Market Summary

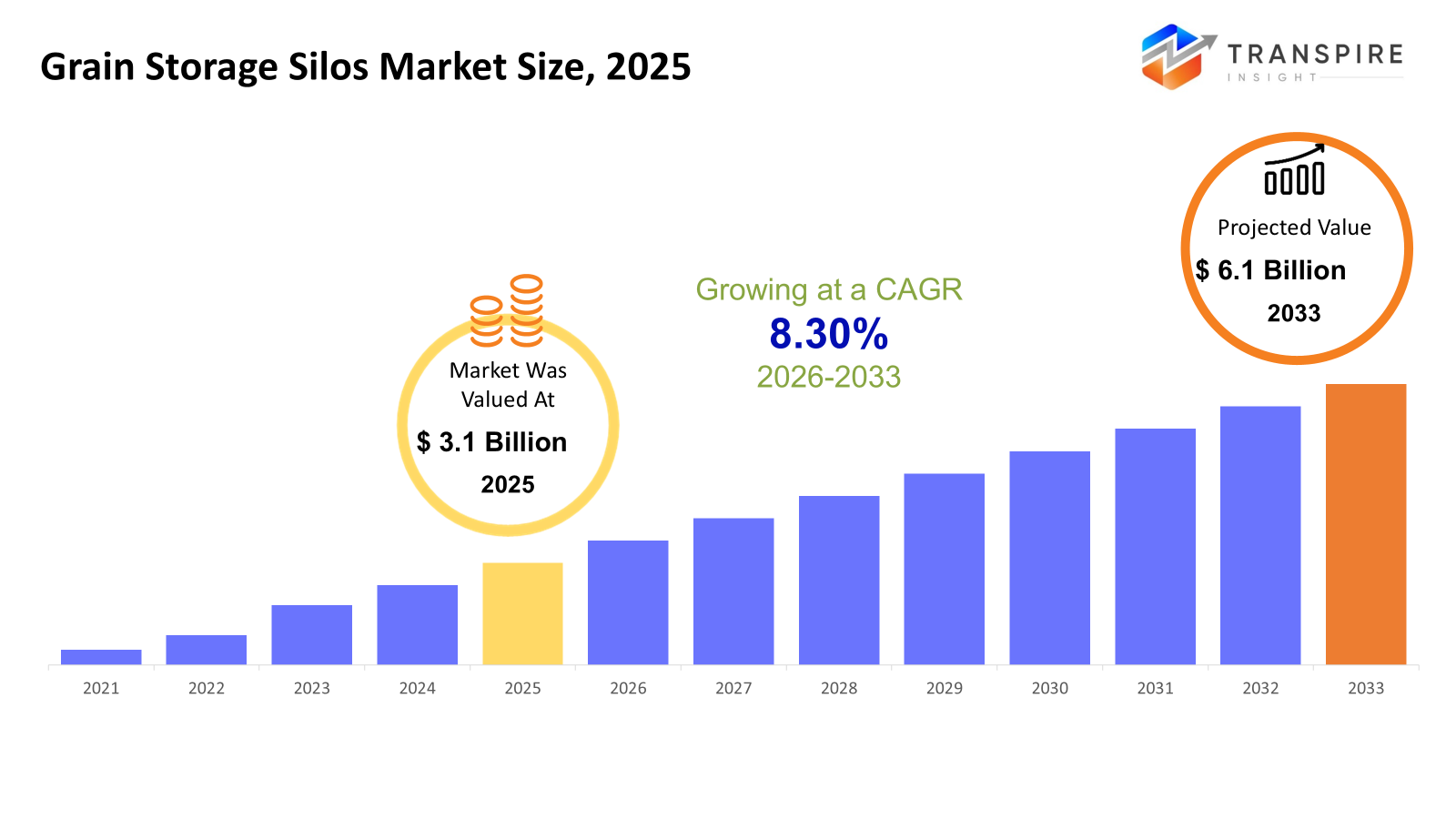

The global Grain Storage Silos Market size was valued at USD 3.1 billion in 2025 and is projected to reach USD 6.1 billion by 2033, growing at a CAGR of 8.30% from 2026 to 2033.

