Market Summary

The global Anime market size was valued at USD 31.50 billion in 2025 and is projected to reach USD 75.00 billion by 2033, growing at a CAGR of 11.90% from 2026 to 2033. The increasing global penetration of streaming services and simulcast releases has increased global accessibility, leading to accelerated subscription revenue growth and global licensing agreements for anime. The development of strong franchise ecosystems that combine merchandising, gaming, and live experiences is diversifying revenue streams and enhancing lifetime value per intellectual property.

Market Size & Forecast

- 2025 Market Size: USD 31.50 Billion

- 2033 Projected Market Size: USD 75.00 Billion

- CAGR (2026-2033): 11.90%

- North America: Largest Market in 2026

- Asia Pacific: Fastest Growing Market

To learn more about this report, Download Free Sample Report

Key Market Trends Analysis

- The North America market is expected to retain its strong anime consumption patterns through well-established streaming platforms, high discretionary spending, and a strong convention culture, thus allowing for continuous subscription growth, theatrical success, and merchandise sales across a broad range of demographic groups.

- The United States is the key driver of the regional market through its adoption of high-end streaming platforms, exclusive licensing deals, and a growing number of theatrical releases, thus solidifying its position as the key revenue driver and hub for international anime distribution and franchise development.

- The Asia Pacific market continues to enjoy its natural leadership position as the production hub and largest viewer base, driven by the content leadership of Japan, growing digital penetration in India and Southeast Asia, and increasing platform investments in original anime content.

- TV Series continue to be the most popular content type, as the storytelling format helps improve viewer retention, supports long-term franchise development, and is more in line with the streaming platform-driven binge-watching consumption patterns that help drive continuous subscription and licensing revenue.

- Action genre remains the top-performing genre, as it has the ability to transcend cultures and is easily adaptable to other forms of media such as video games and movies.

- Streaming Platforms remain the top trend in distribution, as simulcasting, localization, and algorithms have increased the reach of content globally and have reduced the reliance on traditional broadcasting.

- Streaming and Licensing remain the top revenue-generating trend, as exclusive content licensing, cross-border licensing, and investments in platforms have increased the value of intellectual properties while ensuring predictable revenue streams.

So, The anime market includes the production, distribution, and monetization of animated content that has its origin in Japan and is distributed worldwide through television, online platforms, cinema, and home entertainment. The market includes various genres and demographics, creating a defined ecosystem for intellectual property development and expansion. The market is fueled by the digital evolution of media consumption, with online platforms allowing for global simultaneous releases and localized content distribution. This has opened the market for global viewers and generated recurring revenue streams through subscription-based services and licensing deals. The anime industry also operates in a multi-tiered monetization structure that combines merchandising, gaming collaborations, music, and events. The industry’s robust character-based storytelling allows for sustainable franchises, while inter-industry collaborations improve monetization and global brand awareness across all demographics.

