Market Summary

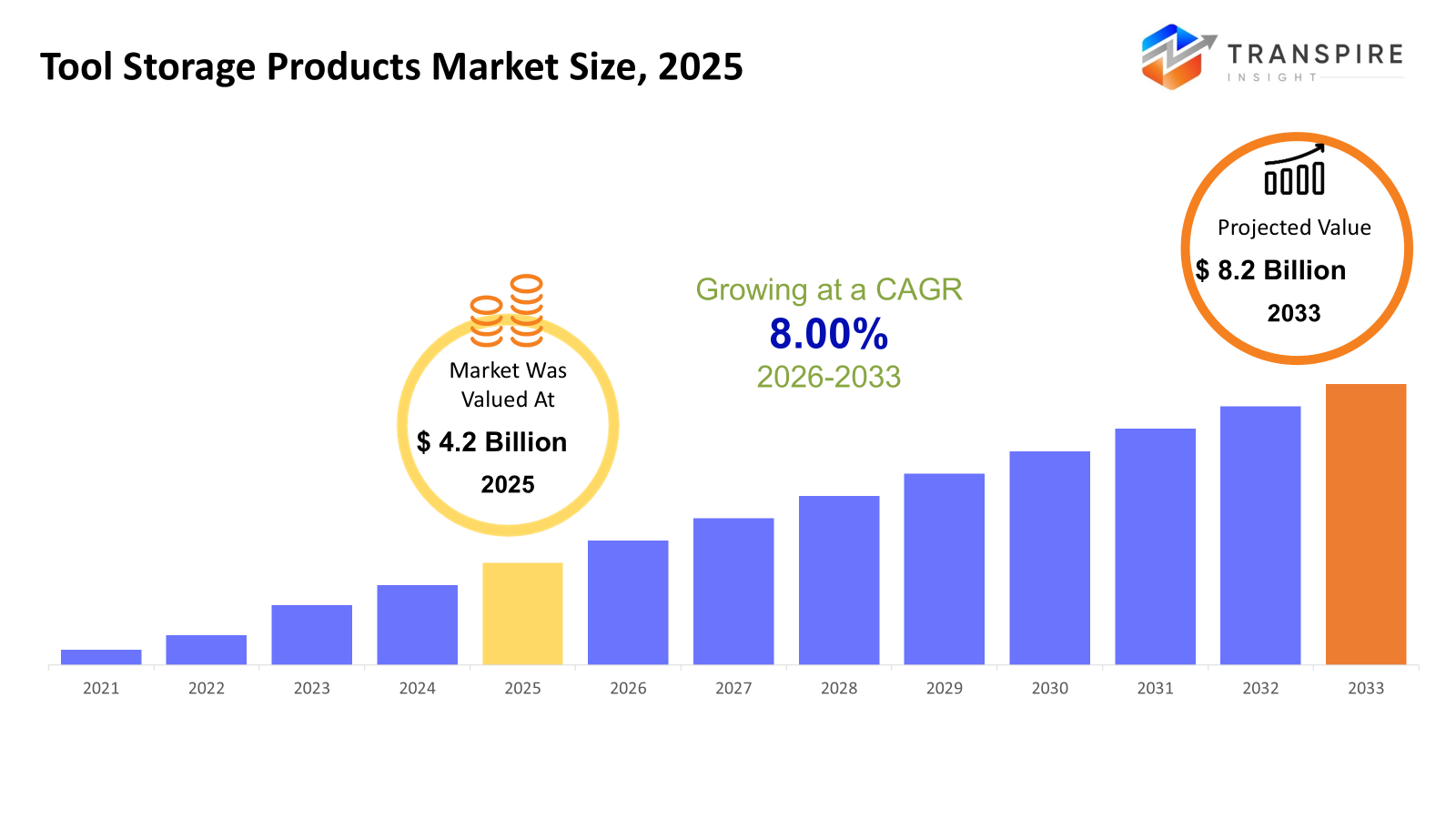

The global Tool Storage Products market size was valued at USD 4.2 billion in 2025 and is projected to reach USD 8.2 billion by 2033, growing at a CAGR of 8.00% from 2026 to 2033. The market for Tool Storage Products is expected to have a strong CAGR due to the growing need for real-time inventory management, medication safety, and loss prevention. The rising digitalization of processes, along with the reduction in the cost of RFID components, is driving the market. The pressure for traceability continues to increase as a regulatory requirement, particularly in the pharma and hospital segments. Moreover, the integration of RFID Cabinets with analytics and cloud solutions within hospitals is also opening up new usage scenarios.

