Market Summary

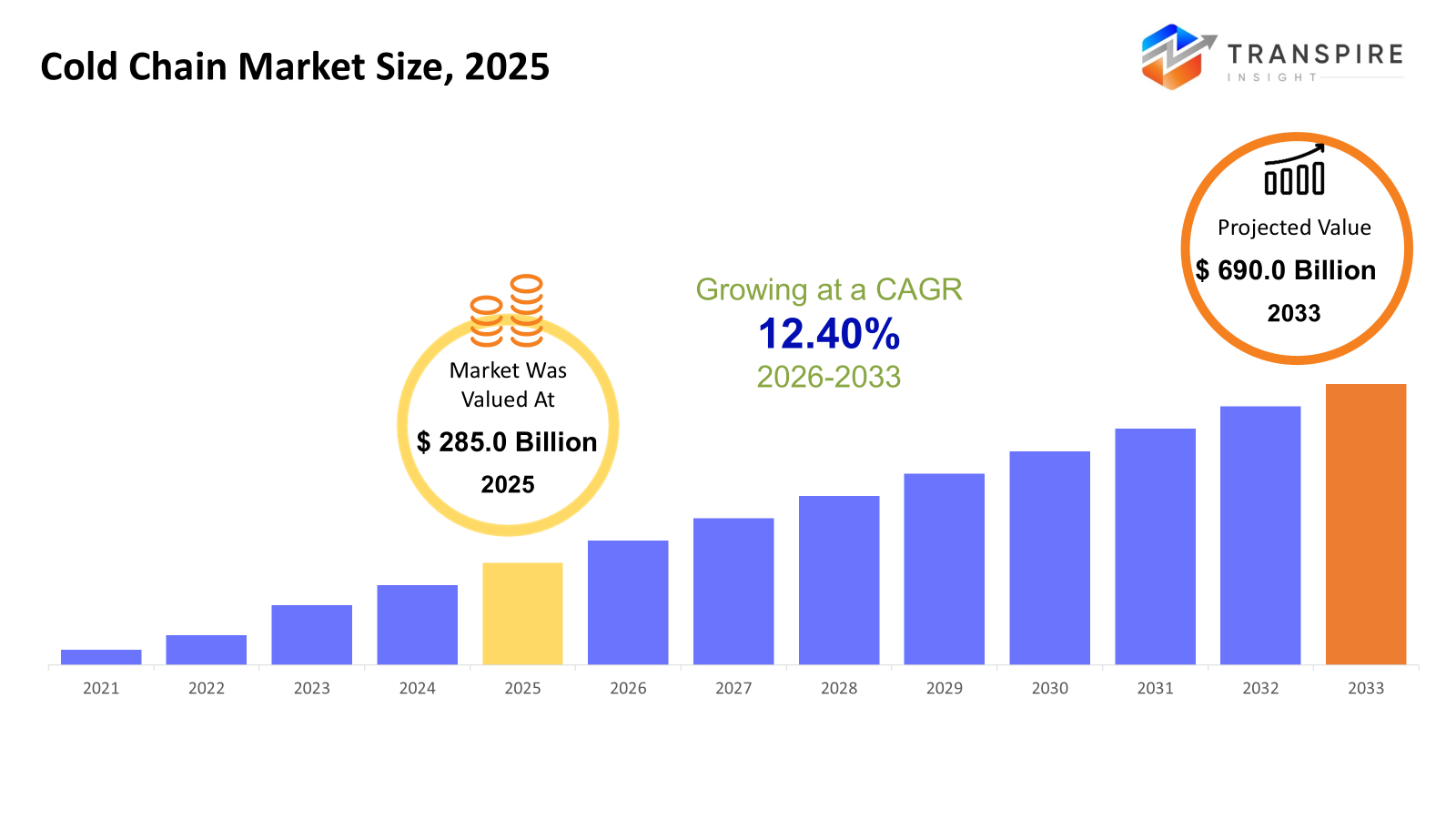

The global Cold Chain Market size was valued at USD 285.0 billion in 2025 and is projected to reach USD 690.0 billion by 2033, growing at a CAGR of 12.40% from 2026 to 2033. Due to growing demand for temperature-sensitive foods, medications, and biologics brought on by urbanization and increased international trade, the worldwide cold chain industry is expanding at a steady compound annual growth rate. Using IoT-enabled monitoring systems and automated storage improves operational effectiveness and lowers losses. Government programs to reduce post-harvest waste and infrastructure development are the main drivers of growth in emerging economies, especially in Asia Pacific and South America. Sustained market expansion is also supported by strict global regulations and growing awareness of food safety.