Anime Market Segmentation

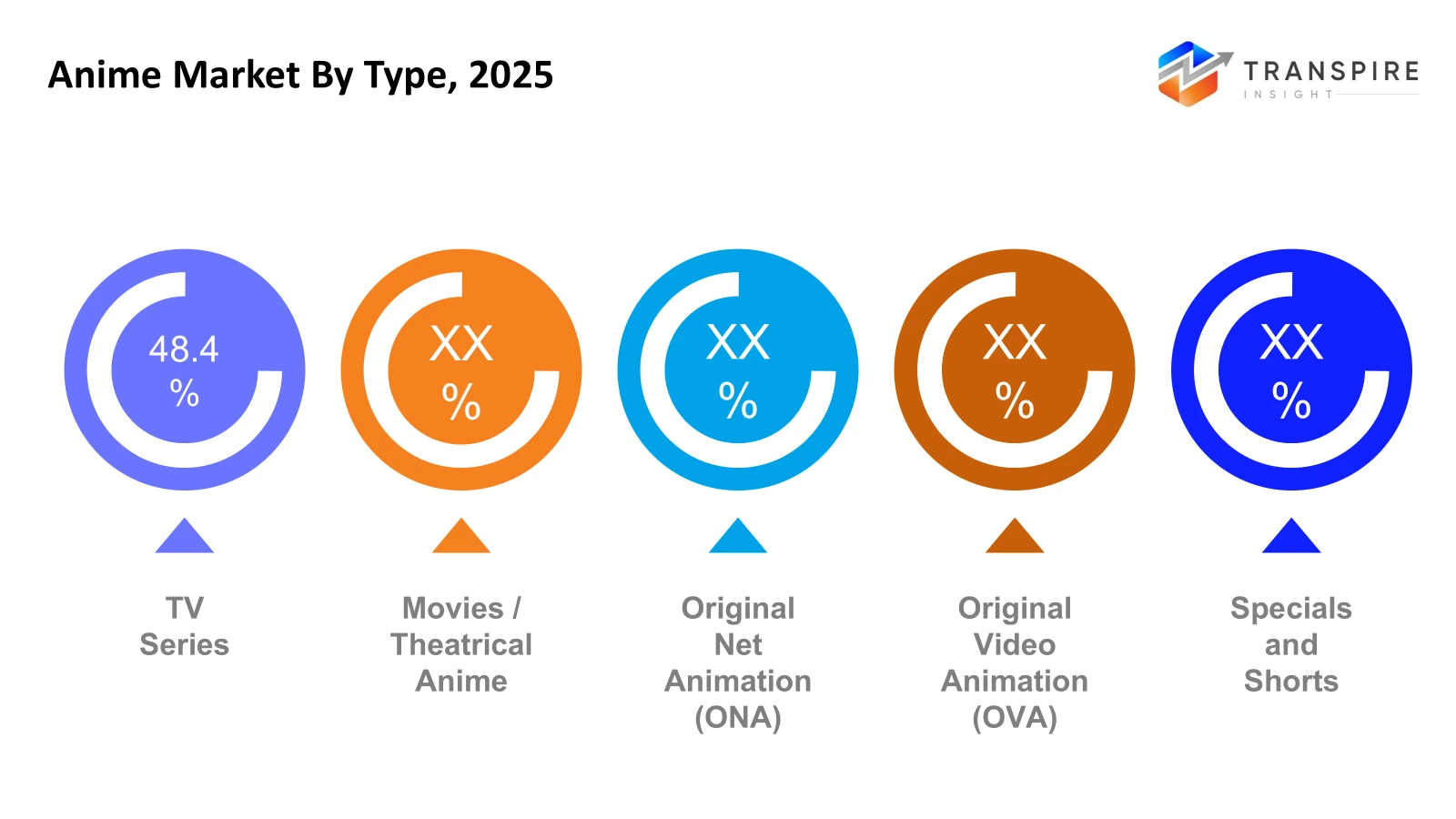

By Type

- TV Series

TV series are the most fundamental form of anime production, which is fueled by the concept of episodic content and engagement. The continuous release of content supports the merchandising and streaming business, making this category the most important for franchise development and distribution.

- Movies / Theatrical Anime

Theatrical anime movies have the potential to generate significant revenue from box office sales and high-end releases. The quality of animation and existing fan support enable companies to capitalize on theatrical releases while increasing market penetration in international markets.

- Original Net Animation (ONA)

The production of ONA content is mainly focused on digital distribution via online streaming platforms. This category is fueled by flexible episode formats, worldwide accessibility, and shorter production times, which are in line with the changing consumption patterns of viewers.

- Original Video Animation (OVA)

The content in OVAs is designed for niche audiences and fans. OVAs are used to support existing franchises by providing additional content to keep fans engaged and to generate additional revenue streams.

- Specials and Shorts

Specials and short anime are used for promotional or supplementary purposes in larger franchises. These are used to keep fans engaged between major releases and are increasingly being used for digital campaigns.