The world grain storage silos market is rising gradually, as there is an increased need from various players like growers and governments faced with an increased need for developing effective storage options that can prevent grains from losing value. Grain storage silos, large constructions usually useful in storing large volumes of grains like rice, cereals, and others, can be described as increasingly imperative since they play an important role in reducing losses from grains. The world grain storage silos market has witnessed an increased rise from players developing and applying increasingly effective and technologically advanced storage facilities. The developing world harvest is expected to be higher than previous ones. In addition, there is an increased need and focus on developing effective storage options like those involving IoT devices and effective climate management. Thus, there is an increased need from players like growers and governments, and hence there is an expansion of the world grain storage silos market.

Market Size & Forecast

- 2025 Market Size: USD 3.1 Billion

- 2033 Projected Market Size: USD 6.1 Billion

- CAGR (2026-2033): 8.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- Adoption of Advanced Technologies for Storage: There is an increased adoption in the use of smart and automated silo systems that are fitted with sensors, temperature and humidity monitoring, and real-time data analytics to reduce post-harvest losses and improve grain quality along the storage value chain.

- Greater Emphasis on Food Safety and Losses Incurred during Post-Harvest Period: Infrastructure for reducing post-harvest losses is gaining traction among governments and farming societies around the world, hence investing more in modern silo installations to preserve wheat, rice, and maize.

- There is an increasing demand for large capacity and modular silos due to the rise in farm sizes and volumes of grain production; hence, the need for a silo design that can be expanded without huge costs to meet evolving storage needs.

- Commercial and Cooperative Storage Solutions: Centralized silo facilities are increasingly being adopted by agricultural cooperatives and private grain handlers, aimed at overall supply chain efficiency, improved bulk handling capabilities, and market distribution, especially in export-oriented regions.

- Growth in Emerging Economies: The rapid development of agriculture in emerging economies like the Asia-Pacific and Latin America increases the demand for grain storage facilities. Their government has promoted investment in rural logistics to increase the pace of agricultural mechanization.

Grain Storage Silos Market Segmentation

By Silo Type

- Flat Bottom Silos

Flat bottom silos are widely used in large volumes and long-term storage, particularly for commercial and industrial facilities. On the global front, they are leading due to their high-capacity structure stability and suitability for bulk storing grains such as wheat, corn, and rice.

- Silos of Hoppers

Hopper-bottom silos were designed with a conical bottom feature, making the discharge of grains easy and complete. Therefore, this type is especially applicable to situations where the frequency of loading and unloading operations is high. Because of these advantages, hopper-bottom silos are finding increasing applications in processing plants and smaller storage facilities in many parts of the world where efficient flow of grains is a prime requirement.

- Grain Bins

Grain bins are the most used facility on farms for short- to medium-term storage and seasonal grain holding. On a global scale, they have become popular for small- and medium-scale farmers because of their affordability, ease of installation, and flexibility.

- Others

Others include specialty storage: temporary silos, bag storage systems, and customized designs. These are starting to receive interest globally in regions that need options for inexpensive, flexible, or portable grain storage, particularly during peak harvest seasons.

To learn more about this report, Download Free Sample Report

By Material

- Steel

Steel silos dominate the global grain storage silos market due to their high strength, durability, and resistance to harsh weather conditions. They are widely used for large-capacity and long-term grain storage, offering superior protection against pests, moisture, and structural damage.

- Aluminum

Aluminum silos are valued for their lightweight, corrosion-resistant properties, making them suitable for regions with high humidity or coastal environments. At the global level, they are often used in smaller or modular storage systems where ease of handling and installation is important.

- Wood

Wooden silos are traditional storage structures and are now limited to small-scale or rural applications in certain regions. While they are cost-effective and easy to construct, their lower durability and maintenance requirements have reduced their adoption in modern grain storage systems.

- Others

The “others” segment includes materials such as concrete, fiberglass, and hybrid composites. These materials are gaining attention globally for specialized applications where enhanced insulation, long service life, or customized storage solutions are required.

By End-user

- Feed Mills & Animal Feed

In animal feed production, feed mill plants use storage silos for storing raw grain supplies like corn, wheat, and barley. In the global animal feed production industry, an increased demand has been witnessed for animal and poultry products, thus an increased need to invest in effective storage facilities.

- Grain Processing Mills

Grain processing mills depend on grain silos as storage facilities for the storage of grains prior to processing. At the global level, the increase in the production of flour, starch, and breakfast cereals indicates the need for large storage facilities to meet the demands of different customers.

