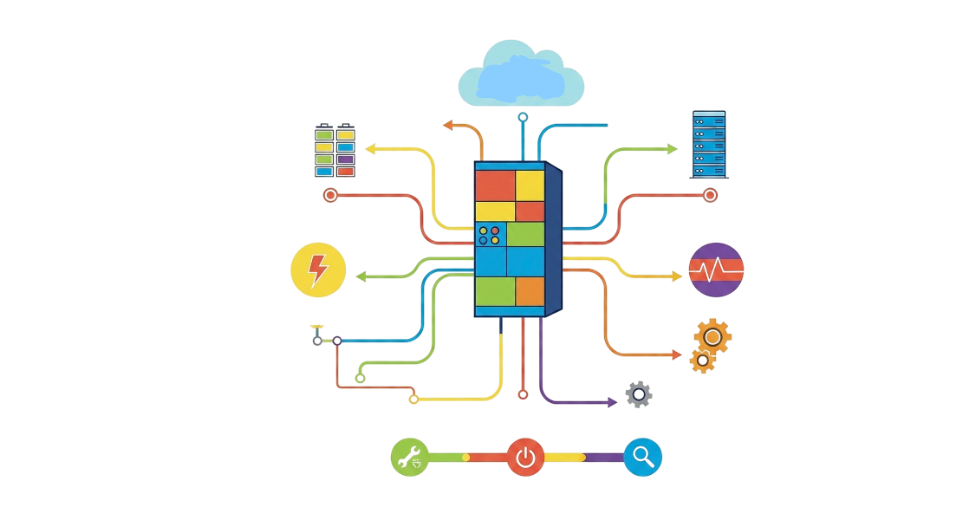

Fresh tech shifts are remaking the marketplace, bringing together heat capture, power recycling, and ventilation tuned to real-time needs. Devices today carry detectors, intelligent regulators, plus self-adjusting functions that fine-tune air movement when people come and go, or pollution levels shift. Efficiency climbs as electricity use drops, giving standalone setups a strong appeal among those watching their energy footprint.

Faster setup times shape how these systems spread into more buildings. Because they demand less downtime during operation, interest grows steadily among property managers. Wherever airflow matters, offices rise above suburbs or labs need precision, they fit without major changes. Efficiency is not just about energy bills; it shows in simpler repairs, too. Preference shifts quietly but surely toward setups that ask little yet deliver consistently. Long-term gains come not from hype but steady function day after day.

Decentralized Ventilation Systems Market Segmentation

By Product Type

- Without Heat Recovery Systems

Fresh air moves in and out when there is no heat recovery, yet warmth or coolness escapes during the swap. Energy slips away even as airflow continues through open paths.

- Heat Recovery Ventilation

A breath of fresh air does not have to mean losing warmth. Instead of letting heated indoor air escape unused, a system can pull its warmth before it leaves. This captured heat then warms the incoming outdoor air. Stale inside air exits as new air enters, balancing comfort and cleanliness. The temperature stays stable without wasting power meant to reheat empty spaces.

- Energy Recovery Ventilation

Moisture moves along with warmth when fresh air enters through an energy recovery ventilator. As indoor air exits, it swaps conditions with the new airflow, balancing temperature and dampness without extra equipment. This exchange happens quietly inside the unit while maintaining steady indoor comfort levels throughout seasonal shifts.

- Balanced Ventilation Systems

A steady push and pull of air keeps things even inside these setups. Equal amounts move in while just as much flows out. Pressure stays calm because of this balance. Air quality does not swing wildly when both sides match. What matters is how intake pairs with exit across time.

- Demand-Controlled Ventilation

When people come in, the fresh air flow changes by itself. Occupancy sensors tell the system when to move more or less air. Instead of running full-time, it follows real-time needs. Air quality checks help decide how much ventilation works at any moment. This kind of setup responds without needing manual tweaks.

- Exhaust Air Systems

Stale air gets pulled out by exhaust systems, targeting spots where airflow matters most. These setups work quietly behind walls, clearing fumes before they spread too far. Instead of pushing fresh air in, their job is pulling old air away fast. Efficiency rises when pockets of trapped breath are cleared regularly. Ventilation gains strength not through force but through steady removal.