Market Size & Forecast

- 2025 Market Size: USD 285.0 Billion

- 2033 Projected Market Size: USD 690.0 Billion

- CAGR (2026-2033): 12.40%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The strong demand for frozen and chilled foods, sophisticated refrigerated storage systems and the incorporation of AI-based monitoring and logistics optimization throughout the food, pharmaceutical, and chemical industries have all contributed to North America's continued dominance in cold chain infrastructure.

- Due to its massive refrigerated transportation networks, strict FDA rules, high pharmaceutical consumption, and the growing trend of food delivery via e-commerce, which necessitates reliable last-mile cold chain solutions, the United States leads the North American industry.

- In order to fulfill the growing demand for food and pharmaceuticals, Asia Pacific is growing at the fastest rate due to factors like population growth, urbanization, retail and e-commerce expansion, improved logistics networks, and large investments in cold storage and temperature controlled transportation.

- As businesses prioritize centralized, high-capacity warehouses to manage inventory effectively, support food security, and adhere to pharmaceutical storage standards, while automation and high-density designs enhance throughput and lower operating costs, refrigerated storage continues to be the most important type segment.

- Because chilled temperature solutions are widely used in fresh foods, dairy products, beverages, and some pharmaceuticals, and because retail, foodservice, and export-oriented supply chains place a high priority on preserving product freshness, quick turnover, and regulatory compliance, they dominate temperature-based demand.

- As manufacturers and distributors increasingly outsource cold warehousing to gain scalability, lower capital expenditures, and access sophisticated inventory management, quality control, and compliance capabilities provided by specialized cold chain operators, storage services are driving the service market.

- Due to the growing demand for frozen, processed, and ready-to-eat foods, the expansion of online shopping platforms, and the growing global food commerce that necessitates constant temperature control and low spoiling throughout supply chains, food and drinks continue to be the largest end-use segment.

So, The storage, distribution and transportation of temperature-sensitive goods, such as food, drinks, medications, and specialized chemicals, are all included in the global cold chain market. By preserving regulated temperature conditions throughout the supply chain, it guarantees integrity from manufacture to end-user delivery. Global use of refrigerated storage and transportation systems has accelerated due to rising urbanization, changing consumer lifestyles, and rising demand for frozen and ready-to-eat goods. Precision logistics and ultra-low temperature storage are essential for the pharmaceutical industry, especially for vaccines, biologics, and other temperature-sensitive medications. By increasing productivity, lowering losses, and enabling real-time temperature control, technological innovations including IoT-enabled monitoring, AI-driven inventory management, automated cold storage and blockchain-based tracking systems are revolutionizing the business.

Growing populations, food export prospects, and government efforts to reduce post-harvest losses are all contributing to the rapid rise of emerging regions, especially Asia Pacific and South America. Due to their well-established infrastructure, strict regulatory compliance, and large per capita consumption of chilled goods, North America and Europe continue to lead in terms of value. Global supply chain optimization, technological innovation, and rising demand are all factors that are reflected in the market as a whole.