To learn more about this report, Download Free Sample Report

By Genre

- Action

Action anime leads the pack in worldwide consumption because of its universal appeal, engaging storytelling, and robust merchandising opportunities. High replay value and universal themes make it a popular choice for global licensing and franchise development.

- Fantasy

Fantasy anime leverages world-building and long-form storytelling to create extended franchise opportunities. The genre performs well in streaming platforms where long-form storytelling promotes long-term audience retention.

- Adventure

Adventure anime integrates exploration-based storytelling with character development, appealing to a wide demographic audience. Adaptability across age demographics supports steady consumption across television and streaming platforms.

- Romance

Romance anime sustains a loyal viewership through engaging storytelling and character development. The genre performs well in streaming platforms where binge-watching promotes audience engagement.

- Comedy

Comedy anime sustains high repeat viewership and adaptability across localization. Short-form storytelling and universality make it a popular choice for digital platforms and global audiences looking for light entertainment content.

By Distribution Channel

- Streaming Services

Streaming services are the leading form of distribution because of their global reach and on-demand nature. Subscription services and simulcast distribution allow for quicker global adoption and less reliance on television broadcasting schedules.

- Television Distribution

Television distribution is still relevant for home audience reach and first exposure, especially in established anime markets. It still supports advertising revenue and franchise recognition despite the gradual shift to digital consumption.

- Theatrical Distribution

Theatrical distribution is exclusive to high-budget productions and established franchises. Theatrical distribution allows for enhanced brand recognition and event-driven consumption that fuels further merchandise and media sales.

- Home Video (DVD & Blu-ray)

The home video market continues to have relevance in the collector's space and among hardcore fans who are looking for premium releases. Although a declining business in terms of volume, it is still a high-margin revenue stream in niche markets.

- Digital Download

Digital downloads offer ownership-based consumption for consumers who want to access content offline. This is an additional revenue stream that can be realized in markets with different levels of internet accessibility.

By Revenue Source

- Streaming & Licensing

Streaming and licensing are the most rapidly expanding sources of revenue, fueled by global competition among streaming platforms and the need for premium content. Licensing contracts extend the market reach well beyond the home market.

- Merchandising

Merchandising is another significant source of revenue, generated by figures, clothing, and collectibles. Well-branded characters and popular franchises provide a foundation for sustained revenue generation, independent of content distribution.

- Box Office Revenue

Box office revenue is primarily generated by blockbuster films and franchise movies. Success at the box office boosts global recognition and provides secondary revenue sources through licensing and merchandise sales.

- Gaming & Collaborations

Gaming collaborations are the extension of anime properties into gaming. Industry collaborations boost viewer engagement and provide additional revenue sources through mobile, console, and online gaming platforms.

- Music & Live Events

Music sales, concerts, and fan events are additional sources of revenue that expand the franchise by building viewer engagement. Live events build brand loyalty and provide additional revenue sources through performances and activities.