To learn more about this report, Download Free Sample Report

By Installation Type

- Ceiling-Mounted Units

Up above, these units tuck into ceiling spaces, freeing up floor space while spreading air evenly across the area. Sometimes hidden, they work quietly, making airflow smooth without taking up walls or corners. Their placement helps keep interiors clean and uncluttered, yet fully functional.

- Wall-Mounted Units

Sitting up high on walls, these units slide into place without fuss - perfect when updating old spaces or fitting homes. A snug fit comes naturally, making setup smooth even where space is tight.

- Floor-Mounted Units

Floor-mounted units show up when ceilings or walls will not work. These sit low, right on the ground, fitting spaces others can not reach. Sometimes that’s just how it has to be, no overhead room, nowhere to hang things neatly. So they stand there, doing their job without needing support above.

- Others

Fitted right into windows or shaped to fit unusual spaces, these options adapt to unique architectural plans. Custom setups show up where standard sizes won’t work. Buildings with special outlines often need solutions built just for them.

By Application

- Residential Buildings

That happens when systems quietly upgrade how buildings breathe. Efficiency sneaks in through smarter airflow tricks inside houses, even flats. Think less stuffiness, more steady comfort without wasting power. Little changes here make spaces feel clearer, day after day.

- Commercial Buildings

Offices, shops, and hotels now use these systems because they need proper airflow and steady indoor conditions. What you see is buildings staying compliant without drawing attention. Ventilation runs quietly behind daily activity. Comfort is not guessed is built into how spaces operate. Standards shape choices more than trends do. You notice it only when something feels off. Most adjustments happen before anyone walks through the door.

- Industrial Facilities

Fans hum, filters catch dust, and systems manage temperature inside factories where things are built or changed. Machines work alongside airflow designs meant to clear fumes while keeping conditions stable for production tasks.

- Public Buildings

Schools see these units go up first. Government spaces follow close behind. Fresh air becomes a quiet priority indoors. Clean surroundings matter most here.

- Healthcare Facilities

Fresh air matters most inside medical centers, so systems run constantly to block contaminants. Clean airflow becomes a quiet priority where patients recover slowly. Machines filter particles without pause because safety depends on steady performance. Protection builds through constant monitoring behind closed doors.

By End-Users

- Homeowners

Folks living in houses now use setups that make rooms feel better, cut power costs, while also cleaning the air inside slowly over time.

- Builders

Fresh builds can include networked setups right from the start, helping them follow rules and run smarter. Not just compliant but smoother too, thanks to early adoption of distributed tech during framing stages. Systems talk to each other better when wired into design plans upfront. Efficiency climbs when decentralization is part of blueprints, not an afterthought. Meeting standards becomes simpler if these elements arrive with the foundation work.

- HVAC Contractors

From blueprints to airflow, HVAC contractors set up climate control tailored to each building's demands. Equipment choices follow function, shaped by how spaces will be used. Every installation answers the specific rhythm of the environment it serves.

- Facility Managers

Fresh air flows better when machines watch the filters. Machines adjust heating as people move through rooms.

- Architects

Shape them early, when floor plans take form. Decisions made then stick through construction. Matching airflow to room shapes matters most at the start. Early picks lock how well spaces breathe later. Layouts and vents grow together, best if planned hand in hand.

Regional Insights

It starts up north, where machines learn fast. This part of the world already runs deep with smart systems tucked into factories. Progress moves quickly here because labs keep testing new ideas. Factories in the United States stand out, using learning algorithms to spot machine failures before they happen. Think robots that adapt, lines that optimize themselves. Car makers, plane builders, tech producers, they all lean on these tools now. Digital upgrades are not rare; they are routine. When coders team up with plant managers, things shift faster. Growth feeds itself when knowledge flows like this.