Cold Chain Market Segmentation

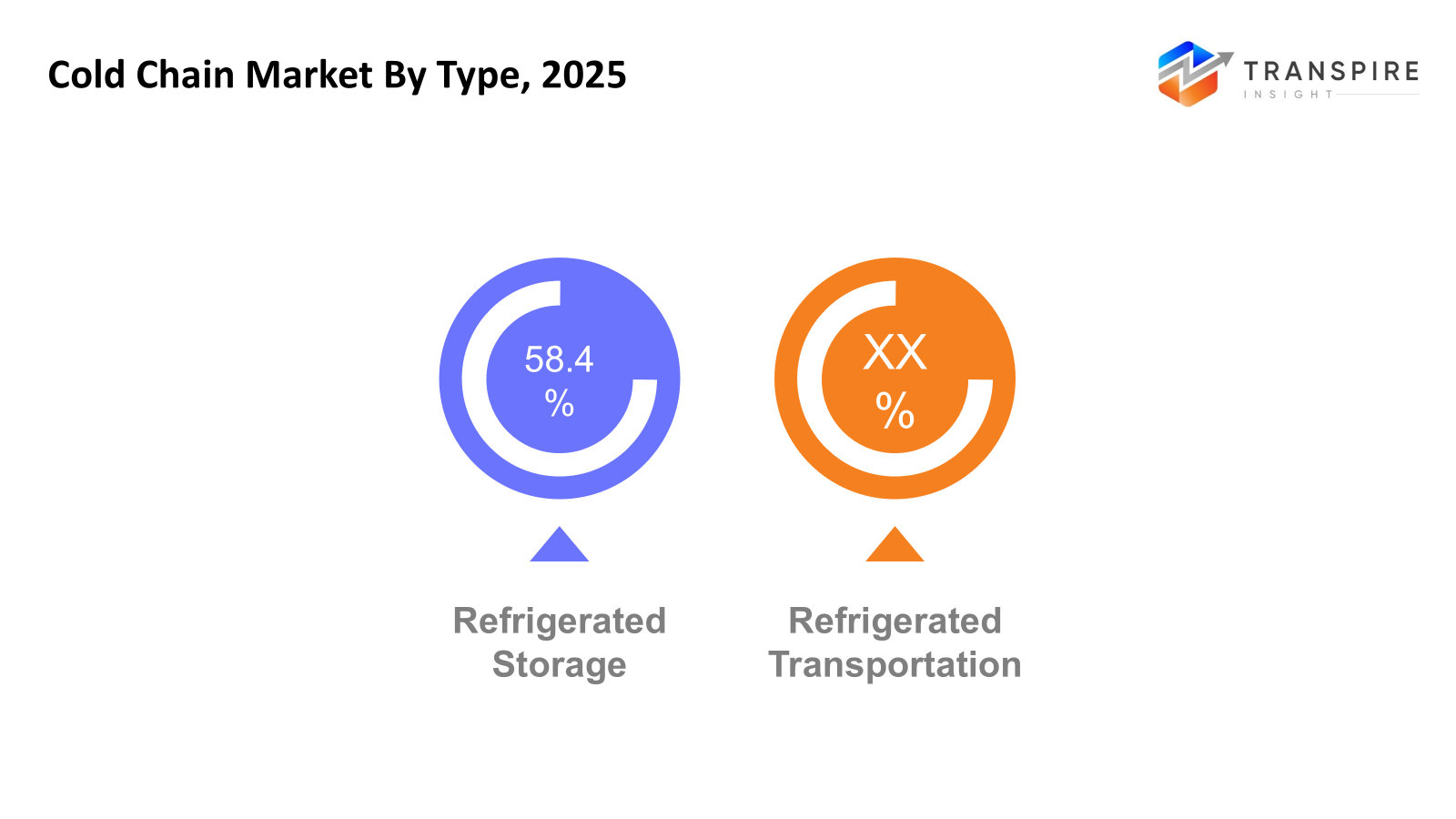

By Type

- Refrigerated Storage

The cold chain market's foundation is chilled storage, which is fueled by consolidated distribution centers, growing need for food preservation, and pharmaceutical stockpiling. Large-scale refrigerated warehouses are driving robust growth in North America and Europe, while food processing and organized retail are driving rapid capacity increase in Asia Pacific. In order to save operating expenses, automation and energy-efficient technology are being used more and more. Developing nations are making significant investments to boost supply chain dependability and lower post-harvest losses.

- Refrigerated Transportation

For both short- and long-distance logistics, refrigerated transportation guarantees temperature integrity, especially for perishable commodities and temperature-sensitive medications. Due to increased exports and urban consumption, the market is growing quickly in South America and Asia Pacific. While sea-based reefer containers are essential for cross-border trade, road-based refrigerated transport is the norm in most countries. Improved cold chain connectivity between farms, ports and cities promotes growth.

To learn more about this report, Download Free Sample Report

By Temperature Type

- Chilled (0°C to 8°C)

Because it is widely used in fresh produce, dairy, drinks, and some pharmaceutical items, the chilled segment has a sizable market share. Europe and North America have the highest demand, which is bolstered by established retail infrastructure and stringent food safety laws. Urbanization and expanding consumption of fresh foods are driving uptake in Asia Pacific. High turnover efficiency is necessary for chilled storage, which encourages investments in contemporary warehousing.

