Market Summary

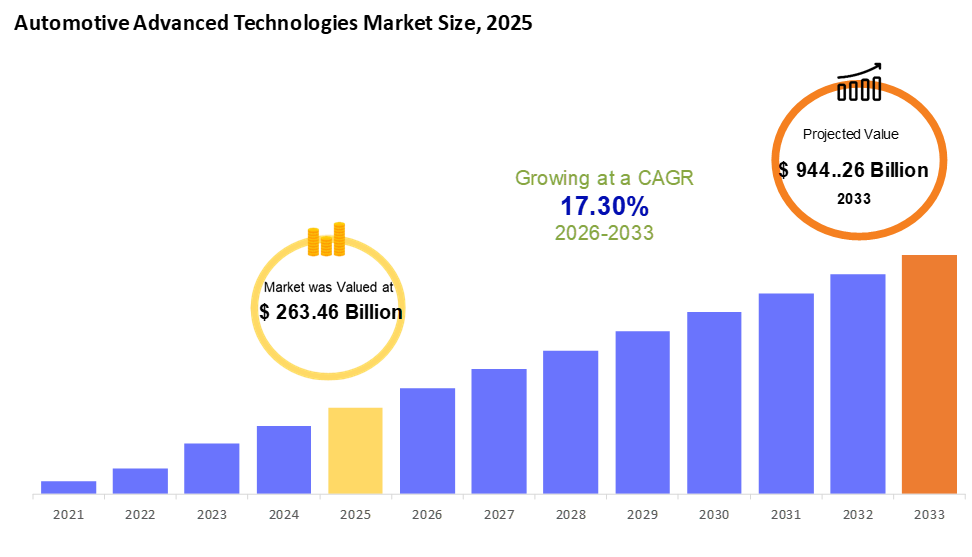

The Automotive Advanced Technologies Market shift suggests the industry could reach roughly $944.26 billion in 2033. The automotive advanced technologies market is fast-moving global due to the accelerated vehicle electrification, vehicle connectivity, vehicle safety, and vehicle automation. Car manufacturers are incorporating more and more ADAS, autonomous driving systems, and software-defined vehicle systems as a safety, efficiency, and user experience mechanism. Another significant growth catalyst is the increasing use of electric vehicles, and this is backed by the development of improved power electronics and battery technologies. Also, vehicles are becoming smart, data-driven mobility providers, and it is through connected car technologies and the likes of over-the-air software updates. On the whole, the market is expanding towards more intelligent, much safer, and sustainable transportation solutions throughout the world.

Market Size & Forecast

- 2025 Market Size: USD 263.46 Billion

- 2033 Projected Market Size: USD 944.26 Billion

- CAGR (2026-2033): 17.30%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

Key Market Trends Analysis

- North America’s market share should hit around 34% by 2026. It's driven by rising use of driver-assist systems, networked car tech, along with flexible vehicle designs to solid research networks, and supportive government rules.

- Startups focused on tech plus car makers can push the U.S. auto scene forward since self-driving advances, smart safety tools using artificial brains, also remote upgrades are reshaping everything quickly.

- Asia Pacific is becoming the most rapidly changing region to adopt advanced automotive technologies due to the high volumes of its vehicle production, strong EV implementation, and governmental assistance of smart mobility.

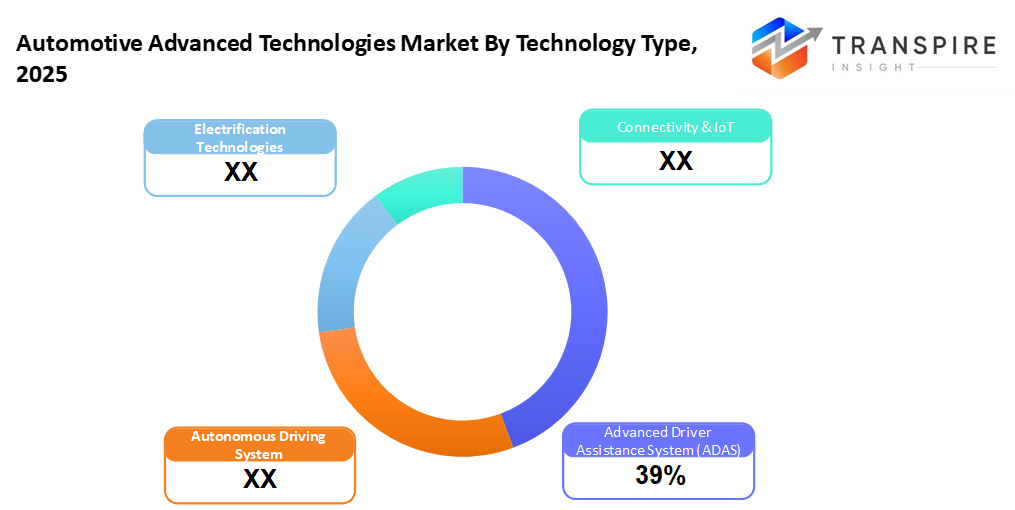

- Advanced Driver Assistance Systems (ADAS) is approximately estimated up to 40% in 2026. Advanced Driver Assistance Systems (ADAS) have quick adoption of standard and advanced ADAS capabilities in the mass-market cars due to safety standards and consumer needs.