- Port & Bulk Terminals

The ports and bulk terminals operate large grain storage silos in support of import/export and bulk handling operations within the country. The grain handling sector consists of large grain storage silos to support operations in the import/export sector at the global level.

- Food & Beverage Processors

Food processing industries require grain storage silos to ensure a high level of quality and food safety in their raw agricultural inputs. An increasing demand worldwide in terms of packaged beverages and food products from grain processing has fueled interest in using grain storage silos.

Regional Insights

North America is one of the major markets for grain storage silos across the world, backed by highly developed agriculture infrastructure, large-scale commercial farming activities, and heavy investment in post-harvest management infrastructure. The emphasis on minimizing post-harvest loss is also driving the adoption of steel silos and other technologically enabled infrastructure for storage purposes in North America.

Europe has a considerable share in the world market due to its well-developed agricultural sector in countries like France, Germany, Spain, and so on. European farmers have been adopting the latest advancements in silo technology for better functioning in the face of stern regulations on grain quality under food safety regulations in those countries.

Asia-Pacific is the growth driver in the regional market, owing to the rise in grain production, emphasis on food security, and use of contemporary agricultural practices in the region. Countries like China, India, and others in Southeast Asia are investing heavily in grain storage infrastructure in the form of silos, unlike traditional storage practices prevalent in previous years.

To learn more about this report, Download Free Sample Report

Recent Development News

- In September 2025, Chief Agri, part of Chief Industries, Inc., introduced three new grain-storage silos. These products focus on providing smarter, stronger, and more user-friendly solutions, aiming to improve efficiency, durability, and ease of use for farmers managing grain storage and handling.

- In September 2025, AGI partnered with Live to Farm and RIPCO Systems to showcase farming realities in a televised series. Together, they built a new AGI grain bin on a farm, featuring AGI’s BinManager technology, highlighting advanced grain storage and management solutions in real agricultural settings.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 3.1 Billion |

|

Market size value in 2026 |

USD 3.5 Billion |

|

Revenue forecast in 2033 |

USD 6.1 Billion |

|

Growth rate |

CAGR of 8.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Ecosphere India Pvt. Ltd, Silos Córdoba, PRADO SILOS, Hoffmann, Inc., Symaga S.A.U., Silos Metálicos Zaragoza S.L.U., Bentall Rowlands Silo Storage Ltd, Mysilo, Sukup Manufacturing Co., CST Industries, Sioux Steel Company, Chief Agri/Industrial Group, Grain & Protein Technologies, Brock Grain Systems, Ag Growth International Inc (AGI) |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Silo Type (Flat Bottom Silos, Hopper Silos, Grain Bins, Others), By Material (Steel, Aluminium, Wood, Others), By End-User (Feed Mills & Animal Feed, Grain Processing Mills, Port & Bulk Terminals, Food & Beverage Processors) |

Key Grain Storage Silos Company Insights

With its broad portfolio-including IoT-enabled precision equipment, autonomous machinery, and data analytics platforms-Deere & Company is a clear market leader. Its global presence and significant investment in research and development allow the company to continue to innovate, providing scalable solutions for farmers that help improve operational efficiency and sustainability. Deere's ability to integrate hardware and software ecosystems provides a competitive advantage, which fosters wide diffusion across large commercial farms worldwide.

Key Grain Storage Silos Companies:

- Ecosphere

- Silos Córdoba

- PRADO SILOS

- Hoffmann, Inc.

- Symaga S.A.U.

- Silos Metálicos Zaragoza S.L.U.

- Bentall Rowlands Silo Storage Ltd

- Mysilo

- Sukup Manufacturing Co.

- CST Industries

- Sioux Steel Company

- Chief Agri/Industrial Group

- Grain & Protein Technologies

- Brock Grain Systems

- Ag Growth International Inc

Global Grain Storage Silos Market Report Segmentation

By Silo Type

- Flat Bottom Silos

- Hopper Silos

- Grain Bins

- Others

By Material

- Steel

- Aluminum

- Wood

- Others

By End-user

- Feed Mills & Animal Feed

- Grain Processing Mills

- Port & Bulk Terminals

- Food & Beverage Processors

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636