- Frozen (-18°C to -25°C)

Meat, fish, frozen foods, and vaccinations are all frequently stored at freezing temperatures, making it a major source of income worldwide. Asia Pacific exhibits the quickest growth due to shifting dietary patterns, whereas North America and Europe lead due to large consumption of frozen food. Longer shelf life and compatibility with international trade are advantages of frozen logistics. Technological developments are lowering the dangers associated with temperature fluctuations and increasing energy efficiency.

- Deep Frozen / Ultra-Low Temperature (below -25°C)

High-value frozen seafood, specialized chemicals and biopharmaceuticals are the main drivers of this market. North America, Europe, and developed Asia Pacific markets like South Korea and Japan account for the majority of demand. Adoption is constrained in emerging regions by high infrastructure and operating expenses. However, the worldwide footprint of this market is gradually growing due to increased vaccination distribution and biologics development.

By Service

- Storage Services

Because food and medications need to be stored for extended periods of time, storage services make up a significant amount of cold chain revenue. As businesses outsource storage to cut capital expenditures, growth is robust in every region. While Asia Pacific and South America prioritize capacity expansion, North America and Europe concentrate on automated high-density facilities. Capabilities for inventory management and regulatory compliance are important differentiators in the marketplace.

- Transportation Services

Increased interregional trade and last-mile perishable deliveries are driving significant expansion in transportation services. With the help of pharmaceutical distribution and online food shopping, Asia Pacific is growing at the fastest rate. Because of its large reefer fleets, North America continues to dominate the market. Investments in real-time monitoring systems are necessary because reliable temperature regulation during transit is still crucial.

- Value-Added Services

As consumers want for integrated cold chain solutions, value-added services like packing, labeling, blast freezing, and cross-docking are becoming more and more important. Due to their extremely efficient supply systems, North America and Europe have the highest rates of adoption. As food exports and pharmaceutical outsourcing rise, Asia Pacific is quickly catching up. For cold chain providers, these services increase customer retention and operational efficiency.

By End-Use Industry

- Food & Beverages

The greatest end-use category is food and beverages, which is fueled by an increase in the consumption of dairy, meat, frozen foods, and fresh vegetables. Because of their well-established cold storage networks and large per capita consumption, North America and Europe are the dominant regions. The fastest-growing region is Asia Pacific, driven by changes in nutrition and population. Adoption of the cold chain is primarily motivated by reducing food wastage and preserving quality.

- Pharmaceuticals

The increasing need for biologics, vaccines, and medications that are sensitive to temperature is driving the pharmaceutical industry's steady growth. Because of their sophisticated healthcare systems and strict regulations, North America and Europe are in the lead. With rising pharmaceutical production and distribution Asia Pacific is becoming a major growth region.

- Chemicals

Specialty and temperature-sensitive formulations are the main applications for cold chain solutions for chemicals. Industrialized areas like North America, Europe, and portions of Asia Pacific are where demand is concentrated. Compared to food and pharmaceuticals, growth is modest, but it stays steady because of stringent handling regulations. Service specialization is driven by strict safety regulations and regulated storage conditions.

- Agriculture

The post-harvest storage of fruits, vegetables, and seeds is the main emphasis of agriculture-based cold chain usage. Due to initiatives to lower post-harvest losses and enhance export quality, Asia Pacific and South America exhibit robust growth. Infrastructure investments and government programs help emerging economies grow. Utilization rates in this category are influenced by seasonal demand trends.

- Others

Niche industrial goods, flower products, and diagnostic samples are all included in the "Others" category. It offers consistent demand across developed regions, while having a lesser proportion. International trade and the need for specialized storage both contribute to growth. This market is distinguished by premium pricing and custom handling solutions.