- Passenger Cars have the premature introduction of superior safety, infotainment, and connectivity systems on mid-range and high-end models.

- Safety and Security System has increasing use of collision avoidance and driver monitoring technologies and predictive safety technology as standard car features.

The automobile advanced technologies market is experiencing a significant shift in the world market, over which vehicles are being transformed into intelligent, software-based mobility platforms instead of mechanical systems. Advanced driver Assistance Systems (ADAS), electrification solutions, connectivity and IoT platforms, and autonomous driving are also among the advanced technologies that automakers across the globe are increasingly incorporating in their designs to improve vehicle safety, performance, and user experience. The constant increase in the market value in the forecast period indicates the constant innovation, market pressure towards safer vehicles, and increasing acceptability of the technology-enabled mobility solutions to consumers in the passenger and commercial vehicle markets.

The market has been influenced mainly due to the increasing safety consciousness, more stringent government policies, and the quick electrification of the automobile sector. There is a notable level of demand in ADAS technologies since these devices have started to be standard features of numerous vehicles with such functions as automatic emergency braking, lane-keeping assistance, and adaptive cruise control. Simultaneously, the growing use of electric and hybrid vehicles is driving the need to use sophisticated power electronics, battery controllers, and software-defined car systems. The need to have efficient transport that is connected and growing urbanization further boost the market demand.

Technologically and in terms of vehicle, passenger cars still have the greatest adoption base of advanced automotive technologies, and this is attributed to the high volumes of production and early integration of features. Hybrid and electric cars emerge as a major source of growth, as they are, per se, based on sophisticated software, connectivity, and efficiency-related technologies. Light commercial vehicles are more inclined to adopt telematics and safety systems to increase the productivity of the fleet, whereas heavy commercial vehicles are more inclined to ADAS and connectivity solutions to improve road safety and their operational efficiency.

Regarding regional and application-specific forces, North America is one of the strongest markets; it is characterized by early technology adoption, robust R&D ecosystems, and a large scale of ADAS and connected vehicle platforms. The safest and most secure systems constitute the most visible section of the application, which is backed by the regulatory requirements and consumer preference in terms of safer driving experiences. Telematics, connectivity, and infotainment technologies, on the other hand, are growing in popularity as cars get more customized, networked, and digitally integrated, and support the long-term expansion view of the global automotive advanced technologies market.

Automotive Advanced Technologies Market Segmentation

By Technology Type

- Autonomous Driving System

Increasing focus on commercialization with advanced AI, sensors, and autonomous deployments in premium and pilot-use vehicles.

- Advanced Driver Assistance Systems (ADAS)

Smart driving aids are most offenly used in all cars. New rules on safety, plus growing interest in tools that help avoid crashes or assist drivers.

- Electrification Technologies

Switching to electric rides means better batteries, smart power tools, besides ways to handle energy use efficiently.

- Connectivity & IoT

Links plus gadgets let cars share info now, get fixes online, or talk to roads, lights, making trips easier.

By Vehicle Class

- Passenger Cars

First adopts advanced technologies because of large volumes of production and a high demand by consumers for safety and comfort features

- Light Commercial Vehicles

There is a growing trend of integrating telematics and ADAS in order to make the fleet efficient and controllable.

- Heavy Commercial Vehicles

The main solutions to be adopted include safety, driver monitoring, and connectivity solutions to enhance the performance of the logistics and regulatory compliance.

- Electric & Hybrid Vehicles

They are highly dependent on sophisticated software, networking technology, and powertrain technology to optimize their performance and efficiency.

By Application

- Safety & Security Systems

Safety and security setups are leading the way to rules that demand them, while more people now care about avoiding accidents.

- Powertrain & Efficiency

Engines go electric, smart power use cuts pollution while boosting car performance through better fuel control.

- Telematic & Connectivity

Telematics with smart links lets fleets run better, with live updates that help plan repairs before issues happen, while enabling smoother travel options through constant info flow.

- Infotainment & Comfort

Entertainment plus comfort get a boost with sharper displays, better speech control, also personalized cabin tech packed in.