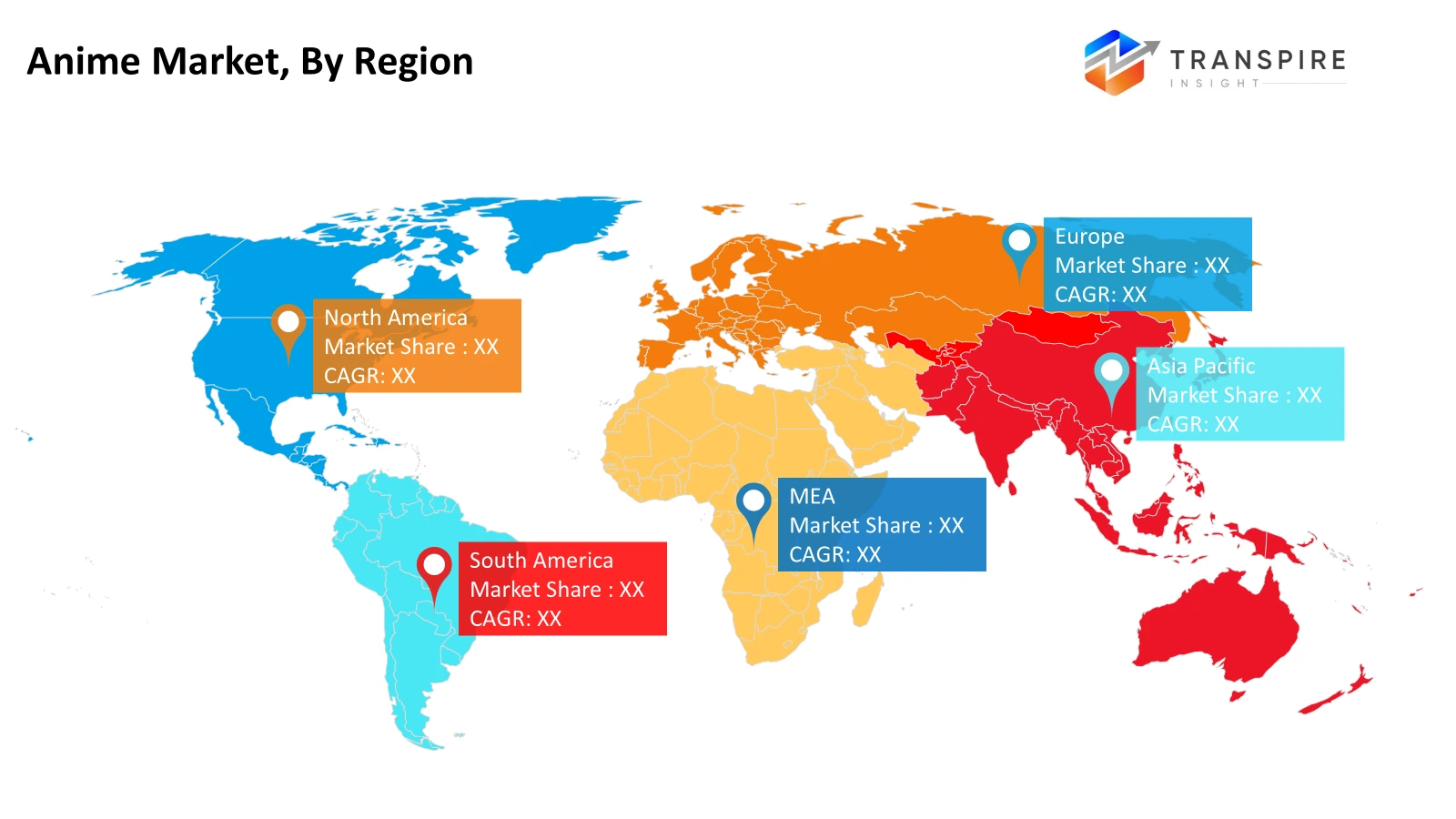

Regional Insights

From a geographical perspective, North America, comprising the United States, Canada, and Mexico, is a high-value Tier 1 market with mature streaming adoption and high spending on premium content. Europe, comprising Germany, the United Kingdom, France, Spain, Italy, and the Rest of Europe, is a stable Tier 1 and Tier 2 market with strong support from localization and existing fan bases. The Asia Pacific region is both the production center and the biggest consumption market. Japan is the primary Tier 1 market, while China, South Korea, Australia & New Zealand are strong Tier 2 markets. India and the Rest of Asia Pacific are emerging Tier 2 and Tier 3 markets, fueled by digital growth and young demographics. South America, comprising Brazil and Argentina, is a developing Tier 2 market fueled by streaming adoption. The Middle East & Africa, comprising Saudi Arabia, United Arab Emirates, South Africa, and the Rest of the Middle East & Africa, is an emerging Tier 2 and Tier 3 market, fueled by improving digital infrastructure and entertainment industry investments.

To learn more about this report, Download Free Sample Report

Recent Development News

- January 2026, Netflix announced a strategic partnership with MAPPA to co-develop globally focused anime projects, including production, distribution, and merchandising collaboration. The strategic partnership is intended to enhance the development of creator-driven content development and further improve the global distribution of anime content through exclusive streaming releases.