Regional Insights

In view of its sophisticated infrastructure, strong refrigerated transportation networks, and high consumption of frozen goods and medications, North America which includes the United States, Canada, and Mexico has the largest cold chain market in the world. With its strict laws, expanding e-commerce food deliveries, and high demand for biologics and vaccinations, the United States is a leader. The expansion of cold storage facilities and cross-border refrigerated logistics are the main priorities for Canada and Mexico. With energy-efficient refrigerated storage, automated warehouses, and sustainable logistics methods that meet high per capita consumption and strict food safety requirements, Europe including Germany, the UK, France, Spain, Italy, and the rest of Europe shows continuous growth. infrastructure. Larger urbanization, larger retail chains, increased exports, and government investments in cold storage and refrigerated transportation have made Asia Pacific which includes Japan, China, Australia & New Zealand, South Korea, India, and the rest of the region the fastest-growing market. In order to reduce post-harvest losses and increase export quality, South America which includes Brazil, Argentina, and the rest of the region is primarily growing in the food and beverage industry. Pharmaceuticals, imported goods, and retail expansion are all being adopted across the Middle East and Africa, which includes Saudi Arabia, the United Arab Emirates, South Africa, and other nations. All things considered, every location shows distinct drivers influenced by changing consumer behavior, technological adoption, and regulatory frameworks.

To learn more about this report, Download Free Sample Report

Recent Development News

- November 2025, The Canadian cold chain and logistics company Andlauer Healthcare Group Inc. was acquired by United Parcel Service (UPS) for around CAD 2.2 billion (USD 1.6 billion). This calculated step improves end-to-end cold chain offerings for pharmaceuticals and healthcare items by greatly increasing UPS Healthcare's temperature-controlled logistics footprint in North America and around the world.

- In March 2025, In order to facilitate expansion with a new big retail client and add around 35,700 pallet slots to its cold storage network, Americold Realty Trust, Inc. officially stated that it had paid about $127 million to acquire a temperature-controlled warehouse facility in Houston, Texas. With this acquisition, Americold is strengthening its capacity in strategic logistical hubs and extending its leadership in high-turn refrigerated storage.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 285.0 Billion |

|

Market size value in 2026 |

USD 305.0 Billion |

|

Revenue forecast in 2033 |

USD 690.0 Billion |

|

Growth rate |

CAGR of 12.40% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Lineage Logistics Holding LLC, Americold Logistics LLC, Nichirei Logistics Group, Inc., United States Cold Storage, Inc., Burris Logistics Inc., VersaCold Logistics Services, AGRO Merchants Group, LLC, DHL International GmbH, UPS (United Parcel Service), OOCL Logistics, SSI SCHAEFER, Kloosterboer, NewCold Coöperatief U.A., CWT Limited, AIT |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (Refrigerated Storage, Refrigerated Transportation), By Temperature Type (Chilled (0°C to 8°C), Frozen (-18°C to -25°C), Deep Frozen / Ultra-Low Temperature (below -25°C)), By Service (Storage Services, Transportation Services, Value-Added Services) and By End Use Industry (Food & Beverages, Pharmaceuticals, Chemicals, Agriculture, Others) |

Key Cold Chain Company Insights

With more than 400 temperature-controlled facilities worldwide and more than 2.5 billion cubic feet of storage capacity, Lineage Logistics Holding LLC is the largest cold chain logistics supplier in the world. The company sets the standard through data-driven warehouse optimization, sophisticated automation technologies and strategic acquisitions that significantly increase throughput and lower spoilage. Serving the food, pharmaceutical and specialty industries, Lineage's varied service offering includes end-to-end cold storage, last-mile delivery, and e-commerce fulfillment. Its geographic growth into Europe and Asia Pacific, together with its ongoing focus on technology integration such as robotics and predictive analytics reinforces its market leadership and resilience in the face of changing supply chain needs.

Key Cold Chain Companies:

- Lineage Logistics Holding LLC

- Americold Logistics LLC

- Nichirei Logistics Group, Inc.

- United States Cold Storage, Inc.

- Burris Logistics Inc.

- VersaCold Logistics Services

- AGRO Merchants Group, LLC

- DHL International GmbH

- UPS (United Parcel Service)

- OOCL Logistics

- SSI SCHAEFER

- Kloosterboer

- NewCold Coöperatief U.A.

- CWT Limited

- AIT

Global Cold Chain Market Report Segmentation

By Type

- Refrigerated Storage

- Refrigerated Transportation

By Temperature Type

- Chilled (0°C to 8°C)

- Frozen (-18°C to -25°C)

- Deep Frozen / Ultra-Low Temperature (below -25°C)

By Service

- Storage Services

- Transportation Services

- Value-Added Services

By End-Use Industry

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Agriculture

- Others

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636