Market Size & Forecast

- 2025 Market Size: USD 4.2 Billion

- 2033 Projected Market Size: USD 8.2 Billion

- CAGR (2026-2033): 8.00%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- North America is a mature but high-value geography, due to its robust construction output, renovation activities, and high tool ownership penetration. Demand for replacement, high-end product and innovation-driven upgrades continue to fuel steady revenue growth among professionals and households.

- The United States is the prime example of the major contributor in the global market due to its extensive base of contractors, a robust automotive aftermarket and a high level of DIY activity. The demand is driven towards more modular, mobile, and durable storage solutions that aim to improve the efficiency and safety of workflows.

- The Asia Pacific market is observed to have the fastest growth rate, thanks to the fast-paced industrialization, infrastructure development and urbanization taking place in the region. The rising acceptance of organized tool storage solutions among small contractors, manufacturers and households fuels the volume-driven growth in the emerging as well as developed markets.

- Traditional & Portable solutions for tools are leading the product type market beacuse of flexibility, easy mobility and versatility. Modular designs, stackable systems and increasing demand from construction professionals service engineers and home users are some of the major factors for driving the demand

- Steel-material storage products continue to be the most prominent material type, driven by it's robustness, high carrying capacity and adaptability to harsh usage conditions. Industrial production, construction sites and car service centers continue to prefer steel storage solutions despite their relatively high cost.

- The construction industry continues to be the largest market for storage solutions, driven by infrastructure development and commercial construction projects. Demand is fueled by the need for secure, portable and weather resistant storage solutions that minimize tool losses and enhance productivity on construction sites.

- Offline retail channels continue to be the most prominent distribution channel, driven by the need for physical product inspection for high-priced items. Professional buyers continue to depend on specialized dealers for product quality assurance, technical expertise and post-sales service keeping the channel relevant despite the rise of online retail.

So, The market for tool storage products comprises a broad range of solutions that are intended for tool organization, protection and transportation in professional, industrial, and residential settings. Toolboxes, tool bags, cabinets, chests and modular storage solutions are critical for maintaining efficiency. The demand for these products is directly related to construction, manufacturing, and automotive repair. Market development is fueled by the growing understanding of workplace safety and efficiency. Tool storage solutions enable the reduction of tool damage, downtime and workflow management. High-use industries are increasingly adopting standardized storage solutions to meet regulatory and business needs. Innovation in tool storage solutions aimed at ergonomics, durability and compatibility with modular solutions further drives adoption.

The residential demand has increased owing to the growing home improvement and DIY trends. Consumers are also showing a preference for organized storage solutions that enhance storage efficiency. The presence of MNCs and local companies has led to a competitive landscape that is driven by product quality and pricing.

Tool Storage Products Market Segmentation

By Product Type

- Traditional & Portable Solutions

Portable options (such as toolboxes, carry bags, and carts) lead the way because of their portability, the rise of DIY culture, and their general appeal to light to medium-duty users. Investors are optimistic about the adoption of compact and modular designs with advanced features.

- Stationary & Heavy‑Duty Units

Conventional stationary/heavy-duty models (such as large cabinets and workshop chests) are also essential in their environment, which is the industrial or professional world where durability and capacity are valued. The market's growth is tied to the expansion of the construction and industrial base worldwide

To learn more about this report, Download Free Sample Report

By Material Type

- Steel

Steel dominates the market because of its strength and long life and it is most sought after in industrial applications.

- Plastic

Plastic units are growing in popularity because of their low cost, lightness and ease of use, especially in domestic and small commercial applications.

- Wood

Wood still finds a niche market in craft workshops where appearance and customization are more important than ruggedness.

- Aluminum & Others

Aluminum and other materials are finding favor in applications where strength and lightness are required but their market is still relatively smaller compared to steel and plastic.

By Application

- Construction Sites

High demand for robust and large-format storage solutions to organize tools and equipment on complex projects. Infrastructure development in emerging and developed regions drives the demand.

- Automotive Repair / Workshops

Stable demand for modular and mobile storage solutions to optimize space and improve workflow efficiency in repair and maintenance facilities.

- Industrial Manufacturing

Tool storage solutions are essential for operational safety and efficiency. Industrial customers demand heavy-duty materials and customizable solutions

- Home Improvement/DIY

The residential and DIY market is growing as a result of the increasing DIY culture and ease of access through e-commerce, particularly in APAC and Europe.