Regional Insights

The automotive advanced technologies Tier-I markets in the North America and Europe regions can be attributed to early adoption, a well-developed regulatory environment, and a well-developed automotive ecosystem. In North America, the U.S. and Canada are highly penetrated with ADAS and connected vehicle platforms and software-defined vehicle architecture, which is backed by intense R&D funding and autonomous driving pilot programs. Europe and its subregions, such as Germany, France, the UK, and the Nordics, are motivated by the rigorous safety and emission standards, the rapid adoption of ADAS, electrification, and smart powertrain systems, especially in passenger cars and high-end vehicles.

The fastest growing Tier-1 market is the Asia Pacific region, which is driven by the volume production of vehicles and the intensive uptake of EVs, and supported by smart mobility programs by governments. The large subregions of China, Japan, South Korea, and India are fast adopting technologies of ADAS, connectivity, and electrification in mass-market vehicles. China is the strongest in EVs and connected cars, and Japan and South Korea are concerned with the development of high-level safety systems and autonomous-ready technologies. The adoption of ADAS and telematics is increasing in India as an emerging subregion, especially with passenger cars and commercial fleet vehicles.

Latin America and the Middle East & Africa (MEA) are classified as Tier-2 and emerging markets, which are slowly adopting the same. Countries in Latin America, like Brazil and Mexico, are experiencing an increase in the demand for safety systems, telematics, and infotainment due to the enhancement of the vehicle standard and the digitization of the fleet. The UAE, Saudi Arabia, and South Africa are on the frontline of a gradual adoption of connected car technologies and ADAS in both premium and commercial vehicles, with the aid of infrastructure development, and with growing attention to road safety. The combination of these territories leads to the potential of long-term growth as the world continues to become more technologically penetrated.

Recent Development News

- October 9, 2025 – Honda unveils next-generation technologies at the Honda Automotive Technology workshop for an electrified model. (Source: Honda https://global.honda/en/newsroom/news/2025/4251106eng.html

- September 9, 2025 – Rimac Technology launched new automotive technologies at IAA. (Source: https://www.just-auto.com/news/rimac-technology-iaa/)

- March 28, 2025 – Hyundai Motor Group launched the Pleos Software brand, unveiled new SDV technologies, and collaboration. (Source: Hyundai Motor)

- January 02, 2025 - Cerence AI Signs Long-Term, Strategic Partnership to Build Luxury Automaker’s Next-Gen In-Car Experience. (Source: Investors Cerence: https://investors.cerence.com/news-events/press-releases/detail/109/cerence-ai-signs-long-term-strategic-partnership-to-build-luxury-automakers-next-gen-in-car-experience

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 263.46 Billion |

|

Market size value in 2026 |

USD 309.03 Billion |

|

Revenue forecast in 2033 |

USD 944.26 Billion |

|

Growth rate |

CAGR of 17.30% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key company profiled |

Ford Motor Company, Tesla Inc., Waymo LLC, BYD Auto Co. Ltd, Volkswagen Group, Toyota Motor Corporation, Hyundai Motor Group, General Motors, BMW Group, Ford Motor Company, Mercedes-Benz Group, Renault Group, Honda Motor Co., Ltd, Momenta, Rivian, Others |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Technology Type (Autonomous Driving Systems, Advanced Driver Assistance Systems, Electrification Technologies, Connectivity & IoT), By Vehicle Class (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric & Hybrid Vehicles) By Application (Safety & Security Systems, Powertrain & Efficiency, Telematics & Connectivity, Infotainment & Comfort), |

Key Automotive Advanced Technologies Company Insights

Toyota stands out global when it comes to new car tech, especially hybrids, electric models, and self-driving features. It helped lead the way in driver-help tools that boost safety, weaving them into nearly every model they make. Instead of just working alone, the automaker teams up with tech firms while pouring resources into AI-powered driving projects. By zeroing in on electric powertrains, digital links between cars, and smarter ways to get around, it stays ahead as vehicles change fast. On top of that, Toyota pushes greener, safer travel options, matching international rules for cleaner air and fewer crashes.

Key Automotive Advanced Technologies Companies:

- Tesla In

- Ford Motor Company

- Waymo LLC

- BYD Auto Co. Ltd

- Volkswagen Group

- Toyota Motor Corporation

- Hyundai Motor Group

- General Motors

- BMW Group

- Ford Motor Company

- Mercedes-Benz Group

- Renault Group

- Honda Motor Co., Ltd

- Momenta

- Rivian

- Others

Global Automotive Advanced Technologies Market Report Segmentation

By Technology Type

- Autonomous Driving Systems

- Advanced Driver Assistance Systems

- Electrification Technologies

- Connectivity & IoT

By Vehicle Class

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric & Hybrid Vehicles

By Application

- Safety & Security Systems

- Powertrain & Efficiency

- Telematics & Connectivity

- Infotainment & Comfort

Regional Outlook

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636