(Source:https://about.netflix.com/en/news/netflix-strengthens-strategtic-parternship-with-mappa)

- In January 2025, Crunchyroll and Sony-related partners have announced the production of an anime series based on the Ghost of Tsushima series of games, emphasizing the expansion of IP across multiple media platforms, including gaming and anime. This partnership indicates the increasing focus of the industry on using existing entertainment IPs to enhance anime engagement.

|

Report Metrics |

Details |

|

Market size value in 2025 |

USD 31.50 Billion |

|

Market size value in 2026 |

USD 34.00 Billion |

|

Revenue forecast in 2033 |

USD 75.00 Billion |

|

Growth rate |

CAGR of 11.90% from 2026 to 2033 |

|

Base year |

2025 |

|

Historical data |

2021 – 2024 |

|

Forecast period |

2026 – 2033 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

United States; Canada; Mexico; United Kingdom; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; United Arab Emirates |

|

Key company profiled |

Toei Animation Co., Ltd., Toho Co., Ltd., Sony Group Corporation, Studio Ghibli Inc., Bandai Namco Filmworks Inc., MAPPA Co., Ltd., Pierrot Co., Ltd., Kyoto Animation Co., Ltd., Production I.G, Inc., Bones Inc., Kadokawa Corporation, Shueisha Inc., Netflix, Inc., The Walt Disney Company, and TV Tokyo Corporation. |

|

Customization scope |

Free report customization (country, regional & segment scope). Avail customized purchase options to meet your exact research needs. |

|

Report Segmentation |

By Type (TV Series, Movies / Theatrical Anime, Original Net Animation (ONA), Original Video Animation (OVA), Specials and Shorts), By Genre (Action, Fantasy, Adventure, Romance, Comedy), Additive Manufacturing, Powder Forging, Others), By Distribution Channel (Streaming Platforms, Television Broadcasting, Theatrical Release, Home Video (DVD & Blu-ray), Digital Download) and By Revenue Source (Streaming & Licensing, Merchandising, Box Office Revenue, Gaming & Collaborations, Music & Live Events) |

Key Anime Company Insights

Sony Group Corporation has a leading presence in the anime industry with its integrated ecosystem that covers production, distribution, music, and streaming platforms worldwide. The company uses its subsidiaries, Aniplex and Crunchyroll, to cover various aspects of the value chain, which helps it license and directly interact with consumers efficiently. The business model focuses on expanding its reach worldwide, simulcasting, and acquiring exclusive content, which improves subscription revenues. The company uses its ownership of intellectual properties, merchandising, and music monetization to maximize the value of franchises. Its strong geographical reach in North America and Asia Pacific helps it maintain its leading position in setting global anime consumption trends.

Key Anime Companies:

- Toei Animation Co., Ltd.

- Toho Co., Ltd.

- Sony Group Corporation

- Studio Ghibli Inc.

- Bandai Namco Filmworks Inc.

- MAPPA Co., Ltd.

- Pierrot Co., Ltd.

- Kyoto Animation Co., Ltd.

- Production I.G, Inc.

- Bones Inc.

- Kadokawa Corporation

- Shueisha Inc.

- Netflix, Inc.

- The Walt Disney Company

- TV Tokyo Corporation

Global Anime Market Report Segmentation

By Type

- TV Series

- Movies / Theatrical Anime

- Original Net Animation (ONA)

- Original Video Animation (OVA)

- Specials and Shorts

By Genre

- Action

- Fantasy

- Adventure

- Romance

- Comedy

By Distribution Channel

- Streaming Platforms

- Television Broadcasting

- Theatrical Release

- Home Video (DVD & Blu-ray)

- Digital Download

By Revenue Source

- Streaming & Licensing

- Merchandising

- Box Office Revenue

- Gaming & Collaborations

- Music & Live Events

Regional Outlook

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- Australia & New Zealand

- South Korea

- India

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

APAC:+91 7666513636

APAC:+91 7666513636