- Commercial & Fleet Use

The market in commercial environments (such as facility services and fleet maintenance) is growing moderately, with a focus on reliability and lifecycle cost efficiency.

By Distribution Channel

- Offline Retail

Still constitutes the major share of sales, primarily because of the nature of high-value sales and the requirement of physical inspection before making a purchase.

- Online Retail

The fastest-growing sales channel driven by the penetration of e-commerce, convenience, competitive pricing and access to digital catalogs for both consumers and small businesses.

Regional Insights

Geographically, North America is the largest market, with the United States being the Tier 1 country because of its robust construction, automotive repair, and home improvement markets. Canada is a steady contributor to the market through residential construction and industrial maintenance, while Mexico is a Tier 2 market due to its growing manufacturing base. The European market has stable demand in the Tier 1 countries of Germany, the United Kingdom, and France, which is driven by industrial production and renovation. Spain, Italy, and the remaining Europe are Tier 2 markets, which are driven by small-scale construction and DIY adoption. The Asia Pacific is the most rapidly growing market, driven by Tier 1 countries such as China, Japan, and India. The Asia Pacific is followed by Australia, South Korea, and the remaining Asia Pacific countries, which form the Tier 2 countries due to their consistent industrial and residential demand.

The South America market is an emerging market, driven by the Tier 1 country of Brazil, with Argentina and the remaining South America countries forming the Tier 2 countries. The Middle East and Africa market has long-term prospects, with Saudi Arabia and the United Arab Emirates being the Tier 1 countries due to their infrastructure investments while the remaining countries are Tier 2 countries.

To learn more about this report, Download Free Sample Report

Recent Development News

- December 2025, Stanley Black & Decker made a significant corporate announcement regarding the sale of its Consolidated Aerospace Manufacturing business for $1.8 billion. Although it is not a product launch announcement, it is a part of the overall strategy of portfolio repositioning, which impacts the allocation of capital to core businesses, including tools and storage solutions.

- In October 2024, Milwaukee Tool made an announcement regarding the launch of eight new PACKOUT Tool Box Attachments that lock securely into the PACKOUT system.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 4.2 Billion |

|

Market size value in 2026 |

USD 4.8 Billion |

|

Revenue forecast in 2033 |

USD 8.2 Billion |

|

Growth rate |

CAGR of 8.00% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Stanley Black & Decker, Milwaukee Tool (Techtronic Industries), Husky, Snap-on Incorporated, DeWalt, Craftsman, Bosch, Keter Plastic Ltd., Ridgid, Apex Tool Group, Waterloo Industries, Homak Manufacturing, Kennedy Manufacturing, GearWrench, Proto Industrial Tools |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Product Type (Traditional & Portable Solutions, Stationary & Heavy‑Duty Units), By Material Type (Steel, Plastic, Wood, Aluminum, Others), By Application (Construction Sites, Automotive Repair / Workshops, Industrial Manufacturing, Home Improvement / DIY, Commercial, Vehicle / Fleet Use, Others) and By Distribution Channel (Offline Retail, Online Retail) |

Key Tool Storage Products Company Insights

Stanley Black & Decker has positioned itself as a bedrock in the global tool storage products market through its diverse and extensive range of tool chests, portable systems, cabinets, and modular storage solutions. The company’s strategic merging of its legacy brands such as DeWalt and Craftsman has also reinforced its multi-segment presence in the professional, industrial, and consumer markets. The company’s focus on building its products to be durable, ergonomic, and modular has also facilitated widespread acceptance from construction floors to automotive repair shops, while its extensive distribution networks in North America, Europe, and Asia have also helped the company maintain a competitive edge.

Key Tool Storage Products Companies:

- Stanley Black & Decker

- Milwaukee Tool (Techtronic Industries)

- Husky

- Snap-on Incorporated

- DeWalt

- Craftsman

- Bosch

- Keter Plastic Ltd.

- Ridgid

- Apex Tool Group

- Waterloo Industries

- Homak Manufacturing

- Kennedy Manufacturing

- GearWrench

- Proto Industrial Tools

Global Tool Storage Products Market Report Segmentation

By Product Type

- Traditional & Portable Solutions

- Stationary & Heavy‑Duty Units

By Material Type

- Steel

- Plastic

- Wood

- Aluminum

- Others

By Application

- Construction Sites

- Automotive Repair / Workshops

- Industrial Manufacturing

- Home Improvement / DIY

- Commercial

- Vehicle / Fleet Use

- Others

By Distribution Channel

- Offline Retail

- Online Retail

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636