Not far behind, Europe keeps pace in the AI-driven industrial shift thanks to strong factory bases in nations like Germany, the United Kingdom, France, and Italy. Thanks to pushes toward smarter factories - part of broader Industry 4.0 moves AI tools now help meet strict rules while chasing greener operations. Energy use gets sharper, inspections grow more precise, lines adapt faster, all aided by artificial intelligence stepping into older setups. Firms across the continent turn to these systems not just to keep up, but to stay ahead as automated workflows gain ground steadily.

Not far behind, the Asia Pacific races ahead factories spread wide across China, India, Japan, and Southeast nations, pulling momentum forward. Government pushes for smarter production lines add fuel, while heavy industry presence gives weight to its rise. Beyond chips and gadgets, cars and everyday items now lean on artificial intelligence more each year. New spending flows into digital tools, helping systems learn, adapt, and leave old methods behind. Farther out, Latin lands start tuning machines to think sharper, work longer without fault. Across deserts and cities in Africa and the Middle East, signals show change, too, a slow but sure climb begins. Factories there eye better output, find help in software that predicts breakdowns before they happen. Rising funds go toward tech upgrades, not just for status, but survival amid global shifts.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 5, 2024 – Hevac launched Airmaster decentralized MVHR for schools.

(Source: https://passivehouseplus.ie/news/marketplace/hevac-launches-airmaster-decentralised-mvhr-for-schools)

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 5.20 Billion |

|

Market size value in 2026 |

USD 5.70 Billion |

|

Revenue forecast in 2033 |

USD 9.20 Billion |

|

Growth rate |

CAGR of 7.10% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Daikin Industries, Mitsubishi Electric Corporation, Panasonic Corporation, Johnson Controls International plc, Carrier Global Corporation, Lennox International Inc., Systemair AB, Swegon Group AB, Zehnder Group AG, Greenheck Fan Corporation, Aldes Group, Vent-Axia Group Ltd, Broan-NuTone LLC, RenewAire LLC, Vortice S.p.A., Venmar Ventilation, and TROX GmbH |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Without Heat Recovery Systems, Heat Recovery Ventilation, Energy Recovery Ventilation, Balanced Ventilation Systems, Demand-Controlled Ventilation, Exhaust Air Systems), By Installation Type (Ceiling-Mounted Units, Wall Mounted Units, Floor-Mounted Units, Others), By Application (Residential Buildings, Commercial Buildings, Industrial Facilities, Public Buildings, Healthcare Facilities), By End-Users (Homeowners, Builders, HVAC Contractors, Facility Managers, Architects) |

Key Decentralized Ventilation Systems Company Insights

One name stands out when it comes to local ventilation setups: Zehnder Group AG. Their gear leans heavily into saving power while keeping indoor air fresh. Instead of just moving air around, their units capture warmth before it escapes. Homes and offices both benefit from these room-specific setups. Innovation isn’t a slogan here; it shows up in every new product they roll out. Green construction ideas fit naturally into how they design things. Contractors who handle heating and cooling often pick Zehnder by default. Architects trust them because performance doesn’t drop over time. Across continents, builders choose this Swiss firm without second thoughts. High efficiency? That part speaks for itself.

Key Decentralized Ventilation Systems Companies:

- Daikin Industries

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Johnson Controls International plc

- Carrier Global Corporation

- Lennox International Inc.

- Systemair AB

- Swegon Group AB

- Zehnder Group AG

- Greenheck Fan Corporation

- Aldes Group

- Vent-Axia Group Ltd

- Broan-NuTone LLC

- RenewAire LLC

- Vortice S.p.A.

- Venmar Ventilation

- TROX GmbH

Global Decentralized Ventilation Systems Market Report Segmentation

By Product Type

- Without Heat Recovery Systems

- Heat Recovery Ventilation

- Energy Recovery Ventilation

- Balanced Ventilation Systems

- Demand-Controlled Ventilation

- Exhaust Air Systems

By Installation Type

- Ceiling-Mounted Units

- Wall-Mounted Units

- Floor-Mounted Units

- Others

By Application

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Public Buildings

- Healthcare Facilities

By End-Users

- Homeowners

- Builders

- HVAC Contractors

- Facility Managers

- Architects

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

_Market,_Forecast_to_2033.png)

-market-pr1.png)

APAC:+91 7666513636

APAC:+91 7666513636